financial declaration can be completed online without any problem. Just use FormsPal PDF editing tool to perform the job without delay. Our tool is consistently developing to give the very best user experience achievable, and that is thanks to our commitment to continual enhancement and listening closely to user feedback. Starting is effortless! All that you should do is take the next simple steps directly below:

Step 1: Press the orange "Get Form" button above. It's going to open our editor so that you could begin filling in your form.

Step 2: With this handy PDF file editor, it is possible to do more than merely complete forms. Edit away and make your forms appear perfect with custom text incorporated, or tweak the file's original input to excellence - all that comes along with the capability to insert any graphics and sign the PDF off.

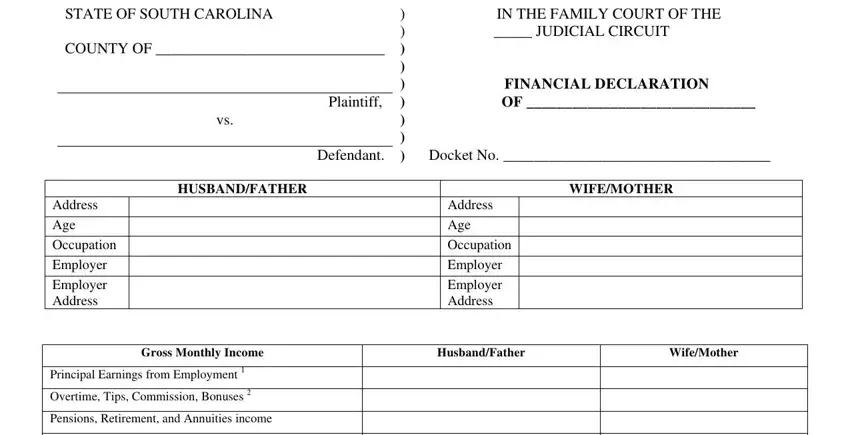

As for the fields of this precise PDF, here's what you should know:

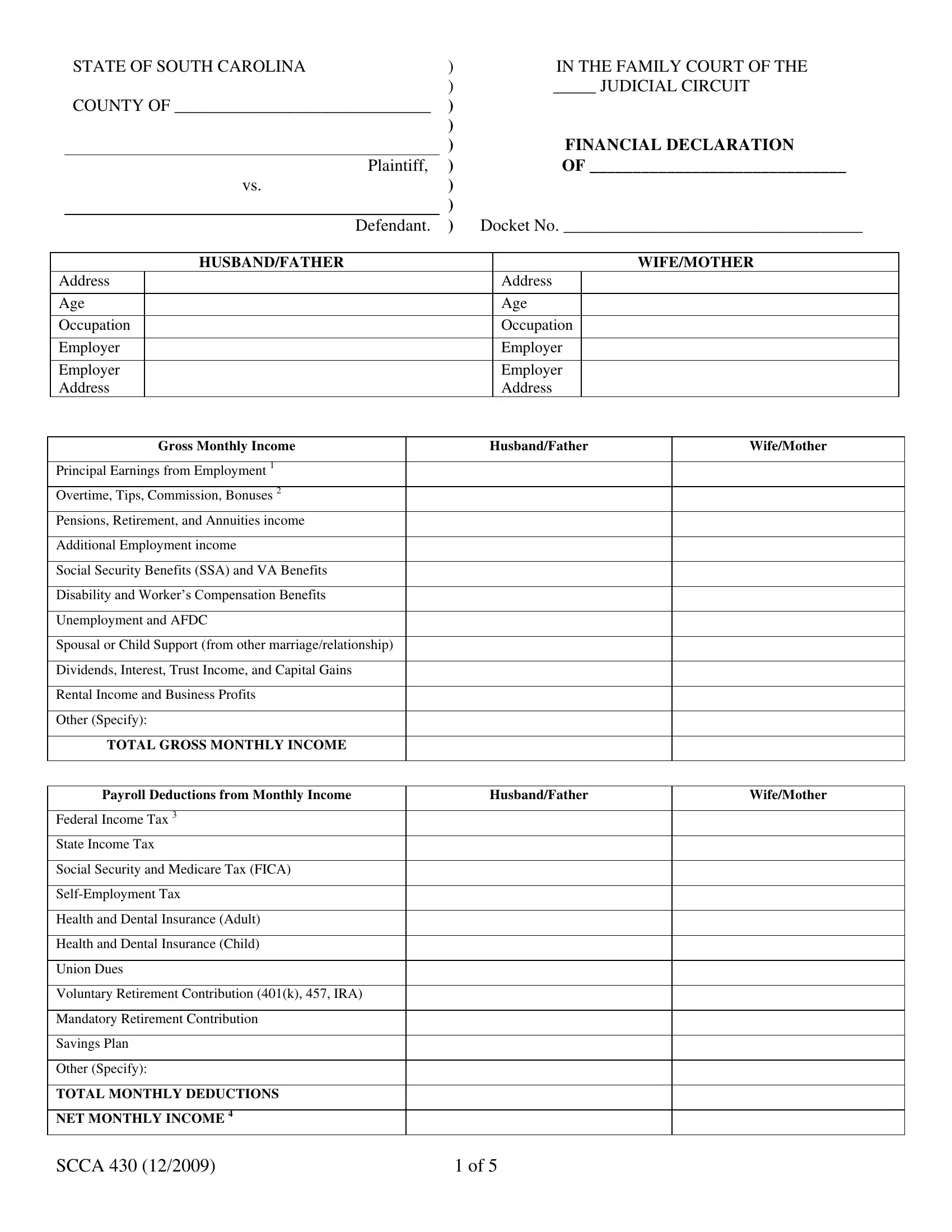

1. It's very important to complete the financial declaration accurately, therefore be attentive when working with the areas comprising these fields:

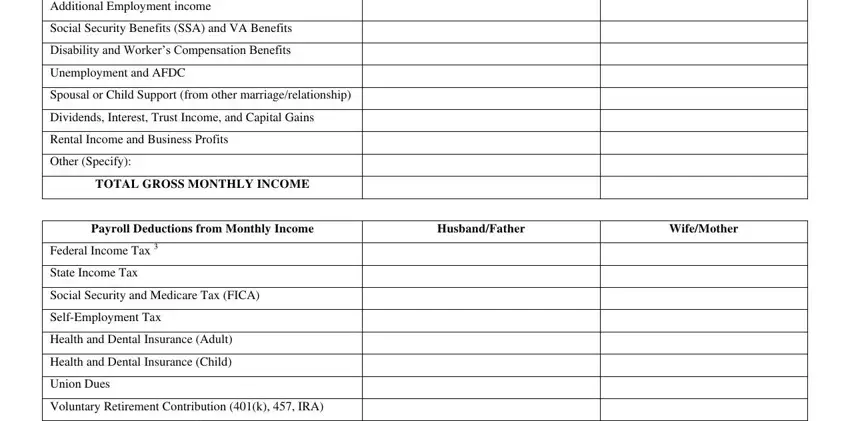

2. Once the last section is finished, you're ready add the required details in Additional Employment income, Social Security Benefits SSA and, Unemployment and AFDC, Spousal or Child Support from, Dividends Interest Trust Income, Rental Income and Business Profits, Other Specify, TOTAL GROSS MONTHLY INCOME, Payroll Deductions from Monthly, HusbandFather, WifeMother, Federal Income Tax, State Income Tax, Social Security and Medicare Tax, and SelfEmployment Tax allowing you to go further.

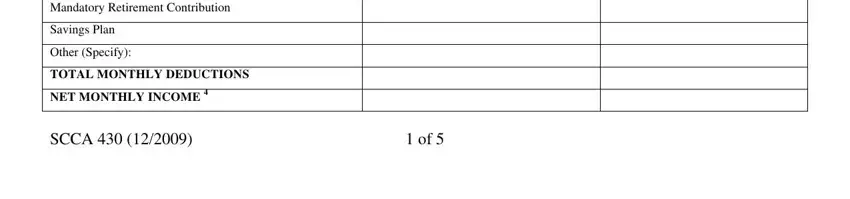

3. The following section is all about Mandatory Retirement Contribution, Savings Plan, Other Specify, TOTAL MONTHLY DEDUCTIONS, NET MONTHLY INCOME, and SCCA - complete every one of these blanks.

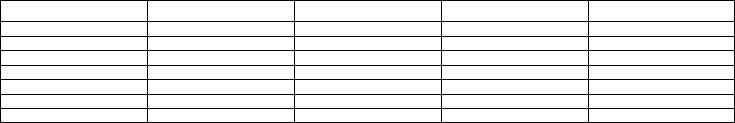

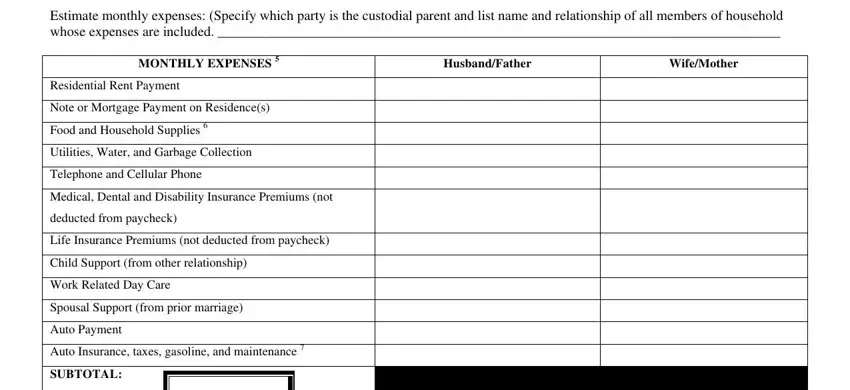

4. Your next paragraph will require your details in the following places: Estimate monthly expenses Specify, MONTHLY EXPENSES, HusbandFather, WifeMother, Residential Rent Payment, Note or Mortgage Payment on, Food and Household Supplies, Utilities Water and Garbage, Telephone and Cellular Phone, Medical Dental and Disability, deducted from paycheck, Life Insurance Premiums not, Child Support from other, Work Related Day Care, and Spousal Support from prior marriage. Be sure you fill in all of the requested info to go onward.

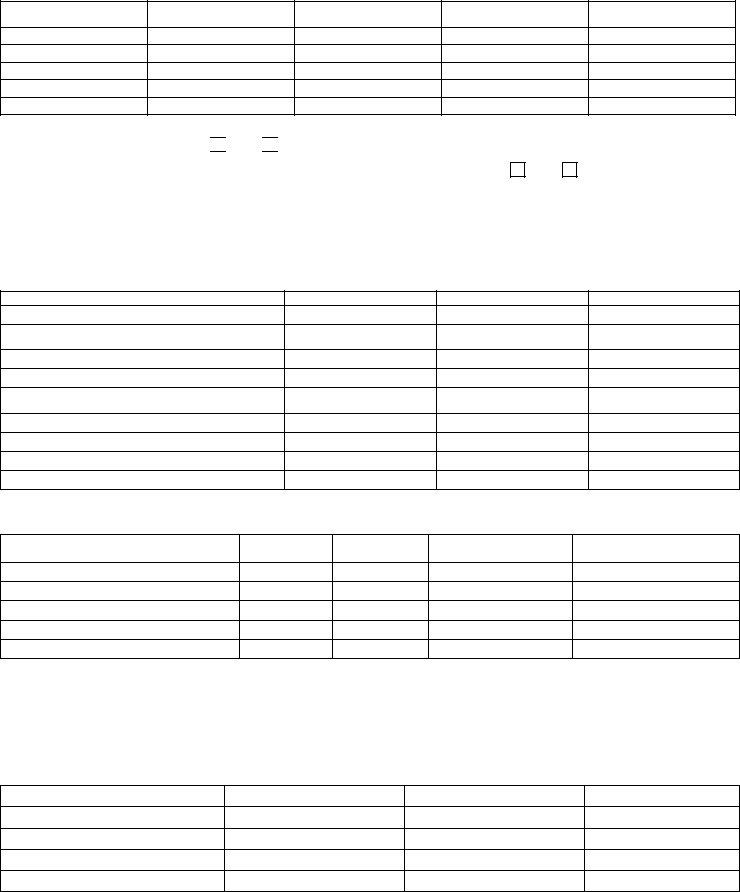

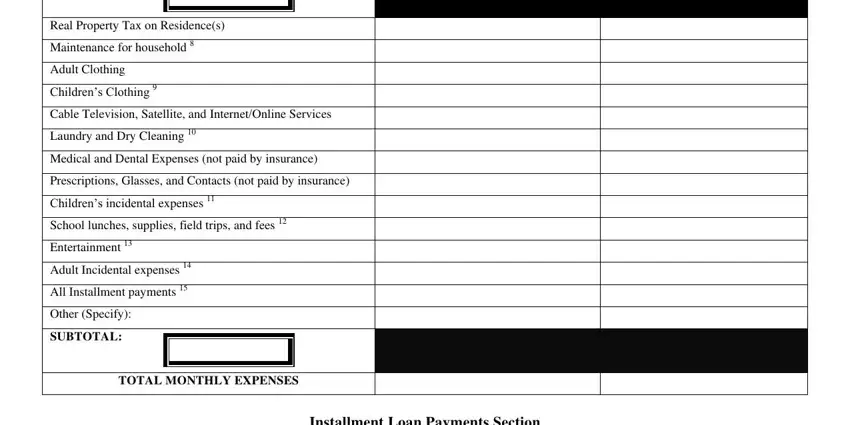

5. To conclude your document, the last part requires a few extra blanks. Filling in Real Property Tax on Residences, Maintenance for household, Adult Clothing Childrens Clothing, Cable Television Satellite and, Laundry and Dry Cleaning, Medical and Dental Expenses not, Prescriptions Glasses and Contacts, Entertainment, Adult Incidental expenses, All Installment payments, Other Specify, SUBTOTAL, TOTAL MONTHLY EXPENSES, and Installment Loan Payments Section will certainly wrap up everything and you will be done in the blink of an eye!

Be very careful when filling in TOTAL MONTHLY EXPENSES and Maintenance for household, because this is the part in which many people make a few mistakes.

Step 3: Revise all the information you have typed into the form fields and click the "Done" button. Right after starting afree trial account at FormsPal, you'll be able to download financial declaration or email it right away. The document will also be easily accessible through your personal account page with your adjustments. FormsPal ensures your information privacy with a protected method that in no way records or shares any kind of sensitive information provided. Be confident knowing your files are kept confidential any time you use our editor!