It is possible to fill out sba form information get easily in our PDF editor online. To make our tool better and simpler to work with, we continuously come up with new features, with our users' suggestions in mind. To begin your journey, consider these basic steps:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: This editor enables you to change your PDF file in a variety of ways. Improve it by writing any text, adjust original content, and put in a signature - all at your fingertips!

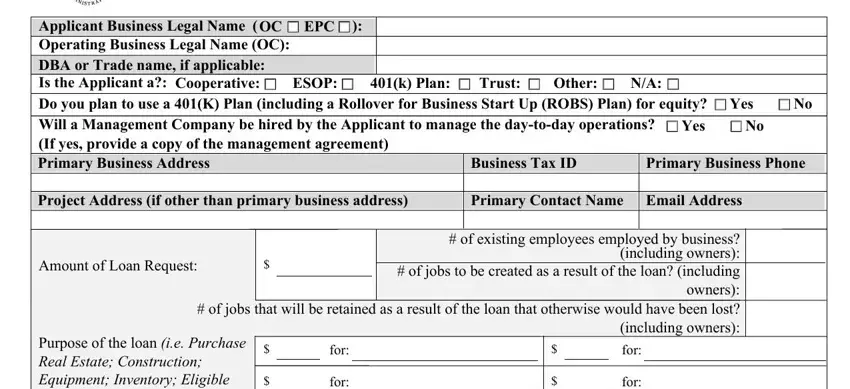

This PDF form requires specific information to be typed in, so be sure to take the time to enter what is expected:

1. Begin completing your sba form information get with a selection of necessary blanks. Note all of the necessary information and make sure absolutely nothing is missed!

2. Immediately after the first section is filled out, go to enter the suitable information in all these - Purpose of the loan ie Purchase, for, for, for, for, If financial statements provided, List all proprietors partners, Ownership of the Applicant, Owners Legal Name, Title, TIN, Address Address, ESOP K COOP, Owned, and SSNEIN.

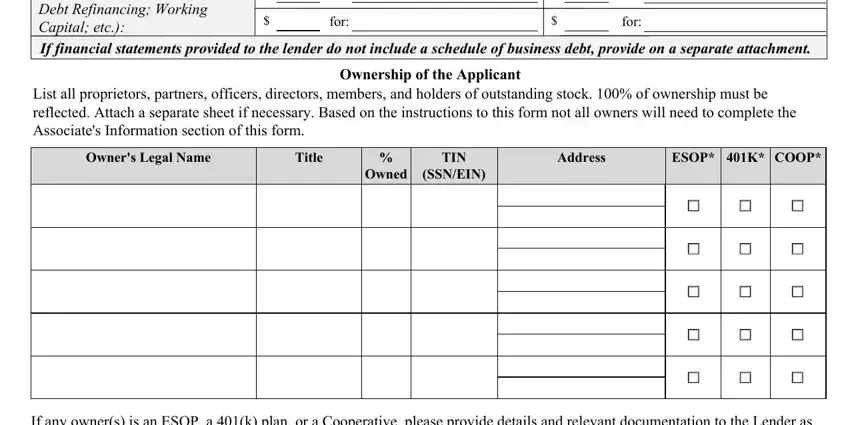

3. The following segment is all about Are there coapplicants If Yes, Has an application for the, Has the Applicant andor its, a Is any of the financing, b Did any of this financing ever, Is the Applicant presently, Does the Applicant Business, Does the Applicant have any, Has the Applicant andor its, and Is the Applicant andor its - type in each one of these blank fields.

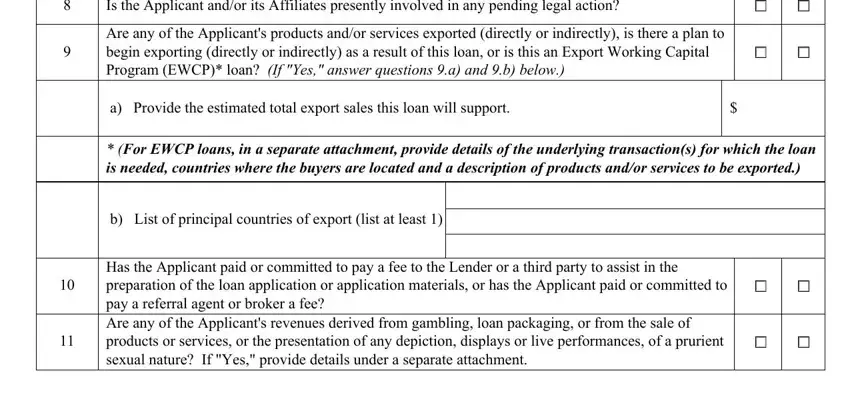

4. This part arrives with the following form blanks to focus on: Is the Applicant andor its, Are any of the Applicants products, a Provide the estimated total, For EWCP loans in a separate, b List of principal countries of, and Has the Applicant paid or.

Always be really careful when filling out Are any of the Applicants products and Is the Applicant andor its, because this is where most people make errors.

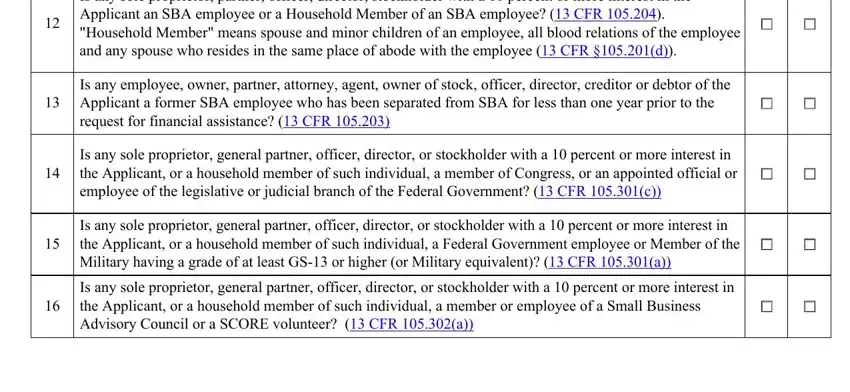

5. When you get close to the final sections of your form, there are actually several more things to undertake. Particularly, Is any sole proprietor partner, Is any employee owner partner, Is any sole proprietor general, Is any sole proprietor general, and Is any sole proprietor general should all be filled in.

Step 3: Prior to submitting your form, it's a good idea to ensure that form fields have been filled out as intended. When you are satisfied with it, click “Done." Join us today and immediately access sba form information get, ready for download. All modifications made by you are preserved , helping you to customize the pdf at a later time if necessary. When using FormsPal, it is simple to complete forms without worrying about data leaks or data entries getting distributed. Our protected system ensures that your private information is maintained safely.