Are you having difficulty with the South Carolina Employment Security Commission's (ESC) Form St 389? You are not alone. Many individuals in South Carolina apply for unemployment benefits each year, and most of them encounter some confusion when completing the administrative paperwork associated with filing a claim. This blog post is designed to provide you with an overview of ESC's form St 389, so that you can fill it out correctly and submit your application on time. Regardless of whether you are new to the process or have applied for Jobless Benefits before, this guide will help make sure that your paperwork gets where it needs to go without delay.

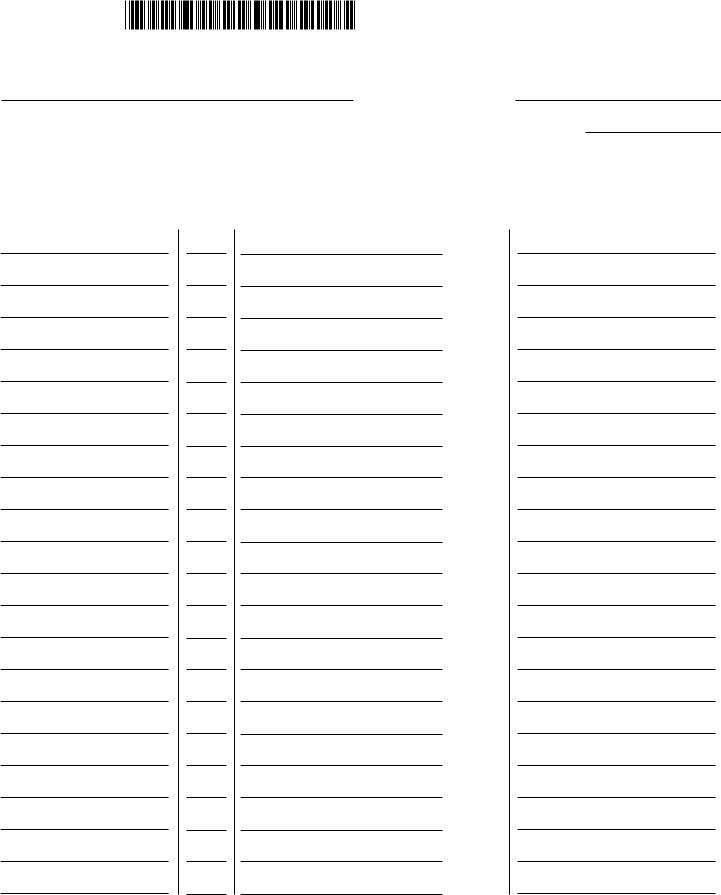

| Question | Answer |

|---|---|

| Form Name | Sc Form St 389 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | sc st389, st 389 form 2021, sc tax st389 form, south carolina st 389 |

1350

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

|

||||||||||||

dor.sc.gov |

|

|

|

|

|

|

|

SCHEDULE FOR LOCAL TAXES |

|

|

(Rev. 6/19/19) |

||||||||||||

|

Attach to form |

|

5063 |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Retail License or Use Tax |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Registration Number |

|

|

|

|

|

|

|

|

|

|||

|

|

Business Name |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Period ended |

|

|

|

|

|

|

Page |

|

of |

|

|||||||||||||

|

NOTE: DO |

NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

To apply for refunds, see |

|

|

|

|

|

|||||||||

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

|

Local |

||||||||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

|

Tax |

||||||||||

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. CAPITAL PROJECT TAX |

|

|

|

|

(A) |

|

|

(B) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 1 if necessary.

page 1 of 6

50631100

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

of |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

Net Taxable |

|

|

|

|

|

Local |

|

|||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

Tax |

|

||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. SCHOOL DISTRICT / EDUCATION |

CAPITAL IMPROVEMENT TAX |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 2 if necessary.

page 2 of 6

50632108

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

of |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

Local |

|

|

|||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

Tax |

|

|

|||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

3. TRANSPORTATION TAX |

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||||||||||||

|

4. CATAWBA TRIBAL TAX |

|

|

|

Only complete this section if you are making sales on the reservation. |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

(A) |

|

|

|

|

|

(B) |

|

|

||

|

|

|

|

|

|

|

|

|

x 8% = |

|

|

|

|

|

|||||

LANCASTER |

|

1029 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

x 7% = |

|

|

|

|

|

||||

YORK |

|

1046 |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submit all pages with applicable data. Attach additional page 3 if necessary.

page 3 of 6

50633106

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

Period ended |

|

Page |

|

of |

If your sales or purchases are delivered within a city or town, you must use the CITY or TOWN code to properly identify the specific municipality, not the general county code. List one entry per line.

Name |

Code |

Net Taxable |

Local |

of County |

|

Amount |

Tax |

or Jurisdiction |

|

|

|

5. LOCAL OPTION TAX |

|

(A) |

(B) |

x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% = x 1% =

Submit all pages with applicable data. Attach additional page 4 if necessary.

page 4 of 6

50634104

NOTE: DO NOT TAKE CREDITS OR REPORT NEGATIVE AMOUNTS ON THIS FORM.

To apply for refunds, see

Business Name

Retail License or Use Tax Registration Number

|

Period ended |

|

|

|

|

Page |

|

|

|

|

|

of |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Code |

|

|

Net Taxable |

|

|

|

|

|

|

Local |

|

|

||||

|

of County |

|

|

|

|

Amount |

|

|

|

|

|

|

Tax |

|

|

||||

|

or Jurisdiction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. TOURISM DEVELOPMENT TAX |

|

|

(A) |

|

|

|

|

|

|

(B) |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x 1% = |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY: Complete all pages of the

1.Enter total of Column A from pages

2.Enter total of Column B from pages

NOTE: Other counties may adopt local taxes at a later date.

Questions? Call

Submit all pages with applicable data.

page 5 of 6

50635101

(If applicable)

The

For instance, the sales of unprepared foods are exempt from the state Sales and Use Tax rate. However, local taxes still apply to sales of unprepared foods unless the local tax law specifically exempts such sales. Sales of unprepared foods that qualify for local Sales and Use Tax exemption which also qualified for state Sales and Use Tax exemption should be shown as a deduction on Item 2 of the

Note: When your sales, purchases, and withdrawals are made or delivered into a locality with more than one local tax type, the total net taxable amount on line 1, page 5 of the

Item 1. Total - Gross proceeds of sales/rental, Use Tax and withdrawals of |

1. |

inventory for own use: As reported on state Sales and Use Tax Return Worksheet |

|

(Item 3 of |

|

Item 2. |

Local Tax allowable deductions |

|

|

|

|

|

||||

|

|

|

Column A |

|

Column B |

|

||||

|

|

|

Type of Deduction |

|

Amount of Deduction |

|

||||

|

a. Catawba Sales less than $100.00 |

|

$ |

|

|

|

|

|||

|

b. Sales not subject to Local Tax |

$ |

|

|

|

|

||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

Item 3. |

Total amount of deductions: Enter the total allowable deductions from Column B. |

3. |

||||||||

Item 4. |

Net sales and purchases: Item 1 minus Item 3. |

4. |

||||||||

Note: This form does not address the local taxes on sales that are collected directly by the counties or municipalities (sales of accommodations or prepared meals.) It only addresses the general local taxes collected by the SCDOR on behalf of the counties, school districts, and the Catawba Indian tribal government.

CAPITAL PROJECT, CATAWBA TRIBAL, EDUCATION CAPITAL IMPROVEMENT, SCHOOL DISTRICT, TOURISM DEVELOPMENT AND TRANSPORTATION TAX NUMERICAL CODES

As a result of specific legislation, certain counties and jurisdictions now impose additional Sales and Use Taxes, which are identified as Capital Project, Catawba Tribal, Education Capital Improvement, School District, Tourism Development, or Transportation Tax. These taxes are required to be reported based upon the county or jurisdiction in which the sale takes place. Usually this is where the business is located, but it can be the place of delivery or physical presence by acceptance of the goods sold, if different from the business location. For your convenience, the counties and jurisdictions that currently impose these additional taxes are listed in the

Submit all pages with applicable data.

page 6 of 6

50636109