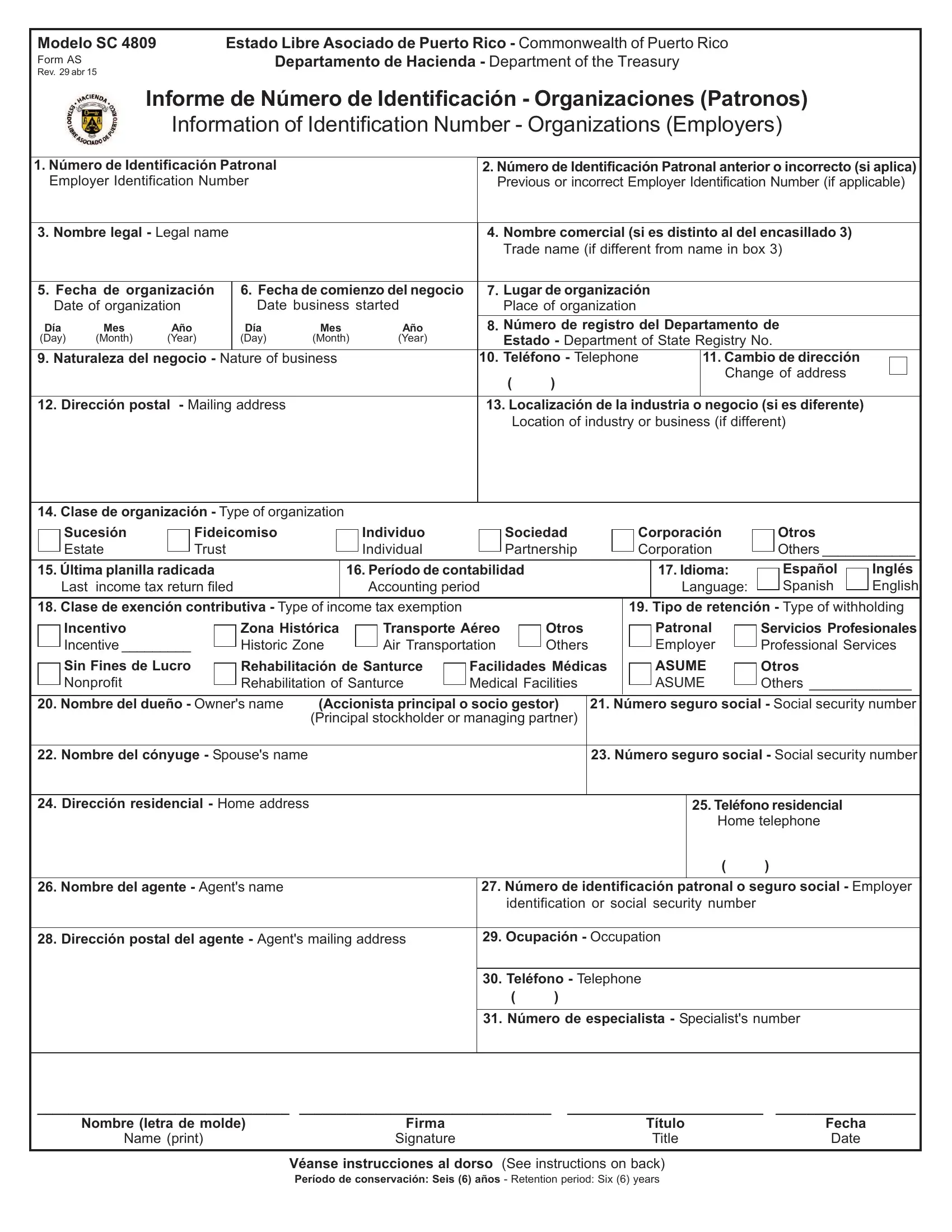

Modelo SC 4809 |

Estado Libre Asociado de Puerto Rico - Commonwealth of Puerto Rico |

Form AS |

Departamento de Hacienda - Department of the Treasury |

Rev. 29 abr 15 |

|

Informe de Número de Identificación - Organizaciones (Patronos)

Information of Identification Number - Organizations (Employers)

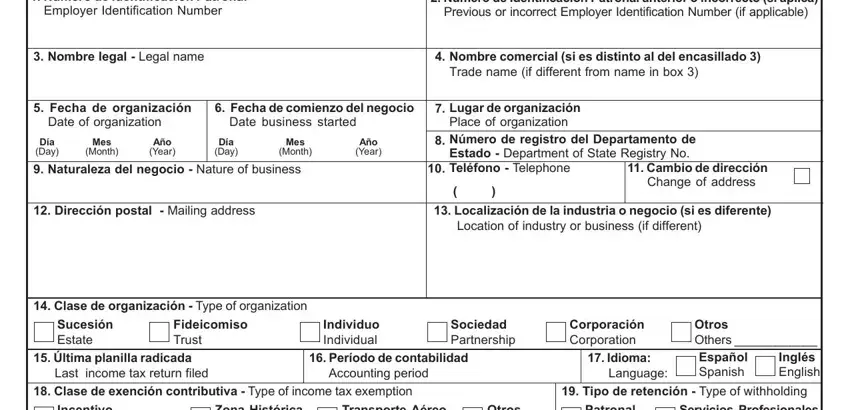

1. Número de Identificación Patronal |

|

|

|

|

|

|

|

|

|

|

2. Número de Identificación Patronal anterior o incorrecto (si aplica) |

|

Employer Identification Number |

|

|

|

|

|

|

|

|

|

|

Previous or incorrect Employer Identification Number (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Nombre legal - Legal name |

|

|

|

|

|

|

|

|

|

|

|

4. Nombre comercial (si es distinto al del encasillado 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name (if different from name in box 3) |

|

|

|

|

|

|

|

|

|

|

|

|

5. Fecha de organización |

|

6. Fecha de comienzo del negocio |

|

|

7. Lugar de organización |

|

|

|

|

|

|

Date of organization |

|

Date business started |

|

|

|

Place of organization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Día |

Mes |

Año |

|

Día |

Mes |

|

Año |

|

|

8. Número de registro del Departamento de |

|

|

(Day) |

(Month) |

(Year) |

|

(Day) |

(Month) |

|

(Year) |

|

|

|

Estado - Department of State Registry No. |

|

9. Naturaleza del negocio - Nature of business |

|

|

|

|

|

10. Teléfono - Telephone |

|

|

|

11. Cambio de dirección |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

Change of address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Dirección postal - Mailing address |

|

|

|

|

|

|

|

|

|

|

13. Localización de la industria o negocio (si es diferente) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of industry or business (if different) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Clase de organización - Type of organization |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sucesión |

|

Fideicomiso |

|

|

|

|

|

Individuo |

|

|

|

Sociedad |

|

|

|

|

Corporación |

|

|

|

Otros |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estate |

|

Trust |

|

|

|

|

|

|

Individual |

|

|

|

Partnership |

|

|

|

|

Corporation |

|

|

|

Others ____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Última planilla radicada |

|

|

|

16. Período de contabilidad |

|

|

|

|

|

|

|

|

17. Idioma: |

|

|

Español |

|

Inglés |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last |

income tax return filed |

|

|

|

|

|

|

Accounting period |

|

|

|

|

|

|

|

|

Language: |

|

|

Spanish |

|

English |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. Clase de exención contributiva - Type of income tax exemption |

|

|

|

|

|

|

|

|

|

19. Tipo de retención - Type of withholding |

|

|

Incentivo |

|

|

|

|

|

Zona Histórica |

|

|

|

Transporte Aéreo |

|

Otros |

|

|

|

|

|

|

Patronal |

|

|

Servicios Profesionales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incentive _________ |

|

|

|

Historic Zone |

|

|

|

Air Transportation |

|

Others |

|

|

|

|

|

|

Employer |

|

|

Professional Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sin Fines de Lucro |

|

|

Rehabilitación de Santurce |

|

Facilidades Médicas |

|

|

|

ASUME |

|

|

Otros |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonprofit |

|

|

|

|

|

Rehabilitation of Santurce |

|

Medical Facilities |

|

|

|

|

|

|

ASUME |

|

|

Others _____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

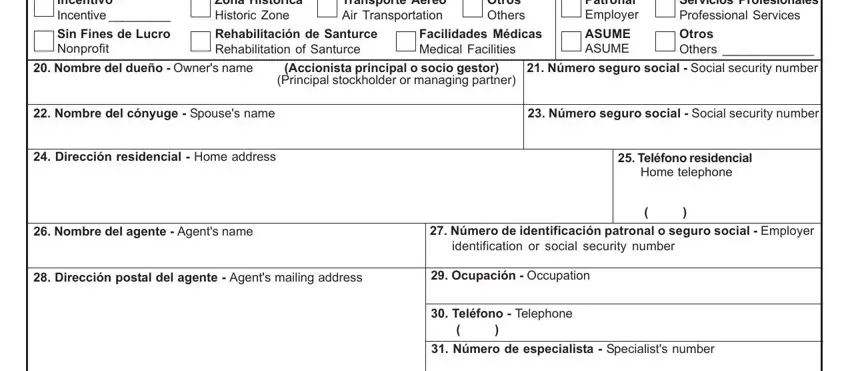

20. Nombre del dueño - Owner's name |

(Accionista principal o socio gestor) |

|

21. Número seguro social - Social security number |

|

|

|

|

|

|

|

|

|

|

(Principal stockholder or managing partner) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. Nombre del cónyuge - Spouse's name |

|

|

|

|

|

|

|

|

|

|

23. Número seguro social - Social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. Dirección residencial - Home address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. Teléfono residencial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home telephone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. Nombre del agente - Agent's name |

|

|

|

|

|

|

|

|

|

|

27. Número de identificación patronal o seguro social - Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

identification or social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. Dirección postal del agente - Agent's mailing address |

|

|

29. Ocupación - Occupation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. Teléfono - Telephone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. Número de especialista - Specialist's number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

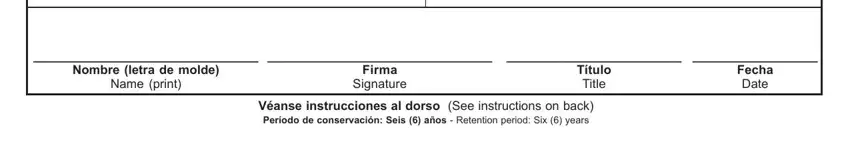

_________________________________ |

_________________________________ _________________________ __________________ |

|

|

Nombre (letra de molde) |

|

|

|

|

|

|

Firma |

|

|

|

|

|

|

|

|

|

|

|

|

Título |

|

|

Fecha |

|

|

|

|

Name (print) |

|

|

|

|

|

|

|

Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Date |

|

Véanse instrucciones al dorso (See instructions on back)

Período de conservación: Seis (6) años - Retention period: Six (6) years

INSTRUCCIONESGENERALES

La información requerida en este formulario es necesaria para implantar las disposiciones de la Ley Núm. 50 aprobada el 6 de junio de 1963. Esta ley y sus reglamentos facultan al Secretario de Hacienda a asignar un número de identificación a todo contribuyente, hacer obligatorio el uso de dicho número de identificación y establecer penalidades por el incumplimiento de la obligación. Además, requiere que toda organización dedicada a una industria o negocio, o con una responsabilidad contributiva, complete este formulario en todas sus partes y envíe el mismo dentro de los 15 días a partir de la fecha de recibido a: DEPARTAMENTO DE HACIENDA, PO BOX 9022501, SAN JUAN PR 00902-2501. También puede entregarlo en la Colecturía de Rentas Internas de su Municipio.

Toda persona que viole las disposiciones de la citada ley, los requerimientos del Secretario de Hacienda bajo la misma o los reglamentos promulgados al efecto, estará sujeta a SANCIONES ADMINISTRATIVAS Y PENALES, según sea determinado. Por lo tanto, la información suministrada debe ser correcta y completa.

INSTRUCCIONESESPECÍFICAS

Llene todos los encasillados a maquinilla o letra de molde.

Encasillado 1 - Indique el número de identificación patronal que le ha sido asignado por el Servicio de Rentas Internas Federal. Incluya copia de la certificación emitida por dicha agencia donde le asignan el número (Forma SS-4 o SS-4PR).

Encasillado 2 - Complete este encasillado solamente si su número de identificación patronal cambió o va a notificar alguna corrección al mismo.

Encasillado 3 - Indique el nombre con el cual aparece registrada oficialmente la organización (Nombre legal). Incluya copia del Certificado de Incorporación emitido por el Departamento de Estado.

Encasillado 4 - Indique el nombre con el cual se conoce la organización (Nombre comercial). Complete este encasillado solo si el nombre comercial es distinto al nombre legal indicado en el encasillado 3.

Encasillado 17 -Indique el idioma en que desea recibir cualquier documentación del Departamento de Hacienda.

Encasillados 26 al 30 -Indique nombre, número de identificación patronal o seguro social, dirección postal, ocupación y número de teléfono de la persona que está autorizada a representar la industria o negocio (agente).

Encasillado 31 - Si el agente es un Especialista en Planillas o Declaraciones, indique el número de especialista.

GENERALINSTRUCTIONS

The information required on this form is necessary to implement the provisions of Act No. 50 of June 6, 1963. This act and its regulations authorize the Secretary of the Treasury to assign an identification number to all taxpayers, make compulsory the use of such identification number and assess penalties for the nonfulfillment of the duty. Also, it requires that all organizations engaged in a trade or business, or with a tax responsibility, complete this form in all of its parts and mail it within 15 days from the date it was received to: DEPARTMENT OF THE TREASURY, PO BOX 9022501, SAN JUAN PR 00902-2501. Also you may deliver it to the Internal Revenue Collections Office of your Municipality.

Any person who violates the provisions of said act, the requirements of the Secretary of the Treasury thereunder, or the regulations promulgated to that effect, shall be subject to CIVIL AND CRIMINAL SANCTIONS, as it may be determined. Therefore, the information submitted should be correct and complete.

SPECIFIC INSTRUCTIONS

Type or print the information required in all boxes.

Box 1 - Enter the employer identification number as assigned by the Federal Internal Revenue Service. Include copy of the Certification issued by said agency where they assign you the number (Form SS-4 or SS-4PR).

Box 2 - Complete this box only if your employer identification number changed or you are going to notify any correction to the same.

Box 3 - Indicate the name of the organization as officially registered (Legal name). Include copy of the Certificate of Incorporation issued by the Department of the State.

Box 4 - Indicate the name of the organization as it is commercially known (Trade name). Complete this box only if the trade name is different from the legal name indicated in box 3.

Box 17 - Indicate the language in which you like to receive any documentation from the Department of the Treasury.

Boxes 26 through 30 -Indicate the name, employer identification or social security number, mailing address, occupation and telephone number of the person authorized to represent the industry or business (agent).

Box 31 - If the agent is a Returns or Declarations Specialist, indicate the specialist's number.