OMB Control No: 3245-0201

FEE DISCLOSURE FORM AND COMPENSATION AGREEMENT

For Agent Services In Connection With an SBA Disaster Assistance Loan

POLICIES AND REGULATIONS CONCERNING REPRESENTATIVES AND THEIR FEES

Purpose of this form: Section 13 of the Small Business Act requires that an SBA disaster loan applicant (“Applicant”) identify the names of persons engaged by or on behalf of the Applicant for the purpose of expediting the application and the fees paid or to be paid to any such person. 13 C.F.R., Part 103.5 requires any agent or packager to execute and provide to SBA a compensation agreement (“Agreement”). SOP 50-30, Appendix 14 defines how the reasonableness of fees may be determined. Each Agreement governs the compensation charged for services rendered or to be rendered to the Applicant in any matter involving SBA assistance. “Agent” includes a loan packager, accountant, attorney, consultant, engineer, architect, appraiser, or any other party that receives compensation from representing an Applicant for an SBA disaster loan.

SBA does not require an Applicant to engage the services of any Agent to file an application or close a loan. No fees or compensation will be reimbursed or paid by SBA to any Agent. If an Applicant chooses to employ an Agent, the compensation an Agent charges to and that is paid by the Applicant must bear a necessary and reasonable relationship to the services actually performed and must be comparable to those charged by other Agents in the geographical area. Compensation cannot be contingent on loan approval. In addition, compensation must not include any expenses which are deemed by SBA to be unreasonable for services actually performed or expenses actually incurred. Compensation must not include charges prohibited in 13 CFR 103 or SOP 50-30, Appendix 14. If the compensation is determined by SBA to be unreasonable, the Agent must cancel the compensation, or refund to the Applicant any portion the Applicant already paid. In cases where SBA deems the amount of compensation unreasonable, the Agent must reduce the compensation to an amount SBA deems reasonable, refund to the Applicant any sum in excess of the amount SBA deems reasonable, and refrain from charging or collecting directly or indirectly from the Applicant an amount in excess of the amount SBA deems reasonable. Violation by an Agent of any of these rules may result in SBA’s suspension or revocation of the Agent’s privilege of conducting business with SBA.

The following are not considered Agents for purposes of this Agreement and, therefore, are not required to complete this Agreement: 1) Applicant’s accountant for the preparation of financial statements or tax returns required by the Applicant in the normal course of business and not related to the loan application; 2) Any professional retained by Applicant for services required by the Applicant in the normal course of business and not related to the application or loan closing. Direct costs associated with document preparation in connection with the loan closing do not need to be reported in this Agreement.

Instructions on completion of this form: This form must be completed in connection with a loan application if the Applicant has paid (or will be paying) compensation to an Agent in excess of the following amounts:

$500 for a disaster home loan $2500 for a disaster business loan

If the compensation exceeds these amounts, the Agent must provide an itemization and justification of the services performed.

There must be a completed Agreement for each Agent compensated by the Applicant. If the certifications are made by a legal entity other than an individual (e.g., corporation, limited liability company), execution of the certification must be in the legal entity’s name by a duly authorized officer or other representative of the entity; if by a partnership, execution of the certification must be in the partnership’s name by a general partner.

PLEASE NOTE: The estimated burden for completion of this Form 159D is 5 minutes per response. You are not required to respond to this information collection unless it displays a currently valid OMB approval number. Comments on the burden should be sent to U.S. Small Business Administration, Chief, Administrative Information Branch, Washington, D.C. 20416, and Desk Officer for SBA, Office of Management and Budget, New Exec. Office Building, Room 10202, Washington, D. C. 20503. (3245-0201). PLEASE DO NOT SEND FORMS TO OMB.

SBA Form 159D (7-05) Ref SOP 50 30 Previous edition of SBA 159 obsolete |

1 |

|

FEE DISCLOSURE FORM AND COMPENSATION AGREEMENT

For Agent Services In Connection With an SBA Disaster Assistance Loan

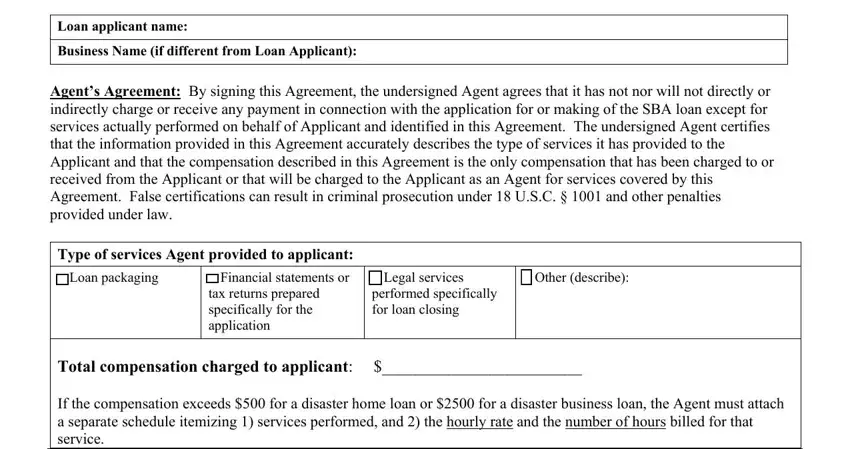

Loan applicant name:

Business Name (if different from Loan Applicant):

Agent’s Agreement: By signing this Agreement, the undersigned Agent agrees that it has not nor will not directly or indirectly charge or receive any payment in connection with the application for or making of the SBA loan except for services actually performed on behalf of Applicant and identified in this Agreement. The undersigned Agent certifies that the information provided in this Agreement accurately describes the type of services it has provided to the Applicant and that the compensation described in this Agreement is the only compensation that has been charged to or received from the Applicant or that will be charged to the Applicant as an Agent for services covered by this Agreement. False certifications can result in criminal prosecution under 18 U.S.C. § 1001 and other penalties provided under law.

Type of services Agent provided to applicant:

□ Loan packaging |

□ Financial statements or |

□ Legal services |

□ Other (describe): |

|

tax returns prepared |

performed specifically |

|

|

specifically for the |

for loan closing |

|

|

application |

|

|

|

|

|

|

Total compensation charged to applicant: $________________________

If the compensation exceeds $500 for a disaster home loan or $2500 for a disaster business loan, the Agent must attach a separate schedule itemizing 1) services performed, and 2) the hourly rate and the number of hours billed for that service.

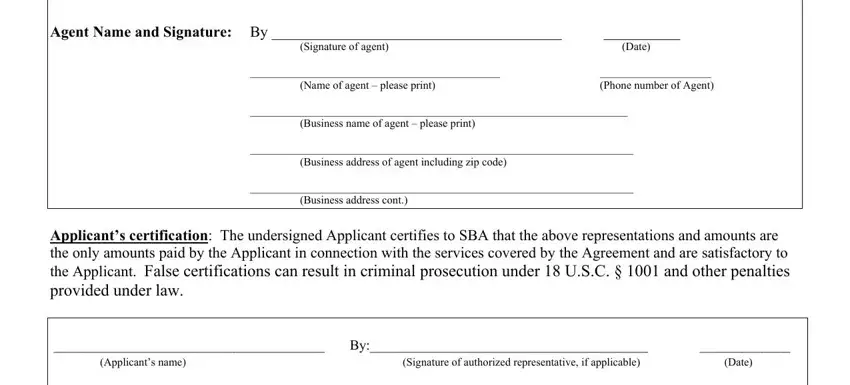

Agent Name and Signature: By ______________________________________ |

__________ |

(Signature of agent) |

(Date) |

_____________________________________________ |

____________________ |

(Name of agent – please print) |

(Phone number of Agent) |

____________________________________________________________________

(Business name of agent – please print)

_____________________________________________________________________

(Business address of agent including zip code)

_____________________________________________________________________

(Business address cont.)

Applicant’s certification: The undersigned Applicant certifies to SBA that the above representations and amounts are the only amounts paid by the Applicant in connection with the services covered by the Agreement and are satisfactory to the Applicant. False certifications can result in criminal prosecution under 18 U.S.C. § 1001 and other penalties provided under law.

_______________________________________ |

By:________________________________________ |

_____________ |

(Applicant’s name) |

(Signature of authorized representative, if applicable) |

(Date) |

______________________________________ |

___________________________________________ |

|

(Applicant’s name -- please print) |

(Name of authorized representative – please print) |

|

SBA Form 159D (7-05) Ref SOP 50 30 Previous edition of SBA 159 obsolete |

2 |

|