When welcoming a new child into the world, the complexities of managing work and family commitments suddenly become a prominent concern for many parents. In the UK, the government provides support through the SC3 form—a critical document for parents looking to take ordinary statutory paternity leave or claim Ordinary Statutory Paternity Pay (OSPP). This form is the gateway for eligible parents—biological fathers, partners, husbands, or civil partners not being the baby’s biological father—to receive financial support during this pivotal time. Specifically, it outlines entitlements such as receiving either the weekly rate of OSPP prevailing at the time of leave or 90% of one's average weekly earnings (whichever is lower) for one or two weeks of leave. Furthermore, the form serves as a declaration of the parent's commitment to taking responsibility for the child’s upbringing and details the prerequisites for eligibility, including employment and earnings criteria. Parents wishing to access these benefits must engage with their employers about their leave and pay plans well in advance, adhering to specific deadlines to ensure they receive the support they are entitled to. With provisions for early births and the need to possibly revisit plans, the SC3 form emphasizes communication between the employee and employer, making the process as seamless as possible for the soon-to-be-expanded family. It also foreshadows potential help in disputes regarding eligibility and hints at additional support for those who might not qualify for OSPP, underlining the government’s commitment to supporting families during these early stages of parenthood.

| Question | Answer |

|---|---|

| Form Name | Sc3 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | sc3 form pdf, spp form, sc3 form editable, sc3 paternity form |

Ordinary Statutory Paternity Pay/ ordinary paternity leave – becoming a parent

Becoming a parent

If you want to take time off work to support the mother of the baby or look after the baby you may be entitled to:

•Ordinary Statutory Paternity Pay (OSPP) — at least part of your wages will be paid for one or two weeks. You will get the weekly rate of OSPP current at the time of your ordinary paternity leave, or 90% of your average weekly earnings, whichever is less

•ordinary paternity leave — up to two weeks time off.

Please read through the terms and conditions below and if you think you might qualify, fill in the form opposite and complete the declaration on page 2.

Terms and conditions

OSPP and ordinary paternity leave are available to:

•a biological father

•a partner, husband or civil partner that is not the baby’s biological father.

You must be able to declare that:

•you are

—the baby’s biological father, or

—married to or in a civil partnership with the mother, or

—living with the mother in an enduring family relationship, but are not an immediate relative, and

•you will be responsible for the child’s upbringing, and

•you will take time off work to support the mother or care for the child.

You must be continuously employed by the same employer for at least 26 weeks by the end of the 15th week before the week the baby is due. You must then continue to be employed by the same employer until the date the baby is born.

To get OSPP you must also have average earnings over a set period above a set amount — your employer will work this out for you.

You cannot start your ordinary paternity leave before the child is born. You can choose to take one or two whole weeks leave, but not two separate weeks, which must end by the 56th day after the date of birth. If the baby is born early you can choose to take your leave any time between the actual date of birth and the end of an

You must discuss your leave plans with your employer and tell them what time off you want by the 15th week before the week the baby is due. Your employer can tell you when this is, if you are not sure.

You must complete this form and give it to your employer at least 28 days before you want to start receiving OSPP.

You can change your mind, but you must give your employer 28 days notice of the dates. If you do change your mind, you and your employer may find it helpful if you filled in a fresh form SC3 Ordinary Statutory Paternity Pay/ordinary paternity leave.

If you cannot tell your employer what time off you want in time, or the baby is born sooner or later than expected, please discuss the situation with your employer.

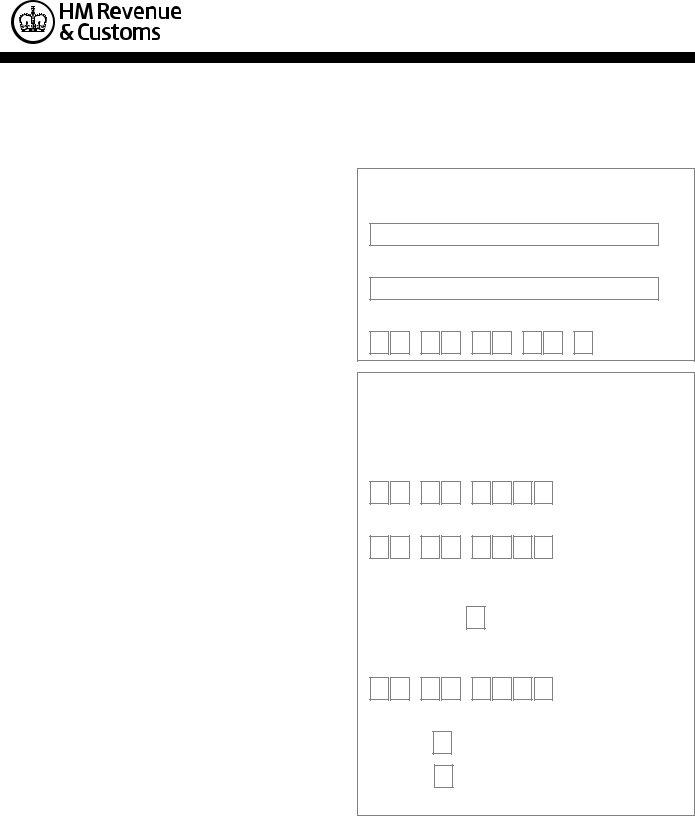

Personal details

Surname or family name

First name(s)

National Insurance number

Your dates for pay and leave

Give the date the baby is due.

If the baby has already been born, give the date the baby was due and the actual date of birth.

Due date DD MM YYYY

Actual date of birth (if applicable) DD MM YYYY

I would like my OSPP and/or ordinary paternity leave to start on the date the baby is born

No |

|

Yes |

If ‘No’, I would like my OSPP to start within eight weeks of the date the baby was born starting on or around DD MM YYYY

I want to be away from work for

one week

two weeks

Please turn over

SC3 |

Page 1 |

HMRC 12/13 |

Your declaration

You must be able to tick all three boxes below to get OSPP and ordinary paternity leave.

I declare that:

•I am

—the baby’s biological father, or

—married to or in a civil partnership with the mother, or

—living with the mother in an enduring family relationship, but am not an immediate relative, and

•I will have responsibility for the child’s upbringing, and

•I will take time off work to support the mother or care for the child.

Signature

Date DD MM YYYY

Give this form to your employer, but keep a copy of the terms and conditions for your records.

Further information and other help

Depending on your circumstances you may not qualify for OSPP and/or ordinary paternity leave. Your employer will let you know. If this is the case you will get more advice and information at the time.

If you are not entitled to OSPP you may be entitled to other government help. Contact any Jobcentre Plus office for further information.

For details covering social security benefits go to www.gov.uk

For further information on OSPP you can also go to:

•www.gov.uk

•www.acas.org.uk

Disagreements

If your employer tells you that you are not entitled to OSPP and/or ordinary paternity leave and you have looked at the further information about OSPP on the Gov.uk website, you can challenge that decision. You must do this within six months of the first day that you are notified of your employer’s decision. If you need help with this, for:

•OSPP — if you wish to register a dispute after getting further information, see Further information and other help, phone our Statutory Payments Disputes Team on 03000 560630

•ordinary paternity leave — phone the Advisory Conciliation and Arbitration Service (Acas) Helpline number

08457 47 47 47. In Northern Ireland, phone the Labour Relations Agency on 028 9032 1442.

Additional Statutory Paternity Pay (ASPP)

If you are entitled to OSPP you may also be entitled to Additional Statutory Paternity Pay (ASPP).

If you would like more information about entitlement to ASPP you should ask your employer or go online at www.gov.uk

Penalties

We may charge penalties where a person, either fraudulently or negligently, gives incorrect information or makes a

false statement or declaration for the purpose of claiming entitlement to OSPP.

Page 2