1040EZ can be filled in online effortlessly. Simply open FormsPal PDF editor to complete the task in a timely fashion. The tool is constantly improved by us, receiving new features and turning out to be a lot more convenient. With a few easy steps, you may start your PDF journey:

Step 1: Press the "Get Form" button above. It'll open up our editor so that you can start filling out your form.

Step 2: With the help of this advanced PDF editor, you'll be able to accomplish more than just fill out blanks. Express yourself and make your docs look great with customized textual content added, or tweak the original content to excellence - all that comes with an ability to insert stunning images and sign the file off.

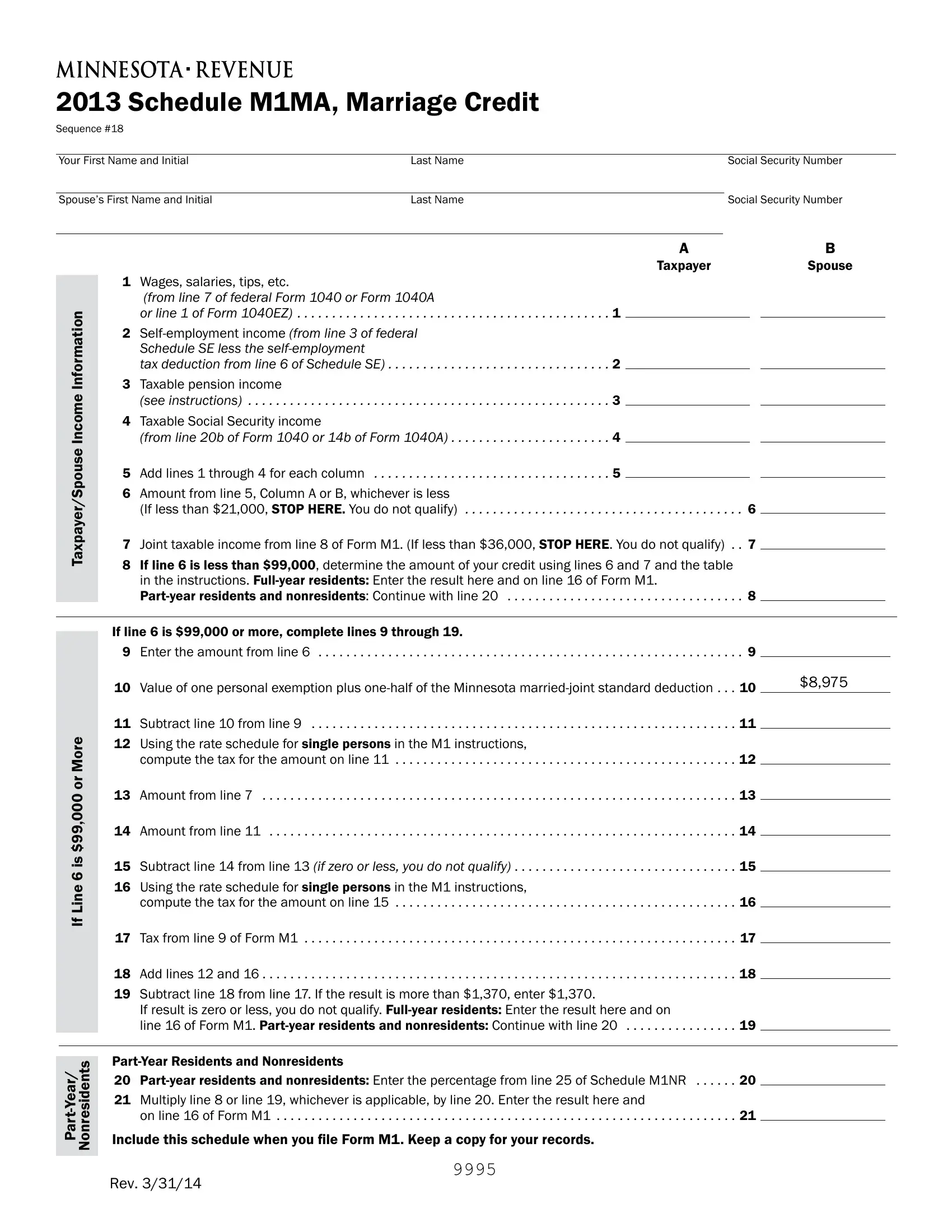

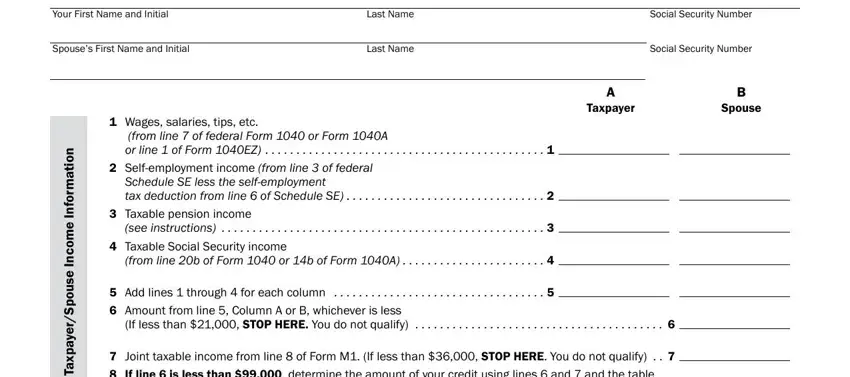

This PDF form will need particular details to be typed in, hence you must take the time to fill in what is required:

1. Begin filling out your 1040EZ with a selection of essential fields. Note all of the important information and make certain absolutely nothing is omitted!

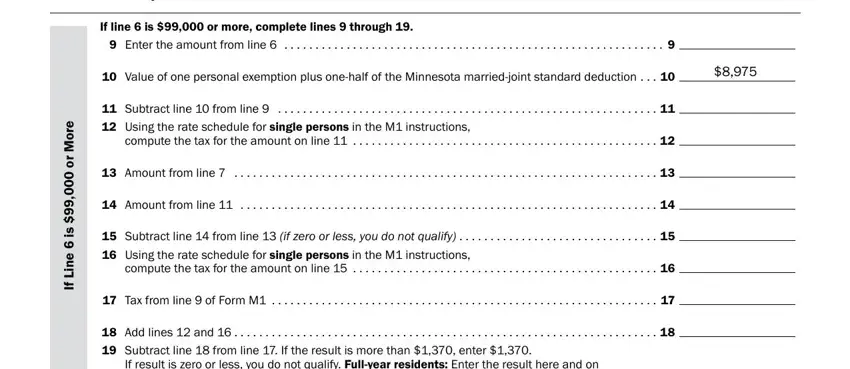

2. Your next step is usually to complete the following blank fields: e r o M, r o s i, e n i L f I, Partyear residents and, If line is or more complete, Enter the amount from line, Value of one personal exemption, Subtract line from line, Using the rate schedule for, compute the tax for the amount on, Amount from line, Amount from line, Subtract line from line if zero, compute the tax for the amount on, and Tax from line of Form M.

Be very mindful while completing e r o M and Subtract line from line, because this is where most users make some mistakes.

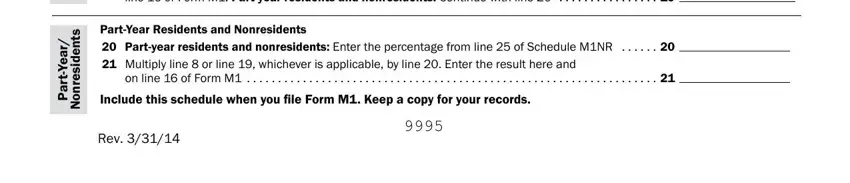

3. This part is usually straightforward - fill in every one of the empty fields in r a e Y t r a P, s t n e d i s e r n o N, If result is zero or less you do, PartYear Residents and, on line of Form M, Include this schedule when you ile, and Rev to conclude the current step.

Step 3: Soon after looking through the entries, hit "Done" and you're all set! Acquire your 1040EZ after you register online for a 7-day free trial. Readily view the pdf form from your personal account, together with any modifications and changes being conveniently preserved! FormsPal ensures your data privacy by having a secure system that in no way saves or distributes any kind of sensitive information provided. Be confident knowing your docs are kept protected when you use our editor!