Eligible Donors

•Any full-time or regular part-time employee who, prior to the donation, has in the aggregate at least one year of accredited service with Shell Oil Company and its subsidiaries and affiliates who are participants in the overall Shell Benefits Program.

•Members and retired members of the Board of Directors of Shell Oil Company, or of any other Participating Company. Members must have at least one year of service.

•Pensioners who have retired directly from active service of Shell Oil Company or of any other Participating Company.

Eligible Educational Institutions

Only high schools and higher education institutions are eligible. These include: public and private high schools; graduate and professional schools; four-year and two-year colleges; and technical institutes.

The institution must be degree granting, located in the United States or one of its possessions, accredited by a nationally recognized regional or professional association, and recognized by the IRS as a tax-exempt educational institution.

In addition, the following organizations are eligible:

The American Indian College Fund, The Hispanic Association of Colleges and Universities and The United Negro College Fund. Alumni funds for scholarships and educational programs are eligible. No other funds or federations are eligible.

Gifts that cannot be matched

•Forms received more than one year after the date of the gift.

•Payments for which the Donor, their family, or other individuals designated by the Donor receive a direct benefit. Examples include:

Payments for services, tuition, books, or other student fees.

Gifts to fulfill pledges, tithes or other religious-related financial commitments or legal obligations, publication subscription fees, membership dues, or ticket purchases.

Insurance premiums; Bequests.

•Gifts must be personal contributions from the Donor's own assets. Gifts are ineligible if the donation includes: gifts from spouses, other family members or contributions made jointly by several individuals.

•Gifts to ineligible organizations. Examples include:

Gifts to primary schools.

Alumni associations, athletic associations, booster clubs, parent-teacher associations or organizations, etc.

Contributions to individuals, fraternities or sororities.

Gifts given to or through a third party.

Gifts for nonscholastic purposes. The gift must support the primary educational mission of the institution. Dinners, events, athletics, athletic scholarships, marching band, stadium construction or maintenance are typical ineligible gifts.

•Gifts must be charitable contributions, which can be deducted by the individual for federal income tax purposes.

Policies

•The minimum gift is $25. The aggregate limit is $5,000 per donor per calendar year. The first $500 per year is matched 2:1 and the balance is matched 1:1.

•Only the tax-deductible portion of a gift can be matched. The value of items received by the donor must be deducted from the amount to be matched.

•GIFTS MUST BE PAID, NOT MERELY PLEDGED.

•The Shell Oil Company Foundation may suspend, amend or discontinue the Program at any time and reserves the right to determine whether any gift shall be matched.

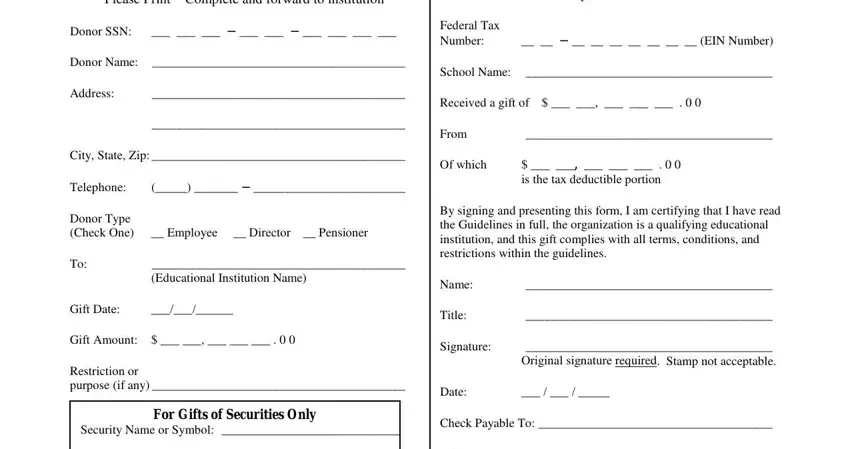

Procedure for Matching Gifts

Donor Instructions

•Read the Guidelines in full. Complete and sign the DONOR SECTION of the form.

•Gifts of securities are valued on the gift date. These securities must have a publicly listed market value. Please complete the Securities section of the form when contributing securities.

•If your gift was earmarked for a specific purpose (e.g. Scholarship Fund) note this on the Restrictions or purpose line. The Company's matching amount will be designated for the same purpose.

•Mail the completed form with your check or securities gift to the high school or higher education institution of your choice.

Educational Institution Instructions

•Read the Guidelines in full. Complete and sign the EDUCATIONAL INSTITUTION section of the form. NOTE: ORIGINAL SIGNATURE IS REQUIRED. A stamped signature is not acceptable and the form will be returned.

•Fill in the Pay To name with the payee's full name. This can be the educational institution name or the name of its foundation.

•Provide the name, telephone number, etc. for the person or office we should contact with questions concerning this match request.

•Completing and signing the form certifies that you have read the Guidelines, that this is a qualified educational institution, that this is a qualified gift and that Shell Oil Company, the Shell Oil Company Foundation or other Participating Companies neither received nor expects to receive any benefit or quid pro quo.

•If the gift is only partially tax deductible (i.e. the Donor received a gift, subscription, tickets or other tangible benefit), list the amount of the gift and the amount of the tax-deductible portion of the gift. The Program only matches the tax-deductible portion of the gift.

•Provide proof of your federal tax-exempt status with the initial matching request.

•Mail all forms to the address shown below. Incorrect or incomplete forms will be returned for correction or completion.

•Eligible donor contributions made during a calendar year are paid on a quarterly basis. Please reference the chart below for program cut off dates and payment dates.

Forms Received by: |

Matching Gifts Paid by: |

February 28 |

March 31 |

May 31 |

June 30 |

August 31 |

September 30 |

November 30 |

December 31 |

•Forms received more than one year after the date of the gift cannot be matched and will be rejected.

•A list of the individual contributions and resulting matches is included with the payment.

Contact Information

If you have any questions about the educational matching gift program, your eligibility, the eligibility of a specific gift or institution or questions about a specific gift; please contact us by electronic mail, phone, fax or US Mail.

Completed matching gift forms cannot be faxed. Original signatures are required.

1-(800) 554-7861

1-(609) 799-8019 shell@easymatch.com

Shell Oil Company Foundation, Educational Matching Gifts Program, P. O. Box 8687, Princeton, NJ 08543-8687