U.S. SMALL BUSINESS ADMINISTRATION APPLICATION FOR SECTION 504 LOANS

OMB APPROVAL NO.: 3245-0071

EXPIRATION DATE: 12/31/2019

This form and exhibits are to be completed by the loan applicant and the Certified Development Company (CDC). The information is used to review the small business loan applicant’s eligibility, its indebtedness, creditworthiness, and certain other disclosures. SBA also uses the information to assess the CDC’s request for guarantee of the debenture. The loan applicant submits the requested information to the CDC. The CDC will forward the information to SBA:

SBA Sacramento Loan Processing Center at 6501 Sylvan Road, Suite 111, Citrus Heights CA 95610-5017.

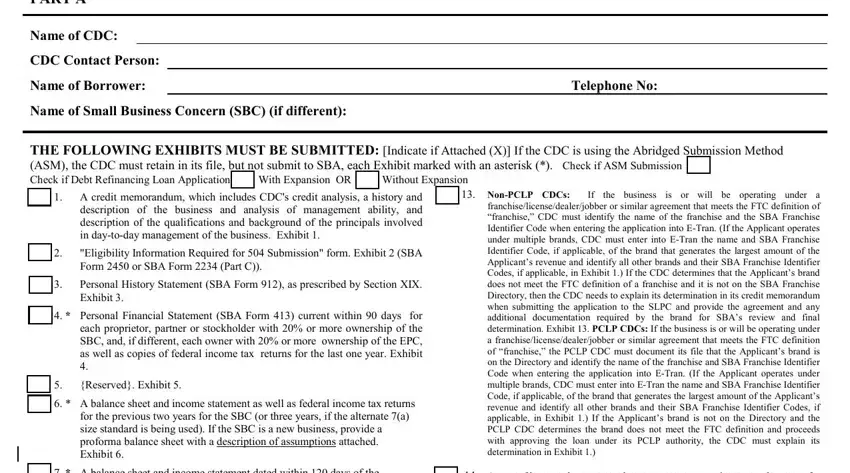

PART A

Name of CDC:

CDC Contact Person:

Name of Borrower:Telephone No: Name of Small Business Concern (SBC) (if different):

THE FOLLOWING EXHIBITS MUST BE SUBMITTED: [Indicate if Attached (X)] If the CDC is using the Abridged Submission Method (ASM), the CDC must retain in its file, but not submit to SBA, each Exhibit marked with an asterisk (*). Check if ASM Submission

|

Check if Debt Refinancing Loan Application |

|

With Expansion OR |

|

Without Expansion |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Non-PCLP CDCs: |

If the business is or will be operating under a |

|

|

1. |

A credit memorandum, which includes CDC's credit analysis, a history and |

|

|

|

|

|

franchise/license/dealer/jobber or similar agreement that meets the FTC definition of |

|

|

|

|

|

description of the business and |

analysis of management |

ability, and |

|

|

|

|

|

|

|

|

|

“franchise,” CDC must identify the name of the franchise and the SBA Franchise |

|

|

|

|

|

description of the qualifications and background of the principals involved |

|

|

|

|

|

|

|

|

|

Identifier Code when entering the application into E-Tran. (If the Applicant operates |

|

|

|

|

|

in day-to-day management of the business. Exhibit 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

under multiple brands, CDC must enter into E-Tran the name and SBA Franchise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

"Eligibility Information Required for 504 Submission" form. Exhibit 2 (SBA |

|

|

Identifier Code, if applicable, of the brand that generates the largest amount of the |

|

|

|

|

|

Form 2450 or SBA Form 2234 (Part C)). |

|

|

|

|

Applicant’s revenue and identify all other brands and their SBA Franchise Identifier |

|

|

|

|

|

|

|

|

|

Codes, if applicable, in Exhibit 1.) If the CDC determines that the Applicant’s brand |

|

|

|

|

3. |

Personal History Statement (SBA Form 912), as prescribed by Section XIX. |

|

|

|

|

|

|

|

does not meet the FTC definition of a franchise and it is not on the SBA Franchise |

|

|

|

|

|

Exhibit 3. |

|

|

|

|

|

|

|

Directory, then the CDC needs to explain its determination in its credit memorandum |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. * |

Personal Financial Statement (SBA Form 413) current within 90 days for |

|

|

when submitting the application to the SLPC and provide the agreement and any |

|

|

|

|

|

|

|

|

|

|

additional documentation required by the brand for SBA’s review and final |

|

|

|

|

|

each proprietor, partner or stockholder with 20% or more ownership of the |

|

|

determination. Exhibit 13. PCLP CDCs: If the business is or will be operating under |

|

|

|

|

|

SBC, and, if different, each owner with 20% or more ownership of the EPC, |

|

|

a franchise/license/dealer/jobber or similar agreement that meets the FTC definition |

|

|

|

|

|

as well as copies of federal income tax returns for the last one year. Exhibit |

|

|

of “franchise,” the PCLP CDC must document its file that the Applicant’s brand is |

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

on the Directory and identify the name of the franchise and SBA Franchise Identifier |

|

|

|

|

|

|

|

|

|

|

|

|

|

Code when entering the application into E-Tran. (If the Applicant operates under |

|

|

5. |

{Reserved}. Exhibit 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

multiple brands, CDC must enter into E-Tran the name and SBA Franchise Identifier |

|

|

|

|

6. * A balance sheet and income statement as well as federal income tax returns |

|

|

Code, if applicable, of the brand that generates the largest amount of the Applicant’s |

|

|

|

|

|

|

|

|

|

|

|

|

revenue and identify all other brands and their SBA Franchise Identifier Codes, if |

|

|

|

|

|

for the previous two years for the SBC (or three years, if the alternate 7(a) |

|

|

|

|

|

|

|

|

|

applicable, in Exhibit 1.) If the Applicant’s brand is not on the Directory and the |

|

|

|

|

|

size standard is being used). If the SBC is a new business, provide a |

|

|

PCLP CDC determines the brand does not meet the FTC definition and proceeds |

|

|

|

|

|

proforma balance sheet with a description of assumptions attached. |

|

|

with approving the loan under its PCLP authority, the CDC must explain its |

|

|

|

|

|

Exhibit 6. |

|

|

|

|

|

|

|

determination in Exhibit 1.) |

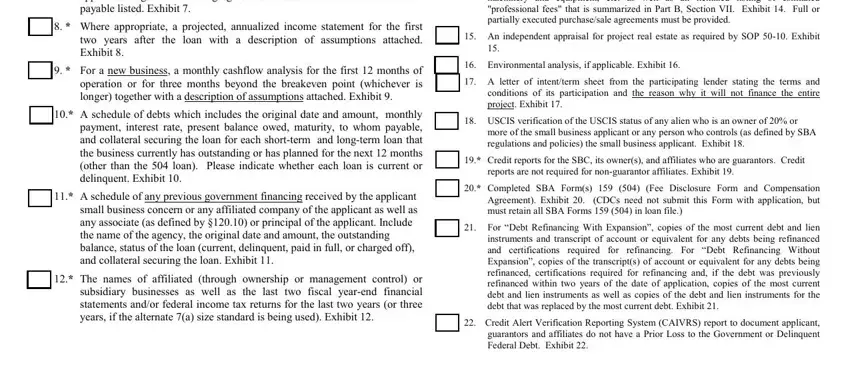

7. * A balance sheet and income statement dated within 120 days of the application together with an aging of the accounts receivable and accounts payable listed. Exhibit 7.

8. * Where appropriate, a projected, annualized income statement for the first two years after the loan with a description of assumptions attached. Exhibit 8.

9. * For a new business, a monthly cashflow analysis for the first 12 months of operation or for three months beyond the breakeven point (whichever is longer) together with a description of assumptions attached. Exhibit 9.

10.* A schedule of debts which includes the original date and amount, monthly payment, interest rate, present balance owed, maturity, to whom payable, and collateral securing the loan for each short-term and long-term loan that the business currently has outstanding or has planned for the next 12 months (other than the 504 loan). Please indicate whether each loan is current or delinquent. Exhibit 10.

11.* A schedule of any previous government financing received by the applicant small business concern or any affiliated company of the applicant as well as any associate (as defined by §120.10) or principal of the applicant. Include the name of the agency, the original date and amount, the outstanding balance, status of the loan (current, delinquent, paid in full, or charged off), and collateral securing the loan. Exhibit 11.

12.* The names of affiliated (through ownership or management control) or subsidiary businesses as well as the last two fiscal year-end financial statements and/or federal income tax returns for the last two years (or three years, if the alternate 7(a) size standard is being used). Exhibit 12.

14. A copy of key cost documents such as contractor costs, estimates, vendor quotes for machinery and equipment, etc. as well as an itemized listing of estimated "professional fees" that is summarized in Part B, Section VII. Exhibit 14. Full or partially executed purchase/sale agreements must be provided.

15. An independent appraisal for project real estate as required by SOP 50-10. Exhibit 15.

16. Environmental analysis, if applicable. Exhibit 16.

17.A letter of intent/term sheet from the participating lender stating the terms and conditions of its participation and the reason why it will not finance the entire project. Exhibit 17.

18. USCIS verification of the USCIS status of any alien who is an owner of 20% or more of the small business applicant or any person who controls (as defined by SBA regulations and policies) the small business applicant. Exhibit 18.

19.* Credit reports for the SBC, its owner(s), and affiliates who are guarantors. Credit reports are not required for non-guarantor affiliates. Exhibit 19.

20.* Completed SBA Form(s) 159 (504) (Fee Disclosure Form and Compensation Agreement). Exhibit 20. (CDCs need not submit this Form with application, but must retain all SBA Forms 159 (504) in loan file.)

21.For “Debt Refinancing With Expansion”, copies of the most current debt and lien instruments and transcript of account or equivalent for any debts being refinanced and certifications required for refinancing. For “Debt Refinancing Without Expansion”, copies of the transcript(s) of account or equivalent for any debts being refinanced, certifications required for refinancing and, if the debt was previously refinanced within two years of the date of application, copies of the most current debt and lien instruments as well as copies of the debt and lien instruments for the debt that was replaced by the most current debt. Exhibit 21.

22. Credit Alert Verification Reporting System (CAIVRS) report to document applicant, guarantors and affiliates do not have a Prior Loss to the Government or Delinquent Federal Debt. Exhibit 22.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 1 of 13 |

U.S. SMALL BUSINESS ADMINISTRATION

APPLICATION FOR SECTION 504 LOAN

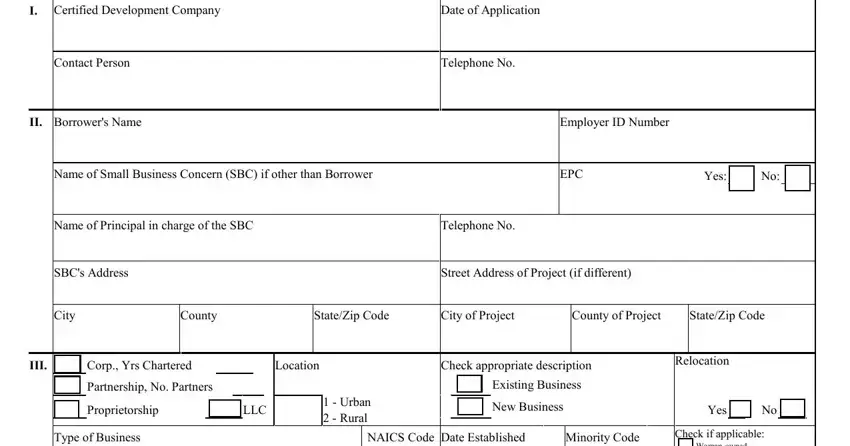

PART B

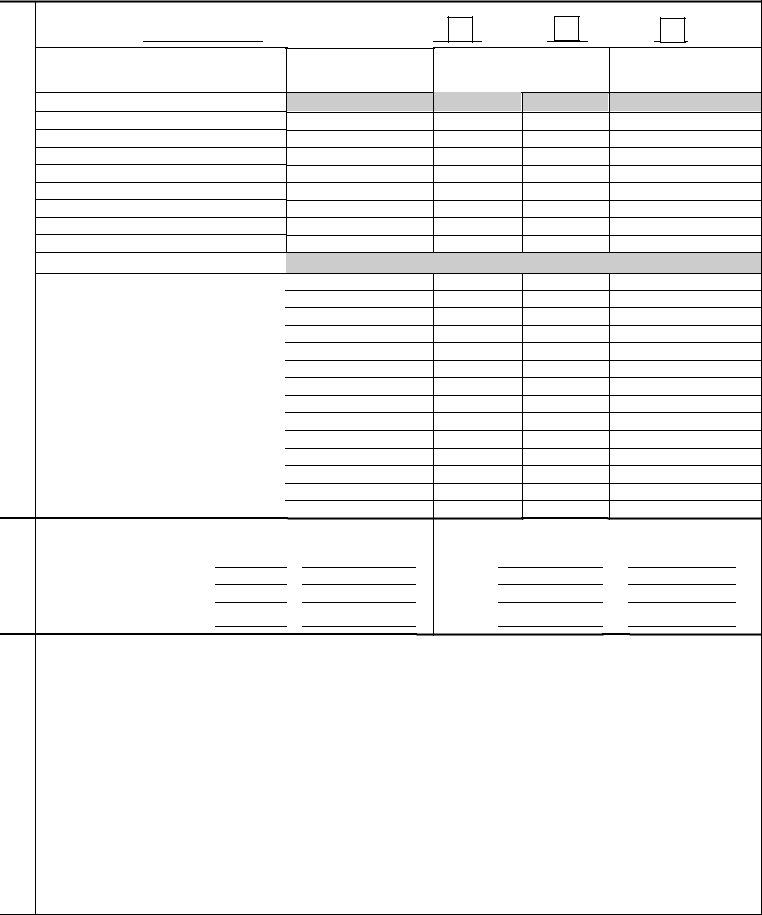

I. |

Certified Development Company |

|

|

|

|

|

|

|

|

|

Date of Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. |

Borrower's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer ID Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Small Business Concern (SBC) if other than Borrower |

|

|

|

|

|

|

EPC |

|

|

|

|

Yes: |

|

|

|

No: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Principal in charge of the SBC |

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBC's Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address of Project (if different) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

County |

|

|

|

|

|

|

State/Zip Code |

City of Project |

|

|

|

County of Project |

|

|

State/Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III. |

|

|

|

Corp., Yrs Chartered |

|

|

|

|

|

|

Location |

Check appropriate description |

Relocation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partnership, No. Partners |

|

|

|

|

|

|

|

|

|

|

|

|

|

Existing Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proprietorship |

|

|

|

|

|

|

LLC |

|

|

1 - Urban |

|

|

|

|

New Business |

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 - Rural |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Business |

|

|

|

|

|

|

|

|

|

|

|

|

NAICS Code |

Date Established |

|

|

Minority Code |

Check if applicable: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Woman-owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Veteran-owned |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service Disabled Veteran-owned |

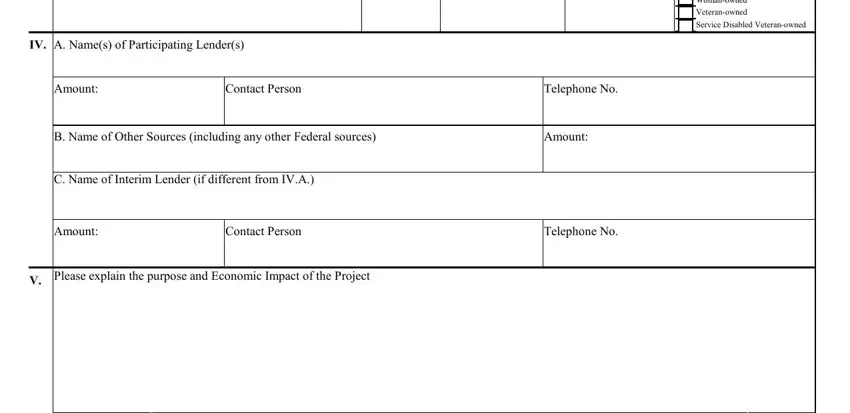

IV. A. Name(s) of Participating Lender(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount: |

|

|

|

|

Contact Person |

|

|

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Name of Other Sources (including any other Federal sources) |

|

|

|

|

|

Amount: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Name of Interim Lender (if different from IV.A.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount: |

|

|

|

|

Contact Person |

|

|

|

|

|

Telephone No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V.Please explain the purpose and Economic Impact of the Project

SBA USE ONLY |

|

|

|

Approved by SLPC |

Date |

Funding Approved |

Date |

SBA Form 1244 (04-18) Previous editions obsolete |

Page 2 of 13 |

VI. |

A. Impact on Jobs |

|

|

|

|

|

|

|

|

|

|

|

|

B. CDC's overall portfolio job ratio as of the date of the last |

|

|

|

|

|

|

1. Pre-project Employment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Economic Development Objectives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Number of jobs to be created in the next |

|

|

|

|

|

|

|

|

|

|

|

|

|

Community or Area Development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public Policy Goals |

(check one or more below)*** |

|

|

|

|

|

|

two years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficiency Goals |

|

|

3. Number of jobs to be retained because of |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rural development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

project |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business district revitalization |

|

_____ |

Reduce energy use by 10% |

|

|

4. Total jobs to be created and retained (2 + 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Debenture Amt./$65,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expansion of exports |

|

_____ |

Sustainable building design |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(504 projects only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minority-owned business |

|

|

Renewable energy |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enhanced economic competition |

|

|

production |

|

|

6. Does Project meet job requirement of 1 job |

|

|

|

|

|

Yes |

|

|

|

|

|

Changes necessitated by Federal |

|

______ |

Reduces unemployment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

per $65,000? |

|

|

|

|

|

|

|

No |

|

|

|

|

|

budget cutbacks |

|

|

|

|

|

|

in labor surplus areas |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business restructuring from Federally mandated policies affecting the |

|

|

7. If small manufacturing, does Project meet |

|

|

|

|

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

job requirement of 1 job per $100,000? |

|

|

|

|

|

|

|

No |

|

|

|

|

|

environment, employee safety or health. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Veteran-owned business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Woman-owned business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VII. |

Proposed Uses of Funds |

Amount Requested |

|

|

VIII. Debenture Pricing (504) |

|

|

|

|

|

|

|

|

|

|

|

Requested |

|

A. Land (and purchase of existing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A.SBA Share ( |

|

|

|

|

%) of Project Cost |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B.Administrative Costs |

|

|

|

|

|

|

|

|

|

|

|

building, if applicable): |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Building (new construction, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. SBA Guarantee Fee (Ax______%) |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Funding Fee (Ax0.0025) |

|

|

|

|

|

$ |

|

|

|

|

remodeling, L/H improvement, etc.): |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. CDC Processing Fee (Ax_____%) |

|

|

|

$ |

|

|

|

C. Machinery & equipment (purchase, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Closing Costs |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

installation, etc.): |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Total (B1 through B4) |

|

|

|

|

|

$ |

|

|

|

D. Debt to be refinanced |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Underwriters Fee* |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E. Professional fees (appraiser, architect, |

|

|

|

|

|

|

|

|

|

|

|

7. |

Total (B5 plus B6) |

|

|

|

|

|

$ |

|

|

|

|

legal, etc.): |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Total Debenture Amount (A plus B7, rounded up to |

|

|

|

|

|

F. Other Expenses (eligible business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

next thousand) |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Balance to Borrower (C minus (A + B7) |

|

|

|

$ |

|

|

|

|

expenses, construction contingency, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest on interim financing, etc.): |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G. TOTAL PROJECT COST (Not |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

including 504-related fees) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IX. |

Sources of Funds (504 projects only) |

|

Dollar Request |

|

|

|

% Project Cost |

|

Maturity |

|

|

Interest Rate |

|

|

Lien Position |

|

A. Net Debenture (VIII.A.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XXX |

|

|

|

|

|

XXX |

|

|

|

|

|

XXX |

|

|

Gross Debenture (VIII.C.) |

|

|

|

XXX |

|

|

|

|

XXX |

|

|

|

|

|

|

|

|

XXX |

|

|

|

|

|

|

|

|

B. Private Sector |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C. Other Financing (specify)

D. Borrower Injection

E. CDC Injection

F. TOTAL PROJECT FINANCING** |

|

|

100.00% |

|

|

|

XXX |

|

|

XXX |

|

|

XXX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X.Source of Equity Injection

* Underwriters fee calculated as follows: For 20 or 25 year Debentures, the sum of VIII.A . and B.5 divided by 0.99600; round this number up to the next highest thousand; multiply this number by 0.00400. For 10 year Debentures, the sum of VIII.A. and B.5 divided by 0.99625; round this number up to the

next highest thousand; multiply this number by 0.00375.

**This does not include 504-related fees and costs.

***The public policy goals refer to the public policy goals referenced in section 501(d)(3)(A) through (K) of the Small Business Investment Act. Applicants are eligible for a higher debenture if they can show the project achieves an applicable energy public policy or small manufacturing goal.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 3 of 13 |

ALL QUESTIONS MUST BE ANSWERED BY THE FOLLOWING INDIVIDUALS AND ARE SUBJECT TO VERIFICATION BY SBA:

(All parties listed below are considered “Associates” of the small business applicant.)

• For a sole proprietorship, the sole proprietor;• For a corporation, all owners of 20% or more of the corporation

• For a partnership, all general partners and all limited partners and each officer and director;

owning 20% or more of the equity of the firm, or any partner • For limited liability companies (LLCs), all members owning 20%

that is involved in management of the applicant business; |

or more of the company, each officer, director, and managing |

|

member; and |

|

• Any person hired by the business to manage day-to-day operations. |

(If more than one person must complete this section, this page may be copied, completed, and attached to this form.)

1. Are you presently subject to an indictment, criminal information, arraignment, or

|

|

|

|

|

other means by which formal criminal charges are brought in any jurisdiction? |

Yes |

|

|

|

|

|

2. Have you been arrested in the past six months for any criminal offense? |

Yes |

|

|

3.For any criminal offense (other than a minor vehicle violation) have you ever: 1) been convicted; 2) plead guilty; 3) plead nolo contendere; 4) been placed on

pre-trial diversion; or 5) been placed on any form of parole or probation |

|

(including probation before judgment)? |

Yes |

4.Has an application for the loan you are applying for now ever been submitted to SBA or to a Certified Development Company or Lender in connection with any SBA program?

5.Are you presently debarred, suspended, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any Federal department or agency?

6.If you are at least a 50% or more owner of the applicant business, are you more than 60 days delinquent on any obligation to pay child support arising under an administrative order, court order, repayment agreement between the holder and a custodial parent, or repayment agreement between the holder and a state agency providing child support enforcement services?

Initials:____________

Initials:____________

Initials:____________

Yes No

Yes No

Yes No N/A

7. Are you a U.S. citizen? |

Yes |

|

No |

|

Initials:____________ |

If “No,” are you a Lawful Permanent Resident alien? |

Yes |

|

No |

|

Initials:____________ |

If “Yes,” provide Alien Registration Number: _______________ |

If “No,” country of citizenship:_________________________ |

Signature:____________________________________ |

Association to Applicant: ____________________________ |

|

(SEE LIST ABOVE) |

|

|

|

Print Name: __________________________________ |

|

|

|

|

|

•If “YES” to Question 1, the loan request is ineligible for SBA assistance.

•If “YES” to Question 2 or 3, you must complete and submit to the CDC SBA Form 912. The CDC will determine whether the completed Form 912 must be submitted to SBA for a background check and a character determination in accordance with SBA Loan Program Requirements (as defined in 13 CFR § 120.10).

•If “YES” to Question 3 and you are currently on parole or probation (including probation before judgment), the loan request is ineligible for SBA assistance.

•If “YES” to Questions 4, 5 or 6, the application may not be approved by a PCLP CDC under its delegated authority. The application must be submitted to the SLPC for processing and approval.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 7 of 13 |

U.S. SMALL BUSINESS ADMINISTRATION

PART C

Statements Required by Law and Executive Order

Federal executive agencies, including the Small Business Administration (SBA), are required to withhold or limit financial assistance, to impose special conditions on approved loans, to provide special notices to applicants or borrowers and to require special reports and data from borrowers in order to comply with legislation passed by the Congress and Executive Orders issued by the President and by the provisions of various inter-agency agreements. SBA has issued regulations and procedures that implement these laws and executive orders, and they are contained in Parts 112, 113, 116, and 117, Title 13, Code of Federal Regulations Chapter 1, or Standard Operating Procedures.

Freedom of Information Act (5 U.S.C. 552)

This law provides, with some exceptions, that SBA must supply information reflected in agency files and records to a person requesting it. Information about approved loans that will be automatically released includes, among other things, statistics on our loan programs (individual borrowers are not identified in the statistics) and other information such as the names of the borrowers (and their officers, directors, stockholders or partners), the collateral pledged to secure the loan, the amount of the loan, its purpose in general terms and the maturity. Proprietary data on a borrower would not routinely be made available to third parties. All requests under this Act are to be addressed to the nearest SBA office and be identified as a Freedom of Information request.

Privacy Act (5 U.S.C. 552a)

A person can request to see or get copies of any personal information that SBA has in his or her file when that file is retrieved by individual identifiers such as name or social security numbers. Requests for information about another party may be denied unless SBA has the written permission of the individual to release the information to the requestor or unless the information is subject to disclosure under the Freedom of Information Act.

Under the provisions of the Privacy Act, you are not required to provide your social security number. But see Debt Collection notice below. Disclosures of name and other personal identifiers are, required for a benefit, as SBA requires an individual seeking assistance from SBA to provide it with sufficient information for it to make a character determination. In determining whether an individual is of good character, SBA considers the person’s integrity, candor, and disposition toward criminal actions. In making loans pursuant to section 7(a)(6) of the Small Business Act (the Act), 15 USC Section 636(a)(6), SBA is required to have reasonable assurance that the loan is of sound value and will be repaid or that it is in the best interest of the Government to grant the assistance requested. Additionally, SBA is specifically authorized to verify your criminal history, or lack thereof, pursuant to section 7(a)(1)(B), 15 USC Section 636(a)(1)(B). Further, for all forms of assistance, SBA is authorized to make all investigations necessary to ensure that a person has not engaged in acts that violate or will violate the Act or the Small Business Investment Act, 15 USC Sections 634(b)(11) and 687b(a). For these purposes, you are asked to voluntarily provide your social security number to assist SBA in making a character determination and to distinguish you from other individuals with the same or similar name or other personal identifier.

The Privacy Act authorizes SBA to make certain “routine uses” of information protected by that Act. One such routine use is the disclosure of information maintained in SBA’s investigative files system of records when this information indicates a violation or potential violation of law, whether civil, criminal, or administrative in nature. Specifically, SBA may refer the information to the appropriate agency, whether Federal, State, local or foreign, charged with responsibility for, or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. Another routine use is that SBA may disclose the information maintained in SBA’s investigative files to other Federal agencies conducting background check to the extent the information is relevant to the requesting agencies’ function. An additional routine use of personal information is to assist in obtaining credit bureau reports, including business credit reports on the small business borrower and consumer credit reports and scores on the principals of the small business and guarantors on the loan for purposes of originating, servicing, and liquidating small business loans and for purposes of routine periodic loan portfolio management and lender monitoring. In addition, as a routine use, SBA may transfer to the Department of Housing and Urban Development, or other Federal agency, information related to a debt that a person is delinquent in paying to SBA in connection with its loan programs for publication on a computer database system to allow searches by participating Government agencies and approved private lenders, consistent with applicable law. SBA and its authorized lenders may also use this computer database system to perform a computer match to determine a loan applicant’s credit status with participating agencies of the Federal Government. See Revision of Privacy Act System of Records, SBA 21- Loan System, 74 FR 14890 (April 1, 2009) for additional background and other routine uses, as amended by notices published at 77 FR 15835 (3/16/2012) and 77 FR 61467 (10/9/2012), and as may be further amended from time to time.

Right to Financial Privacy Act of 1978 (12 U.S.C. 3401)

This is notice to you as required by the Right of Financial Privacy Act of 1978, of SBA's access rights to financial records held by financial institutions that are or have been doing business with you or your business, including any financial institutions participating in a loan or loan guarantee. The law provides that SBA shall have a right of access to your financial records in connection with its consideration or administration of assistance to you in the form of a Government loan or loan guaranty agreement. SBA is required to provide a certificate of its compliance with the Act to a financial institution in connection with its first request for access to your financial records, after which no further certification is required for subsequent accesses. The law also provides that SBA's access rights continue for the term of any approved loan or loan guaranty agreement. No further notice to you of SBA's access rights is required during the term of any such agreement.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 8 of 13 |

The law also authorizes SBA to transfer to another Government authority any financial records included in an application for a loan, or concerning an approved loan or loan guarantee, as necessary to process, service or foreclose on a loan or loan guarantee or to collect on a defaulted loan or loan guarantee. No other transfer of your financial records to another Government authority will be permitted by SBA except as required or permitted by law.

Debt Collection Act of 1982 Deficit Reduction Act of 1984 (31 U.S.C. 3701 et seq. and other titles)

These laws require SBA to aggressively collect any loan payments which become delinquent. SBA must obtain your taxpayer identification number when you apply for a loan. If you receive a loan, and do not make payments as they come due, SBA may take one or more of the following actions:

-Report the status of your loan(s) to credit bureaus

-Hire a collection agency to collect your loan

-Offset your income tax refund or other amounts due to you from the Federal Government

-Suspend or debar you or your company from doing business with the Federal Government

-Refer your loan to the Department of Justice or other attorneys for litigation

-Foreclose on collateral or take other action permitted in the loan instruments

-If you default on an SBA loan and fail to fully reimburse SBA for any resulting loss, refer you to the computer database of delinquent Federal debtors maintained by the Department of Housing and urban Development, or other Federal agency, which may disqualify you from receiving financial assistance from other Federal agencies. In addition, unless SBA is reimbursed in full for the loss, you will not eligible for additional SBA financial assistance.

Flood Disaster Protection Act (42 U.S.C. 4011)

Regulations have been issued by the Federal Insurance Administration (FIA) and by SBA implementing this Act and its amendments. These regulations prohibit SBA from making certain loans in an FIA designated floodplain unless Federal flood insurance is purchased as a condition of the loan. Failure to maintain the required level of flood insurance makes the applicant ineligible for any future financial assistance from SBA under any program, including disaster assistance.

Executive Orders -- Floodplain Management and Wetland Protection (42 F.R. 26951 and 42 F.R. 26961)

The SBA discourages any settlement in or development of a floodplain or a wetland. This statement is to notify all SBA loan applicants that such actions are hazardous to both life and property and should be avoided. The additional cost of flood preventive construction must be considered in addition to the possible loss of all assets and investments in future floods.

Occupational Safety and Health Act (15 U.S.C. 651 et seq.)

This legislation authorizes the Occupational Safety and Health Administration in the Department of Labor to require businesses to modify facilities and procedures to protect employees or pay penalty fees. In some instances, the business can be forced to cease operations or be prevented from starting operations in a new facility. Therefore, in some instances SBA may require additional information from an applicant to determine whether the business will be in compliance with OSHA regulations and allowed to operate its facility after the loan is approved and disbursed. Signing this form as borrower is a certification that the OSA requirements that apply to the borrower's business have been determined and the borrower to the best of its knowledge is in compliance.

Civil Rights Legislation

All businesses receiving SBA financial assistance must agree not to discriminate in any business practice, including employment practices and services to the public, on the basis of categories cited in 13 C.F.R., Parts 112, 113, and 117 of SBA Regulations. This includes making their goods and services available to handicapped clients or customers. All business borrowers will be required to display the "Equal Employment Opportunity Poster" prescribed by SBA.

Equal Credit Opportunity Act (15 U.S.C. 1691)

The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status or age (provided that the applicant has the capacity to enter into a binding contract); because all or part of the applicant's income derives from any public assistance program, or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The Federal agency that administers compliance with this law concerning this creditor is the Federal Trade Commission, Equal Credit Opportunity, Washington, D.C. 20580.

Executive Order 11738 -- Environmental Protection (38 C.F.R. 25161)

The Executive Order charges SBA with administering its loan programs in a manner that will result in effective enforcement of the Clean Air Act, the Federal Water Pollution Act and other environmental protection legislation. SBA must, therefore, impose conditions on some loans. By acknowledging receipt of this form and presenting the application, the principals of all small businesses borrowing $100,000 or more in direct funds stipulate to the following:

1.That any facility used, or to be used, by the subject firm is not cited on the EPA list of Violating Facilities.

2.That subject firm will comply with all the requirements of Section 114 of the Clean Air Act (42 U.S.C. 7414) and Section 308 of the Water Act (33 U.S.C 1318) relating to inspection, monitoring, entry, reports and information, as well as all other requirements specified in Section 114 and Section 308 of the respective Acts, and all regulations and guidelines issued thereunder.

3.That subject firm will notify SBA of the receipt of any communication from the Director of the Environmental Protection Agency indicating that a facility utilized, or to be utilized, by subject firm is under consideration to be listed on the EPA List of Violating Facilities.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 9 of 13 |

|

Immigration and Nationality Act (8 U.S.C. 1101, et seq., as amended)

If you are an alien who was in this country illegally since before January 1, 1982, you may have been granted lawful temporary resident status by the United States Citizenship and Immigration Services pursuant to the Immigration Reform and Control Act of 1986 (Pub. L. 99- 603). For five years from the date you are granted such status, you are not eligible for financial assistance from the SBA in the form of a loan or guaranty under section 7(a) of the Small Business Act unless you are disabled or a Cuban or Haitian entrant. When you sign this document, you are making the certification that the Immigration Reform and Control Act of 1986 does not apply to you, or if it does apply, more than five years have elapsed since you have been granted lawful temporary resident status pursuant to such 1986 legislation.

Lead-Based Paint Poisoning Prevention Act (42 U.S.C. 4821 et seq.)

Borrowers using SBA funds for the construction or rehabilitation of a residential structure are prohibited from using lead-based paint (as defined in SBA regulations) on all interior surfaces, whether accessible or not, and exterior surfaces, such as stairs, decks, porches, railings, windows and doors, which are readily accessible to children under 7 years of age. A "residential structure" is any home, apartment, hotel, motel, orphanage, boarding school, dormitory, day care center, extended care facility, college or other school housing, hospital, group practice or community facility and all other residential or institutional structures where persons reside.

Executive Order 12549 as amended by E.O. 12689, Debarment and Suspension (2 CFR 180, adopted by reference in 2 CFR Part 2700 (SBA Debarment Regulations)) -- By submission of this loan application, you certify and acknowledge that neither you nor any Principals have within the past three years been: (a) debarred, suspended, declared ineligible from participating in, or voluntarily excluded from participation in a transaction by any Federal department or agency; (b) formally proposed for debarment, with a final determination still pending; (c) indicted, convicted, or had a civil judgment rendered against you for any of the offenses listed in the Regulations; or (d) delinquent on any amounts due and owing to the U.S. Government or its agencies or instrumentalities as of the date of execution of this certification.

If you are unable to certify and acknowledge (a) through (d), you must obtain and attach a written statement of exception from SBA permitting participation in this 504 loan. You further certify that you have not and will not knowingly enter into any agreement in connection with the goods and/or services purchased with the proceeds of this loan with any individual or entity that has been debarred, suspended, declared ineligible from participating in, or voluntarily excluded from participation in a Transaction. All capitalized terms have the meanings set forth in 2 C.F.R. Part 180.

Applicant Notifications

The Applicants, its proprietors, partners, officers or stockholders owning 20% or more of the Applicant have/ have not been involved in bankruptcy or insolvency proceedings. This question covers not only the Applicant, but also the personal bankruptcy or insolvency proceedings of proprietors, partners, officers or stockholders owning 20% or more of the Applicant. You must attach copies of the proceedings, if any.

The Applicant, its proprietors, partners, officers or stockholders owning 20% of more the Applicant |

are/ |

|

are not |

involved in any pending lawsuits. This question covers not only the Applicant, but also proprietors, partners, officers or stockholders owning 20% or more of the Applicant in their personal capacities.

Applicant's Acknowledgment

My signature acknowledges receipt of these Statements Required by Laws and Executive Orders, that I have read it and that I have a copy for my files. My signature represents my agreement to comply with the requirements SBA makes in connection with the approval of my loan request and to comply, whenever applicable, with the limitations contained in these Statements.

Certification as to Application Accuracy – Criminal Penalties for False Statements

The undersigned certifies that all information provided to the CDC, and that all information in, and submitted with this application, including all exhibits is true and complete to the best of his or her knowledge. Applicant acknowledges that the application and exhibits are submitted to the CDC and to SBA so that the CDC and SBA can decide whether to approve this application. Any future submissions of information to the CDC must be accompanied by a certification as to the accuracy of that information.

The undersigned acknowledges that whoever makes any false statement or report, or willfully overvalues any land property or security for the purpose of influencing in any way the action of the SBA under the Small Business Investment Act, as amended, may be punished by a fine of not more than $1,000,000 or by imprisonment for up to 30 years, or both, pursuant to 18 U.S.C. 1014. The undersigned further acknowledges that, in connection with a 504 loan, submission of any false statement to the CDC or SBA or submission of any record to the CDC or SBA omitting material information can result in civil money penalties and additional monetary liability up to three times the amount of damages which the Government sustains because of the false statement under the False Claims Act, 31 U.S.C. 3729.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 10 of 13 |

Borrower Agreements and Certifications

I agree that if SBA approves this application, I will not for at least two years hire an employee or consult anyone who was employed by the SBA during the one year period prior to the disbursement of the debenture.

I certify: I have not paid anyone connected with the Federal government for help getting this financial assistance. I also agree to report to the SBA Office of Inspector General, 409 Third Street S.W., Washington, D.C. 20416, any Federal government employee who offers in return for any type of compensation to help get this application approved. I understand that I need not pay anybody to deal with SBA. I also understand that a Certified Development Company may charge the applicant a percentage of the loan proceeds as set forth in SBA regulations as a fee for preparing and processing the loan applications. I agree to pay for or reimburse SBA for the cost of any surveys, title or mortgage examinations, appraisals, etc., performed by non-SBA personnel provided that I have given my consent.

Regulations issued by SBA prohibit the making of loans to relocate any operations of a small business which will cause a net reduction of one-third or more in the workforce of the relocating small business or a substantial increase in unemployment in any area of the country.

In the event that proceeds from this loan are used to provide a facility for relocation of the beneficiary small business concern (including any affiliate, subsidiary or other business entity under direct, indirect or common control), the undersigned certifies that such relocation will not significantly increase unemployment in the area of the original location.

No overlapping relationship exists between the small business concern, including its associates, and the CDC, including its associates, or any other lender providing financing for the project that could create an appearance of a conflict of interest as defined in 13 CFR 120.140 or violate 13 CFR 120.851. No such relationships existed within six months of this application or will be permitted to exist while assistance is outstanding.

I authorize disclosure of all information submitted in connection with this application to the financial institution agreeing to participate with SBA's guaranteed debenture. I waive all claims against SBA and its consultants for any management and technical assistance that may be provided. In consideration for assistance from the Small Business Administration, I hereby agree that I will comply with all Federal laws and regulations to the extent that they are applicable to such assistance, including conditions set forth in this application. I, my spouse, or any member of my household, or anyone who owns, manages, or directs the business or their spouses or members of their households do not work for the SBA, Small Business Advisory Council, SCORE or ACE, any Federal agency, or the participating lender. If someone does, the name and address of such person and where employed is provided on an attached page.

(Each Proprietor, each General Partner, each Limited Partner or Stockholder owning 20% or more, and each Guarantor must sign. Each person should only sign once.)

If Applicant is a proprietor or partnership, sign below: |

If Applicant is an L.L.C. or corporation, sign below: |

|

|

|

|

|

|

|

|

|

Name of Business |

|

|

Corporate Name |

|

|

By: |

|

Date: |

|

By: |

|

Date: |

|

|

|

|

|

Attested by: |

|

(seal, if required) |

Additional Proprietors, Partners, Stockholders or Guarantors as required:

Signature |

|

Date |

|

|

|

Signature |

|

Date |

|

|

|

Signature |

|

Date |

|

|

|

Signature |

|

Date |

SBA Form 1244 (04-18) Previous editions obsolete |

Page 11 of 13 |

CDC Agreements and Certifications

The CDC agrees that if SBA approves this application, it will not for at least two years after the disbursement of the debenture hire an employee or consult anyone who was employed by the SBA during the one-year period prior to the disbursement of the debenture.

The CDC certifies that it does not own any stock or equity in the SBC and no officer, director, or person within a controlling group of the CDC is an officer, director or holder of any direct or indirect pecuniary interest in the SBC.

The CDC authorizes disclosure of all information submitted in connection with this application to the financial institution agreeing to participate with the SBA's guaranteed debenture or loan.

The CDC certifies that it will comply with 13 C.F.R. Sections 112, 113, and 117 which prohibit discrimination on the grounds of race, color, sex, religion, marital status, handicap, age or national origin by recipients of Federal financing assistance; and will require appropriate reports and access to books and records. These requirements are also applicable to anyone who buys or takes control of the business. He/she realizes that if he/she does not comply with these nondiscrimination requirements, SBA can call, terminate, or accelerate repayment on his/her loan.

As consideration for any Management and Technical Assistance that may be provided, the CDC waives all claims against SBA and its consultants.

The CDC certifies that it has not paid anyone connected with the Federal government for help in getting this financial assistance. It also agrees to report to the SBA Office of Inspector General, 409 3rd Str., SW, Washington, D.C. 20416 any Federal government employee who offers in return for any type of compensation to help get this application approved.

The CDC understands that it need not pay anyone to deal with SBA. He/she has read SBA Form 159 which explains SBA policy on representatives and fees.

The CDC states, to the best of its knowledge and belief, that if any funds have been paid or will be paid to any person for influencing or attempting to influence any agency, a Member of Congress, an officer or employee of Congress, or an employee of a Member of Congress in connection with this commitment providing for the United States to insure or guarantee a loan, it shall complete and submit Standard Form-LLL, "Disclosure of Lobbying Activities," in accordance with 13 CFR Part 146. CDC acknowledges that submission of this disclosure is a prerequisite for making or entering into this transaction imposed by 31 U.S.C. 1352 and that any person who fails to file or amend a declaration required to be filed or amended shall be subject to a civil penalty in the amounts set forth in 13 CFR § 146.400.

The CDC in consideration for assistance from SBA hereby agrees that it will comply with all Federal laws and regulations enforced to the extent that they are applicable to such assistance, including conditions set forth in this application.

The undersigned certifies that all information in this application and the exhibits is true and complete to the best of his/her knowledge and is submitted to SBA so that the CDC and SBA can decide whether to approve this application.

The CDC acknowledges that submission of false information to SBA, or the withholding of material information from SBA, can result in criminal prosecution under 18 U.S.C. 1001 and other provisions, liability for treble damages under the False Claims Act, 31 U.S.C. 3729- 3733, debarment and suspension, lender enforcement remedies under 13 C.F.R. Part 120, and other consequences.

The CDC certifies that the credit analysis has been reviewed and approved by the CDC Board of Directors.

Name of Development Company:

Attested By:

PLEASE NOTE: The estimated burden for completing this form and exhibits is 2.25 hours per application for ASM submissions and 2.45 for non-ASM submissions. You are not required to respond to any collection of information unless it displays a currently valid OMB approval number. Comments or questions on the burden estimate should be sent to U.S. Small Business Administration, Chief, AIB, 409 3rd St., S.W., Washington D.C. 20416 and/or SBA Desk Officer, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, D.C. 20503.

PLEASE DO NOT SEND FORMS TO THESE ADDRESSES.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 12 of 13 |

U.S. SMALL BUSINESS ADMINISTRATION

APPLICATION FOR SECTION 504 LOAN

________________________________________________________________________

PART D

Instructions for Third Party Lender Certification for Loans Made For Debt Refinancing

________________________________________________________________________________________________________________________________________________

The Third Party Lender must provide the following certifications in its commitment letter submitted as Exhibit 17 of SBA Form 1244, Application for Section 504 Loan.

The Third Party Lender certifies that it has no reason to believe that the following statements are not true:

1.Either:

(a.) Substantially all (85% or more) of the proceeds of the indebtedness being refinanced were used to acquire and Eligible Fixed Asset (e.g. land, including a building situated thereon, to construct a building thereon, or to purchase equipment) and the remaining amount (15% or less) was incurred for the benefit of the small business seeking the refinancing; or

(b)If the Eligible Fixed Asset(s) was (were) originally financed through a commercial loan (the “original loan”) that was subsequently refinanced one or more times:

(i)substantially all (85% or more) of the proceeds of the original loan was used to acquire an Eligible Fixed Asset (e.g., land, including a building situated thereon, to construct a building thereon, or to purchase equipment) and the remaining (15% or less) was incurred for the small business seeking the refinancing; and

(ii)the existing debt is the most recent refinancing of the original loan.

2.All of the proceeds of the indebtedness being refinanced were used for the benefit of the small business.

3.For Same Institution Debt:

OPTION A - For Debt Refinancing with Expansion

If the indebtedness being refinanced is debt of the Third Party Lender, or any of its affiliates, (Same Institution Debt), the Third Party Lender must certify that it is not in a position to sustain a loss causing a shift to SBA of all or part of a potential loss from the existing debt.

OPTION B – For Debt Refinancing Without Expansion

If the indebtedness being refinanced is debt of the Third Party Lender, or any of its affiliates, (Same Institution Debt), the Third Party Lender must certify that it is not in a position to sustain a loss on the Refinancing Project amount causing a shift to SBA of all or part of a potential loss from the existing debt.

SBA Form 1244 (04-18) Previous editions obsolete |

Page 13 of 13 |