Using PDF files online is very simple using our PDF editor. You can fill out S 240 Form here effortlessly. In order to make our editor better and less complicated to use, we consistently work on new features, with our users' suggestions in mind. With a few easy steps, it is possible to begin your PDF editing:

Step 1: Hit the "Get Form" button above on this webpage to get into our editor.

Step 2: With our advanced PDF tool, you could do more than simply complete blank form fields. Try all the features and make your docs appear professional with customized text incorporated, or modify the file's original input to perfection - all that comes with the capability to add any images and sign it off.

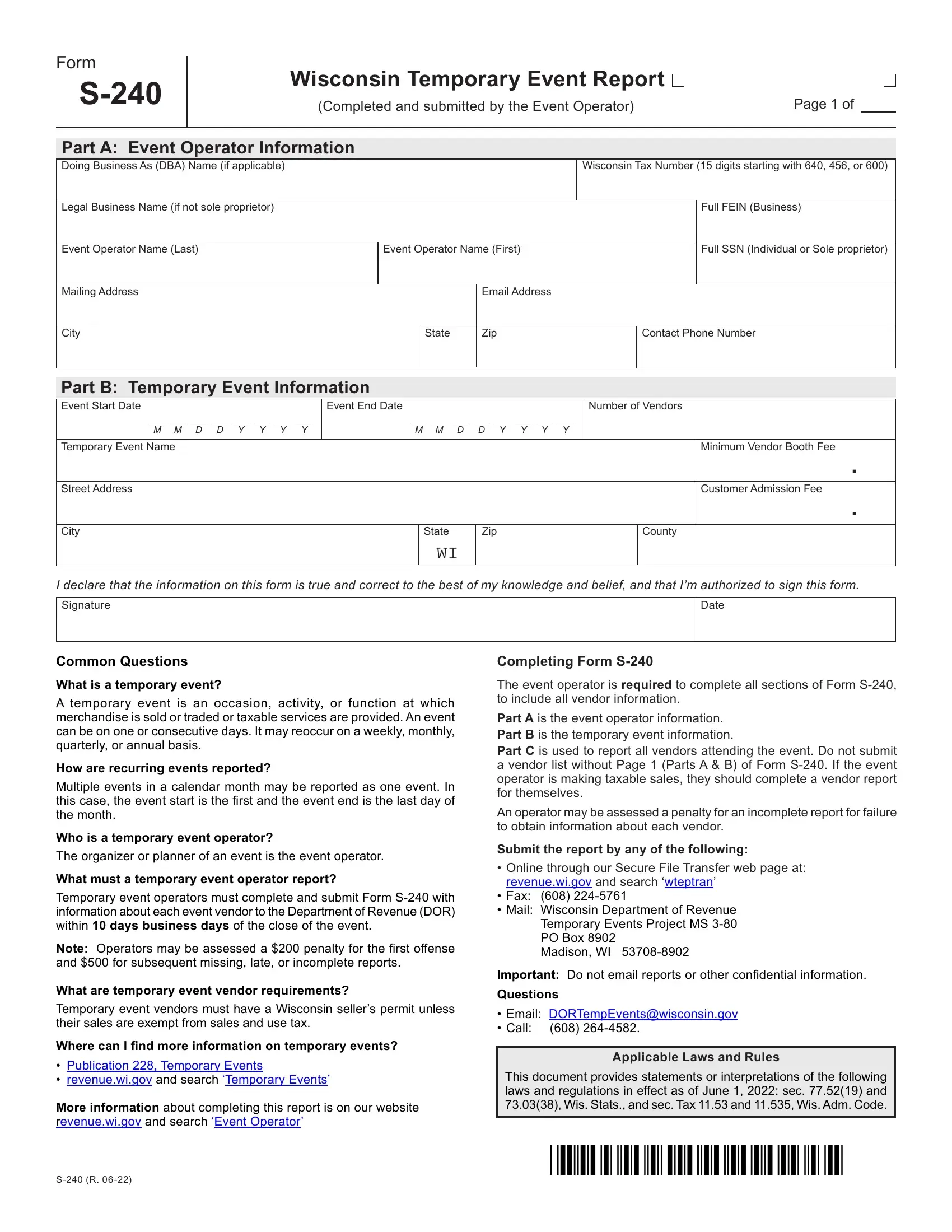

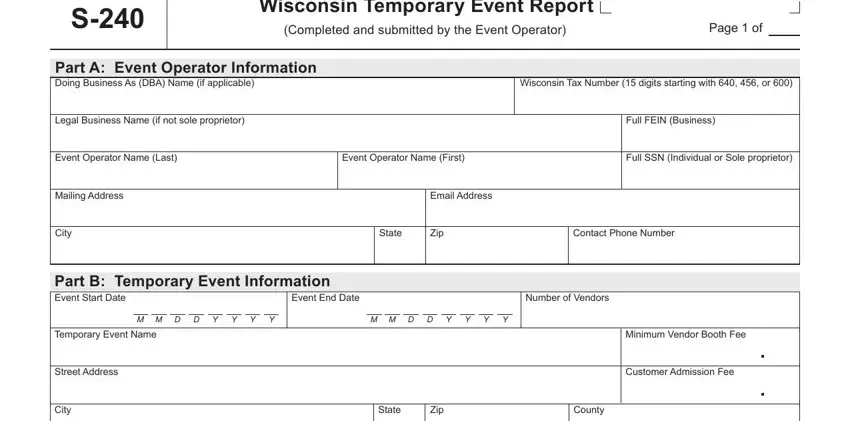

As for the fields of this particular document, here is what you should know:

1. When submitting the S 240 Form, make certain to complete all of the essential blanks within its corresponding part. This will help to hasten the work, enabling your information to be processed efficiently and properly.

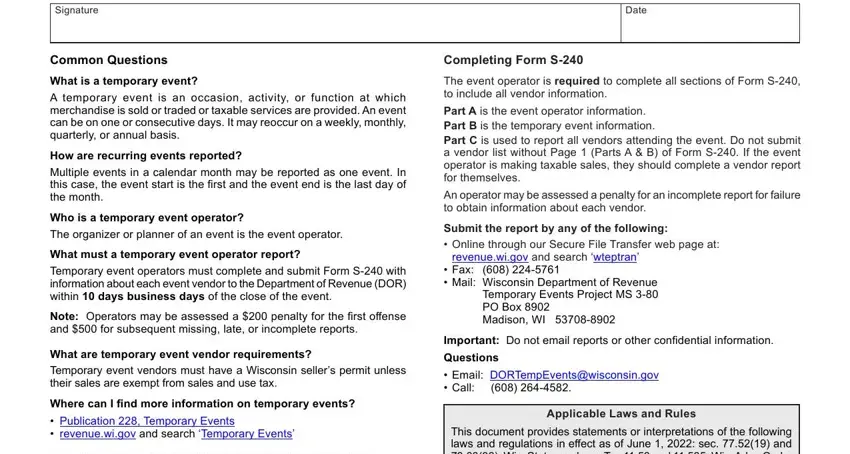

2. Once your current task is complete, take the next step – fill out all of these fields - Signature, Date, Common Questions, Completing Form S, What is a temporary event A, How are recurring events reported, Who is a temporary event operator, What must a temporary event, What are temporary event vendor, The event operator is required to, Part A is the event operator, An operator may be assessed a, Submit the report by any of the, Email DORTempEventswisconsingov, and Applicable Laws and Rules with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

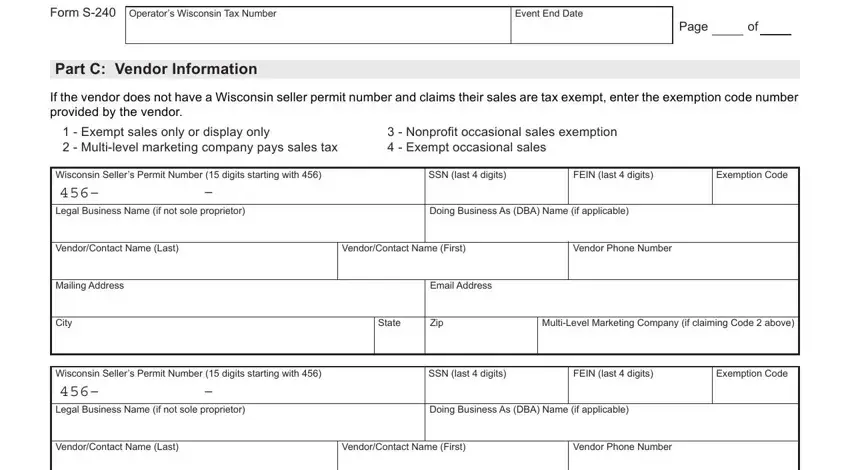

3. This next stage is generally simple - complete all of the fields in Form S, Operators Wisconsin Tax Number, Event End Date, Page, Part C Vendor Information, If the vendor does not have a, Nonprofit occasional sales, Wisconsin Sellers Permit Number, SSN last digits, FEIN last digits, Exemption Code, Legal Business Name if not sole, Doing Business As DBA Name if, VendorContact Name Last, and VendorContact Name First to complete the current step.

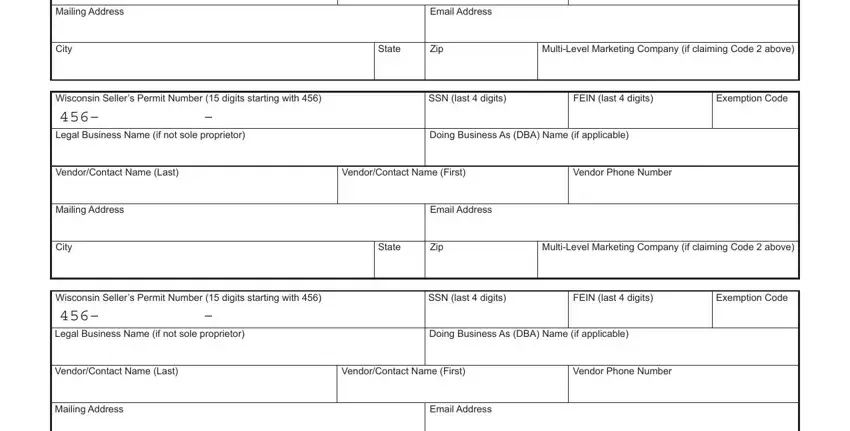

4. The subsequent section requires your input in the following parts: Mailing Address, City, Email Address, State, Zip, MultiLevel Marketing Company if, Wisconsin Sellers Permit Number, SSN last digits, FEIN last digits, Exemption Code, Legal Business Name if not sole, Doing Business As DBA Name if, VendorContact Name Last, VendorContact Name First, and Vendor Phone Number. It is important to provide all needed info to go further.

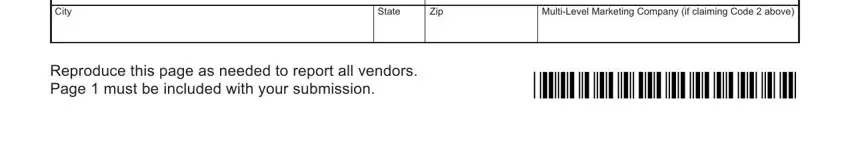

5. This pdf should be wrapped up by filling out this area. Here there's a full set of fields that need to be completed with appropriate information to allow your form submission to be accomplished: City, State, Zip, MultiLevel Marketing Company if, and Reproduce this page as needed to.

People who use this document frequently get some things incorrect when filling out MultiLevel Marketing Company if in this part. Be sure you read twice what you type in here.

Step 3: Before submitting the document, make sure that blanks are filled out as intended. The moment you confirm that it's good, press “Done." Try a 7-day free trial account with us and obtain immediate access to S 240 Form - which you'll be able to then make use of as you wish in your FormsPal cabinet. At FormsPal, we strive to ensure that all your information is maintained private.