Handling PDF documents online is definitely super easy with this PDF editor. You can fill in UCCs here effortlessly. Our tool is consistently evolving to present the very best user experience achievable, and that is thanks to our resolve for constant development and listening closely to user comments. For anyone who is looking to get going, here's what you will need to do:

Step 1: Press the orange "Get Form" button above. It's going to open our tool so that you could start completing your form.

Step 2: With the help of our state-of-the-art PDF editor, you could do more than merely fill out blank fields. Try all the features and make your documents look great with custom text added, or modify the file's original content to excellence - all comes with the capability to insert just about any images and sign it off.

This form will need particular information to be filled out, hence be sure to take your time to enter exactly what is requested:

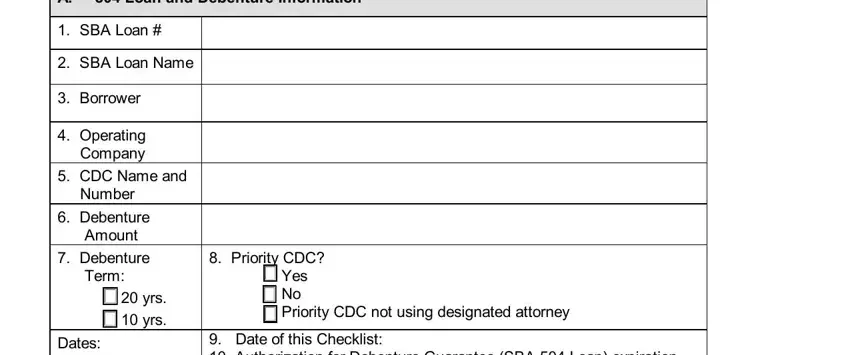

1. Complete the UCCs with a group of major blank fields. Get all the required information and ensure there is nothing overlooked!

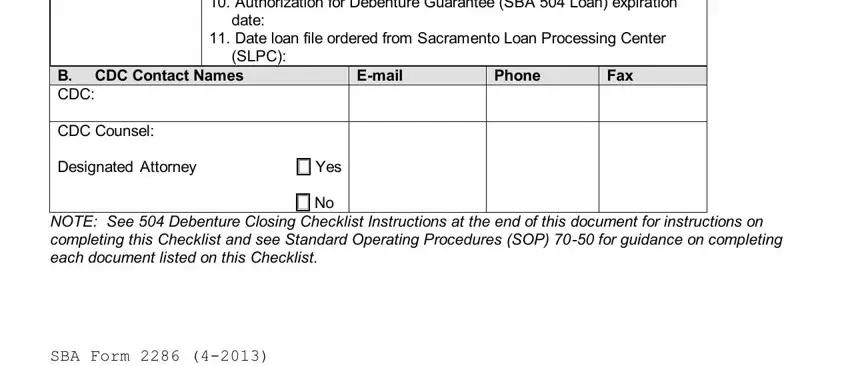

2. Once your current task is complete, take the next step – fill out all of these fields - Priority CDC Yes No Priority, Email, Phone, B CDC Contact Names CDC CDC, Fax, and SBA Form Previous Editions with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

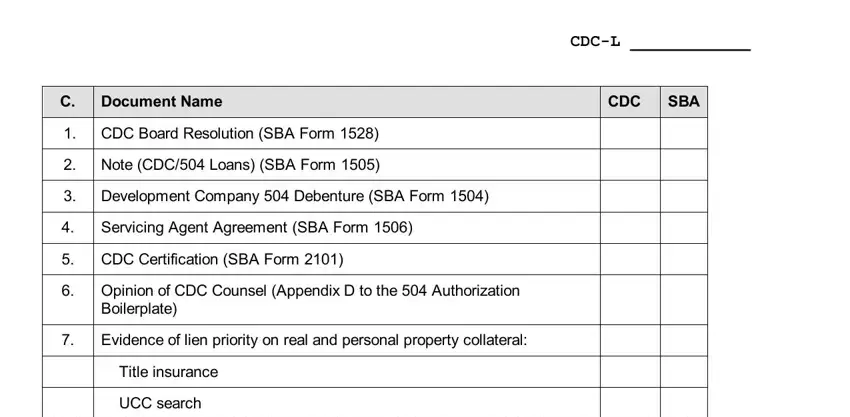

3. The following segment is related to CDCL, C Document Name, CDC, SBA, CDC Board Resolution SBA Form, Note CDC Loans SBA Form, Development Company Debenture, Servicing Agent Agreement SBA Form, CDC Certification SBA Form, Opinion of CDC Counsel Appendix D, Boilerplate, Evidence of lien priority on real, Title insurance, and UCC search - fill out every one of these fields.

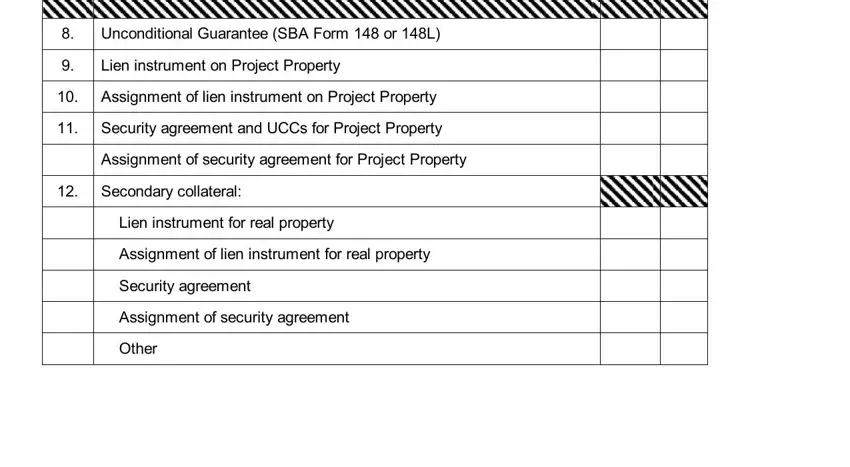

4. This next section requires some additional information. Ensure you complete all the necessary fields - Unconditional Guarantee SBA Form, Lien instrument on Project Property, Assignment of lien instrument on, Security agreement and UCCs for, Assignment of security agreement, Secondary collateral, Lien instrument for real property, Assignment of lien instrument for, Security agreement, Assignment of security agreement, Other, and SBA Form Previous Editions - to proceed further in your process!

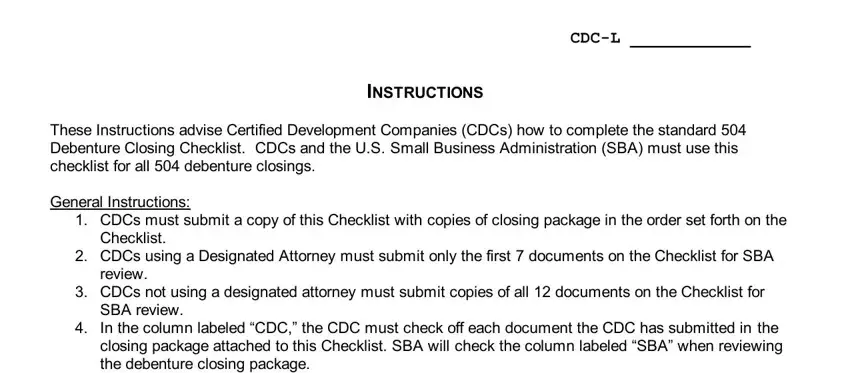

5. As a final point, this last section is what you will have to finish before submitting the PDF. The fields at issue include the next: CDCL, INSTRUCTIONS, These Instructions advise, CDCs must submit a copy of this, Checklist, review, SBA review, CDCs using a Designated Attorney, CDCs not using a designated, In the column labeled CDC the CDC, and After debenture sale CDC must.

People frequently make mistakes when completing Checklist in this area. Be sure you read twice whatever you type in here.

Step 3: Confirm that your information is correct and press "Done" to conclude the process. Download your UCCs as soon as you join for a 7-day free trial. Easily use the form inside your personal cabinet, along with any modifications and changes being conveniently saved! FormsPal offers secure document editing without personal data recording or any type of sharing. Be assured that your information is in good hands with us!