With the help of the online tool for PDF editing by FormsPal, it is easy to complete or modify sba standby creditor agreement right here. Our editor is constantly developing to deliver the very best user experience attainable, and that is due to our commitment to continuous improvement and listening closely to testimonials. Here's what you will want to do to begin:

Step 1: First of all, open the editor by pressing the "Get Form Button" above on this page.

Step 2: The tool gives you the capability to change nearly all PDF forms in various ways. Change it by writing personalized text, correct existing content, and add a signature - all when it's needed!

This PDF form requires specific details; in order to ensure consistency, take the time to take heed of the next guidelines:

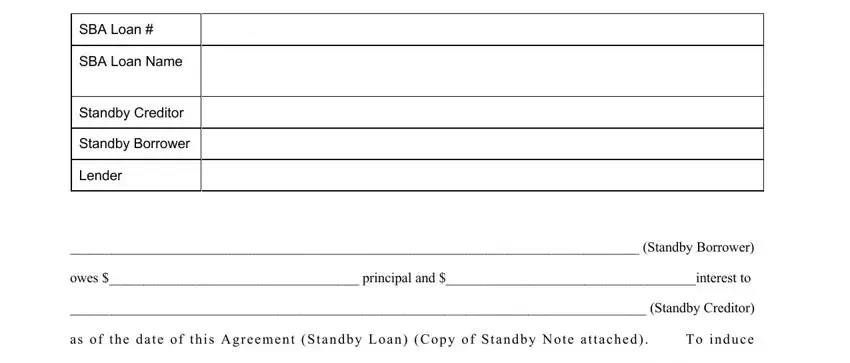

1. Fill out the sba standby creditor agreement with a selection of necessary blank fields. Consider all of the important information and make sure not a single thing left out!

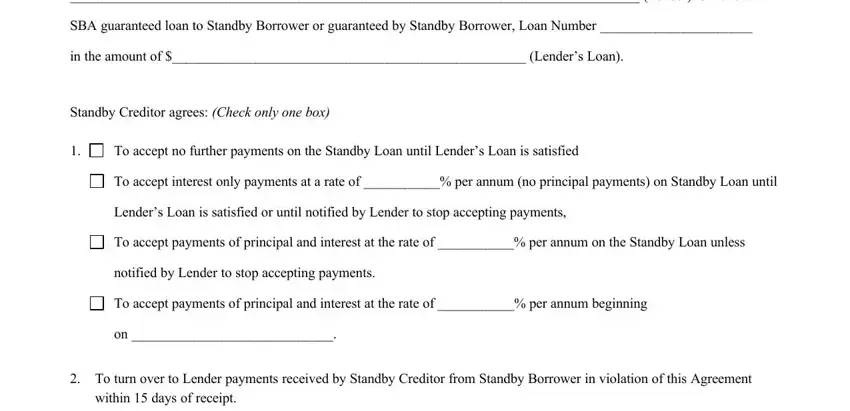

2. Given that the last array of fields is done, it is time to include the necessary particulars in Lender to make an, SBA guaranteed loan to Standby, in the amount of Lenders Loan, Standby Creditor agrees Check only, To accept no further payments on, To accept interest only payments, Lenders Loan is satisfied or until, To accept payments of principal, notified by Lender to stop, To accept payments of principal, To turn over to Lender payments, and within days of receipt allowing you to proceed to the next step.

3. Completing Dated, Standby Creditor, signature, name, SBA Form Previous editions, and Page is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding Dated and Standby Creditor, make sure that you get them right in this section. The two of these are the key fields in the form.

Step 3: Immediately after looking through your fields you've filled out, press "Done" and you are good to go! Obtain the sba standby creditor agreement as soon as you sign up for a 7-day free trial. Quickly access the form inside your FormsPal account, with any modifications and changes conveniently preserved! When you work with FormsPal, you're able to complete documents without being concerned about information leaks or data entries being distributed. Our protected system makes sure that your personal data is kept safely.