You'll be able to prepare Saturna Capital Form 401 K easily by using our PDF editor online. In order to make our editor better and easier to use, we consistently implement new features, taking into consideration suggestions coming from our users. It merely requires a couple of simple steps:

Step 1: Hit the "Get Form" button in the top section of this page to open our editor.

Step 2: The editor lets you change your PDF in a variety of ways. Transform it by writing your own text, correct existing content, and place in a signature - all at your convenience!

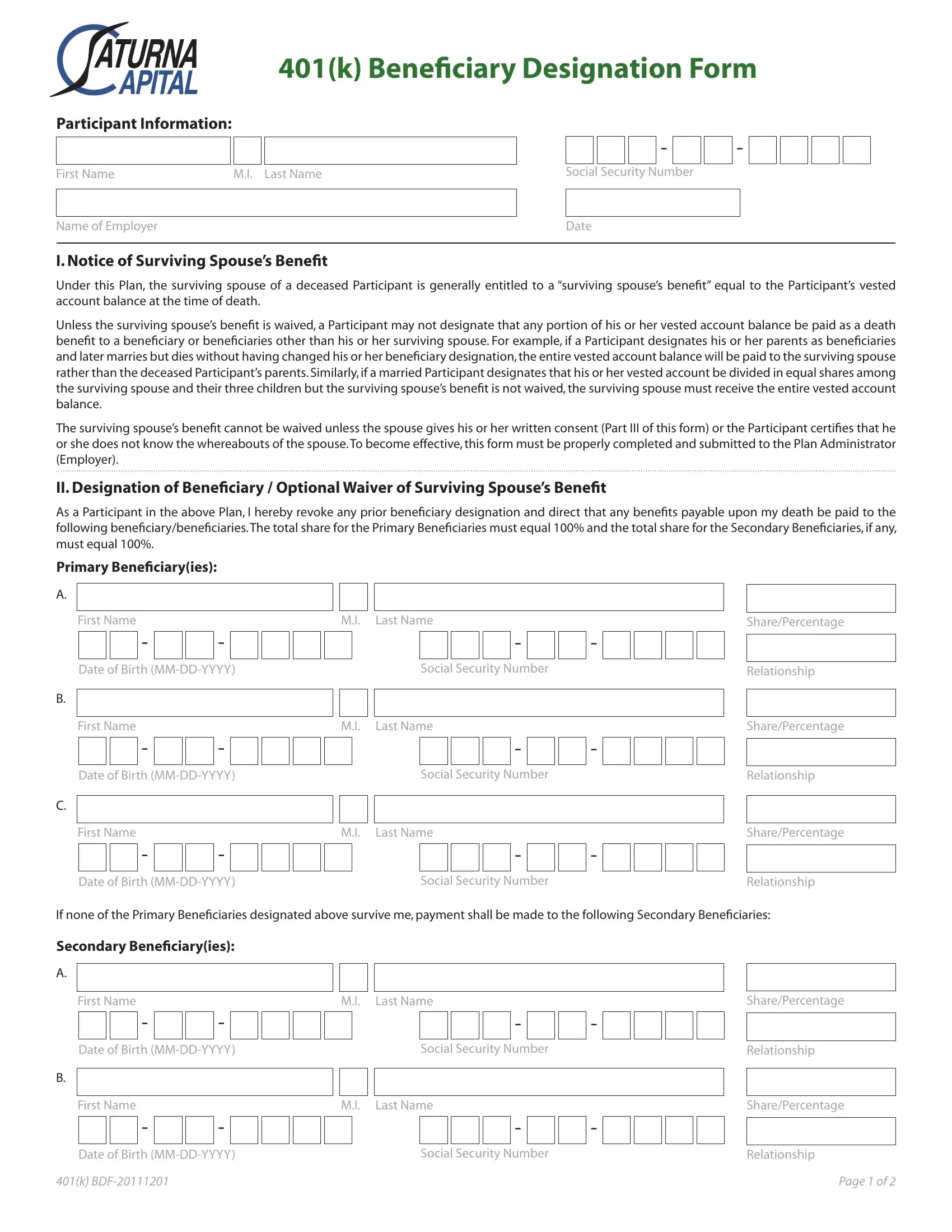

If you want to complete this PDF form, be sure to provide the necessary details in every single area:

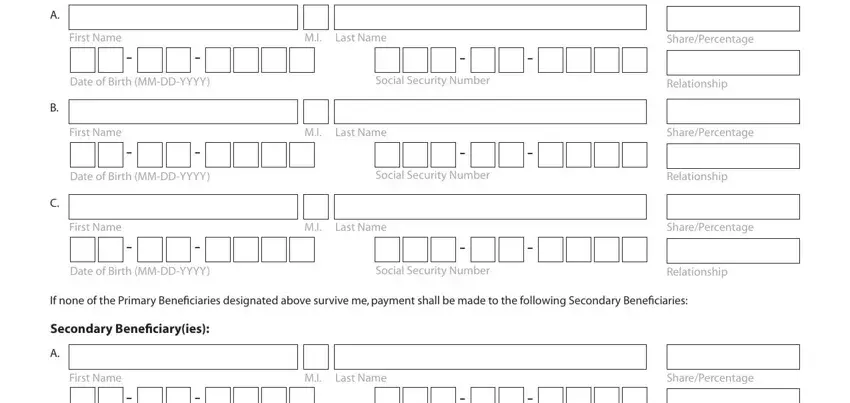

1. To start off, while completing the Saturna Capital Form 401 K, begin with the page that contains the following blank fields:

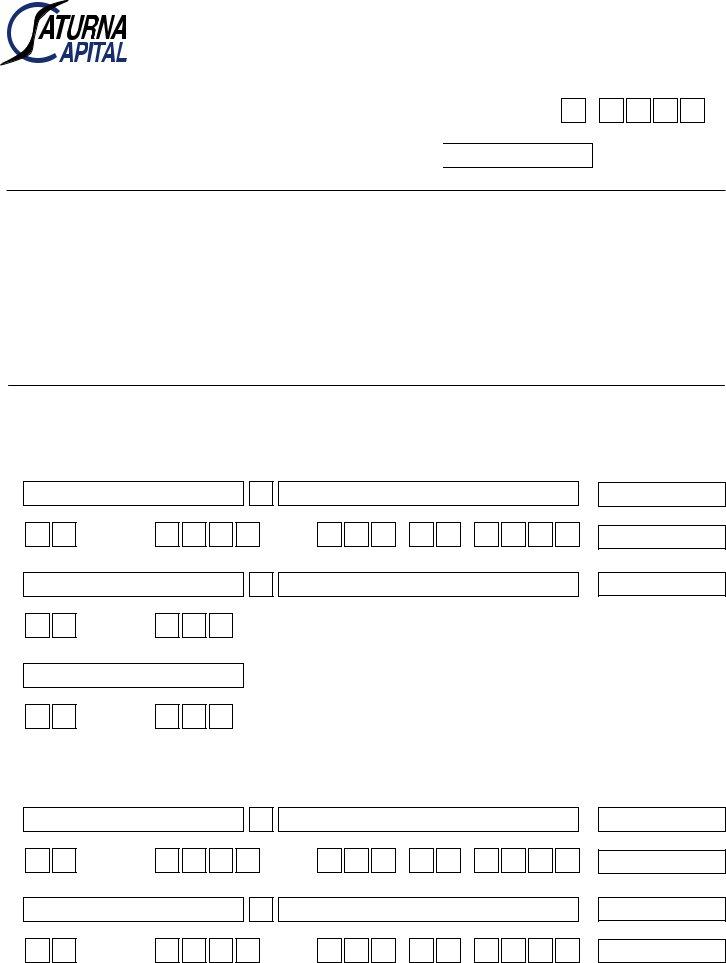

2. Right after finishing the last part, go on to the subsequent stage and fill in all required particulars in all these blanks - First Name, Last Name, Date of Birth MMDDYYYY, Social Security Number, First Name, Last Name, Date of Birth MMDDYYYY, Social Security Number, First Name, Last Name, SharePercentage, Relationship, SharePercentage, Relationship, and SharePercentage.

It is easy to get it wrong when completing the Last Name, therefore make sure that you go through it again before you decide to send it in.

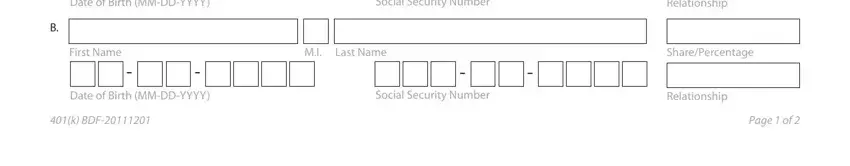

3. This next segment is related to Date of Birth MMDDYYYY, Social Security Number, First Name, Last Name, Relationship, SharePercentage, Date of Birth MMDDYYYY, Social Security Number, Relationship, k BDF, and Page of - type in all of these blanks.

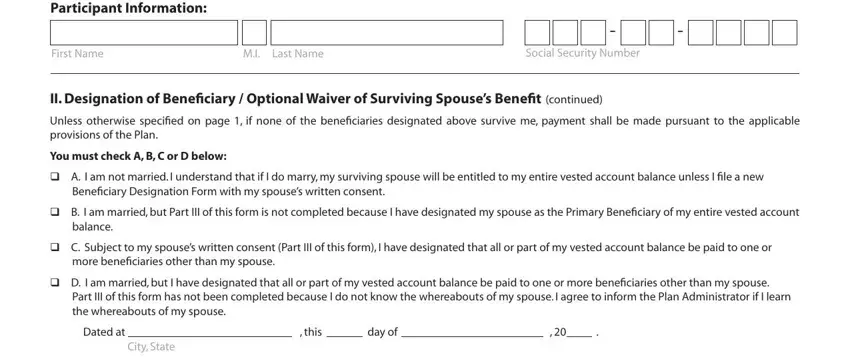

4. Filling in Participant Information, First Name, Last Name, Social Security Number, II Designation of Beneficiary, Unless otherwise specified on page, You must check A B C or D below, A I am not married I understand, Beneficiary Designation Form with, B I am married but Part III of, balance, C Subject to my spouses written, more beneficiaries other than my, D I am married but I have, and Part III of this form has not been is crucial in this part - ensure that you invest some time and fill in each empty field!

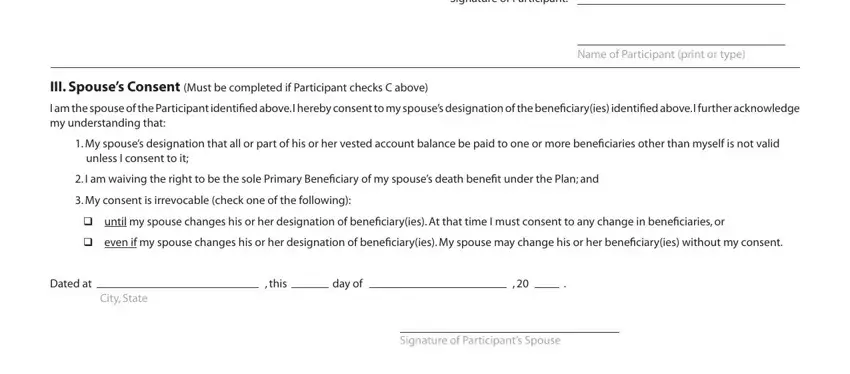

5. This very last step to conclude this PDF form is pivotal. Make certain to fill in the mandatory fields, particularly Signature of Participant, Name of Participant print or type, III Spouses Consent Must be, I am the spouse of the Participant, My spouses designation that all, unless I consent to it, I am waiving the right to be the, My consent is irrevocable check, until my spouse changes his or, even if my spouse changes his or, this, day of, Dated at, City State, and Signature of Participants Spouse, prior to using the file. If you don't, it can generate a flawed and possibly incorrect paper!

Step 3: Ensure that your details are accurate and then simply click "Done" to conclude the project. Go for a free trial account with us and acquire instant access to Saturna Capital Form 401 K - download or modify in your FormsPal cabinet. We don't share or sell any information that you type in while completing forms at our website.