You can prepare fillable sf100 form instantly with the help of our PDF editor online. We at FormsPal are committed to providing you the ideal experience with our editor by regularly adding new features and upgrades. With these improvements, working with our tool gets easier than ever! Here's what you'd need to do to get going:

Step 1: First, access the tool by clicking the "Get Form Button" above on this webpage.

Step 2: The editor gives you the opportunity to modify your PDF in a range of ways. Change it by writing personalized text, adjust what's already in the document, and include a signature - all doable in no time!

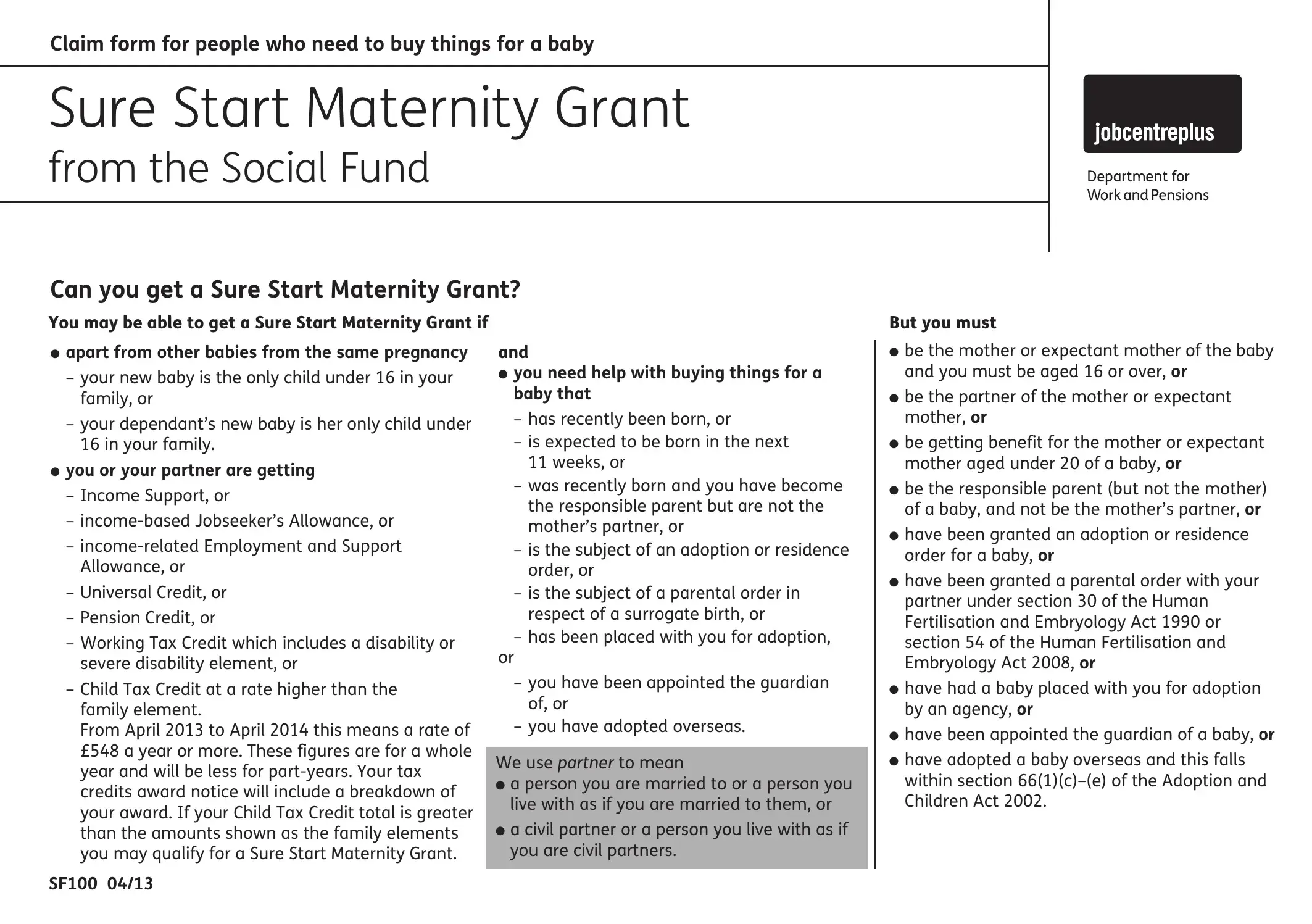

This form will require particular information to be filled out, thus you must take some time to fill in what is asked:

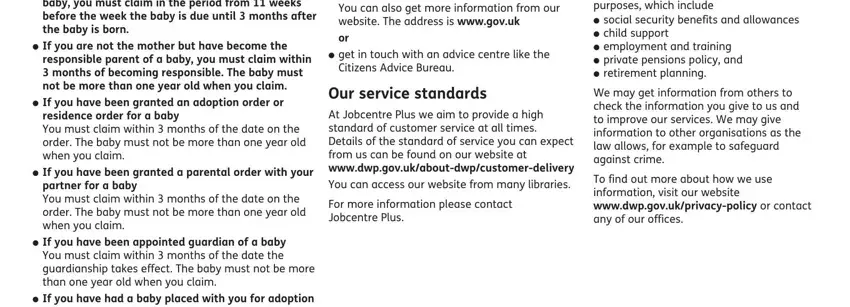

1. The fillable sf100 form usually requires certain information to be typed in. Ensure the following blank fields are completed:

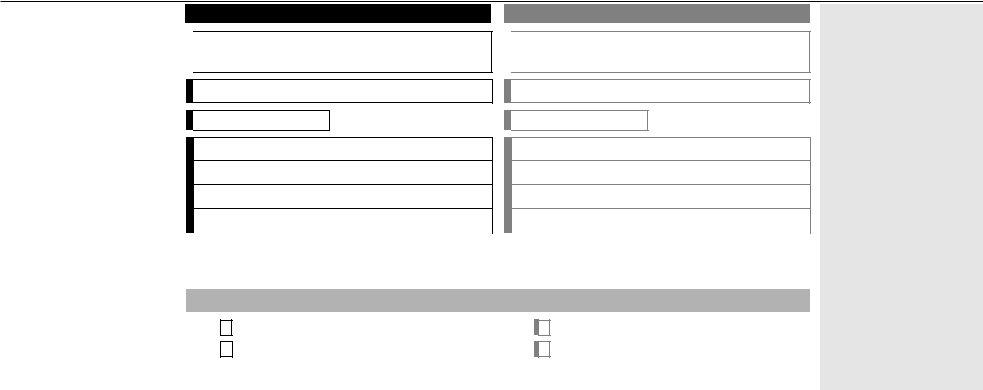

2. Once the previous section is filled out, go to enter the applicable details in all these: Are you or your partner already, No Yes, and If you want to claim Child Benefit.

People who use this PDF often get some things incorrect when completing If you want to claim Child Benefit in this area. Make sure you review whatever you type in here.

Step 3: Once you've looked over the information in the blanks, click on "Done" to finalize your document generation. Create a free trial subscription with us and obtain instant access to fillable sf100 form - download, email, or change from your personal account. FormsPal provides risk-free document editor devoid of personal information recording or sharing. Be assured that your data is safe here!