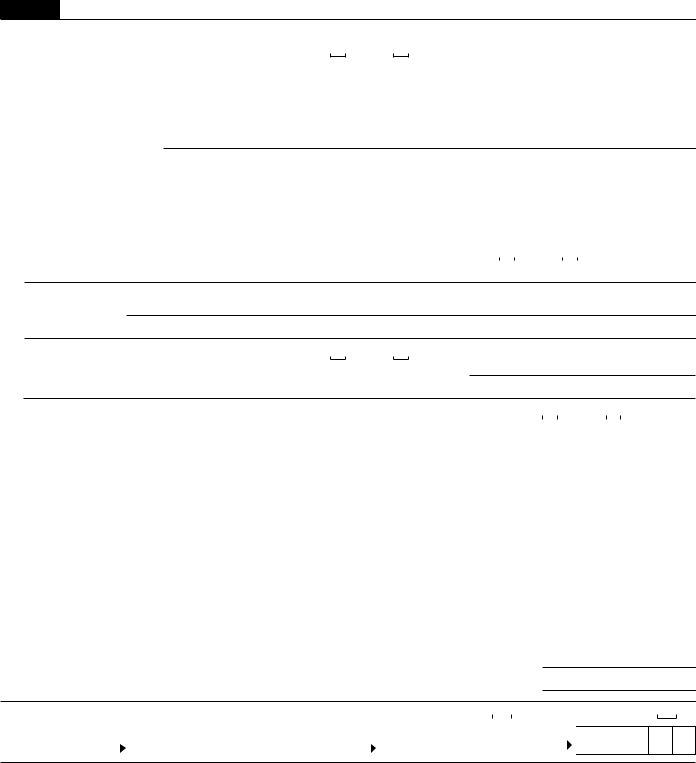

Understanding the ins and outs of taxes can be overwhelming at times, but having a comprehensive comprehension of Schedule Cc Form is essential when filing your taxes. An individual who operates their business as a sole proprietor must file this form with every tax return to report all income earned from their business for the year. Knowing how to accurately fill out this form is key in helping minimize any potential problems that might arise during tax season, so keep reading if you need help understanding what information you should include on your Schedule Cc Form.

| Question | Answer |

|---|---|

| Form Name | Schedule Cc Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Request for a Closing Certificate for Fiduciaries, 2021 I-030 Wisconsin Schedule CC |

CAUTION:

The 2021 Schedule CC may not be filed prior to January 18, 02

|

Schedule |

CC |

|

Request for a Closing Certificate |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||

|

|

|

|

for Fiduciaries |

2021 |

|

||||||

|

Use BLACK INK |

|

|

Wisconsin Department of Revenue |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

ESTATES ONLY – Decedent’s last name |

|

Decedent’s first name |

M.I. |

Decedent’s social security number |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

STAPLENOT |

TRUSTS ONLY – Legal name |

|

|

|

|

|

|

|

|

Estate’s/Trust’s federal EIN |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual or firm to whom the closing certificate should be mailed |

Attention or c/o |

|

|

|

County of jurisdiction (Name Only) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

DO |

Address |

|

|

|

|

|

|

|

|

|

Probate case number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

Zip code |

|

|

|

Date of decedent’s death (MM DD YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I Information Required When Requesting a Closing Certificate for Estates

DO NOT ATTACH SCHEDULE CC TO FORM 2 (see instructions)

Complete lines 1 through 11 and sign on page 2.

1. |

Is a certificate required by the court? |

|

|

|

|

|

Yes |

|

|

|

|

No |

|

See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

If No, DO NOT submit Schedule CC. The department only issues a Closing Certificate if a court requires it to close a proceeding. |

|||||||||||||||||||||||||||||||||||||||||||||

2. |

Does the decedent have a will? |

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

|

No |

|

(If Yes, enclose a copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

3. |

Type of probate |

|

|

Formal |

|

|

|

Informal |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

4. |

If the decedent did not file tax returns for the 4 years prior to death, enter the year and the decedent’s approximate income: |

|||||||||||||||||||||||||||||||||||||||||||||

|

20 |

|

$ |

|

|

|

|

|

, 20 |

|

|

$ |

|

|

|

, |

|

20 |

|

|

$ |

, 20 |

|

$ |

|

|

|

|

. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Was the decedent contacted by the IRS and/or Wis. Dept. of Revenue in the last 3 years? |

|

|

|

|

|

Yes |

|

|

|

|

No |

|

|

||||||||||||||||||||||||||||||||

|

If Yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. |

Is the gross income of the estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

less than $600? |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7. |

Will a final Form 2 be filed at a l |

ter d |

te? |

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

8. |

Was the decedent a resident of Wisconsin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

at the time of death? |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9. |

Did the decedent own an interest in any |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

partnership, S corporation, LLC, or LLP? |

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

10. |

Enter the totals of each of the assets listed below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Probate Assets (Enclose a copy of the inventory) |

|

|

|

|

|

|

|

|

|

|

|

NO COMMAS; NO CENTS |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

. . . . . . . . . . . . .a. Real Estate |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

.10a |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

b. Stocks and Bonds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

. . . |

. . . . . |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

.10b |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

c. Mortgages, Notes, and Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

10c |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

NOTE |

|

|

|

|||||||||||||||||||||||||||||||

|

d. Land Contracts and Installment Sales |

|

|

|

|

|

|

|

|

.10d |

|

|

.00 |

|

|

|

|

|

||||||||||||||||||||||||||||

|

. |

. . |

|

. . |

|

|

|

|

Where any line |

|||||||||||||||||||||||||||||||||||||

|

e. Insurance Payable to Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.10e |

|

|

. |

00 |

|

|

from |

10a |

through |

||||||||||||||||||

|

|

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

|

|

|

|

10L |

is |

left blank, |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

f. |

Annuities and Employee Death Benefits Payable to Estate . . .10f |

|

|

.00 |

|

|

it will |

be |

deemed |

||||||||||||||||||||||||||||||||||||

|

g. Other Miscellaneous Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

.10g |

|

|

.00 |

|

|

that |

NONE is the |

||||||||||||||||||||||||

|

. . . |

|

. . . . . |

. |

. . |

|

. . |

|

|

|

|

DECLAR ATION |

||||||||||||||||||||||||||||||||||

|

Nonprobate Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

for that line by the |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

person(s) |

signing |

||||||||||||

|

h. Jointly Owned Survivorship – Decedent’s share of property . . 10h |

|

|

.00 |

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

Schedule CC. |

|||||||||||||||||||||||||||||||||||||||||

|

i. Decedent’s Share of Survivorship Marital Property |

|

|

|

|

. 10i |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

. . . . . . . . .j. Insurance Payable to Named Beneficiaries |

. |

. . |

|

. . |

. 10j |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . . . . . . .k. Transfers During Decedent’s Life (gifts, etc.) |

. |

. . |

|

. . |

. 10k |

|

|

.00 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

. . . . . . . . . . . .L. Other Assets |

|

. . |

. . . . . . . . . . |

. . . |

|

. . . . . |

. |

|

. . |

|

. . |

. 10L |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

m. Wisconsin GROSS Estate (add lines 10a through 10L) |

. |

|

. . |

. . . . |

. |

. . . . . . . . . . . . . . |

10m |

|

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||||||||||||||||||||

11. |

Fiduciary fees paid or payable to the personal representative or trustee |

|

. . . . . . . . . . . . . . |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|||||||||||||||||||||||||||||

2021 Schedule CC |

Page 2 |

|

|

PART II Information Required When Requesting a Closing Certificate for Trusts

Complete lines 1 through 10 and sign below. |

|

|

1. Is a certificate required by the court? |

Yes |

No |

If Yes, enclose a statement from the court verifying that a Closing Certificate is required to close a proceeding.

If No, DO NOT submit Schedule CC. The department only issues a Closing Certificate if a court requires it to close a proceeding.

2.Enclose a copy of the trust instrument with amendments (will/codicils).

3.a. Name(s) of grantor(s)

|

Social security number(s) |

|

|

|

|

|

||

|

b. Name(s) of grantee(s) |

|

|

|

|

|

||

|

Social security number(s) |

|

|

|

|

|

||

4. |

On what date was the trust funded? |

|

|

|

|

|

||

5. |

Was the trust contacted by the IRS and/or Wis. Dept. of Revenue in the last 3 years? |

|

Yes |

|

No If Yes, explain: |

|||

6.State reason for closing the trust. If death of beneficiary, provide name of beneficiary, social security number, last address, and date of death.

7. Have you petitioned the court to close the trust? |

Yes |

No |

If Yes, enclose a copy of the petition. If No, explain why no petition has been filed:

8. |

Has the trust filed fiduciary income tax returns wi h Wisconsin in any of the last four years? |

|

Yes |

|

No |

|

|

If No, provide either a) copies of informal or ormal annual accountings for the past four years, or b) annual schedules show- |

|||||

|

ing the trust’s income and expenses for each of he past four years. |

|

|

|

|

|

9. |

Enter the total fair market value of e |

ch of the ssets listed below that are held by the trust at the end of the year preceding the |

||||

|

final year of the trust. ( NOTE Where |

ny line from 9a through 9f is left blank, it will be deemed that NONE is the DECLARATION |

||||

for that line by the person(s) signing Schedule CC.)

a. |

Real Estate |

9a |

|

|

|

.00 |

|

|

|

|

|

|

|

|

b. |

Stocks and Bonds |

9b |

|

|

|

.00 |

|

|

|

|

|

|

|

|

c. |

Mortgages, Notes, and Cash |

9c |

|

|

|

.00 |

|

|

|

|

|

|

|

|

d. |

Annuities and Life Insurance |

9d |

|

|

|

.00 |

|

|

|

|

|

|

|

|

e. |

Interest in Partnerships, LLCs, and S Corporations . . . |

9e |

|

|

|

.00 |

|

|

|

|

|

|

|

|

f. |

Other Miscellaneous Property |

9f |

|

|

.00 |

|

|

|

|

|

|

|

||

g. |

Total Assets (add lines 9a through 9f) |

|

|

|

|

|

. |

9g |

||||||

. . . . . |

. . . . |

. . . . . . . . . . . . |

. . . |

|||||||||||

10. Fiduciary fees paid or payable to the personal representative or trustee |

. . . . . . . . . . . . |

. . . 10 |

|

|

|

|

|

|||||||

Third |

Do you want to allow another person to discuss this return with the department (see instructions)? |

|

Yes Complete the following. |

|||||||||||

Party |

Designee’s |

Phone |

|

|

Personal |

|

|

|

|

|

|

|||

|

|

|

|

|

||||||||||

|

( |

) |

identification |

|

|

|

|

|

|

|||||

Designee name |

no. |

number (PIN) |

|

|

|

|

|

|

||||||

.00

.00

No

I, as fiduciary, declare under penalties of law that I have examined this schedule (including accompanying documents and state-

ments) and to the best of my knowledge and belief it is true, correct, and complete.

Your signature |

|

|

Date |

Daytime phone |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Fiduciary’s address |

|

City |

|

State |

|

Zip code |

|

|

|

|

|

|

|

PERSON PREPARING FORM if other than the preceding signer |

Signature of preparer |

Date |

Daytime phone |

|||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Mail to: Wisconsin Department of Revenue • PO Box 8918 • Madison WI