1350 |

|

STATE OF SOUTH CAROLINA |

|

SC SCH.TC-38 |

|

|

|

|

|

|

|

|

|

|

|

|

DEPARTMENT OF REVENUE |

|

(Rev. 7/27/21) |

|

|

|

|

SOLAR ENERGY, SMALL HYDROPOWER SYSTEM, |

|

3430 |

|

|

|

dor.sc.gov |

|

OR GEOTHERMAL MACHINERY AND EQUIPMENT CREDIT |

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

SSN or FEIN |

|

|

|

|

|

|

|

|

|

|

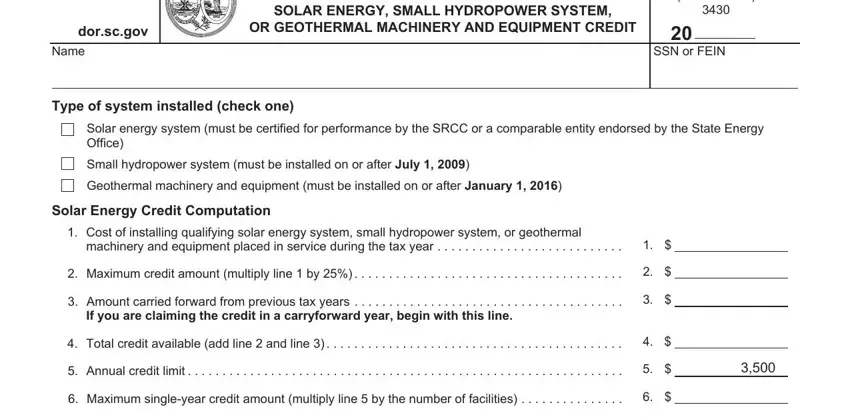

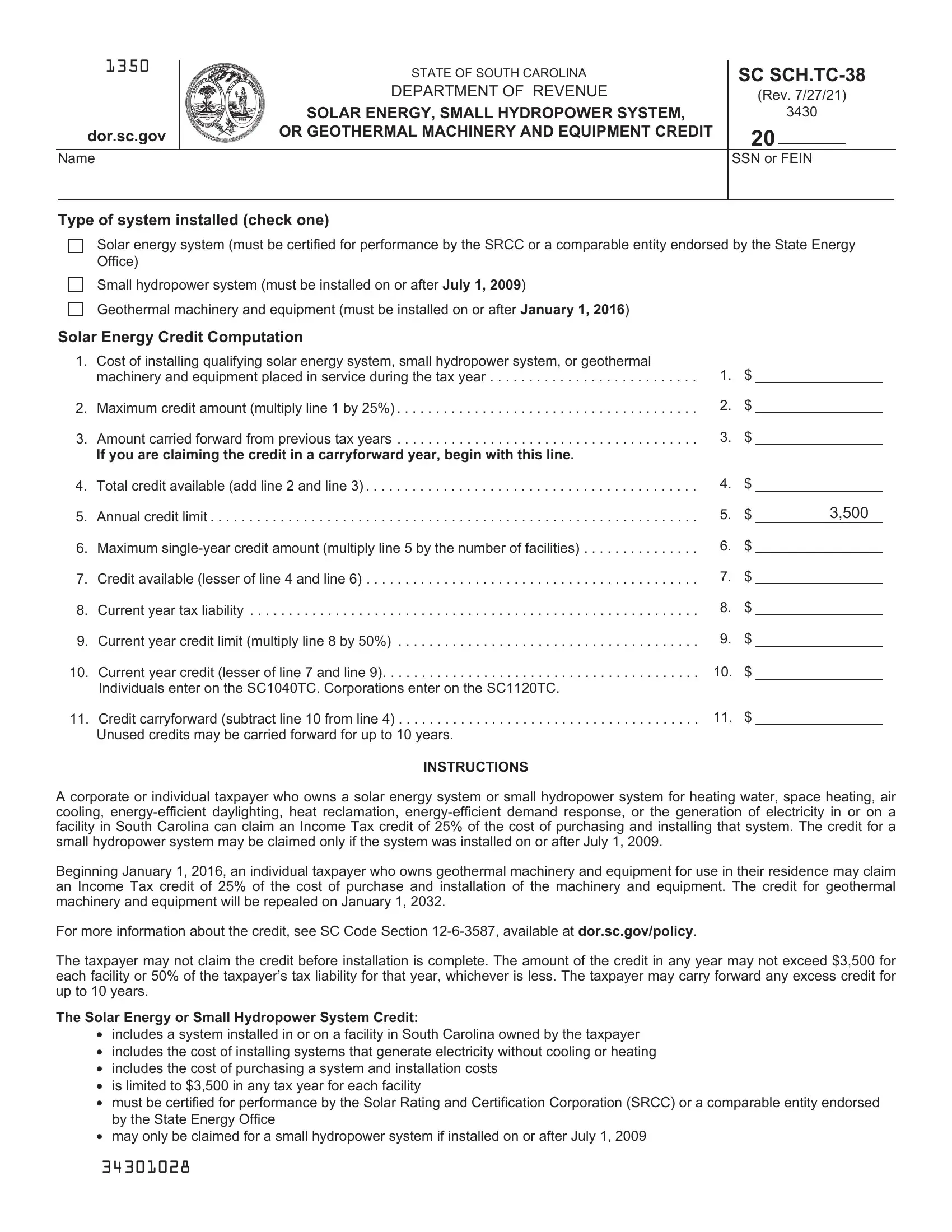

Type of system installed (check one)

Solar energy system (must be certified for performance by the SRCC or a comparable entity endorsed by the State Energy Office)

Small hydropower system (must be installed on or after July 1, 2009)

Geothermal machinery and equipment (must be installed on or after January 1, 2016)

Solar Energy Credit Computation

1. Cost of installing qualifying solar energy system, small hydropower system, or geothermal machinery and equipment placed in service during the tax year . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Maximum credit amount (multiply line 1 by 25%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Amount carried forward from previous tax years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If you are claiming the credit in a carryforward year, begin with this line.

4. Total credit available (add line 2 and line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Annual credit limit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Maximum single-year credit amount (multiply line 5 by the number of facilities) . . . . . . . . . . . . . . .

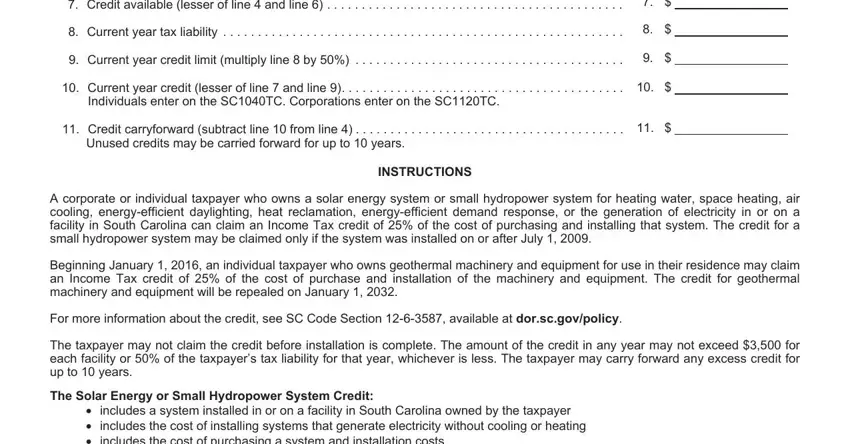

7. Credit available (lesser of line 4 and line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Current year tax liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Current year credit limit (multiply line 8 by 50%) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Current year credit (lesser of line 7 and line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Individuals enter on the SC1040TC. Corporations enter on the SC1120TC.

11. Credit carryforward (subtract line 10 from line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unused credits may be carried forward for up to 10 years.

1.$

2.$

3.$

4.$

6.$

7.$

8.$

9.$

10. $

11. $

INSTRUCTIONS

A corporate or individual taxpayer who owns a solar energy system or small hydropower system for heating water, space heating, air cooling, energy-efficient daylighting, heat reclamation, energy-efficient demand response, or the generation of electricity in or on a facility in South Carolina can claim an Income Tax credit of 25% of the cost of purchasing and installing that system. The credit for a small hydropower system may be claimed only if the system was installed on or after July 1, 2009.

Beginning January 1, 2016, an individual taxpayer who owns geothermal machinery and equipment for use in their residence may claim an Income Tax credit of 25% of the cost of purchase and installation of the machinery and equipment. The credit for geothermal machinery and equipment will be repealed on January 1, 2032.

For more information about the credit, see SC Code Section 12-6-3587, available at dor.sc.gov/policy.

The taxpayer may not claim the credit before installation is complete. The amount of the credit in any year may not exceed $3,500 for each facility or 50% of the taxpayer’s tax liability for that year, whichever is less. The taxpayer may carry forward any excess credit for up to 10 years.

The Solar Energy or Small Hydropower System Credit:

•includes a system installed in or on a facility in South Carolina owned by the taxpayer

•includes the cost of installing systems that generate electricity without cooling or heating

•includes the cost of purchasing a system and installation costs

•is limited to $3,500 in any tax year for each facility

•must be certified for performance by the Solar Rating and Certification Corporation (SRCC) or a comparable entity endorsed by the State Energy Office

•may only be claimed for a small hydropower system if installed on or after July 1, 2009

The Geothermal Machinery or Equipment Credit:

•includes machinery or equipment owned by the taxpayer for use at the taxpayer’s residence

•includes the cost of a heat pump that uses the ground or groundwater as a thermal energy source to heat a structure or as a thermal energy sink to cool a structure

•includes the cost of machinery or equipment that uses the internal heat of the earth as a substitute for traditional energy for water heating or active space heating or cooling

•is for machinery and equipment that, on the date of installation, meets or exceeds applicable federal Energy Star requirements

•may only be claimed if the system is installed on or after January 1, 2016

•is limited to $3,500 in any tax year

Certification:

•The SRCC certifies solar hot water systems.

•Any solar interconnection agreement between a utility and a taxpayer is certification the system has been reviewed by an appropriate entity.

•Taxpayers with a solar energy system not connected to the grid must complete the Certification for PV Systems form, available at energy.sc.gov.

•For all other equipment, the manufacturer certifies the equipment meets applicable federal standards.

•Keep all system, machinery, and equipment certifications with your tax records.

Definitions:

System includes all controls, tanks, pumps, heat exchangers, and other equipment used directly and exclusively for the solar energy system. It does not include any land or structural elements of the building, such as walls and roofs or other equipment ordinarily contained in the structure. The credit is not allowed for a solar system unless the system is certified for performance by the SRCC or a comparable entity endorsed by the State Energy Office.

Small hydropower system is a new generation capacity on a nonimpoundment or on an existing impoundment that:

•meets licensing standards as defined by the Federal Energy Regulatory Commission; or

•is a run-of-the-river facility with a capacity not to exceed 5MW; or

•consists of a turbine in a pipeline or in an irrigation canal.

Geothermal machinery and equipment is a heat pump that uses ground or groundwater as a thermal energy source to heat a structure or as a thermal energy sink to cool a structure. It uses the internal heat of the earth as a substitute for traditional energy for water heating or active space heating or cooling.

Line Instructions:

Line 1: Enter the total costs of the purchase and installation of a solar energy system, small hydropower system, or geothermal machinery and equipment. Include any costs that were not claimed in a previous year. The credit is claimed in the year installation is complete.

Line 2: The credit allowed is for 25% of the purchase and installation costs.

Line 3: Enter any amounts carried forward from previous tax years. Unused credits may be carried forward for up to 10 years. If you are claiming the credit in a carryforward year, begin with this line.

Line 6: The credit for solar energy or small hydropower systems cannot exceed $3,500 for each facility. The credit for geothermal machinery and equipment can only be claimed for one facility.

Line 8: Enter the Income Tax liability from line 10 of the SC1040 or line 9 of the SC1120.

Line 9: The total credit claimed in a year may not exceed 50% of your Income Tax liability.

If filing a paper return, attach to your Income Tax return. If filing electronically, include the information from this form when you file your return. Keep a copy of the form with your tax records.

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to the SCDOR must provide identifying numbers, as prescribed, for securing proper identification. Your Social Security Number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the SCDOR is limited to the information necessary for the SCDOR to fulfill its statutory duties. In most instances, once this information is collected by the SCDOR, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.