Completing the da form 5988 pdf document is simple using our PDF editor. Try out the next steps to create the document without delay.

Step 1: The first thing is to click the orange "Get Form Now" button.

Step 2: Now, you are on the file editing page. You may add information, edit present data, highlight certain words or phrases, place crosses or checks, insert images, sign the form, erase unrequired fields, etc.

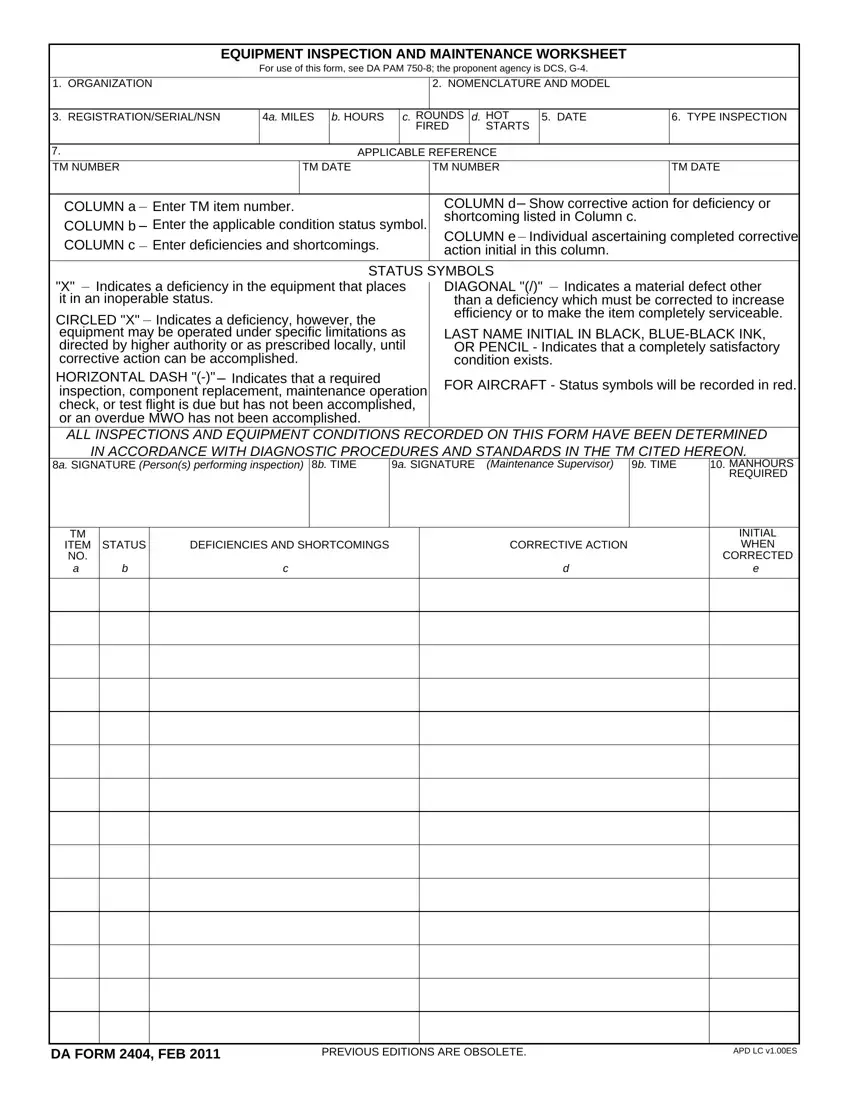

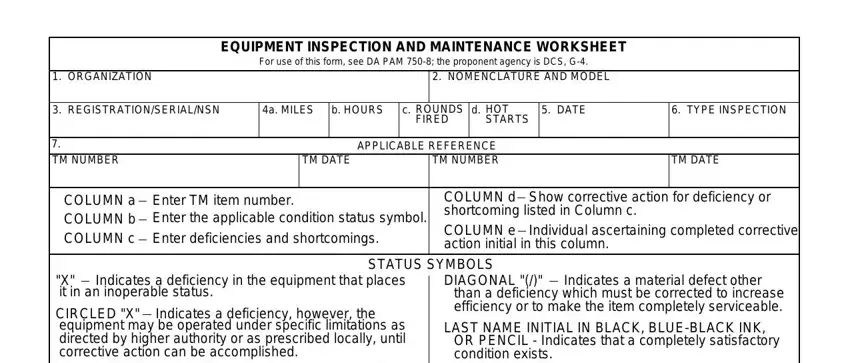

If you want to complete the da form 5988 pdf PDF, enter the information for each of the parts:

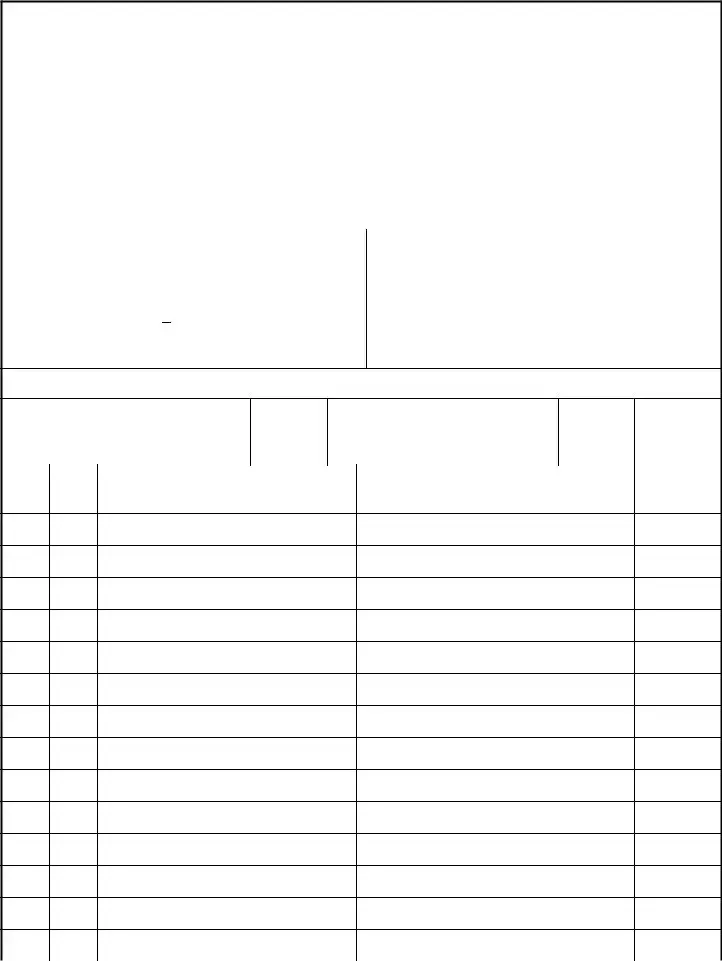

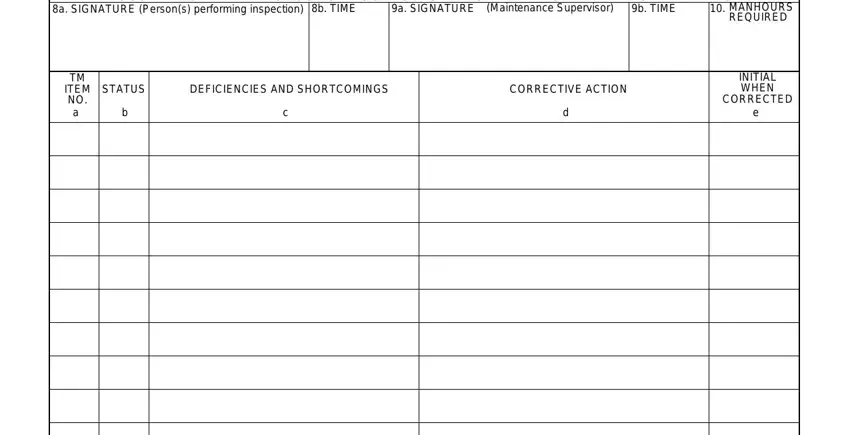

Inside the segment ALL INSPECTIONS AND EQUIPMENT, a SIGNATURE Persons performing, b TIME, a SIGNATURE, Maintenance Supervisor, b TIME, MANHOURS REQUIRED, TM ITEM NO a, STATUS, DEFICIENCIES AND SHORTCOMINGS, CORRECTIVE ACTION, and INITIAL WHEN CORRECTED e note the particulars which the platform requests you to do.

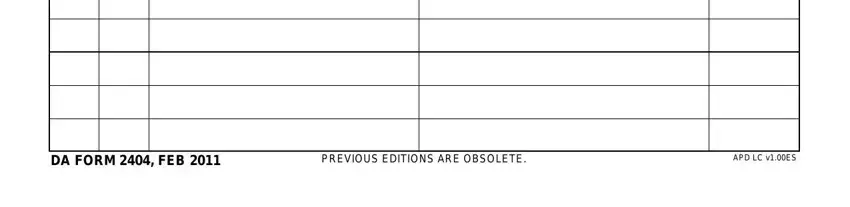

Focus on the most crucial details the DA FORM FEB, PREVIOUS EDITIONS ARE OBSOLETE, and APD LC vES part.

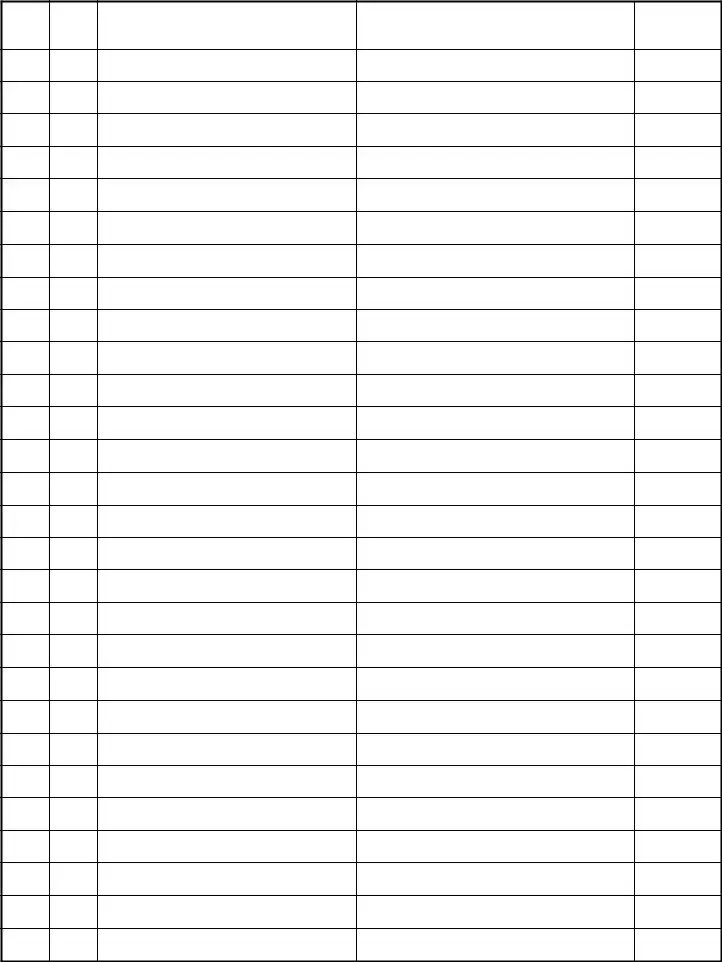

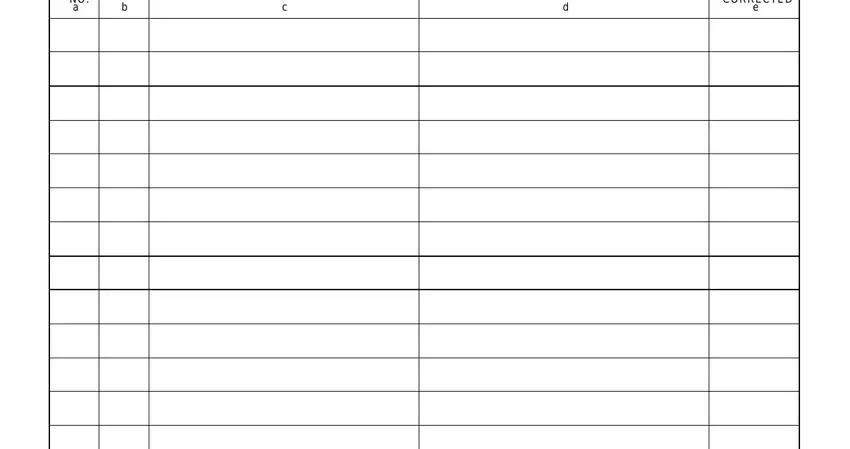

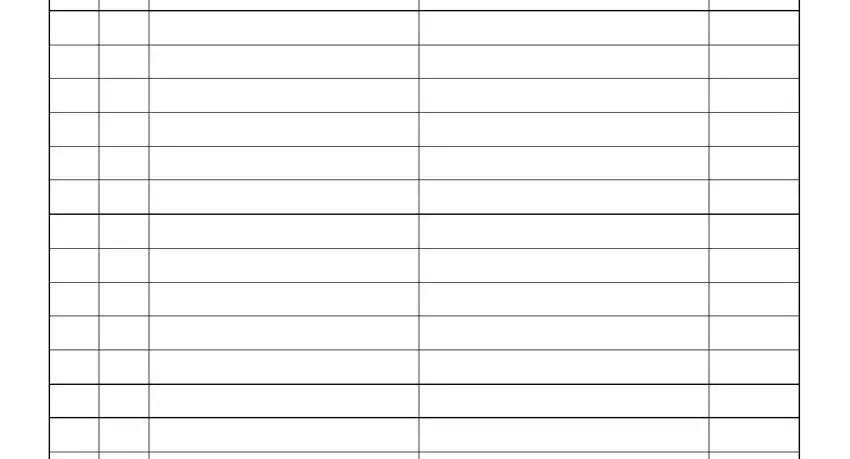

Describe the rights and responsibilities of the sides in the paragraph TM ITEM NO a, and INITIAL WHEN CORRECTED e.

Finish by checking the next sections and filling them out as needed: .

Step 3: Press the button "Done". Your PDF document may be transferred. It is possible to obtain it to your device or send it by email.

Step 4: Make duplicates of your template. This is going to save you from forthcoming misunderstandings. We do not look at or display your information, therefore be sure it will be protected.