If you would like to fill out Schedule In 113 Form, there's no need to download and install any kind of applications - simply try our PDF editor. Our development team is continuously endeavoring to expand the tool and insure that it is even better for clients with its handy features. Enjoy an ever-improving experience now! To get the ball rolling, take these basic steps:

Step 1: Open the PDF file in our tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The editor helps you work with PDF documents in many different ways. Change it with customized text, adjust what is already in the PDF, and place in a signature - all close at hand!

It is actually an easy task to finish the pdf adhering to this detailed tutorial! Here's what you should do:

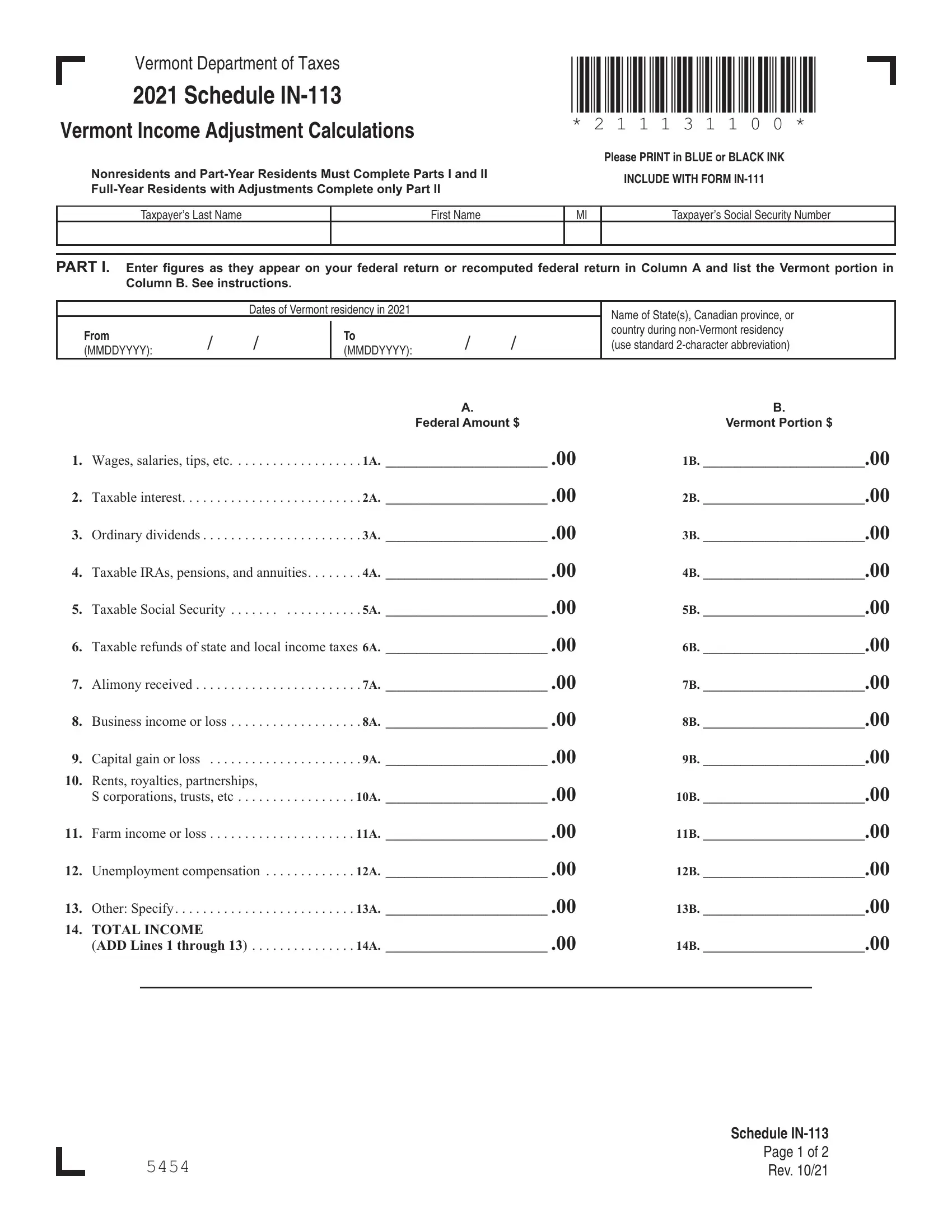

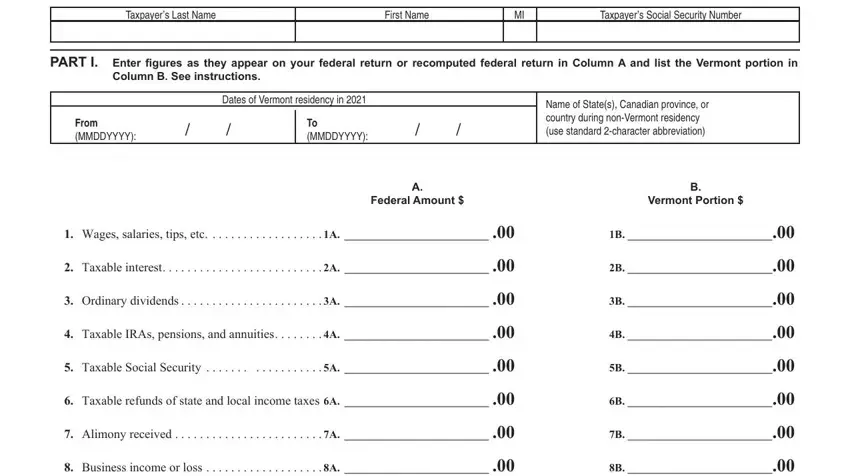

1. First, once filling in the Schedule In 113 Form, beging with the part that contains the following fields:

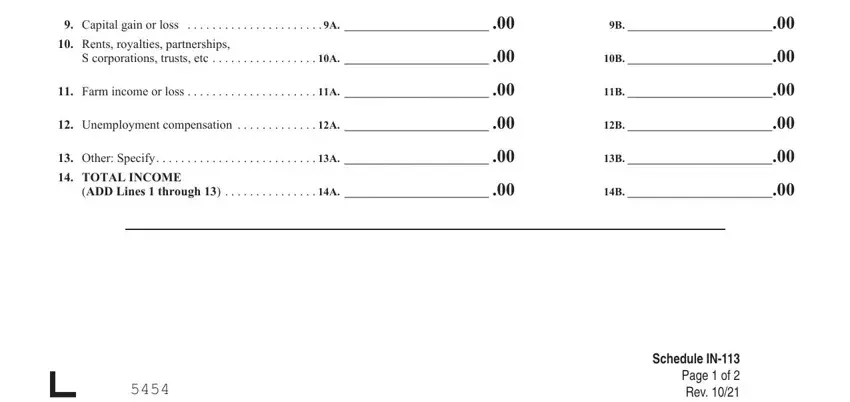

2. After performing the previous step, head on to the next step and enter the necessary particulars in all these blank fields - Capital gain or loss, S corporations trusts etc, Farm income or loss, Unemployment compensation, Other Specify, ADD Lines through, and Schedule IN Page of Rev.

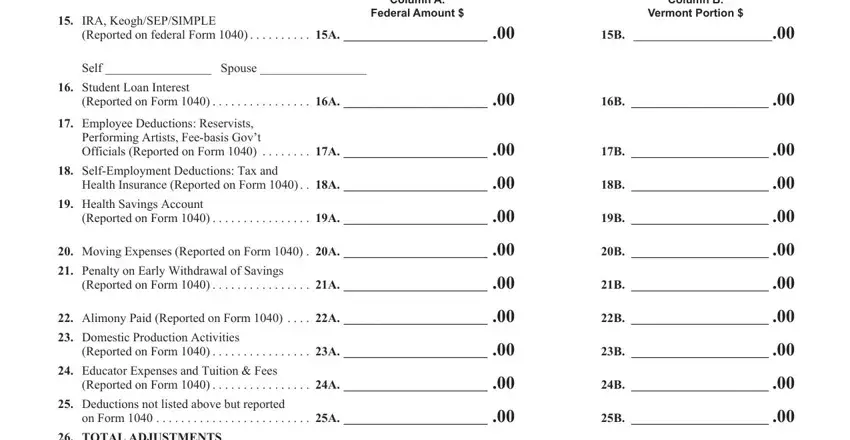

3. Completing IRA KeoghSEPSIMPLE, Reported on federal Form, Column A, Federal Amount, Column B, Vermont Portion, Self Spouse, Student Loan Interest, Reported on Form, Employee Deductions Reservists, Performing Artists Feebasis Govt, SelfEmployment Deductions Tax and, Health Insurance Reported on Form, Health Savings Account, and Reported on Form is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

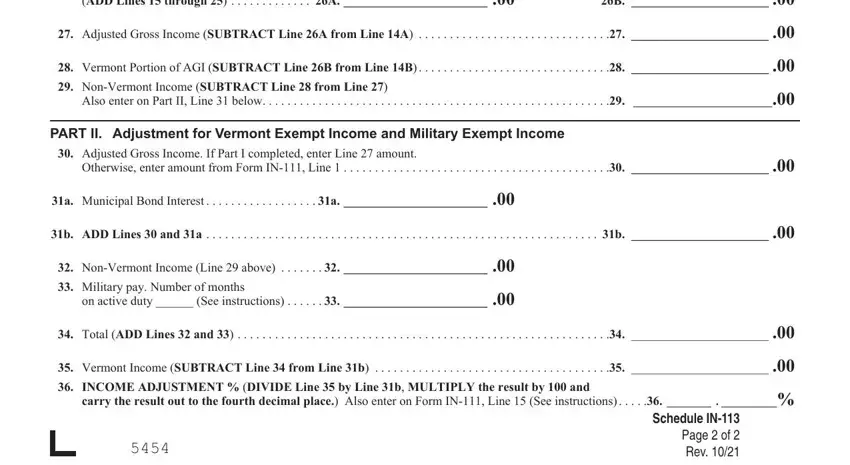

4. You're ready to complete the next segment! In this case you've got all these ADD Lines through A, Adjusted Gross Income SUBTRACT, Vermont Portion of AGI SUBTRACT, Also enter on Part II Line below, PART II Adjustment for Vermont, Adjusted Gross Income If Part I, Otherwise enter amount from Form, a Municipal Bond Interest, b ADD Lines and a, NonVermont Income Line above, on active duty See instructions, Total ADD Lines and, Vermont Income SUBTRACT Line, carry the result out to the fourth, and Schedule IN Page of Rev fields to complete.

In terms of a Municipal Bond Interest and Vermont Portion of AGI SUBTRACT, make sure that you review things here. These are viewed as the key fields in this page.

Step 3: Look through all the information you've inserted in the form fields and then press the "Done" button. Sign up with us right now and instantly obtain Schedule In 113 Form, available for downloading. Every last modification you make is handily preserved , making it possible to modify the document at a later stage anytime. FormsPal is dedicated to the confidentiality of all our users; we make certain that all information put into our editor stays protected.