This PDF editor makes it easy to fill out forms. You should not perform much to update sc closing files. Merely adhere to the following actions.

Step 1: On this web page, choose the orange "Get form now" button.

Step 2: You're now free to modify sc account. You possess a variety of options thanks to our multifunctional toolbar - you can add, erase, or change the content material, highlight the certain sections, as well as conduct other sorts of commands.

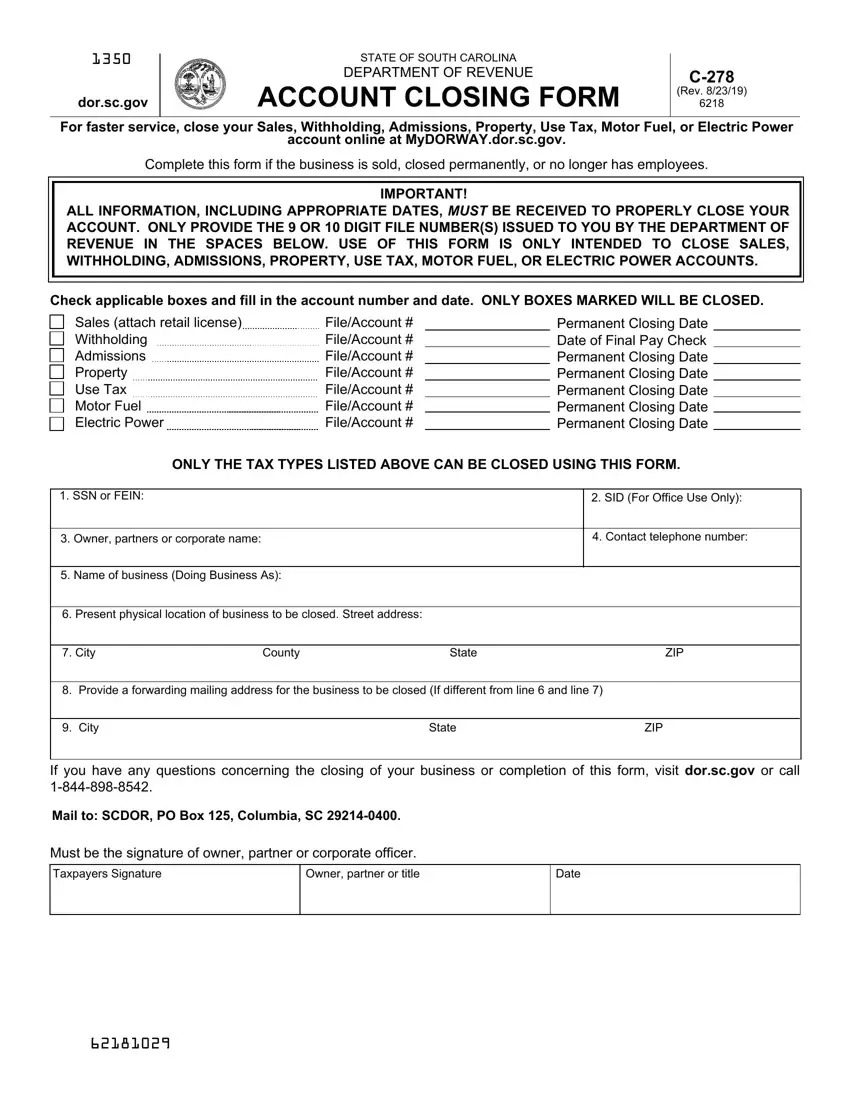

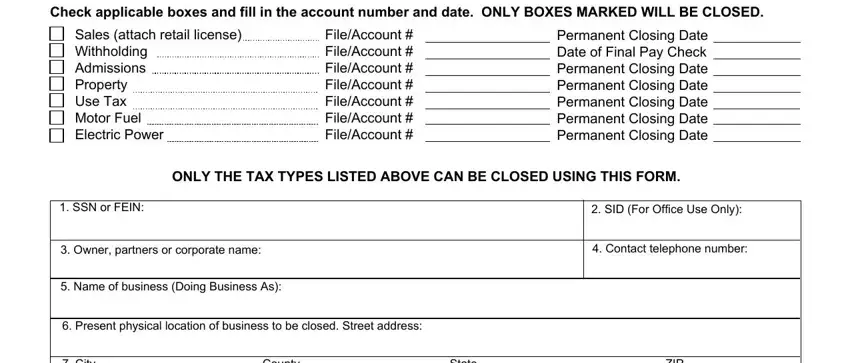

Please type in the following details to prepare the sc account PDF:

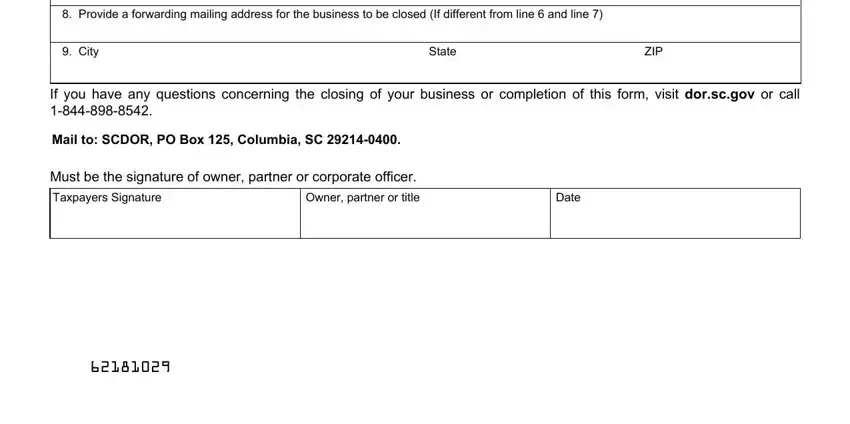

Write down the expected particulars in the field Provide a forwarding mailing, City, State, ZIP, If you have any questions, Mail to SCDOR PO Box Columbia SC, Must be the signature of owner, Taxpayers Signature, Owner partner or title, and Date.

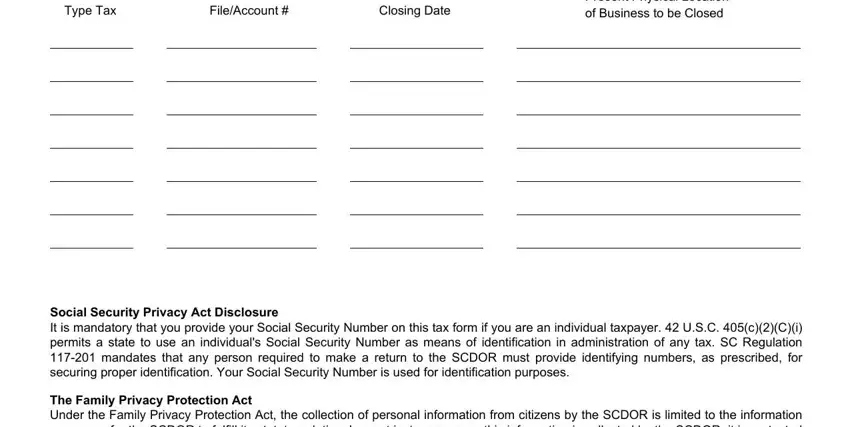

The software will demand you to provide certain significant info to easily fill out the section Type Tax, FileAccount, Permanent Closing Date, Present Physical Location of, Social Security Privacy Act, and The Family Privacy Protection Act.

Step 3: Choose the Done button to assure that your finished document may be exported to any device you select or forwarded to an email you specify.

Step 4: It can be easier to prepare copies of your document. There is no doubt that we are not going to display or check out your particulars.