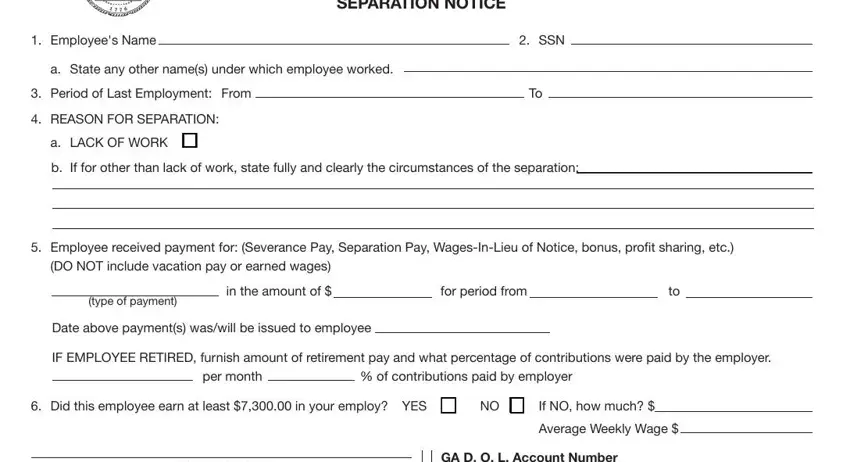

INSTRUCTIONS TO EMPLOYER FOR COMPLETION

OF THIS SEPARATION NOTICE

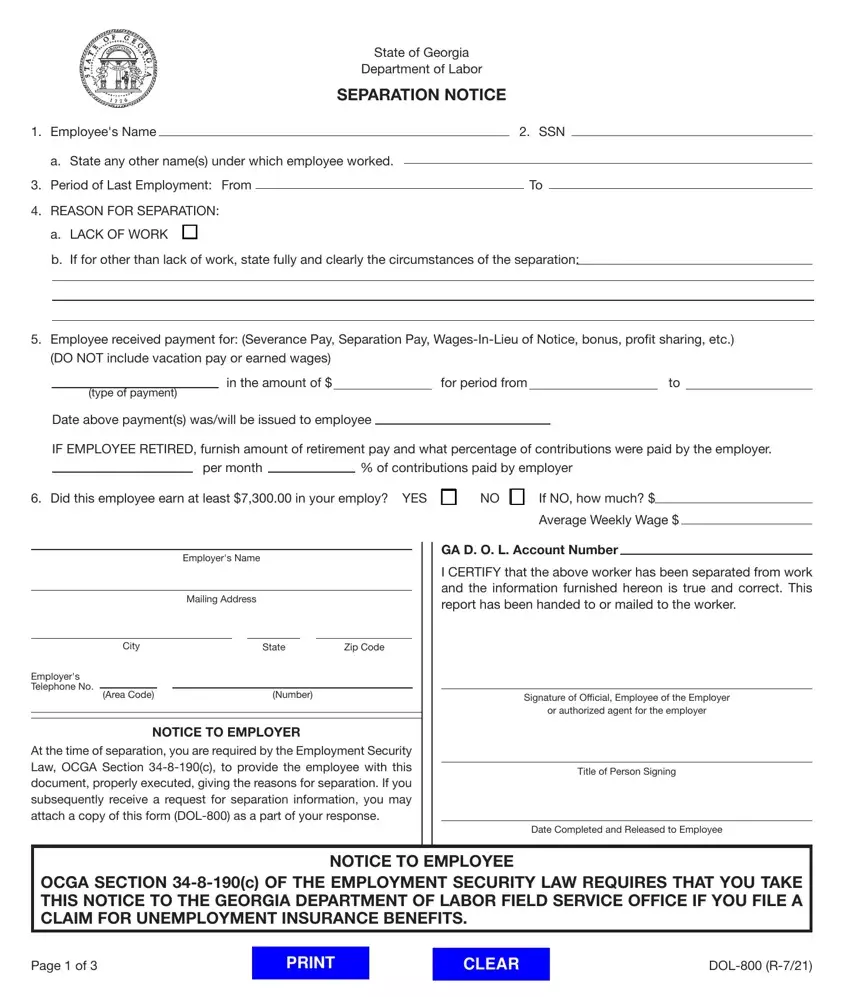

In accordance with the Employment Security Law, OCGA Section 34-8-190(c) and Rules pursuant thereto, a Separation Notice must be completed for each worker who leaves your employment, regardless of the reason for the separation. This notice shall be used where the employer-employee relationship is terminated and shall not be used when employer-filed claims (partial) or mass separation (DOL-402) notices are filed.

Item 1. Enter employee’s name as it appears on your records. If it is different from the name appearing on the employee’s Social Security Card, report both names.

Item 2. Enter the employee’s Social Security Number. Verify for accuracy.

Item 3. Enter the dates of employee’s most recent work period.

Item 4. a. If the reason for separation is for “LACK OF WORK,” check box indicated.

b. If the reason for separation is OTHER THAN “lack of work,” give complete details about the separation in space provided. If needed, add a separate sheet of paper.

Item 5. If any type payment, (i.e. Separation Pay, Wages-in-lieu of Notice, etc.) was made, indicate the type of payment and the period for which payment was made beyond the last day. Give the date on which the payment was/will be issued to the employee. DO NOT include vacation pay or earned wages.

Item 6. Check the appropriate block YES or NO to indicate whether this employee earned at least $7,300.00 in your employ. If you check NO, enter amount earned in your employ. Give average weekly wage (without overtime) at the time of separation.

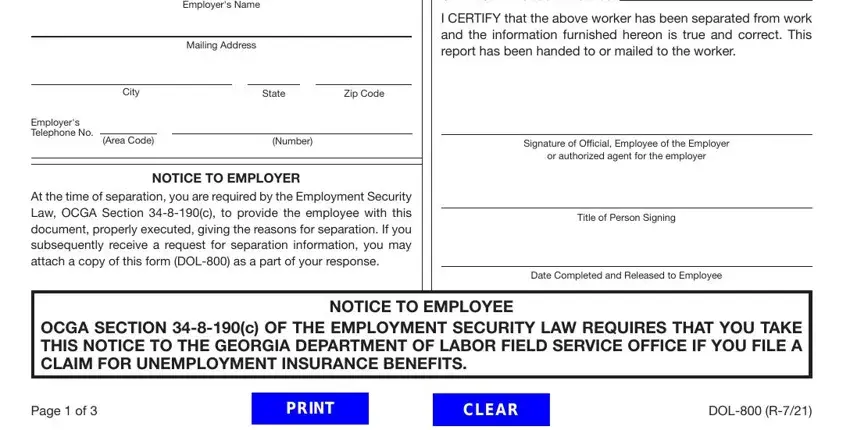

Employer’s Name. |

Give full name of employer under which the business is operated. |

Address. Give full mailing address of the employer where communications are to be sent regarding a potential claim.

GA DOL Account Number Employer’s 8-digit state account number assigned by GDOL.

Your state DOL Unemployment Insurance Account Number as it appears on your Quarterly Tax and Wage Report.

Signature. This notice must be signed by an officer or employee of the employer or authorized agent for the employer, and this person’s title or position held with the employer must be shown.

Date. This notice must be dated as of the date it is handed to the worker. If the employee is no longer available at the time employment ceases, mail this form (DOL-800) to the employee’s last known address and enter date the form is mailed.

OCGA Section 34-8-256(b)

PENALTY FOR OFFENSES BY EMPLOYERS. “Any employing unit or any officer or agent of an employing unit or any other person who knowingly makes a false statement or representation or who knowingly fails to disclose a material fact in order to prevent or reduce the payment of benefits to any individual entitled thereto or to avoid becoming or remaining subject to this chapter or to avoid or reduce any contribution or other payment required from an employing unit under this chapter or who willfully fails or refuses to make any such contributions or other payment or to furnish any reports required under this chapter or to produce or permit the inspection or copying of records as required under this chapter shall upon conviction be guilty of a misdemeanor and shall be punished by imprisonment not to exceed one year or fined not more than $1,000.00 or shall be subject to both such fine and imprisonment. Each such act shall constitute a separate offense.”

OCGA Section 34-8-122(a)

PRIVILEGED STATUS OF LETTERS, REPORTS, ETC., RELATING TO ADMINISTRATION OF CHAPTER. “All letters, reports, communications, or any other matters, either oral or written, from the employer or employee to each other or to the department or any of its agents, representatives, or employees, which letters, reports, or other communications shall have been written, sent, delivered, or made in connection with the requirements of the administration of this chapter, shall be absolutely privileged and shall not be made the subject matter or basis for any action for slander or libel in any court of the State of Georgia.”