OMB Control No: 3245-0378

Expiration Date: 08/31/2021

U.S. SMALL BUSINESS ADMINISTRATION

QUICK BOND GUARANTEE APPLICATION AND AGREEMENT

TO BE COMPLETED BY SMALL BUSINESS AND SURETY FOR SINGLE BONDS NOT EXCEEDING $400,000

Instructions and Terms and Conditions of Agreement on Page #4

Surety Company Name:_______________________________________________________

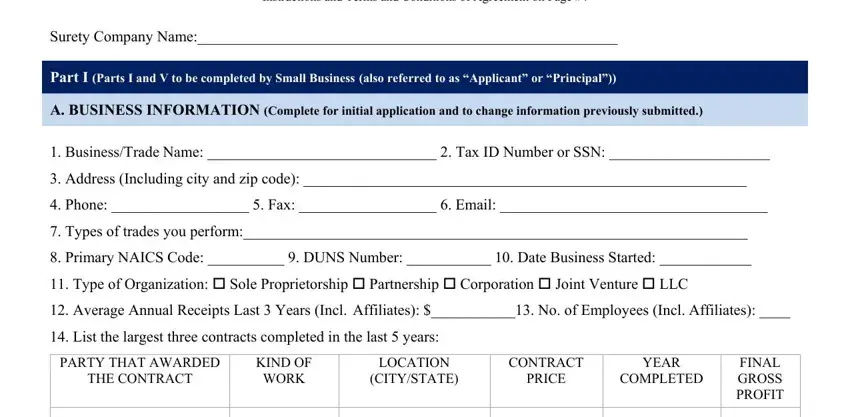

Part I (Parts I and V to be completed by Small Business (also referred to as “Applicant” or “Principal”))

A. BUSINESS INFORMATION (Complete for initial application and to change information previously submitted.)

1.Business/Trade Name: ______________________________ 2. Tax ID Number or SSN: _____________________

3.Address (Including city and zip code): __________________________________________________________

4.Phone: __________________ 5. Fax: __________________ 6. Email: ___________________________________

7.Types of trades you perform:__________________________________________________________________

8.Primary NAICS Code: __________ 9. DUNS Number: ___________ 10. Date Business Started: ____________

11.Type of Organization: Sole Proprietorship Partnership Corporation Joint Venture LLC

12.Average Annual Receipts Last 3 Years (Incl. Affiliates): $___________13. No. of Employees (Incl. Affiliates): ____

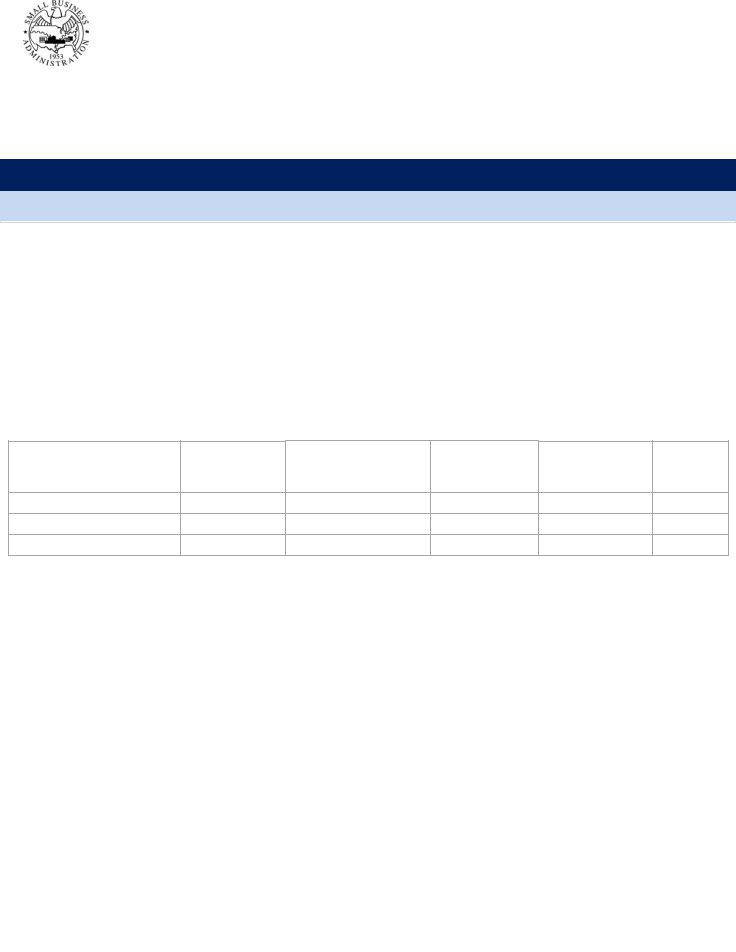

14.List the largest three contracts completed in the last 5 years:

PARTY THAT AWARDED

THE CONTRACT

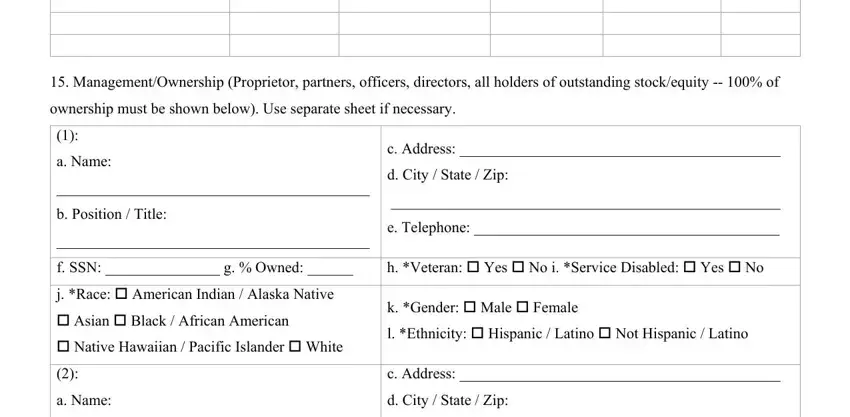

15.Management/Ownership (Proprietor, partners, officers, directors, all holders of outstanding stock/equity -- 100% of ownership must be shown below). Use separate sheet if necessary.

|

(1): |

c. Address: __________________________________________ |

|

a. Name: |

|

d. City / State / Zip: |

|

_________________________________________ |

|

___________________________________________________ |

|

b. Position / Title: |

|

e. Telephone: ________________________________________ |

|

_________________________________________ |

|

|

|

|

|

|

f. SSN: _______________ g. % Owned: ______ |

h. *Veteran: Yes No i. *Service Disabled: Yes No |

|

|

|

|

j. *Race: American Indian / Alaska Native |

k. *Gender: Male Female |

|

Asian Black / African American |

|

l. *Ethnicity: Hispanic / Latino Not Hispanic / Latino |

|

Native Hawaiian / Pacific Islander White |

|

|

|

|

|

|

(2): |

c. Address: __________________________________________ |

|

a. Name: |

d. City / State / Zip: |

|

_________________________________________ |

___________________________________________________ |

|

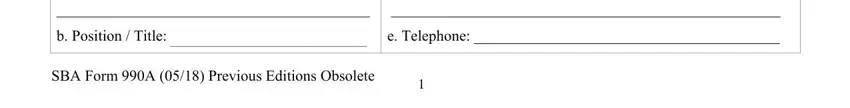

b. Position / Title: _________________________________________ |

e. Telephone: ________________________________________ |

|

SBA Form 990A (05/18) Previous Editions Obsolete |

1 |

|

|

|

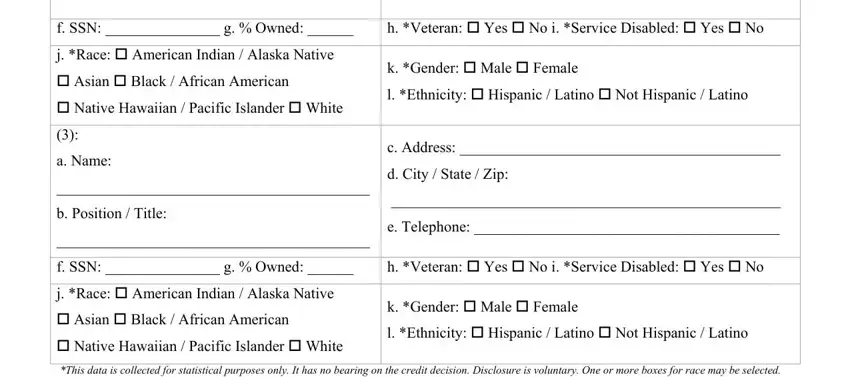

f. SSN: _______________ g. % Owned: ______ |

h. *Veteran: Yes No i. *Service Disabled: Yes No |

|

|

|

|

j. *Race: American Indian / Alaska Native |

k. *Gender: Male Female |

|

Asian Black / African American |

|

l. *Ethnicity: Hispanic / Latino Not Hispanic / Latino |

|

Native Hawaiian / Pacific Islander White |

|

|

|

|

|

|

(3): |

c. Address: __________________________________________ |

|

a. Name: |

|

d. City / State / Zip: |

|

_________________________________________ |

|

___________________________________________________ |

|

b. Position / Title: |

|

e. Telephone: ________________________________________ |

|

_________________________________________ |

|

|

|

|

|

|

f. SSN: _______________ g. % Owned: ______ |

h. *Veteran: Yes No i. *Service Disabled: Yes No |

|

|

|

|

j. *Race: American Indian / Alaska Native |

k. *Gender: Male Female |

|

Asian Black / African American |

|

l. *Ethnicity: Hispanic / Latino Not Hispanic / Latino |

|

Native Hawaiian / Pacific Islander White |

|

|

*This data is collected for statistical purposes only. It has no bearing on the credit decision. Disclosure is voluntary. One or more boxes for race may be selected.

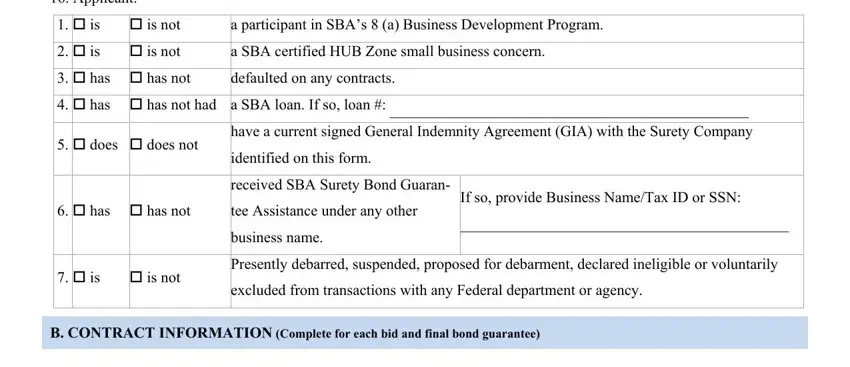

16. Applicant:

|

1. |

is |

is not |

a participant in SBA’s 8 (a) Business Development Program. |

|

|

|

|

|

|

|

2. |

is |

is not |

a SBA certified HUB Zone small business concern. |

|

|

|

|

|

|

|

3. |

has |

has not |

defaulted on any contracts. |

|

|

|

|

|

|

|

4. |

has |

has not had |

a SBA loan. If so, loan #: _______________________________________________ |

|

5. |

does |

does not |

have a current signed General Indemnity Agreement (GIA) with the Surety Company |

|

identified on this form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

received SBA Surety Bond Guaran- |

If so, provide Business Name/Tax ID or SSN: |

|

6. |

has |

has not |

tee Assistance under any other |

|

___________________________________________ |

|

|

|

|

business name. |

|

|

|

|

|

|

|

|

|

|

|

|

7. |

is |

is not |

Presently debarred, suspended, proposed for debarment, declared ineligible or voluntarily |

|

excluded from transactions with any Federal department or agency. |

|

|

|

|

|

|

|

|

|

|

B. CONTRACT INFORMATION (Complete for each bid and final bond guarantee)

1. |

Project Type: Construction Service Supply Other |

|

2. |

Liquidated Damages: $____________ Weekdays Calendar Days |

|

|

|

|

|

3. Project Description: |

4. Project Location: |

|

___________________________________________________ |

_______________________________________ |

|

|

|

|

|

|

5. Project’s NAICS |

|

6. No. of Employees before this project |

7. No. of existing jobs retained due to this project |

|

Code: ____________ |

|

was awarded: ____________ |

(same job cannot be reported as new): _______ |

|

|

|

|

|

|

|

8. Obligee Name: |

9. No. of new jobs due to the project (same job cannot be |

|

_____________________________________ |

reported as retain-above): _______ |

|

|

|

|

|

SBA Form 990A (05/18) Previous Editions Obsolete

2

Obligee Address: |

10. Applicant is |

____________________________________________________ |

prime subcontractor on this project. |

____________________________________________________ |

|

|

|

11. Obligee Type: |

12. Percentage of work subcontracted by |

Federal State Local Private Special District |

Applicant: ________ |

|

|

Applicant certifies that:

A bid, payment or performance bond is required by the bid solicitation or the original contract for this project. Applicant has attempted and failed to obtain the required bonds without SBA'sguarantee.

Applicant, or its Affiliates, has not defaulted on an SBA-guaranteed bond resulting in a Loss that has not been fully reimbursed to SBA or, if SBA has reimbursed the Applicant, or its Affiliates, for any Imminent Breach payments, SBA has been fully reimbursed for thesepayments.

All information in this Application and that relates to this Application which has been submitted to SBA, any agent, or broker, or surety company, is complete and accurate to the best of my knowledge.

If Part I, section A, of this Application has previously been submitted in connection with an earlier Application, I have reviewed that information and certify that it either remains complete and accurate to the best of my knowledge or that I have submitted a revised Part I, section A, with complete and accurate information with this Application. In addition, if Part V, section B has previously been submitted in connection with an earlier Application, it either remains in compliance with the instructions set forth in Part V, section B, or an updated Part V, section B that complies with the instructions set forth in Part V, section B is being submitted with this Application.

Any agency, broker, surety company, financial institution, or other party in possession of credit, financial or work experience information concerning the undersigned applicant and the applicant’s business is authorized to release the same to SBA in order that SBA may evaluate the same for the purpose of bond guarantee assistance.

The individual signing below is authorized to execute this Application on behalf of the Applicant.

I understand that knowingly making a false statement or submitting false information is a violation of Federal law and could result in criminal prosecution or civil penalties under 18 U.S.C. §§ 287, 371, 1001, 15 U.S.C. § 645, or 31 U.S.C. § 3729.

Principal's Signature: ________________________ Date: _________ Printed Name: _________________________

Part II (To be completed by Surety)

A. COMPLETE FOR BID BOND:

1.Estimated Contract Amount: $__________________ 2. Bid Bond Percentage or Amount: _______________

3.Bid Date: ______________ 4. Bid Time: _____________

SBA Form 990A (05/18) Previous Editions Obsolete

3

B. COMPLETE FOR FINAL BOND:

1. |

Contract Amount: $_____________ |

2. |

Anticipate Project Start Date: ______________________ |

3. |

Anticipated Project Completion Date_________________ |

4. |

Payment Bond No.: _________________________ |

5. |

Payment Bond Amount: $__________________________ |

6. |

Performance Bond No.: ______________________ |

7. |

Performance Bond Amount: $_______________________ |

8. |

Bid Spread: Low: $__________________________ |

9. |

2nd Low: $______________________________________ |

10. Contactor Fee Amount: $____________________ |

11. Surety Fee Amount: $____________________________ |

C. COMPLETE FOR CONTRACT/BOND AMOUNT CHANGES

(Specify the increased or decreased bond, premium, and fee amounts)

1. |

Original Contract Amount: $___________________ |

2. |

Increase: Decrease: |

3. |

Revised Contract Amount: $___________________ |

|

|

4. |

Payment Bond Amount: $_____________________ |

5. |

Performance Bond Amount: $_______________________ |

6. |

Contractor Fee Amount: $____________________ |

7. |

Premium and Rate Charged by Surety: $_______________ |

8. |

Surety Fee Amount: $_______________________ |

|

|

In my opinion, the Principal appears to have the financial management and technical abilities to successfully complete this contract. However, I have determined that the Principal falls below the normal underwriting standard of this Surety, who will not issue this bond without an SBA guarantee. On behalf of the Surety, I agree to the Terms and Conditions listed below and I certify that all information provided in connection with this Application and Agreement is true, correct and complete to the best of my knowledge. The Surety certifies that the Applicant is a small business according to the standards in 13 CFR Part 121. I also certify that the Principal meets the eligibility requirements set forth in 13 CFR Part 115 and that this Application does not fall within any of the exclusions set forth in SBA regulations (13 CFR Part 115) under which this SBA Form 990A, Quick Bond Application and Agreement, may not be used. By signing below, I certify that I have been authorized by the Surety to execute this Application on behalf of the Surety.

I understand that knowingly making a false statement or submitting false information is a violation of Federal law and could result in criminal prosecution or civil penalties under statutes including 18 U.S.C. §§ 287, 371, 1001, 15 U.S.C. § 645, or 31 U.S.C. § 3729. SBA reserves the right to review the surety’s documentation relating to this information at any time.

Signature of Surety’s Attorney-in Fact: ____________________________________________ Date: _____________

Printed Name: _________________________________Agency Name _____________________________________

D. TERMS AND CONDITIONS:

1.If the Surety determines that the Contract price is reasonable and the Contract amount does not exceed that statutory ceiling specified in 13 CFR Part 115, Surety shall, conditional on the execution of this guarantee by SBA, become Surety on bid, performance and payment bond(s) required for the award of the Contract. Surety may withdraw its decision to issue such bond(s) if prescribed underwriting conditions are not met or if additional information comes to

SBA Form 990A (05/18) Previous Editions Obsolete

4

the attention of Surety that changes its underwriting determination and notice is given to SBA.

2.The Surety represents that the terms and conditions of such bond(s) are, and will be, in accord with SBA regulations (13 CFR Part 115), SBA’s policies and procedures, and with those standards established and generally accepted by the surety industry for the type of contract for which such bond(s) are required to be furnished by Principal, and Surety represents that such bonds would not be provided for Principal on this Contract without this SBA guarantee.

3.If any suit or claim is filed against Surety upon said bond(s), Surety must inform SBA of the same within 30 days of receipt of notice. Unless SBA decides otherwise, and so notifies Surety, Surety shall take charge of all suits or claims arising under said bond(s) and compromise, settle or defend such suit or claim until so notified. Surety shall take all steps necessary to mitigate any loss resulting from Principal’s default. Surety shall not join SBA as a party in any lawsuit to which Surety is a party unless SBA has denied liability or has agreed to such joinder in writing.

4.No employee of SBA has authority to waive, change or alter the terms of this Quick Bond Guarantee Application and Agreement, unless such alterations are separately attached and both the SBA and Surety’s authorized representatives have signed and dated their assent.

5.This Quick Bond Guarantee Application and Agreement is made exclusively for the benefit of SBA and the Surety, and does not confer any rights or benefits on any other party, such as any right of action against SBA by any person claiming under SBA-guaranteed bonds or otherwise. In the event of the Surety’s insolvency, SBA shall not be liable to the receiver or other representative of the surety except for any loss incurred and monies actually paid by such representative under the bonds guaranteed by SBA.

6.The Surety agrees to comply with all relevant SBA regulations and policies and procedures. If any provision of this Quick Bond Guarantee Application and Agreement is in conflict with any SBA regulation, such regulation shall prevail in construing or applying this Agreement.

PART III (To be completed by sba.)

Signature:___________________________________Title:____________________________Date: ___________

Typed Name: ______________________________________________

Disposition: Approved Declined Returned Withdrawn

In reliance on the information and certifications contained in this application, SBA agrees to guarantee the bond described herein as of the time of issuance, subject to 15 U.S.C. § 694a and b, and SBA regulations in 13 CFR Part 115. SBA guarantees ___% of the loss in consideration of ___% of the surety's own premium base. This guaranty shall become effective upon the execution (as defined in such regulations) of the SBA-guaranteed bond by the Surety.

SBG NUMBER: ________________________________________________

Part IV—INSTRUCTIONS:

The purpose of this form is to collect information about the applicant that is used in evaluating the eligibility of the applicant for surety bond guarantee assistance. Without the information, SBA would be unable to make a decision on the

SBA Form 990A (05/18) Previous Editions Obsolete

5

application and the business would not get a bond.

For first time applications for assistance under SBA’s Surety Bond Guarantee Program, the small business completes and signs Part I of this Quick Bond Guarantee Application and Agreement (Application), and the small business and the individuals identified in Part V complete and sign Part V. The small business then submits the Application to the surety agent of choice

Upon completion of its underwriting, the surety company or agent completes Part II of the Application and signs and submits it through the Capital Access Financial System. SBA reviews the Application, completes and signs Part III of the Application, notifies surety of its decision, and returns the signed Application to the surety.

For subsequent applications for assistance, the small business completes Part I, section B and, if necessary, Part I, section

A.In addition, if necessary to comply with the instructions set forth in Part V, the small business and/or the individuals identified in Part V, section B, complete Part V. The small business submits the Application to the surety agent of choice.

Paperwork Reduction Act:

According to the Paperwork Reduction Act, you are not required to respond to this or any request for collection of information unless it displays a currently valid OMB approval number. The number for this collection of information is 3245-0378. The total estimated time for responding to this request for information, including time to read instructions and compile the information needed to respond is 10 minutes. Comments on the burden or other aspects for this collection of information should be sent to: U.S. Small Business Administration, Chief, AIB, 409 3rd St., S.W., Washington, D.C. 20416 and Desk Officer for the Small Business Administration, Office of Management and Budget, New Executive Office Building, Room 10202, Washington, D.C. 20503.

PLEASE DO NOT SEND FORMS TO OMB.

Part V—CERTIFICATIONS

A. CERTIFICATION ON BEHALF OF THE SMALL BUSINESS (This section to be completed by small business for initial application and updated and submitted to sba when there are any ownership changes):

By my signature, I certify, on behalf of the small business, that I have received and read a copy of the “STATEMENTS` REQUIRED BY LAW AND EXECUTIVE ORDER” (Statement), which was attached to this Application, and I agree to comply with the requirements in the Statement. I also certify that I am authorized to execute this certification on behalf of the small business. I understand that knowingly making a false statement or submitting false information is a violation of Federal law and could result in criminal prosecution or civil penalties under 18 U.S.C. §287, 371, 1001, 15 U.S.C. § 645, or 31 U.S.C. § 3729.

Business Name:___________________________________________________________________________

Principal’s Signature/Title: _________________________________________________ Date: _____________

SBA Form 990A (05/18) Previous Editions Obsolete

6

B. INDIVIDUAL CERTIFICATIONS (Complete this paragraph B as follows: (a) with the first Application submitted on or after October 1 of each year; (b) with any Application that is submitted after any changes in the ownership of the small business; or (c) if any of the answers to questions 1-5 below change with respect to any individual who previously answered these questions in connection with a prior Application, that individual must complete this paragraph B for any subsequent Application)

Individual Certifications:

Each Proprietor, each General Partner, each Guarantor, and each Limited Partner, Stockholder, or other equity holder owning 20% or more of the small business must answer and initial the questions below and then sign at the end of this paragraph B below. The person signing on behalf of the business must also sign in his or her individual capacity. In addition, if spouses collectively own 20% or more of the small business, each spouse must also sign. Initial each response where indicated to confirm your response to the question. Attach a copy of this Part V.B if needed for additional individuals.

1. Are you a U.S. citizen?

Yes |

No |

Individual #1 Initials: _________ |

Yes |

No |

Individual #2 Initials: _________ |

Yes |

No |

Individual #3 Initials: _________ |

If “No” are you a Lawful Permanent Resident alien?

Yes |

No |

If “Yes”, provide Alien Registration Number: |

Individual #1 Initials: _________ |

|

|

__________________________________ |

|

|

If “No”, country of citizenship: |

|

|

__________________________________ |

Yes |

No |

If “Yes”, provide Alien Registration Number: |

Individual #2 Initials: _________ |

|

|

__________________________________ |

|

|

If “No”, country of citizenship: |

|

|

__________________________________ |

Yes |

No |

If “Yes”, provide Alien Registration Number: |

Individual #3 Initials: _________ |

|

|

__________________________________ |

|

|

If “No”, country of citizenship: |

|

|

__________________________________ |

2.Are you presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? (If “Yes”, the applicant is not eligible for SBA assistance.)

Yes |

No |

Individual #1 Initials: __________ |

Yes |

No |

Individual #2 Initials: __________ |

Yes |

No |

Individual #3 Initials: __________ |

3. Have you been arrested in the past six months for any criminal offense?

Yes |

No |

Individual #1 Initials: __________ |

Yes |

No |

Individual #2 Initials: __________ |

Yes |

No |

Individual #3 Initials: __________ |

SBA Form 990A (05/18) Previous Editions Obsolete

7

4.For any criminal offense – other than a minor vehicle violation – have you ever: 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; 4) been placed on pretrial diversion or 5) been placed on any form of parole or probation (including probation before judgement).

Yes |

No |

Individual #1 Initials: __________ |

Yes |

No |

Individual #2 Initials: __________ |

Yes |

No |

Individual #3 Initials: __________ |

If you answer “Yes” to questions 3 or 4, you must furnish details on a separate sheet, including dates, location, fines, sentences, level of charge (whether misdemeanor or felony), dates of parole/probation, unpaid fines or penalties, name(s) under which charged, and any other pertinent information.

If you answer “Yes” to question 4 and are currently on parole or probation, the applicant is not eligible for SBA assistance.

5.Are you presently debarred, suspended, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any Federal department or agency?

Yes |

No |

Individual #1 Initials: __________ |

Yes |

No |

Individual #2 Initials: __________ |

Yes |

No |

Individual #3 Initials: __________ |

By my signature, I certify that I have received and read a copy of the “STATEMENTS REQUIRED BY LAW AND EXECUTIVE ORDER” (Statements), which is attached to this Application, and I agree to comply, whenever applicable, with the requirements in the Statement. I also certify that I have reviewed the information in this Application and that all of the information that I have provided in this Application and in all supporting documents and forms submitted with this Application is true, correct, and complete to the best of my knowledge. I understand that knowingly making a false statement or submitting false information is a violation of Federal law and could result in criminal prosecution or civil penalties under 18 U.S.C. § 287, 371, 1001, 15 U.S.C. § 645, or 31 U.S.C. § 3729. In addition, I authorize the SBA to request criminal record information about me from criminal justice agencies for the purpose of determining my eligibility for programs authorized by the Small Business Investment Act, as amended. I also authorize any agent, broker, Surety Company, financial institution, or other party to release to SBA any information in its possession relating to my credit, financial or work experience in order that SBA may evaluate this application for bond guarantee assistance.

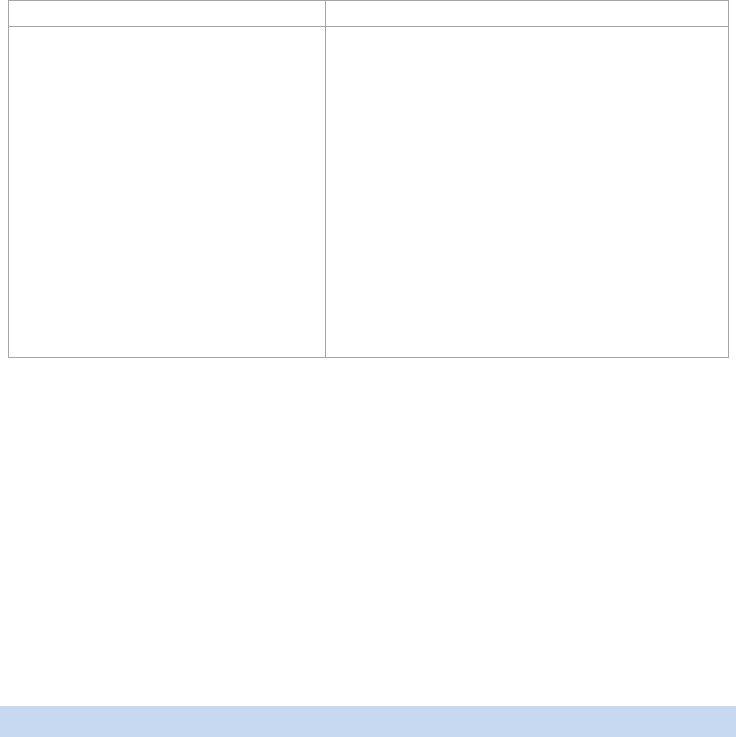

Individual #1 Signature and Title: |

Date: |

______________________________________________________________ |

______________________ |

Individual #2 Signature and Title: |

Date: |

______________________________________________________________ |

______________________ |

Individual #3 Signature and Title: |

Date: |

______________________________________________________________ |

______________________ |

SBA Form 990A (05/18) Previous Editions Obsolete

8

PLEASE READ, DETACH, AND RETAIN FOR YOUR RECORDS

STATEMENTS REQUIRED BY LAW AND EXECUTIVE ORDER

This application, and any assistance provided pursuant to this application, is subject to the following laws, regulations, and Executive Orders:

Freedom of Information Act (5 U.S.C. 552)

This law provides, with some exceptions, that SBA must provide information contained in agency files and records to a person requesting it. Information about approved bond guarantees that will be automatically released includes, among other things, statistics on the Surety Bond Guarantee (SBG) programs and other information such as the names of small businesses (and their officers, directors, stockholders or partners) and the amount of the bond guarantees. Proprietary data on an applicant would not routinely be made available to third parties. All requests under this Act are to be addressed to the nearest SBA office and be identified as a Freedom of Information request.

Privacy Act (5 U.S.C. 552a) and Debt Collection Improvement Act (31 U.S.C. 7701)

Authorities and Purpose for Collecting Information: SBA is collecting the information on this form, including social security numbers and other personal information, to make a character and credit eligibility decision in connection with you or your company’s application for SBA assistance. SBA may also use social security numbers for the purpose of collecting and reporting on any delinquent fees or other amounts owed SBA.

Under the provisions of 31 U.S.C. 7701, the applicant business and any indemnitor of the bond are required to provide their social security numbers, or other taxpayer identification numbers, in order to do business with SBA. Failure to provide this information would affect your ability to obtain an SBA guaranteed bond. For other individuals signing this application, the submission of the social security number is voluntary and failure to provide your social security number may not affect any right, benefit or privilege to which you are entitled. However, in evaluating whether the applicant satisfies the criteria for a bond guarantee under section 411 of the Small Business Investment Act, 15 USC 694b, SBA considers whether the applicant and each owner of 20% or more of its equity, and each of its officer, directors, or general partners, possesses good character. In making this determination, SBA considers the person’s integrity, candor, and criminal history if any. SBA is authorized, through section 308(f) of the Small Business Investment Act, to verify your criminal history, or lack thereof, pursuant to section 7(a)(1)(B) of the Small Business Act, 15 USC § 636(a)(1)(B). In addition, for all forms of assistance, SBA is authorized to make all investigations necessary to ensure that a person has not engaged in acts that violate or will violate the Small Business Investment Act, see 15 USC Section 687b(a). In conducting the criminal background check, SBA also uses your social security number to distinguish you from other individuals with the same or similar name or other personal identifier. This use is permitted under Executive Order 9397.

Routine Uses: Some of the information collected may be checked against criminal history indices of the Federal Bureau of Investigation. When the information collected indicates a violation or potential violation of law, whether civil, criminal, or administrative in nature, SBA may refer it to the appropriate agency, whether Federal, State, local, or foreign, charged with responsibility for or otherwise involved in investigation, prosecution, enforcement or prevention of such violations. See, SBA’s Privacy Act System of Records, at 74 Fed. Reg. 14890 (2009) (as amended from time to time) for other published routine uses for the collected information.

Right to Financial Privacy Act of 1978 (12 U.S.C. 3401)

This is notice, as required by the Right of Financial Privacy Act of 1978, of SBA’s access rights to financial records held by financial institutions that are or have been doing business with you or your business. The law provides that SBA shall have a right of access to your financial records in connection with its consideration or administration of assistance to you in the form of a bond guarantee. SBA is required to provide a certificate of its compliance with this Act to a financial institution in connection with its first request for access to your financial records, after which no further certification is required for subsequent access. The law also provides that SBA’s access rights continue for the term of any approved bond agreement. No further notice to you of SBA’s access rights is required during the term of any such agreement.

The law also authorizes SBA to transfer to another Government authority any financial records included in an application for a bond guarantee, or concerning an approved bond guarantee, as necessary to process or service the bond guarantee. No other transfer of your financial records to another Government authority will be permitted by SBA except as required or permitted by law.

SBA Form 990A (05/18) Previous Editions Obsolete

9

Flood Disaster Protection Act (42 U.S.C. 4011)

Under this Act, and its implementing regulations, SBA is prohibited from providing financial assistance in a designated floodplain unless Federal flood insurance is purchased as a condition of the assistance. Failure to maintain the required level of flood insurance makes the applicant ineligible for any future financial assistance from SBA under any program, including disaster assistance.

Executive Orders 11988 and 11990 -- Floodplain Management and Wetland Protection (42 F.R. 26951 and 42 F.R. 26961) -- SBA discourages settlement in or development of a floodplain or a wetland. This statement is to notify all applicants for SBA assistance that such actions are hazardous to both life and property and should be avoided. The additional cost of flood preventive construction must be considered in addition to the possible loss of all assets and investments due to a future flood.

Executive Order 11738 – Environmental Protection (38 F.R. 251621) -- This Executive Order charges SBA with administering its financial assistance programs in a manner that will result in effective enforcement of the Clean Air Act, the Federal Water Pollution Act and other environmental protection legislation.

Occupational Safety and Health Act (15 U.S.C. 651 et seq.)

This legislation authorizes the Occupational Safety and Health Administration in the Department of Labor to require businesses to modify facilities and procedures to protect employees or pay penalty fees. In some instances, the business can be forced to cease operations or be prevented from starting operations in a new facility. Therefore, in some instances, SBA may require additional information from an applicant to determine whether the business will be in compliance with OSHA regulations and allowed to operate its facility after the bond guarantee agreement is approved. Signing this form as an applicant is a certification that the applicant has determined which OSHA requirements, if any, apply to the applicant’s business and the applicant to the best of its knowledge is in compliance.

Lead-Based Paint Poisoning Prevention Act (42 U.S.C. 4821 et seq.) – Businesses that receive surety bond guarantee assistance from SBA for a contract to construct or rehabilitate a residential structure are prohibited from using lead-based paint (as defined in SBA regulations) on all interior surfaces, whether accessible or not, and exterior surfaces, such as stairs, decks, porches, railings, windows and doors, which are readily accessible to children under 7 years of age. A “residential structure” is any home, apartment, hotel, motel, orphanage, boarding school, dormitory, day care center, extended care facility, college or other school housing, hospital, group practice or community facility and all other residential or institutional structures where persons reside.

Civil Rights Legislation

All businesses receiving SBA assistance must agree not to discriminate in any business practice, including employment practices and services to the public, on the basis of categories cited in 13 C.F.R., Parts 113 and 117 of SBA Regulations. This includes making the business’ goods and services available to handicapped clients or customers. All businesses receiving assistance will be required to display the “Equal Employment Opportunity Poster” prescribed by SBA.

Debt Collection Act of 1982 and Debt Collection Improvement Act of 1996 (5 U.S.C. 5514 note and 31 U.S.C. 3701 et seq.)

These laws require SBA to aggressively collect fee payments (or any other amount due to SBA) that become delinquent. If you receive a bond guarantee, and do not pay the related fee (or any other amount due to SBA), SBA may take one or more of the following actions:

−Report the status of your payment delinquency to credit bureaus

−Hire a collection agency to collect your fee

−Offset your income tax refund or other amounts due to you from the Federal Government

−Suspend or debar you or your company from doing business with the Federal Government

−Refer your delinquent fee (or any other amount due to SBA) to the Department of Justice or other attorney for litigation

−Foreclose on collateral or take other action permitted

SBA Form 990A (05/18) Previous Editions Obsolete

10

Executive Order 12549 as amended by E.O. 12689, Debarment and Suspension (2 CFR 180, adopted by reference in 2 CFR Part 2700 (SBA Debarment Regulations)) -- By submission of this application, you certify and acknowledge

that neither you nor any Principals have within the past three years been: (a) debarred, suspended, declared ineligible from participating in, or voluntarily excluded from participation in a transaction by any Federal department or agency; (b) formally proposed for debarment, with a final determination still pending; (c) indicted, convicted, or had a civil judgment rendered against you for any of the offenses listed in the Regulations; or (d) delinquent on any amounts due and owing to the U.S. Government or its agencies or instrumentalities as of the date of execution of this certification. If you are unable to certify and acknowledge (a) through (d), you must obtain and attach a written statement of exception from SBA permitting participation in this surety bond guarantee. You further certify that you have not and will not knowingly enter into any agreement in connection with the goods and/or services purchased with the proceeds of this loan with any individual or entity that has been debarred, suspended, declared ineligible from participating in, or voluntarily excluded from participation in a Transaction. All capitalized terms have the meanings set forth in 2 C.F.R. Part 180.

SBA Form 990A (05/18) Previous Editions Obsolete

11