rrb w4p can be completed online with ease. Simply try FormsPal PDF tool to get the job done right away. The editor is continually updated by our team, acquiring useful functions and turning out to be greater. To get the process started, take these basic steps:

Step 1: Click on the orange "Get Form" button above. It is going to open up our pdf editor so that you could begin completing your form.

Step 2: The editor grants the ability to work with your PDF document in a variety of ways. Improve it by adding any text, adjust existing content, and place in a signature - all close at hand!

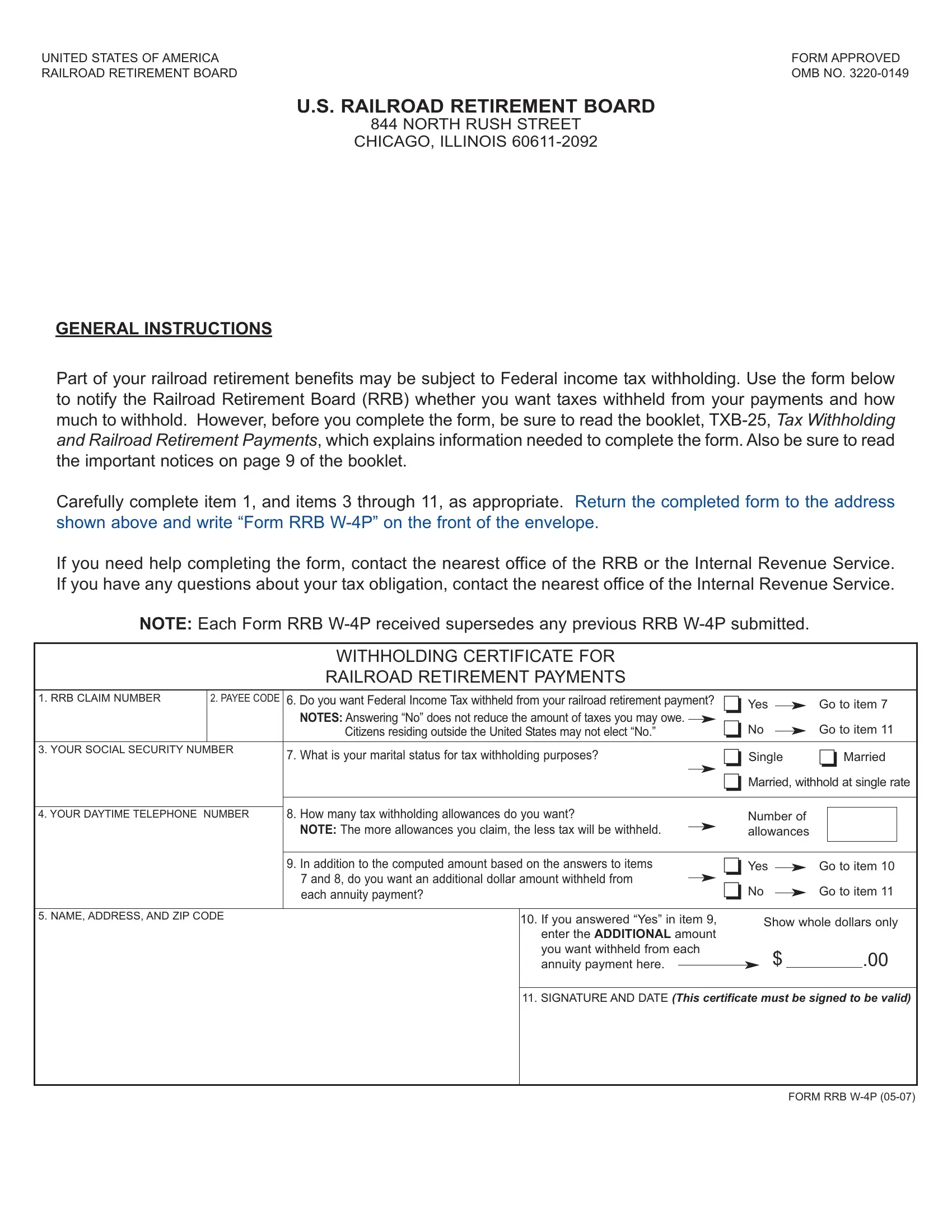

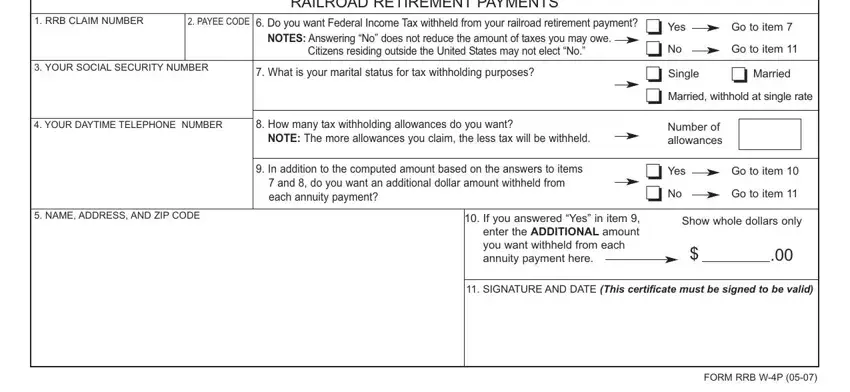

To be able to finalize this PDF form, make certain you provide the information you need in each and every blank:

1. Start filling out your rrb w4p with a selection of essential blanks. Note all the important information and be sure absolutely nothing is missed!

Step 3: As soon as you've reviewed the information in the fields, just click "Done" to complete your FormsPal process. Join us right now and immediately use rrb w4p, available for downloading. Every edit made is handily kept , meaning you can modify the file later as needed. FormsPal is focused on the privacy of our users; we always make sure that all personal information going through our editor is kept confidential.