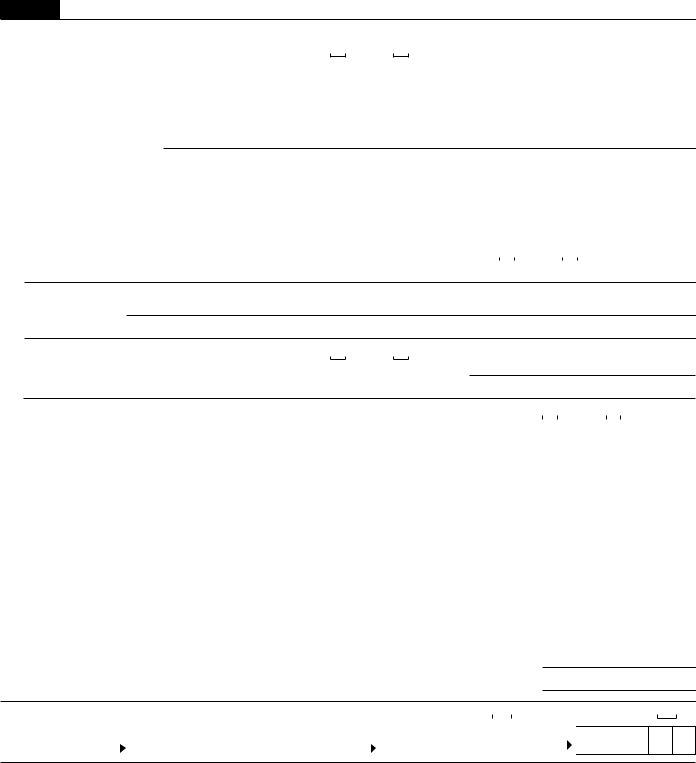

Navigating through the complexities of fiduciary responsibilities and estate handling after a person's death can feel like a daunting task for many. One critical piece in this process, for those managing estates within Wisconsin, is the understanding and submission of the Schedule CC form. This form, specifically designed for 2021, is a Request for a Closing Certificate for Fiduciaries by the Wisconsin Department of Revenue, aimed exclusively at estates, not trusts. It mandates the use of black ink and delves into detailed requirements including the decedent’s personal information, probate case specifics, and an exhaustive declaration of assets both probate and non-probate. Critical questions regarding the necessity of the certificate by the court, presence of a will, types of probate, previous interactions with tax authorities, and detailed inventory of assets shed light on the estate's fiscal footprint. Furthermore, it goes beyond to inquire about fiduciary fees, while part II extends its scope towards trusts, underlining the common thread of financial diligence and lawful adherence. The form differentiates clearly between estates and trusts, yet maintains a unified goal: to provide a clear, documented pathway for fiduciaries to officially close proceedings with the state's blessing, contingent upon stringent adherence to its guidelines.

| Question | Answer |

|---|---|

| Form Name | Schedule Cc Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Request for a Closing Certificate for Fiduciaries, 2021 I-030 Wisconsin Schedule CC |

CAUTION:

The 2021 Schedule CC may not be filed prior to January 18, 02

|

Schedule |

CC |

|

Request for a Closing Certificate |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

|

|

|

|

for Fiduciaries |

2021 |

|

||||||

|

Use BLACK INK |

|

|

Wisconsin Department of Revenue |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

ESTATES ONLY – Decedent’s last name |

|

Decedent’s first name |

M.I. |

Decedent’s social security number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

STAPLENOT |

TRUSTS ONLY – Legal name |

|

|

|

|

|

|

|

|

Estate’s/Trust’s federal EIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual or firm to whom the closing certificate should be mailed |

Attention or c/o |

|

|

|

County of jurisdiction (Name Only) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

DO |

Address |

|

|

|

|

|

|

|

|

|

Probate case number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

Zip code |

|

|

|

Date of decedent’s death (MM DD YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I Information Required When Requesting a Closing Certificate for Estates

DO NOT ATTACH SCHEDULE CC TO FORM 2 (see instructions)

Complete lines 1 through 11 and sign on page 2.

1. |

Is a certificate required by the court? |

|

|

|

|

|

Yes |

|

|

|

|

No |

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

If No, DO NOT submit Schedule CC. The department only issues a Closing Certificate if a court requires it to close a proceeding. |

|||||||||||||||||||||||||||||||||||||||||||||

2. |

Does the decedent have a will? |

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

No |

|

(If Yes, enclose a copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

3. |

Type of probate |

|

|

Formal |

|

|

|

Informal |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4. |

If the decedent did not file tax returns for the 4 years prior to death, enter the year and the decedent’s approximate income: |

|||||||||||||||||||||||||||||||||||||||||||||

|

20 |

|

$ |

|

|

|

|

|

, 20 |

|

|

$ |

|

|

|

, |

|

20 |

|

|

$ |

, 20 |

|

$ |

|

|

|

|

. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Was the decedent contacted by the IRS and/or Wis. Dept. of Revenue in the last 3 years? |

|

|

|

|

|

Yes |

|

|

|

|

No |

|

|

||||||||||||||||||||||||||||||||

|

If Yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. |

Is the gross income of the estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

less than $600? |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

Will a final Form 2 be filed at a l |

ter d |

te? |

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

8. |

Was the decedent a resident of Wisconsin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

at the time of death? |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9. |

Did the decedent own an interest in any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

partnership, S corporation, LLC, or LLP? |

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

10. |

Enter the totals of each of the assets listed below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Probate Assets (Enclose a copy of the inventory) |

|

|

|

|

|

|

|

|

|

|

|

NO COMMAS; NO CENTS |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

. . . . . . . . . . . . .a. Real Estate |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

.10a |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

b. Stocks and Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

. . . |

. . . . . |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

.10b |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

c. Mortgages, Notes, and Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

10c |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

NOTE |

|

|

|

|||||||||||||||||||||||||||||||

|

d. Land Contracts and Installment Sales |

|

|

|

|

|

|

|

|

.10d |

|

|

.00 |

|

|

|

|

|

||||||||||||||||||||||||||||

|

. |

. . |

|

. . |

|

|

|

|

Where any line |

|||||||||||||||||||||||||||||||||||||

|

e. Insurance Payable to Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.10e |

|

|

. |

00 |

|

|

from |

10a |

through |

||||||||||||||||||

|

|

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

|

|

|

|

10L |

is |

left blank, |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

f. |

Annuities and Employee Death Benefits Payable to Estate . . .10f |

|

|

.00 |

|

|

it will |

be |

deemed |

||||||||||||||||||||||||||||||||||||

|

g. Other Miscellaneous Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

.10g |

|

|

.00 |

|

|

that |

NONE is the |

||||||||||||||||||||||||

|

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

DECLAR ATION |

||||||||||||||||||||||||||||||||||

|

Nonprobate Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for that line by the |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

person(s) |

signing |

||||||||||||

|

h. Jointly Owned Survivorship – Decedent’s share of property . . 10h |

|

|

.00 |

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Schedule CC. |

|||||||||||||||||||||||||||||||||||||||||

|

i. Decedent’s Share of Survivorship Marital Property |

|

|

|

|

. 10i |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

. . . . . . . . .j. Insurance Payable to Named Beneficiaries |

. |

. . |

|

. . |

. 10j |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . . . . . . .k. Transfers During Decedent’s Life (gifts, etc.) |

. |

. . |

|

. . |

. 10k |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . . . . . . . . . . .L. Other Assets |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

. 10L |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

m. Wisconsin GROSS Estate (add lines 10a through 10L) |

. |

|

. . |

. . . . |

. |

. . . . . . . . . . . . . . |

10m |

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||||||

11. |

Fiduciary fees paid or payable to the personal representative or trustee |

|

. . . . . . . . . . . . . . |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||||||||||||||||||||||||

2021 Schedule CC |

Page 2 |

|

|

PART II Information Required When Requesting a Closing Certificate for Trusts

Complete lines 1 through 10 and sign below. |

|

|

1. Is a certificate required by the court? |

Yes |

No |

If Yes, enclose a statement from the court verifying that a Closing Certificate is required to close a proceeding.

If No, DO NOT submit Schedule CC. The department only issues a Closing Certificate if a court requires it to close a proceeding.

2.Enclose a copy of the trust instrument with amendments (will/codicils).

3.a. Name(s) of grantor(s)

|

Social security number(s) |

|

|

|

|

|

||

|

b. Name(s) of grantee(s) |

|

|

|

|

|

||

|

Social security number(s) |

|

|

|

|

|

||

4. |

On what date was the trust funded? |

|

|

|

|

|

||

5. |

Was the trust contacted by the IRS and/or Wis. Dept. of Revenue in the last 3 years? |

|

Yes |

|

No If Yes, explain: |

|||

6.State reason for closing the trust. If death of beneficiary, provide name of beneficiary, social security number, last address, and date of death.

7. Have you petitioned the court to close the trust? |

Yes |

No |

If Yes, enclose a copy of the petition. If No, explain why no petition has been filed:

8. |

Has the trust filed fiduciary income tax returns wi h Wisconsin in any of the last four years? |

|

Yes |

|

No |

|

|

If No, provide either a) copies of informal or ormal annual accountings for the past four years, or b) annual schedules show- |

|||||

|

ing the trust’s income and expenses for each of he past four years. |

|

|

|

|

|

9. |

Enter the total fair market value of e |

ch of the ssets listed below that are held by the trust at the end of the year preceding the |

||||

|

final year of the trust. ( NOTE Where |

ny line from 9a through 9f is left blank, it will be deemed that NONE is the DECLARATION |

||||

for that line by the person(s) signing Schedule CC.)

a. |

Real Estate |

9a |

|

|

|

.00 |

|

|

|

|

|

|

|

|

b. |

Stocks and Bonds |

9b |

|

|

|

.00 |

|

|

|

|

|

|

|

|

c. |

Mortgages, Notes, and Cash |

9c |

|

|

|

.00 |

|

|

|

|

|

|

|

|

d. |

Annuities and Life Insurance |

9d |

|

|

|

.00 |

|

|

|

|

|

|

|

|

e. |

Interest in Partnerships, LLCs, and S Corporations . . . |

9e |

|

|

|

.00 |

|

|

|

|

|

|

|

|

f. |

Other Miscellaneous Property |

9f |

|

|

.00 |

|

|

|

|

|

|

|

||

g. |

Total Assets (add lines 9a through 9f) |

|

|

|

|

|

. |

9g |

||||||

. . . . . |

. . . . |

. . . . . . . . . . . . |

. . . |

|||||||||||

10. Fiduciary fees paid or payable to the personal representative or trustee |

. . . . . . . . . . . . |

. . . 10 |

|

|

|

|

|

|||||||

Third |

Do you want to allow another person to discuss this return with the department (see instructions)? |

|

Yes Complete the following. |

|||||||||||

Party |

Designee’s |

Phone |

|

|

Personal |

|

|

|

|

|

|

|||

|

|

|

|

|

||||||||||

|

( |

) |

identification |

|

|

|

|

|

|

|||||

Designee name |

no. |

number (PIN) |

|

|

|

|

|

|

||||||

.00

.00

No

I, as fiduciary, declare under penalties of law that I have examined this schedule (including accompanying documents and state-

ments) and to the best of my knowledge and belief it is true, correct, and complete.

Your signature |

|

|

Date |

Daytime phone |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Fiduciary’s address |

|

City |

|

State |

|

Zip code |

|

|

|

|

|

|

|

PERSON PREPARING FORM if other than the preceding signer |

Signature of preparer |

Date |

Daytime phone |

|||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Mail to: Wisconsin Department of Revenue • PO Box 8918 • Madison WI