|

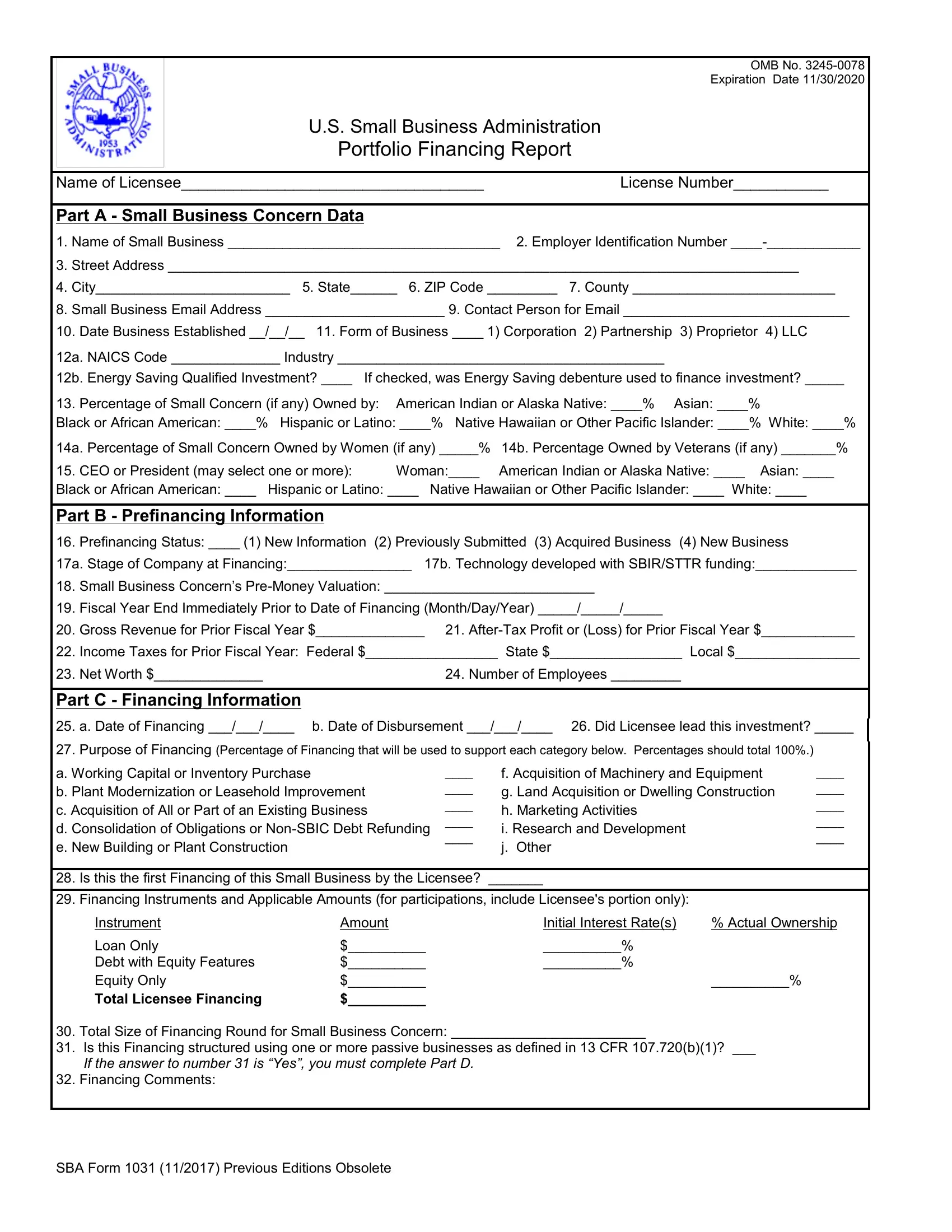

OMB No. 3245-0078 |

|

Expiration Date 11/30/2020 |

U.S. Small Business Administration |

|

Portfolio Financing Report |

|

|

|

Name of Licensee___________________________________ |

License Number___________ |

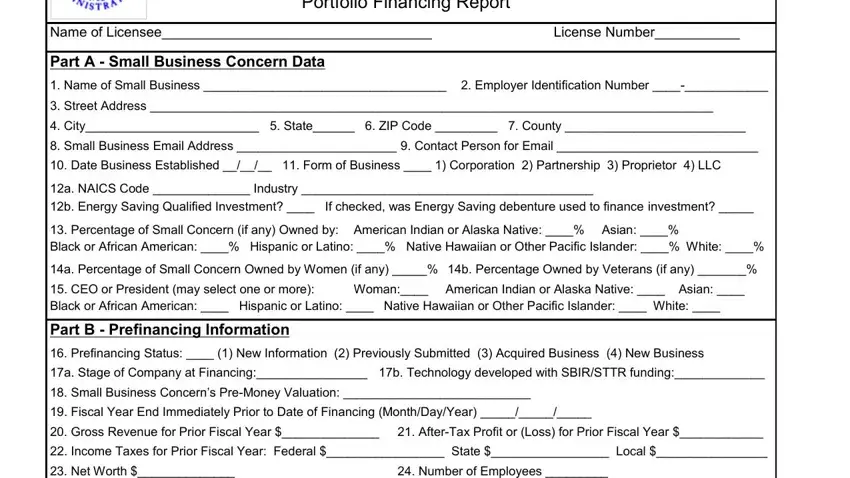

Part A - Small Business Concern Data

1. |

Name of Small Business ___________________________________ 2. Employer Identification Number ____-____________ |

3. |

Street Address _________________________________________________________________________________ |

4. |

City_________________________ 5. State______ 6. ZIP Code _________ 7. |

County __________________________ |

8. |

Small Business Email Address _______________________ 9. Contact Person for |

Email _____________________________ |

|

|

|

|

10. |

Date Business Established __/__/__ 11. Form of Business ____ 1) Corporation 2) Partnership |

3) Proprietor 4) LLC |

12a. |

NAICS Code ______________ Industry __________________________________________ |

|

12b. |

Energy Saving Qualified Investment? ____ If checked, was Energy Saving debenture used to finance investment? _____ |

13. |

Percentage of Small Concern (if any) Owned by: American Indian or Alaska Native: ____% |

Asian: ____% |

Black or African American: ____% Hispanic or Latino: ____% Native Hawaiian or Other Pacific Islander: ____% White: ____%

14a. Percentage of Small Concern Owned by Women (if any) _____% |

14b. Percentage Owned by Veterans (if any) _______% |

15. |

CEO or President (may select one or more): |

Woman:____ |

American Indian or Alaska Native: ____ Asian: ____ |

Black or African American: ____ Hispanic or Latino: ____ Native Hawaiian or Other Pacific Islander: ____ White: ____ |

|

|

|

Part B - Prefinancing Information |

|

|

16. |

Prefinancing Status: ____ (1) New Information |

(2) Previously Submitted (3) Acquired Business (4) New Business |

17a. Stage of Company at Financing:________________ 17b. Technology developed with SBIR/STTR funding:_____________

18. |

Small Business Concern’s Pre-Money Valuation: ___________________________ |

19. |

Fiscal Year End Immediately Prior to Date of Financing (Month/Day/Year) _____/_____/_____ |

20. |

Gross Revenue for Prior Fiscal Year $______________ |

21. |

After-Tax Profit or (Loss) for Prior Fiscal Year $____________ |

22. |

Income Taxes for Prior Fiscal Year: Federal $_________________ State $_________________ Local $________________ |

23. |

Net Worth $______________ |

24. |

Number of Employees _________ |

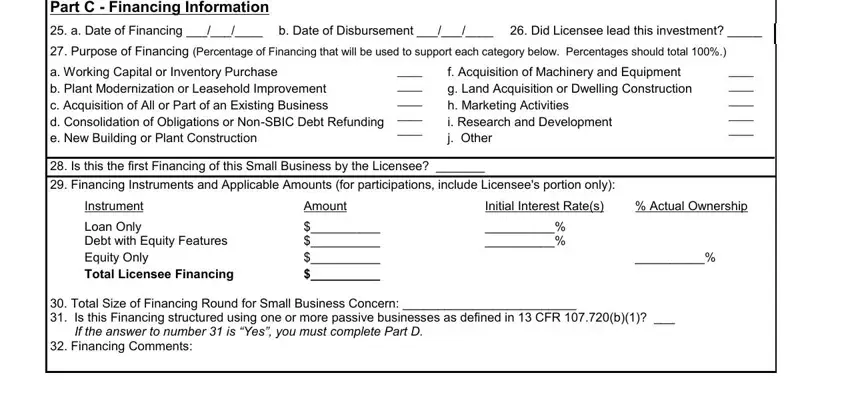

Part C - Financing Information

25. a. Date of Financing ___/___/____ b. Date of Disbursement ___/___/____ 26. Did Licensee lead this investment? _____

27. Purpose of Financing (Percentage of Financing that will be used to support each category below. Percentages should total 100%.)

|

a. Working Capital or Inventory Purchase |

____ |

|

b. Plant Modernization or Leasehold Improvement |

____ |

|

c. Acquisition of All or Part of an Existing Business |

____ |

|

____ |

|

d. Consolidation of Obligations or Non-SBIC Debt Refunding |

|

e. New Building or Plant Construction |

____ |

|

|

f. Acquisition of Machinery and Equipment g. Land Acquisition or Dwelling Construction h. Marketing Activities

i. Research and Development j. Other

28.Is this the first Financing of this Small Business by the Licensee? _______

29.Financing Instruments and Applicable Amounts (for participations, include Licensee's portion only):

Instrument |

Amount |

Initial Interest Rate(s) |

% Actual Ownership |

Loan Only |

$__________ |

__________% |

|

Debt with Equity Features |

$__________ |

__________% |

|

Equity Only |

$__________ |

|

__________% |

Total Licensee Financing |

$__________ |

|

|

30.Total Size of Financing Round for Small Business Concern: _________________________

31.Is this Financing structured using one or more passive businesses as defined in 13 CFR 107.720(b)(1)? ___

If the answer to number 31 is “Yes”, you must complete Part D.

32.Financing Comments:

SBA Form 1031 (11/2017) Previous Editions Obsolete

OMB No. 3245-0078

Expiration Date mm/dd/yyyy

U.S. Small Business Administration

Portfolio Financing Report

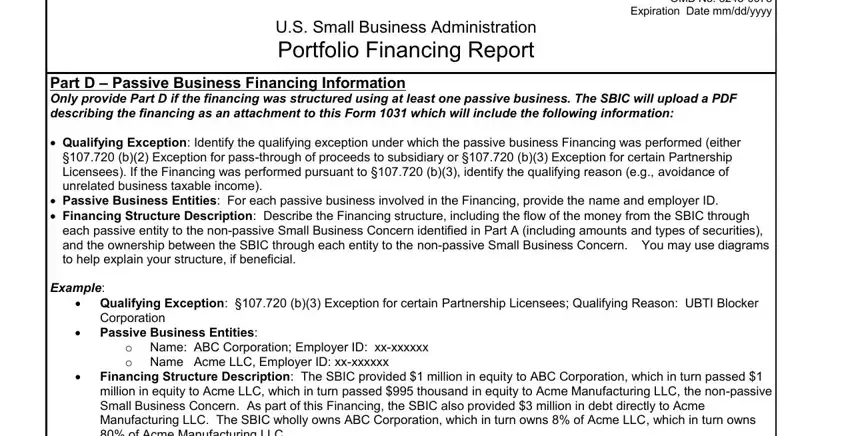

Part D – Passive Business Financing Information

Only provide Part D if the financing was structured using at least one passive business. The SBIC will upload a PDF describing the financing as an attachment to this Form 1031 which will include the following information:

∙Qualifying Exception: Identify the qualifying exception under which the passive business Financing was performed (either §107.720 (b)(2) Exception for pass-through of proceeds to subsidiary or §107.720 (b)(3) Exception for certain Partnership Licensees). If the Financing was performed pursuant to §107.720 (b)(3), identify the qualifying reason (e.g., avoidance of unrelated business taxable income).

∙Passive Business Entities: For each passive business involved in the Financing, provide the name and employer ID.

∙Financing Structure Description: Describe the Financing structure, including the flow of the money from the SBIC through each passive entity to the non-passive Small Business Concern identified in Part A (including amounts and types of securities), and the ownership between the SBIC through each entity to the non-passive Small Business Concern. You may use diagrams to help explain your structure, if beneficial.

Example:

∙Qualifying Exception: §107.720 (b)(3) Exception for certain Partnership Licensees; Qualifying Reason: UBTI Blocker Corporation

∙Passive Business Entities:

OName: ABC Corporation; Employer ID: xx-xxxxxx

OName Acme LLC, Employer ID: xx-xxxxxx

∙Financing Structure Description: The SBIC provided $1 million in equity to ABC Corporation, which in turn passed $1 million in equity to Acme LLC, which in turn passed $995 thousand in equity to Acme Manufacturing LLC, the non-passive Small Business Concern. As part of this Financing, the SBIC also provided $3 million in debt directly to Acme Manufacturing LLC. The SBIC wholly owns ABC Corporation, which in turn owns 8% of Acme LLC, which in turn owns 80% of Acme Manufacturing LLC.

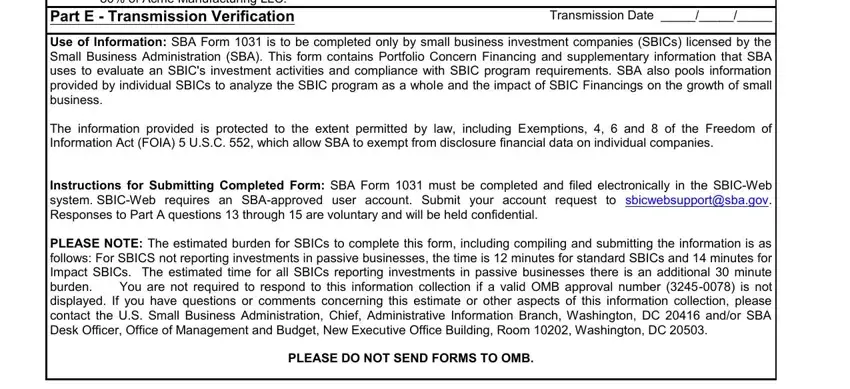

Part E - Transmission Verification |

Transmission Date _____/_____/_____ |

Use of Information: SBA Form 1031 is to be completed only by small business investment companies (SBICs) licensed by the Small Business Administration (SBA). This form contains Portfolio Concern Financing and supplementary information that SBA uses to evaluate an SBIC's investment activities and compliance with SBIC program requirements. SBA also pools information provided by individual SBICs to analyze the SBIC program as a whole and the impact of SBIC Financings on the growth of small business.

The information provided is protected to the extent permitted by law, including Exemptions, 4, 6 and 8 of the Freedom of Information Act (FOIA) 5 U.S.C. 552, which allow SBA to exempt from disclosure financial data on individual companies.

Instructions for Submitting Completed Form: SBA Form 1031 must be completed and filed electronically in the SBIC-Web system. SBIC-Web requires an SBA-approved user account. Submit your account request to sbicwebsupport@sba.gov. Responses to Part A questions 13 through 15 are voluntary and will be held confidential.

PLEASE NOTE: The estimated burden for SBICs to complete this form, including compiling and submitting the information is as

follows: For SBICS not reporting investments in passive businesses, the time is 12 minutes for standard SBICs and 14 minutes for Impact SBICs. The estimated time for all SBICs reporting investments in passive businesses there is an additional 30 minute burden. You are not required to respond to this information collection if a valid OMB approval number (3245-0078) is not displayed. If you have questions or comments concerning this estimate or other aspects of this information collection, please contact the U.S. Small Business Administration, Chief, Administrative Information Branch, Washington, DC 20416 and/or SBA Desk Officer, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, DC 20503.

PLEASE DO NOT SEND FORMS TO OMB.

SBA Form 1031 (11/2017) Previous Editions Obsolete