Once you open the online PDF editor by FormsPal, you can easily complete or change Schedule F Form right here. The tool is constantly updated by us, getting cool functions and turning out to be even more convenient. With a few basic steps, you may start your PDF journey:

Step 1: Simply hit the "Get Form Button" in the top section of this webpage to access our pdf form editing tool. This way, you'll find everything that is required to work with your document.

Step 2: With the help of this handy PDF tool, you could accomplish more than merely fill out blank fields. Edit away and make your docs seem sublime with customized textual content incorporated, or adjust the original content to perfection - all accompanied by an ability to add stunning graphics and sign the PDF off.

It will be easy to finish the document using this detailed tutorial! Here is what you need to do:

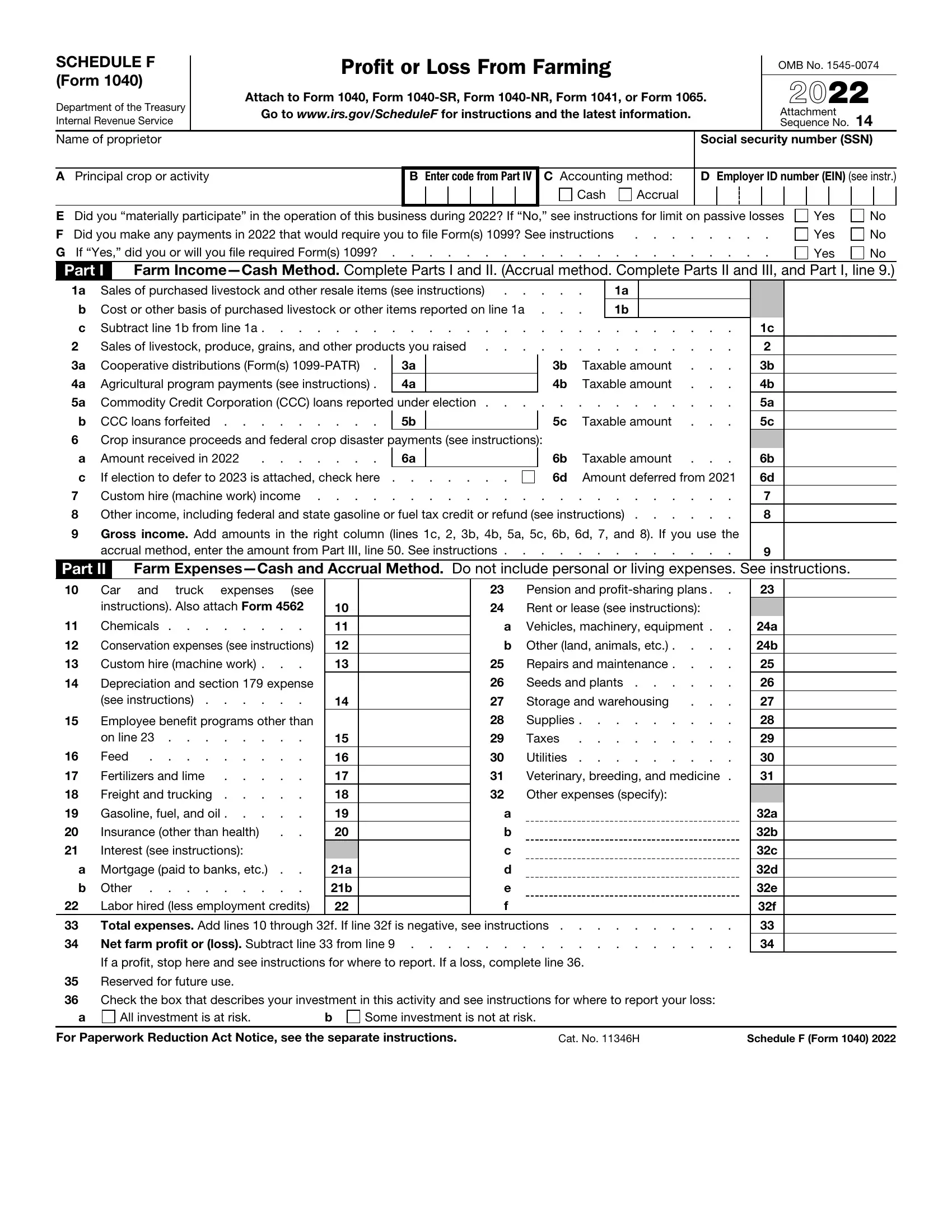

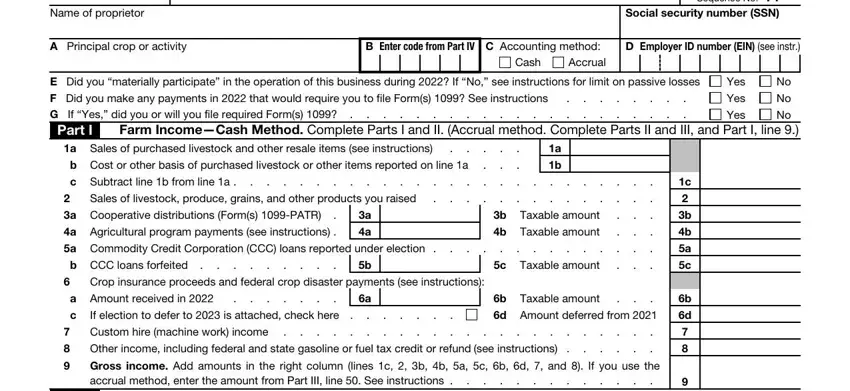

1. When filling in the Schedule F Form, make sure to include all of the necessary blanks in its associated form section. This will help hasten the work, allowing your information to be handled without delay and properly.

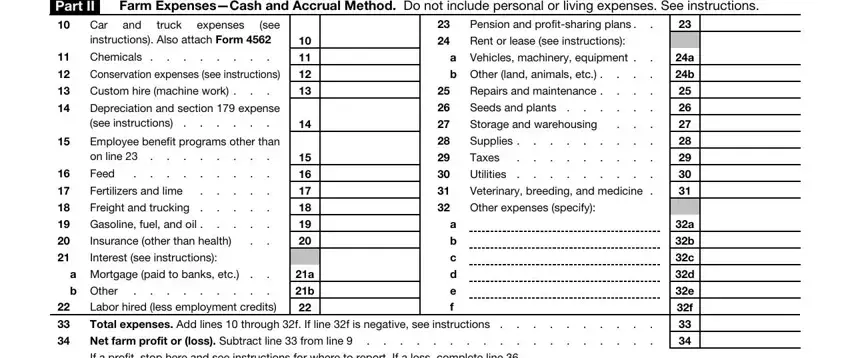

2. Once your current task is complete, take the next step – fill out all of these fields - Part II, Farm ExpensesCash and Accrual, and, Car instructions Also attach Form, expenses, truck, see, Chemicals, Conservation expenses see, Custom hire machine work, Depreciation and section expense, Employee benefit programs other, Feed, Fertilizers and lime, and Freight and trucking with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

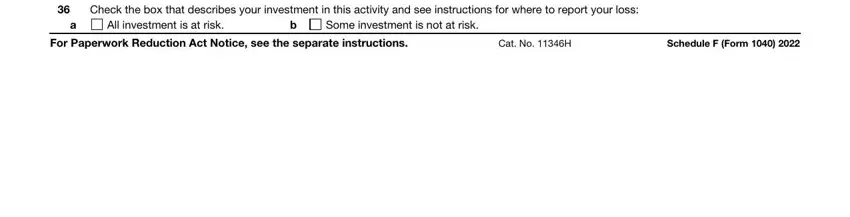

3. Completing Check the box that describes your, All investment is at risk, Some investment is not at risk, For Paperwork Reduction Act Notice, Cat No H, and Schedule F Form is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Always be very careful while filling out Cat No H and For Paperwork Reduction Act Notice, since this is where a lot of people make mistakes.

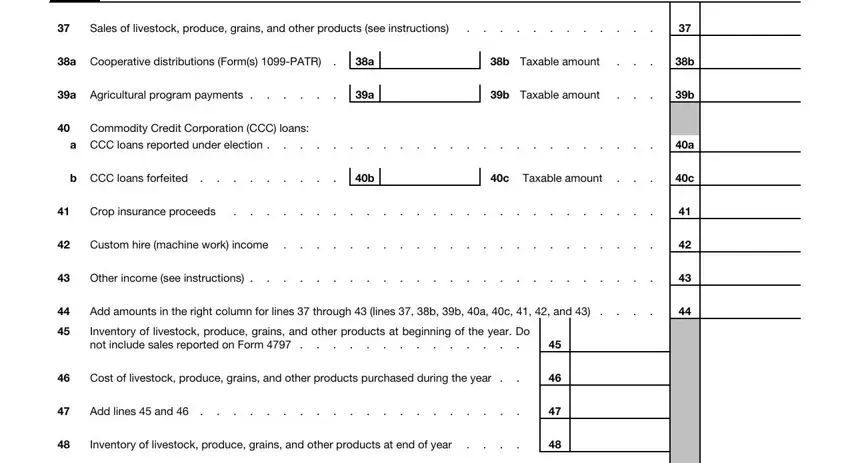

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part III, Farm IncomeAccrual Method see, Sales of livestock produce grains, a Cooperative distributions Forms, a Agricultural program payments, Commodity Credit Corporation CCC, a CCC loans reported under, b CCC loans forfeited, Crop insurance proceeds, Custom hire machine work income, Other income see instructions, b Taxable amount, b Taxable amount, Taxable amount, and Add amounts in the right column - to proceed further in your process!

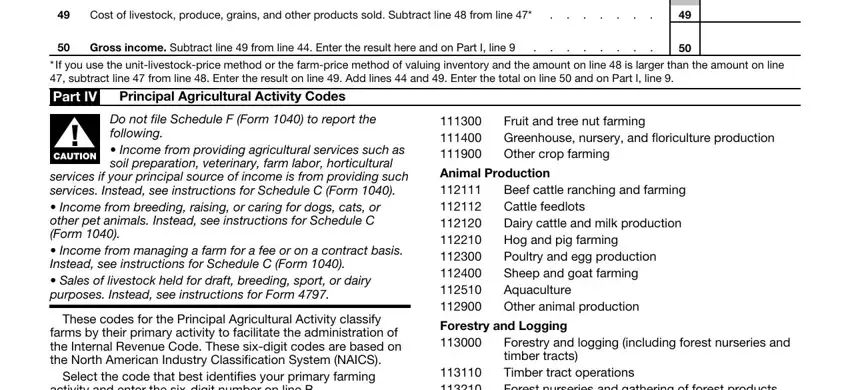

5. When you come near to the end of this document, you'll notice several more things to complete. Particularly, Cost of livestock produce grains, Gross income Subtract line from, If you use the unitlivestockprice, Principal Agricultural Activity, CAUTION, Do not file Schedule F Form to, These codes for the Principal, farms by their primary activity to, activity and enter the sixdigit, Fruit and tree nut farming, Animal Production, Beef cattle ranching and farming, Forestry and Logging Forestry and, and timber tracts Timber tract must be filled out.

Step 3: Immediately after rereading your fields and details, click "Done" and you are all set! Create a 7-day free trial plan at FormsPal and acquire instant access to Schedule F Form - available inside your FormsPal cabinet. FormsPal guarantees your data confidentiality by having a secure method that never saves or shares any kind of personal information involved in the process. You can relax knowing your documents are kept safe whenever you use our editor!