In today's fast-paced financial world, the need for quick and reliable transactions has never been more critical. The Application Form for Funds Transfer Through Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) serves this very purpose, catering to both HDFC Bank customers and non-customers, including those engaging in Indo-Nepal NEFT remittances. This versatile form allows for the transfer of funds across different thresholds, with no limit for HDFC Bank customers and up to INR 50,000 for non-customers and specific remittances. Accuracy is paramount, as the form requires comprehensive beneficiary details, including account numbers, bank and branch names, and the IFSC code, ensuring the funds reach their intended destination without any hitch. Remitters are also obliged to provide their information, underscoring the importance of security and accountability in these transactions. Moreover, the form encapsulates various terms and conditions, including authorization for the bank to proceed with the transaction as mentioned, acknowledgment of the accurate provision of details, and an understanding of the governing RBI regulations. Signatories play a crucial role, with spaces allocated for up to three authorized signatures, validating the form's authenticity. The process is meticulously regulated, with sections reserved solely for bank use, ensuring proper documentation and authorization of each transaction. This form not only exemplifies the seamless integration of banking procedures into digital platforms but also emphasizes the careful consideration of regulatory compliance, security measures, and customer convenience, making it a cornerstone of modern financial transactions.

| Question | Answer |

|---|---|

| Form Name | Rtgs Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | hdfc bank rtgs form fillable, hdfc rtgs form, hdfc rtgs form pdf, hdfc bank rtgs form in word |

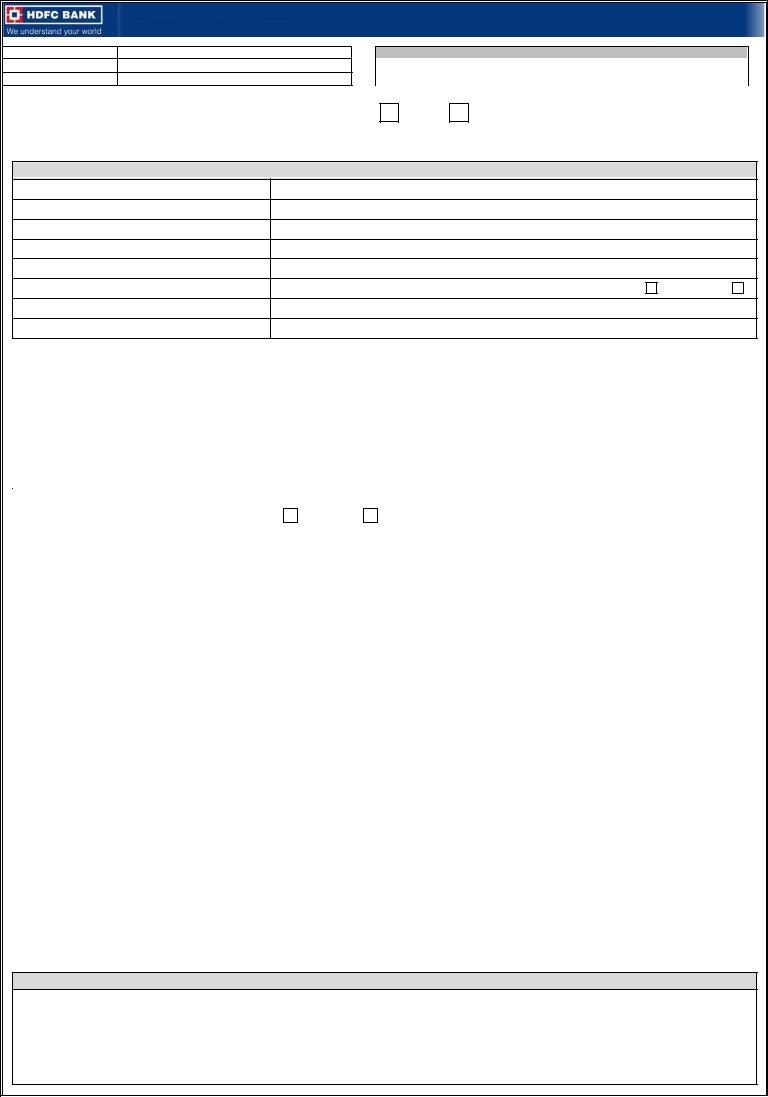

Application Form For Funds Transfer Through

Real Time Gross Settlement (RTGS) / National Electronic Funds Transfer (NEFT)

Branch Code / Name

Date

Time

Maximum Limit for NEFT Transaction

HDFC Bank Customer |

No Limit |

Non HDFC Bank Customer & |

Up to INR 50,000/- |

You are requested to remit the proceeds as per details below through RTGS

/ NEFT

. (Tick the appropriate Box) .

Attaching Cheque No. ________________ for Rs.__________________________. (For RTGS draw cheque favouring “HDFC Bank Ltd – RTGS” and for

NEFT draw cheque favouring “HDFC Bank Ltd – NEFT”)

Beneficiary Details

Beneficiary Name

Beneficiary Account Number

Beneficiary Account Number

Beneficiary Address

Beneficiary Bank Name & Branch

Beneficiary Bank IFSC Code

Amount (in figures) to be credited

Amount (in words) to be credited

Account Type : Resident

/ Non Resident

|

|

|

My / Our Details (Remitter) |

|

|

Remitter (Applicant) Name |

|

|

|

|

|

|

|

|

|

Remitter Account Number |

|

|

|

|

|

|

|

|

|

Cash Deposited (Non HDFC Bank Customer) |

|

|

|

|

|

|

|

|

|

Mobile / Phone Number of Remitter ( Mandatory) |

|

|

|

|

|

|

|

|

|

Address of the Remitter (Mandatory for Non – HDFC |

|

|

|

|

Bank Customer) |

|

|

|

|

Remarks |

|

|

|

Terms & Conditions |

|

|

||

* I / We hereby authorize HDFC Bank Ltd. to carry out the RTGS |

/ NEFT |

transaction as per details mentioned above. (Tick the appropriate Box) |

||

*I / We hereby agree that the aforesaid details including the IFSC code and the beneficiary account are correct.

*I / We further acknowledge that HDFC Bank accepts no liability for any consequences arising out of erroneous details provided by me/us.

*I / We agree that the credit will be affected solely on the beneficiary account number information and beneficiary name particulars will not be used for the same.

*I / We authorize the bank to debit my / our account with the charges plus taxes as applicable for this transaction.

*I / We agree that requests submitted after the cut off time will be sent in next batch or next working day as applicable.

*I / We hereby agree & understand that the RTGS / NEFT request is subject to the RBI regulations and guidelines governing the same.

*I / We also understand that the remitting Bank shall not be liable for any loss of damage arising or resulting from delay in transmission delivery or

*I/We agree that incase of NEFT Transaction if we do not have an account with the bank, we will produce Original identification proof while giving the request. In case I/We submit form 60, we will also submit the address proof.

*In case the RTGS and NEFT option is not ticked by us, I / We authorize you to execute the transaction less than Rupees Two Lacs through NEFT and greater than or equal to Rupees Two Lacs through RTGS and debit the charges as applicable.

|

|

|

|

Signature of |

|

|

|

Authorized |

|

|

|

Signatory |

____________________ |

____________________ |

____________________ |

|

|||

|

1st Signatory |

2nd Signatory |

3rd Signatory |

|

|

Please affix stamp wherever applicable |

|

|

|

Branch Use Only |

|

|

Transaction Reference Number |

|

|

|

|

|

|

|

|

|

Transaction Inputted by |

Employee Code |

|

Signature |

|

|

|

|

||

Transaction Authorized by |

Employee Code |

|

Signature |

|

|

|

|

||

Transaction Authorized by (2nd level) |

|

|

|

|

(for amount > Rs. 5 lacs) |

Employee Code |

|

Signature |

|

KYC documentation done by (only for |

|

|

|

|

Bank Customers) |

Employee Code |

|

Signature |

Branch Stamp, Date & Sign |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Customer Acknowledgement

Received application for RTGS |

|

/ NEFT |

|

for an amount of Rs. ____________________ vide cash / cheque number ________________ to be credited to Account |

Number ________________________________ of _______________________________ Bank with IFSC Code____________________________. Customers will be

guided by the Terms and Conditions mentioned in the form. HDFC Bank will accept no liability for any consequences arising out of erroneous details provided by the Customer.

Date __________________ |

Time_______________ |

_Branch Stamp & Sign __ |