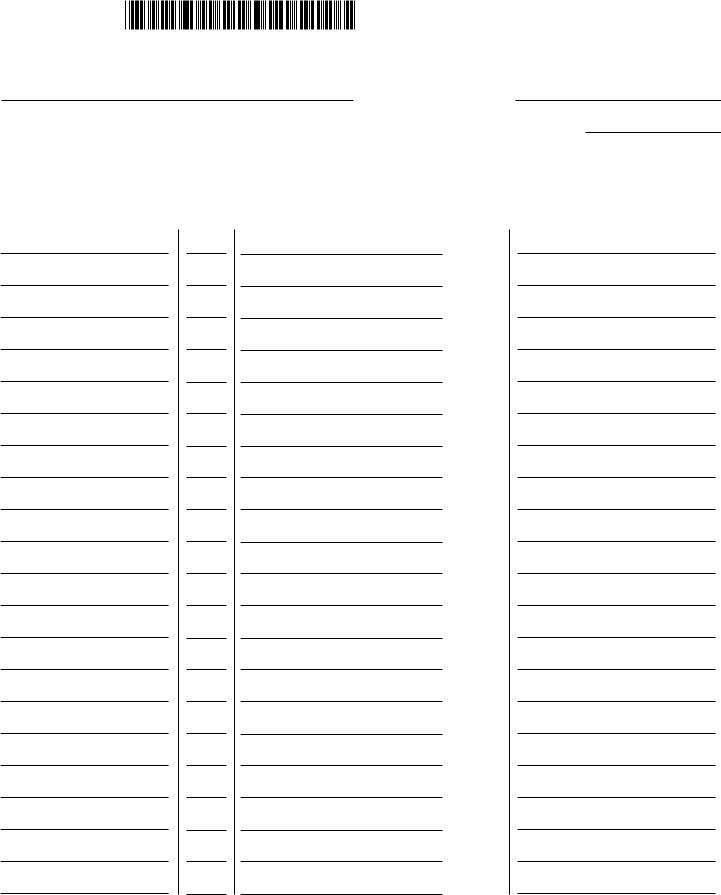

Filing taxes and adhering to local regulations is a critical responsibility for businesses operating in South Carolina. Among the various forms and schedules that need to be completed is the SC ST-389 form, a document designed to aid businesses in reporting and calculating local taxes due for sales and purchases. This form, as revised on June 19, 2019, is an essential attachment to forms ST-3, ST-388, ST-403, and ST-455, streamlining the process for businesses to declare net taxable amounts across various local jurisdictions. The SC ST-389 encompasses detailed sections including capital project tax, school district/education capital improvement tax, transportation tax, Catawba tribal tax, local option tax, and tourism development tax, each calculated at specific rates designated for the county or jurisdiction. It's crucial for businesses to note that credits or negative amounts cannot be reported directly on this form; instead, applications for refunds should be referred through form ST-14. Aside from providing a structured breakdown for local taxes, the form serves as a concise summary of the business's tax obligations at the local level, ensuring compliance and transparency in its financial operations. This introduction sets the groundwork for understanding the importance, complexity, and requirements of filing local taxes in South Carolina, specifically through the lens of the SC ST-389 form.

| Question | Answer |

|---|---|

| Form Name | Sc Form St 389 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | sc st389, st 389 form 2021, sc tax st389 form, south carolina st 389 |

1350

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

||||||||||||

dor.sc.gov |

|

|

|

|

|

|

|

SCHEDULE FOR LOCAL TAXES |

|

|

(Rev. 6/19/19) |

||||||||||||

|

Attach to form |

|

5063 |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Retail License or Use Tax |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Registration Number |

|

|

|

|

|

|

|

|

|

|||

|

|

Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Period ended |

|

|

|

|

|

|

Page |

|

of |

|

|||||||||||||

|

NOTE: DO |

NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

To apply for refunds, see |

|

|

|

|

|

|||||||||

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

|

Local |

||||||||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

|

Tax |

||||||||||

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. CAPITAL PROJECT TAX |

|

|

|

|

(A) |

|

|

(B) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 1 if necessary.

page 1 of 6

50631100

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

of |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

Net Taxable |

|

|

|

|

|

Local |

|

|||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

Tax |

|

||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. SCHOOL DISTRICT / EDUCATION |

CAPITAL IMPROVEMENT TAX |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 2 if necessary.

page 2 of 6

50632108

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

of |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

Local |

|

|

|||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

Tax |

|

|

|||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

3. TRANSPORTATION TAX |

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||||||||

|

4. CATAWBA TRIBAL TAX |

|

|

|

Only complete this section if you are making sales on the reservation. |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

|

||

|

|

|

|

|

|

|

|

|

x 8% = |

|

|

|

|

|

|||||

LANCASTER |

|

1029 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

x 7% = |

|

|

|

|

|

||||

YORK |

|

1046 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 3 if necessary.

page 3 of 6

50633106

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

Period ended |

|

Page |

|

of |

If your sales or purchases are delivered within a city or town, you must use the CITY or TOWN code to properly identify the specific municipality, not the general county code. List one entry per line.

Name |

Code |

Net Taxable |

Local |

of County |

|

Amount |

Tax |

or Jurisdiction |

|

|

|

5. LOCAL OPTION TAX |

|

(A) |

(B) |

x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% =

Submit all pages with applicable data. Attach additional page 4 if necessary.

page 4 of 6

50634104

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

|

of |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

|

Local |

|

|

||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

|

Tax |

|

|

||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. TOURISM DEVELOPMENT TAX |

|

|

(A) |

|

|

|

|

|

|

(B) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY: Complete all pages of the

1.Enter total of Column A from pages

2.Enter total of Column B from pages

NOTE: Other counties may adopt local taxes at a later date.

Questions? Call

Submit all pages with applicable data.

page 5 of 6

50635101