Navigating through the State of South Carolina's Department of Revenue 2020 Individual Income Tax Return, known as SC1040, can seem daunting at first glance. However, dissecting its elements showcases the form's comprehensive design to cater to a wide range of taxpayers—from residents and part-year residents to those serving in military combat zones. Its structure facilitates the declaration of various income sources, adjustments, and deductions to accurately compute state tax obligations. Aspects such as federal taxable income, additions and subtractions unique to South Carolina tax law, and a variety of credits including those for child and dependent care, reveal the form’s dedication to capturing the intricate financial dynamics of its filers. Furthermore, options to amend returns, note special statuses like military service, and details on refunds or tax due augments the SC1040's adaptability. How one interacts with this form, from checking boxes that indicate a new address to detailing deductions for volunteer work or highlighting a combat zone’s name, underscores the personalized taxation journey each South Carolinian taxpayer embarks upon annually.

| Question | Answer |

|---|---|

| Form Name | Sc Form Tax |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | STATE OF SOUTH CAROLINA SC1040TC DEPARTMENT OF REVENUE ... |

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

2020 INDIVIDUAL INCOME TAX RETURN

SC1040

(Rev. 10/14/20)

3075

Your Social Security Number

Check if deceased

Spouse's Social Security Number

Check if deceased

For the year January 1 - December 31, 2020, |

or fiscal tax year beginning __________, 2020 |

and ending __________, 2021 |

|||||

|

|

|

|

|

|

|

|

First name and middle initial |

|

Last name |

|

|

Suffix |

||

|

|

|

|

|

|

|

|

Spouse's first name, if married filing jointly |

|

Last name |

|

|

Suffix |

||

|

|

|

|

|

|

|

|

Check if |

Mailing address (number and street, PO Box) |

|

|

|

County code |

||

new address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

ZIP |

|

Daytime phone number with area code |

|

|

|

|

|

|

|

|

|

Check if address |

Foreign country address including postal code |

|

|

|

|

||

is outside US |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• Amended Return: Check if this is an Amended Return. (Attach Schedule AMD) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you are a

• Check this box only if you are filing a composite return on behalf of a Partnership or

S Corporation. Do not check this box if you are an individual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you have filed a federal or state extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

• Check this box if you served in a military combat zone during the filing period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of the combat zone: _________________________________

CHECK YOUR |

(1) |

FEDERAL FILING STATUS (2)

Single |

(3) |

Married filing jointly |

(4) |

Married filing separately - enter spouse's SSN: __________________

Head of household (5) |

Qualifying widow(er) |

Number of dependents claimed on your 2020 federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Number of dependents claimed that were under the age of 6 years as of December 31, 2020 . . . . . . . . . Number of taxpayers age 65 or older as of December 31, 2020 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DEPENDENTS

First name

Last name

Social Security Number |

Relationship |

|

|

Date of birth (MM/DD/YYYY)

30751200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN _____________ |

|

2020 |

|

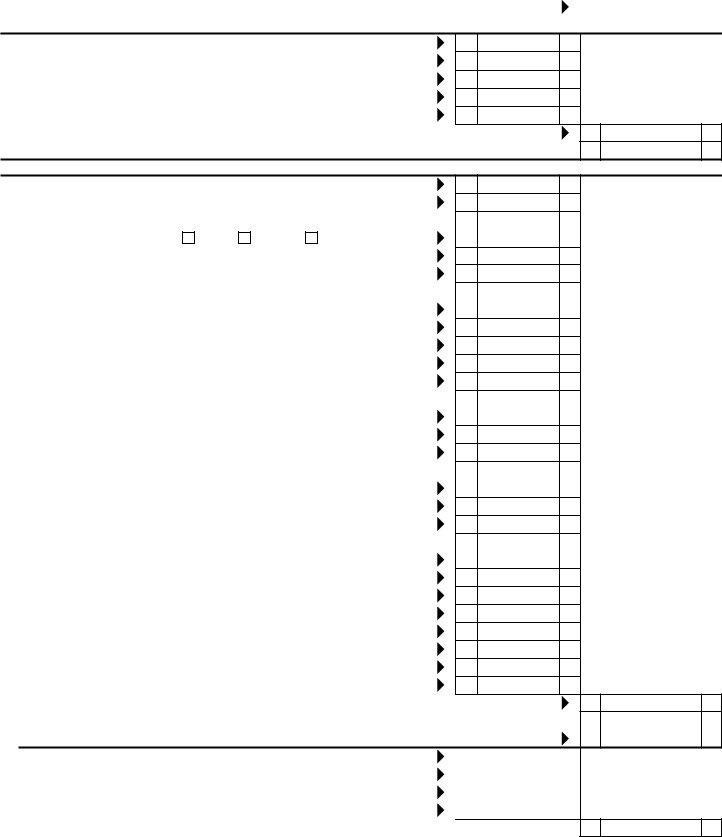

INCOME AND ADJUSTMENTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Enter federal taxable income from your federal form. If zero or less, enter zero here |

|

Dollars |

|

|||||||||||||||||||||||||||||||

Nonresident filers: complete Schedule NR and enter total from line 48 on line 5 below |

1 |

|

00 |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONS TO FEDERAL TAXABLE INCOME |

|

|

|||

a |

State tax addback, if itemizing on federal return (see instructions) |

a |

00 |

||

b |

b |

00 |

|||

c |

Expenses related to National Guard and Military Reserve Income |

c |

00 |

||

d |

Interest income on obligations of states and political subdivisions other than South Carolina |

d |

00 |

||

e Other additions to income. (attach explanation - see instructions) |

e |

00 |

|||

2 Total additions (add line a through line e) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

2 |

||

3 Add line 1 and line 2 and enter the total here |

. . . . . . . . . . . . . . . |

. . 3 |

|||

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME |

|

|

|||

f |

State tax refund, if included on your federal return |

f |

00 |

||

g |

Total and permanent disability retirement income, if taxed on your federal return |

g |

00 |

||

h |

|

|

|||

|

Check type of income/gain: |

Rental |

Business Other ___________ |

h |

00 |

i |

44% of net capital gains held for more than one year |

i |

00 |

||

j |

Volunteer deductions (see instructions) Type: _____________________ |

j |

00 |

||

k |

Contributions to the SC College Investment Program (Future Scholar) |

|

|

||

|

or the SC Tuition Prepayment Program . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

k |

00 |

|

l |

Active Trade or Business Income deduction (see instructions) |

l |

00 |

||

m Interest income from obligations of the US government |

m |

00 |

|||

n Certain nontaxable National Guard or Reserve pay |

n |

00 |

|||

o Social Security and/or railroad retirement, if taxed on your federal return . . |

o |

00 |

|||

p Retirement Deduction (see instructions) |

|

|

|

||

|

00 |

||||

|

00 |

||||

|

00 |

||||

|

Military Retirement Deduction (see instructions) |

|

|

||

|

00 |

||||

|

00 |

||||

|

00 |

||||

qAge 65 and older deduction (see instructions)

|

Taxpayer (date of birth: _____________) |

00 |

||

|

Spouse (date of birth: _____________) |

00 |

||

r |

Negative amount of federal taxable income |

r |

00 |

|

s |

Subsistence allowance (multiply ______ days by $8) |

s |

00 |

|

t |

Dependents under the age of 6 years on December 31 of the tax year . . . . |

t |

00 |

|

u |

Consumer Protection Services |

u |

00 |

|

v |

Other subtractions (see instructions) |

v |

00 |

|

w South Carolina Dependent Exemption (see instructions) |

w |

00 |

||

4 Total subtractions (add line f through line w) |

. . . . . . . . . . . . . . |

4 < |

||

5Residents: subtract line 4 from line 3 and enter the difference. Nonresidents: enter amount from Schedule NR,

|

line 48. If less than zero, enter zero here. This is your SOUTH CAROLINA INCOME SUBJECT TO TAX |

5 |

|||

6 |

TAX on your South Carolina Income Subject to Tax (see SC1040TT) |

|

|

00 |

|

6 |

|

|

|||

|

TAX on Lump Sum Distribution (attach SC4972) |

|

|

|

|

7 |

7 |

|

00 |

|

|

|

TAX on Active Trade or Business Income (attach |

|

|

|

|

8 |

8 |

|

00 |

|

|

|

TAX on excess withdrawals from Catastrophe Savings Accounts |

|

|

|

|

9 |

9 |

|

00 |

|

|

10 |

Add line 6 through line 9 and enter the total here. This is your TOTAL SOUTH CAROLINA TAX . . . . |

. 10. . |

|||

00

00

00>

00

00

30752208

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN _____________ |

2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

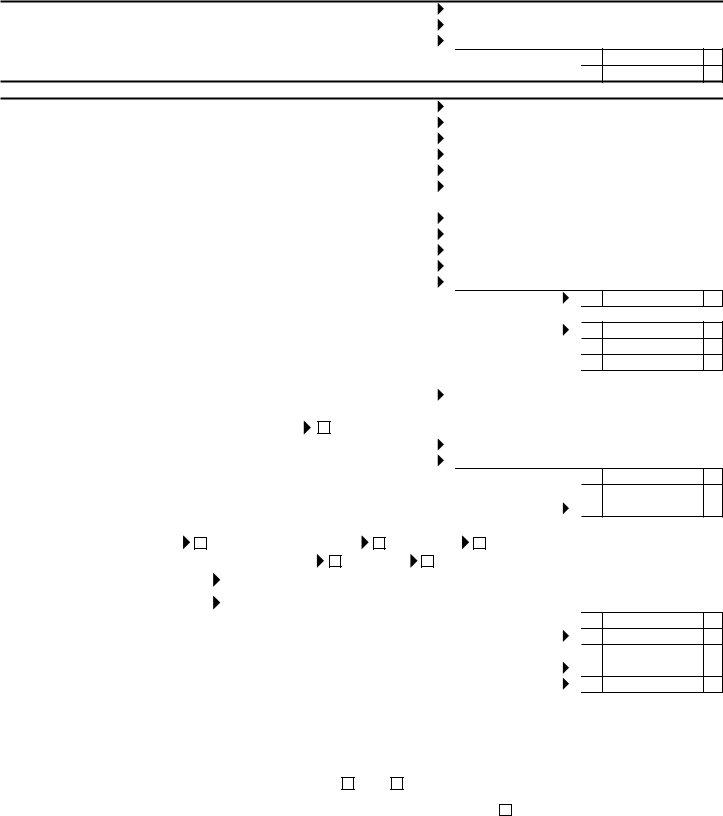

11 |

. . . . . . . . . . . . . . . .Child and Dependent Care (see instructions) |

. . . . . . . . . . |

11 |

|

00 |

|

|

12 |

Two Wage Earner Credit (see instructions) |

|

|

|

|

|

|

. . . . . . . . . . |

12 |

|

00 |

|

|||

13 |

Other nonrefundable credits. Attach SC1040TC and other state returns |

|

|

|

|

||

13 |

|

00 |

|

||||

14 |

. . . .Total nonrefundable credits (add line 11 through line 13) |

. . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . |

. . |

14 |

|

15 |

Subtract line 14 from line 10 and enter the difference. If less than zero, enter zero here |

. . |

15 |

||||

PAYMENTS AND REFUNDABLE CREDITS |

|

|

|

|

|

||

|

SC income tax withheld (attach |

|

|

|

|

|

|

16 |

. . . . . . . . . . |

16 |

|

00 |

|

||

17 |

2020 Estimated Tax payments |

|

|

|

|

|

|

. . . . . . . . . . |

17 |

|

00 |

|

|||

18 |

Amount paid with extension |

|

|

|

|

|

|

. . . . . . . . . . |

18 |

|

00 |

|

|||

19 |

Nonresident sale of real estate |

|

|

|

|

|

|

. . . . . . . . . . |

19 |

|

00 |

|

|||

20 |

. . . . . . . . . . . . . . . . . . . . . . .Other SC withholding (attach 1099) |

. . . . . . . . . . |

20 |

|

00 |

|

|

21 |

. . . . . . . . . . . . . . . . . . . . . . . . . . .Tuition tax credit (attach |

. . . . . . . . . . |

21 |

|

00 |

|

|

22 |

Other refundable credits: |

|

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . .22a Anhydrous Ammonia (attach |

. . . . . . . . . . |

22a |

|

00 |

|

|

|

22b |

. . . . .Milk Credit (attach |

. . . . . . . . . . |

22b |

|

00 |

|

|

22c |

Classroom Teacher Expenses (attach |

|

|

|

|

|

|

. . . . . . . . . . |

22c |

|

00 |

|

||

|

22d |

Parental Refundable Credit (attach |

|

|

|

|

|

|

. . . . . . . . . . |

22d |

|

00 |

|

||

|

22e |

Motor Fuel Income Tax Credit (attach |

|

|

|

|

|

|

. . . . . . . . . . |

22e |

|

00 |

|

||

|

. . . . . .Total refundable credits (add line 22a through line 22e) |

. . . . . . . . . . . . . . |

. . . . |

. . . . . . . . . . . |

|

22 |

|

|

AMENDED RETURN: Use Schedule AMD for line 23 calculation. |

|

|

|

|

||

23 Add line 16 through line 22 and enter the total here. |

These are your TOTAL PAYMENTS |

|

|||||

|

23 |

||||||

24 |

If line 23 is larger than line 15, subtract line 15 from line 23 and enter the overpayment |

24 |

|||||

25 |

If line 15 is larger than line 23, subtract line 23 from line 15 and enter the amount due |

25 |

|||||

|

|

|

|

|

|

|

|

AMENDED RETURN: Enter the amount from line 24 on line 30. Enter the amount from line 25 on line 31.

00

00

00

00

00

00

26 |

. . . . . . . . . . . .USE TAX due on online, |

|

26 |

|

|

|

00 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|||||

|

Use Tax is based on your county's Sales Tax rate. See instructions for more information. |

|

|

|

|

|||||||||

|

If you certify that no Use Tax is due, check here . . . . |

|

|

|

|

|

|

|

|

|

||||

|

Amount of line 24 to be credited to your 2021 Estimated Tax |

|

|

|

|

|

|

|

||||||

27 |

|

27 |

|

|

|

00 |

|

|||||||

28 |

Total Contributions for |

|

|

|

|

|

|

|

|

|

||||

. . . . . . . . . . |

. . . . . . . |

|

28 |

|

|

|

00 |

|

||||||

29 |

. . .Add line 26 through line 28 and enter the total here |

. . . . . . . . . . |

. . . . . . . . |

. . . |

. . . . |

. |

. . . . . . |

. . . . . |

. . |

29 |

||||

30 |

If line 29 is larger than line 24, go to line 31. Otherwise, subtract line 29 from line 24 and enter the |

|

|

|||||||||||

|

amount to be refunded to you (line 30a check box entry is required) |

|

This is your REFUND |

|

30 |

|||||||||

|

REFUND OPTIONS (subject to program limitations) |

|

|

|

|

|

|

|

|

|

||||

|

30a |

Mark one refund choice: |

Direct Deposit (30b required) |

Debit Card |

Paper Check |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

30b |

Direct Deposit (for US accounts only) |

Type: |

Checking |

Savings |

|

|

|

|

|||||

|

|

Routing Number (RTN) |

|

|

|

|

Must be 9 digits. The first two numbers of the |

|

||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

RTN must be 01 through 12 or 21 through 32. |

|

|||||||

|

|

|

|

|

|

|

|

|||||||

|

|

Bank Account Number (BAN) |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

Add line 25 and line 29. If line 29 is larger than line 24, subtract line 24 from line 29, enter the total. This is your tax due |

31 |

||||||||||||

32 |

Late filing and/or late payment: Penalties___________ |

Interest ___________ |

|

Enter total here |

|

32 |

||||||||

33 |

Penalty for Underpayment of Estimated Tax (attach SC2210) |

|

|

|

|

|

|

|

|

|||||

|

Enter exception code from instructions here if applicable ______ |

. . . |

. . . . |

. |

. . . . . . |

. . . . |

|

33 |

||||||

34 Add line 31 through line 33 and enter the total here. |

|

This is your BALANCE DUE |

|

34 |

||||||||||

|

|

Pay online using our free tax portal, MyDORWAY, at dor.sc.gov/pay. |

|

|

||||||||||

00

00

00

00

00

00

I declare that this return and all attachments are true, correct, and complete to the best of my knowledge. If prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge.

Your signature |

|

Date |

|

Spouse's signature (if married filing jointly, BOTH must sign) |

|

|

|

|

|

|

|

I authorize the Director of the SCDOR or delegate to discuss this return, |

Yes |

No |

Preparer's printed name |

||

attachments, and related tax matters with the preparer. |

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

Paid |

Preparer |

Date |

|

Check if self- |

PTIN |

Preparer's |

signature |

|

|

employed |

|

|

|

|

|

||

Use |

Firm name (or yours if self- |

|

|

|

FEIN |

Only |

employed), address, ZIP |

|

|

|

|

|

|

|

Phone |

||

|

|

|

|

|

|

REFUNDS OR ZERO TAX: SC1040 Processing Center, PO Box 101100, Columbia, SC

MAIL TO: BALANCE DUE: Taxable Processing Center, PO Box 101105, Columbia, SC

30753206