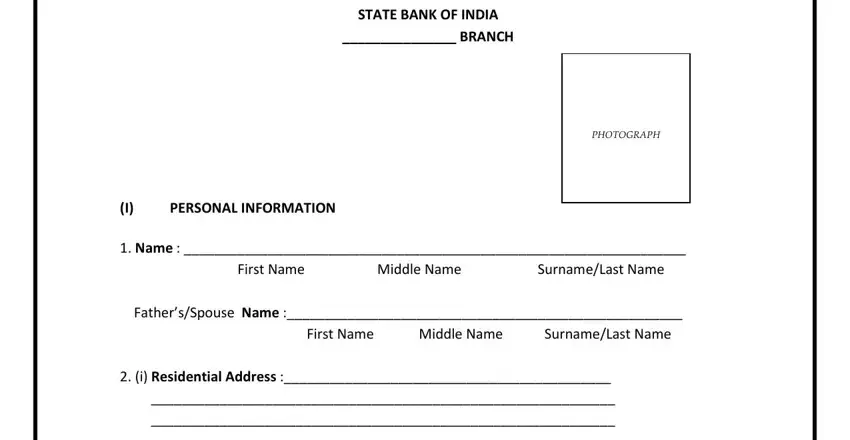

XPRESS CREDIT APPLICATION FORM

STATE BANK OF INDIA

_______________ BRANCH

1. Name : __________________________________________________________________

First Name |

Middle Name |

Surname/Last Name |

Father’s/Spouse Name :____________________________________________________ |

First Name |

Middle Name |

Surname/Last Name |

2.(i) Residential Address :___________________________________________

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

City Pin Code Telephone No.

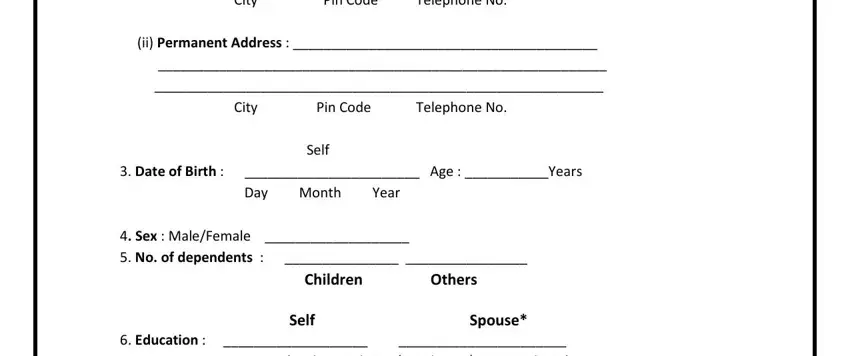

(ii) Permanent Address : ________________________________________

___________________________________________________________

___________________________________________________________

City Pin Code Telephone No.

Self

3. Date of Birth : _______________________ Age : ___________Years

Day |

Month |

Year |

4. Sex : Male/Female ___________________ |

5. No. of dependents : |

_______________ ________________ |

|

Children |

Others |

|

Self |

Spouse* |

6. Education : ___________________ |

______________________ |

|

(Under Graduate / Graduate / Post-Graduate) |

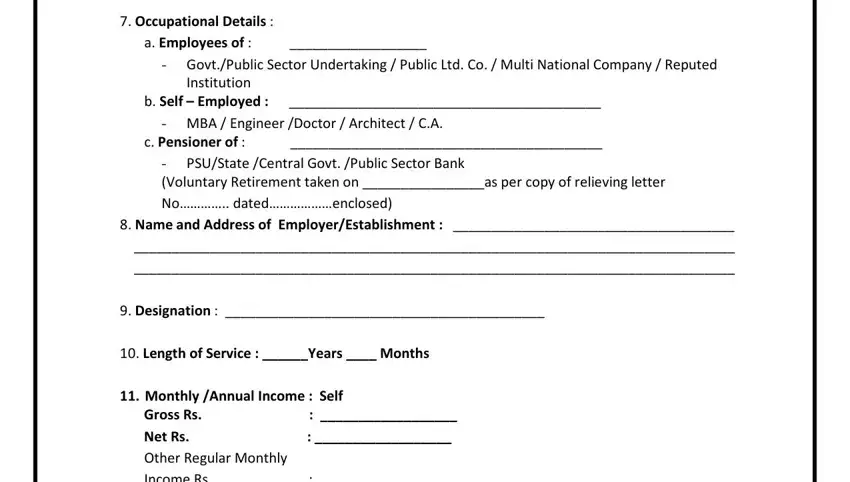

7.Occupational Details :

a.Employees of : __________________

-Govt./Public Sector Undertaking / Public Ltd. Co. / Multi National Company / Reputed Institution

b.Self – Employed : _________________________________________

-MBA / Engineer /Doctor / Architect / C.A.

c.Pensioner of : _________________________________________

-PSU/State /Central Govt. /Public Sector Bank

(Voluntary Retirement taken on ________________as per copy of relieving letter

No………….. dated………………enclosed)

8.Name and Address of Employer/Establishment : _____________________________________

_______________________________________________________________________________

_______________________________________________________________________________

9.Designation : __________________________________________

10.Length of Service : ______Years ____ Months

11.Monthly /Annual Income : Self

Gross Rs. |

: __________________ |

|

Net Rs. |

: __________________ |

|

Other Regular Monthly |

|

|

|

Income Rs. |

: __________________ |

|

Please specify Source |

: __________________ |

|

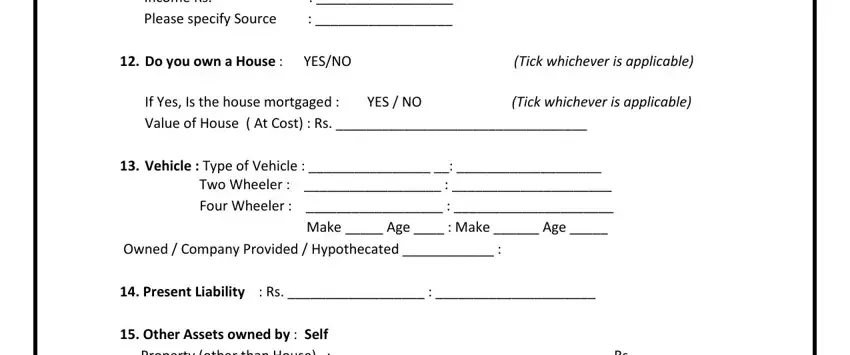

12. Do you own a House : |

YES/NO |

|

(Tick whichever is applicable) |

If Yes, Is the house mortgaged : |

YES / NO |

(Tick whichever is applicable) |

Value of House ( At Cost) : Rs. _________________________________

13.Vehicle : Type of Vehicle : ________________ __: ___________________

Two Wheeler : __________________ : _____________________

Four Wheeler : __________________ : _____________________

Make _____ Age ____ : Make ______ Age _____

Owned / Company Provided / Hypothecated ____________ :

14.Present Liability : Rs. __________________ : _____________________

15.Other Assets owned by : Self

Property (other than House) : |

Rs. _____________ |

Bank/Post Office Deposits, NSC’s, LIC Policy, Gold, Shares, |

|

Debentures, Units of UTI /Mutual Funds: |

Rs. ____________ |

Others |

: |

Rs. _____________ |

Total |

: |

Rs. _____________ |

16.Other Liabilities in Brief :

Friends and Relatives : Rs. _____________

Employers |

: Rs. _____________ |

|

Banks/F.I.s |

: Rs. _____________ |

|

Others |

: Rs. _____________ |

|

Total |

: Rs. _____________ |

|

17. Purpose of Loan : _____________________________________________ |

18. Loan Amount: |

|

|

: Rs. ________________________ |

Proposed Repayment Period |

: ___________________________ Months / Years |

Proposed Monthly Repayment |

: Rs. ________________________ |

(II) Details of Bank Account : |

Self |

|

|

19. Name of the Branch |

____________ |

|

Telephone No. : |

|

____________ |

|

Type of Account: |

|

____________ |

_____________ |

Account Number : |

|

____________ |

_____________ |

Year of Opening : |

|

____________ |

_____________ |

(III) |

Two Personal Reference : |

|

1) Name: ________________________ |

2) Name : ____________________ |

Address : ________________________ |

Address : _____________________ |

_________________________________ |

_____________________________ |

Tel. No. __________________ |

Tel. No. _______________________ |

(IV) Declaration :

I/We declare that all the particulars and information given in the application form are true, correct and complete and that they shall form the basis of any loan, State Bank of India may decide to grant me/us.

I/We undertake to inform State Bank of India regarding change in my/our occupation/employment /residential address and to provide any further information that the bank may require.

I/We confirm that I/we do not have any other credit facilities with any bank other thatn that mentioned above. I/We confirm that if I/we avail of any credit facilities with any other bank in future, I/ we will furnish the details to State Bank of India immediately. I/We further authorize the bank to credit all sums received by the bank or standing to the credit in my/our name jointly or severally to the loan account, if necessary. I/We confirm that the funds will be used for stated purpose and will not be used for speculative purpose. I/We confirm that we are resident Indians.

I also understand that the sanction of the loan is subject to the execution of documents as per the Bank’s requirements. I agree that the Bank has a right to make such enquiries about me as it/they think(s) fit.

|

___________________ |

Place :_______________ |

Signature of Applicant |

Date :_______________ |

|

(V)Documentation: Please submit the following documents along with your application. - Latest monthly salary slip showing deductions - of Self.

- Latest Form 16 from employer (for employees). - of Self

- Copy of IT return for last two years, duly acknowledged by ITO with Computation of income, for Professionals.

- Copy of Passport or Voters ID Card or Driving License for proof of Identity #

-Copy of ration card/Telephone Bill/Passport/Voters I-Card for proof of residence. # #(not required from existing customers)

-Latest Passport size Photograph - of Self

-Last six months Bank Statement of the account where salary is credited - of Self

-Verification of signature from the bank where salary is credited or any employers.

-Relieving Letters of Pensioner from the employer.

-Proof of official address (for other than employees)

-Proof of Professional Qualification: Copy of highest professional degree held.

Place: _____________ |

Signature of Applicant |

Date : _________________ |

|

FOR BANK’S USE

Appraisal / Recommended by : _____________________________________

Date : _________________

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________

____________________________

Sanctioned by : ____________________

Date : ____________________________