Few tasks can be easier than preparing files through our PDF editor. There isn't much for you to do to modify the sample filled sbi personal loan application form file - only adopt these measures in the following order:

Step 1: Choose the "Get Form Now" button to get going.

Step 2: Once you have accessed the sample filled sbi personal loan application form editing page you can find the whole set of actions you can conduct relating to your template at the top menu.

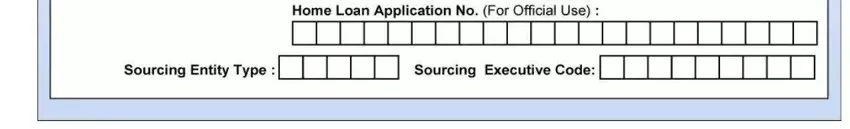

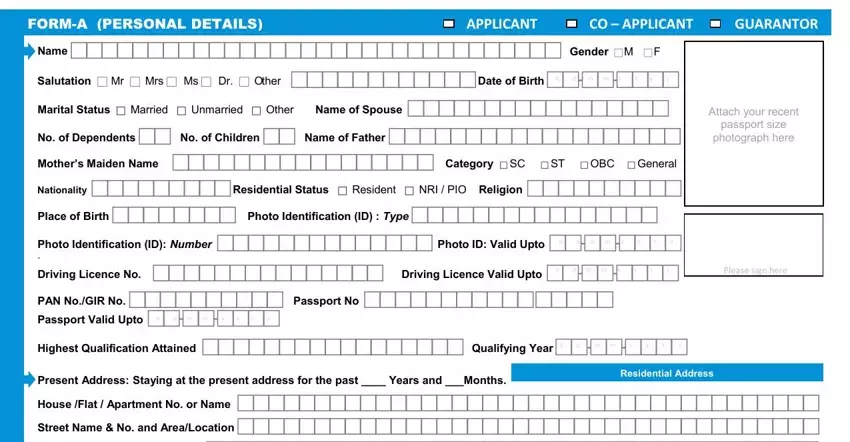

These segments will create the PDF file that you will be creating:

Fill in the d, mm d, mm d, mm d, mm Attach, your, recent passport, size photograph, here Please, sign, here and Residential, Address fields with any information that are asked by the software.

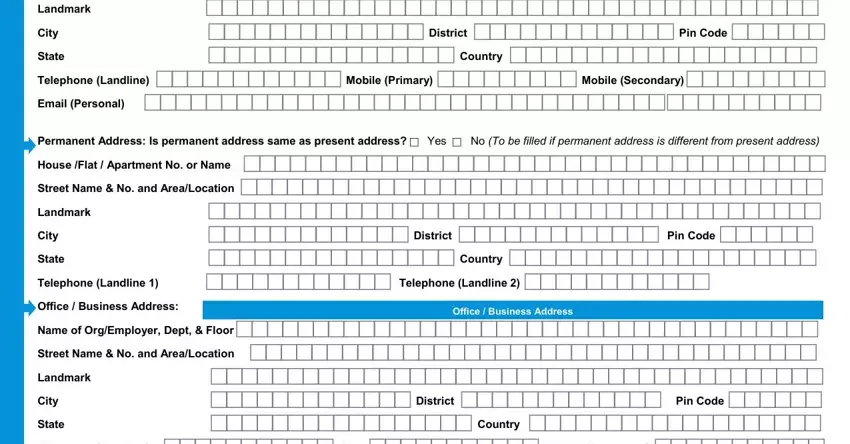

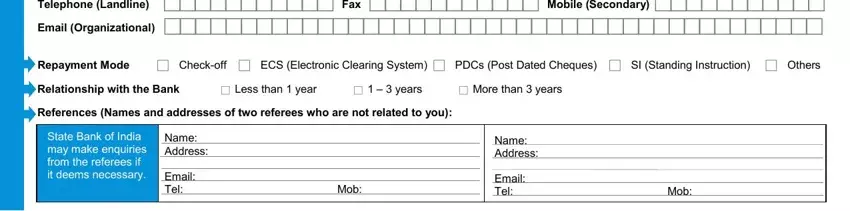

You should be requested for particular significant information so you can submit the Landmark, Email, Personal City, Landmark, Telephone, Landline State, City, Landmark, Office, Business, Address and City segment.

The space Name, Address Name, Address and Email, Email, TelMo, b, TelMo, b is for you to insert all parties, ' rights and obligations.

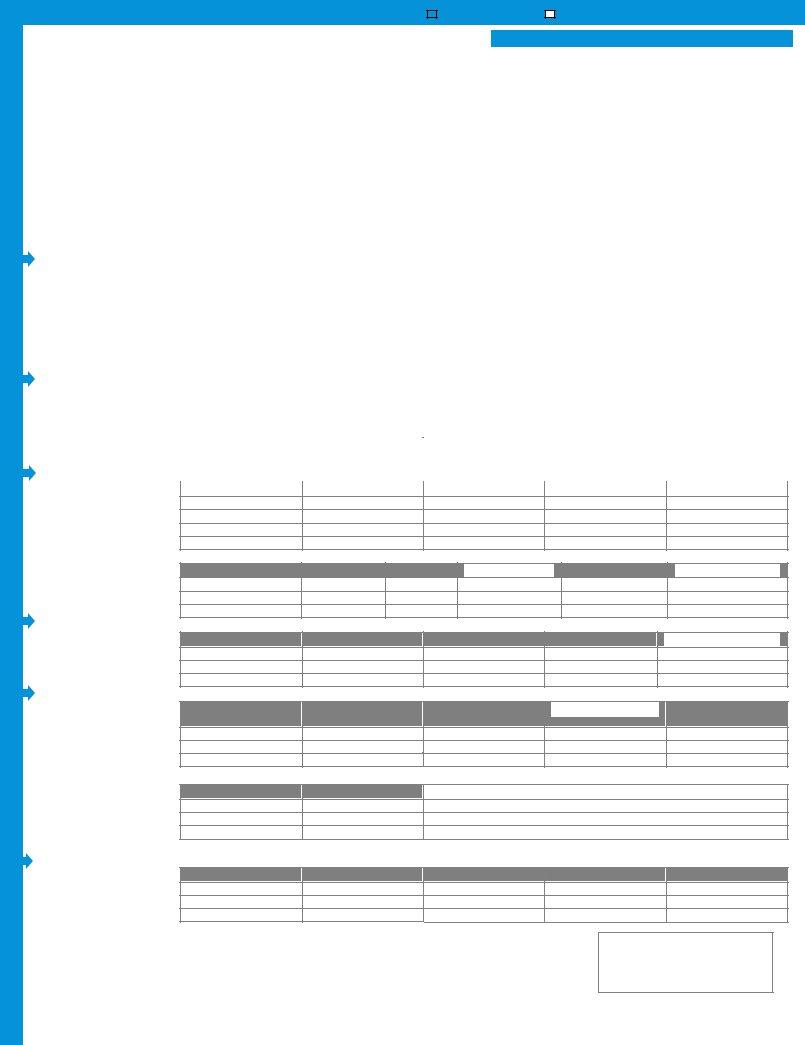

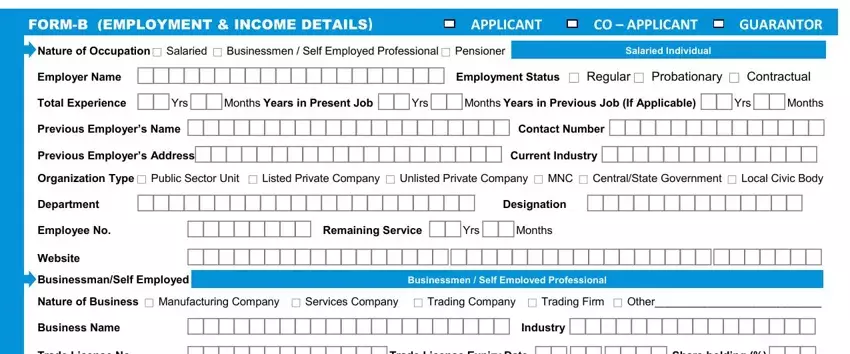

Look at the fields Salaried, Individual Previous, Employers, Name, Contact, Number Department, Designation Employee, No Remaining, Service, Yrs, Months Businessmen, Self, Employed, Professional Industry, Business, Name and Trade, License, No and next fill them in.

Step 3: Press the "Done" button. It's now possible to export the PDF document to your electronic device. Besides, you can forward it by means of email.

Step 4: Make sure you avoid upcoming complications by preparing a minimum of a couple of duplicates of your file.