Navigating the process of expense claims can often seem daunting, but the Ship Shape Expense Claim Form aims to streamline this task for individuals working either as self-employed or under umbrella PAYE. With sections meticulously organized for a wide range of claimable expenses such as travel, subsistence, work items purchased, telephone bills, accommodation, and the use of a private vehicle, the form serves as a comprehensive guide to ensure no eligible expense is overlooked. It emphasizes the importance of retaining receipts and maintaining accurate records, with specific instructions tailored to different employment types regarding the submission of receipts. For instance, while umbrella PAYE workers are required to submit original receipts, self-employed individuals are reminded to keep them for future verification purposes. The form also provides clear guidance on claims related to subsistence, distinguishing between conditions for umbrella workers and self-employed or limited company workers, thus reflecting a deep understanding of varied workplace scenarios. Furthermore, it introduces a freepost return system, simplifying the process of submitting completed forms. With explicit guidelines on every aspect of expense claims, the Ship Shape Expense Claim Form not only aids in accurate submission but also in maximizing the potential benefits for the claimants.

| Question | Answer |

|---|---|

| Form Name | Ship Shape Expence Claim Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 10th, shipshapepay, UK, myshipshape expenses |

SHIP SHAPE EXPENSE CLAIM FORM

Full name

Unique ID (see

Ship Shape card)

Expenses for period

(enter date range)

PLEASE READ THE ‘EXPENSE CLAIM GUIDE’ TO HELP YOU COMPLETE THIS FROM CORRECTLY

1.Gather together your receipts, mileage records etc on a regular basis.

2.Complete this form summarising those receipts. Additional copies are available from www.shipshapepay.com

3.Return expense form to Ship Shape by placing in a suitable envelope and simply writing FREEPOST SHIP SHAPE on the front. No address and no stamp required.

Working as Self Employed: DO NOT SEND RECEIPTS, however it is essential for you to keep all original receipts and a copy of each expense form for verification at a later date.

Working under Umbrella PAYE: SEND ORIGINAL RECEIPTS with your completed expense claim form. We recommend you take copies of these in case they are lost in the post. Note that any Subsistence claim receipts should be retained by you and not sent to Ship Shape unless specifically requested.

Dates |

TRAVEL (To temp workplaces, include dates and reason. No private mileage claims) |

£ Total |

10th – 15th Mar 12

EXAMPLE: Oyster card for travel to work in Paddington

33.50

TOTAL

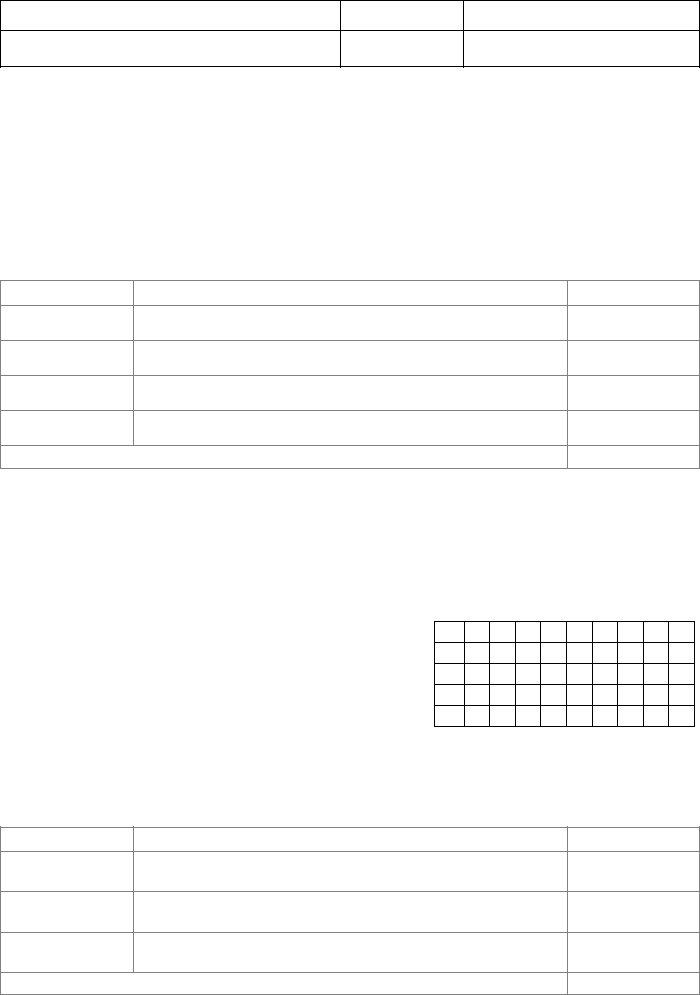

SUBSISTENCE - UMBRELLA WORKERS ONLY:

If you were present at work for 5 hours or 10 hours you are eligible to claim £5 and £10 subsistence per day respectively for meals purchased by completing the table below. Also note dates of unusually early starts (left home before 6.00am and purchased breakfast) and unusually late finishes (after 8.00pm and purchased an evening meal) for which an additional £5 and £15 may be claimed respectively. You must keep receipts to support your claims.

Specify the month(s) and day date (1st, 2nd, 3rd etc), then use a cross (X) to indicate an applicable claim in the boxes below each day date. Continue on a new expense form if necessary. Please do not repeat previous claims.

Month: |

|

|

|

|

|

|

|

|

|

|

Month: |

Day date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At work 5 to 9 hrs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At work 10 hrs or more: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Left home before 6am: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At work after 8pm: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBSISTENCE - SELF EMPLOYED & LIMITED COMPANY WORKERS ONLY:

HMRC allow subsistence claims in your

Dates

Reason for claim (why this claim falls outside of normal work pattern)

£ Total

TOTAL

PLEASE COMPLETE SECTIONS OVERLEAF. DOWNLOAD MORE COPIES OF THIS FORM FROM WWW.SHIPSHAPEPAY.COM

V10

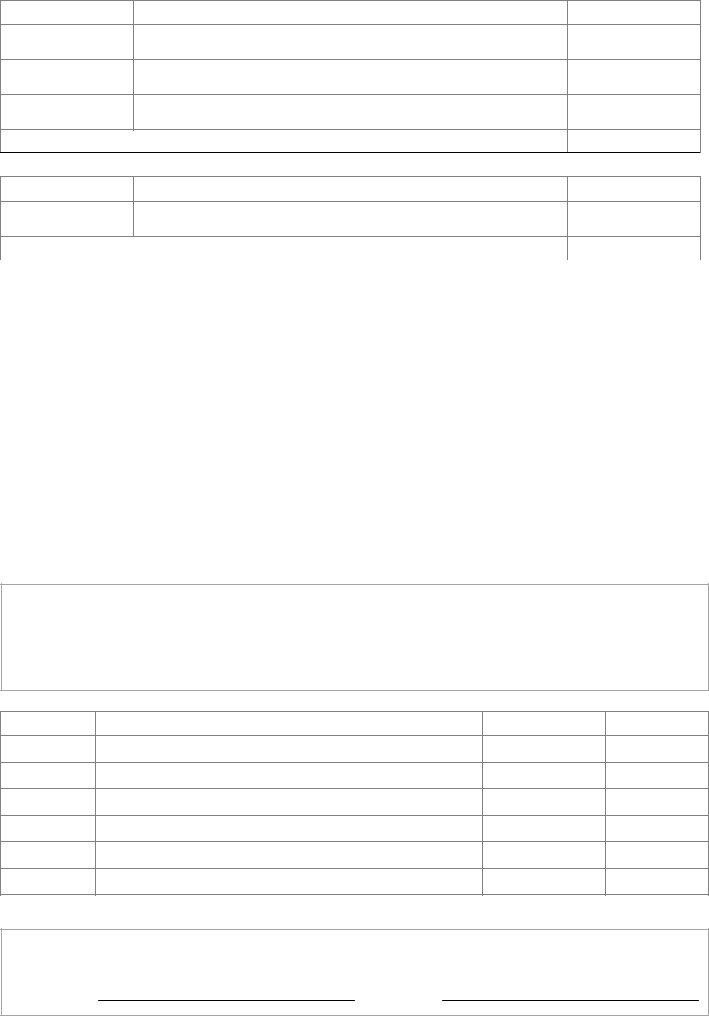

Dates |

WORK ITEMS PURCHASED (e.g. tools, protective/other equipment) |

£ Total |

11th Mar 12

EXAMPLE: Hammer drill purchase

60.00

TOTAL

Dates |

TELEPHONE (itemised bill with business calls indicated or prepay receipts) |

£ Total |

10th – 15th Mar 12

EXAMPLE: See attached pre pay receipt for calls to employment agencies

10.00

|

TOTAL |

|

Dates |

ACCOMMODATION (include dates, proprietor and address. Only valid for |

£ Total |

|

periods working away from UK residence) |

|

10th – 15th Mar 12 |

EXAMPLE: Stay at The Royal Hotel, Paddington W2 1HY whilst working away at |

100.00 |

|

Paddington construction site |

|

|

|

|

|

TOTAL |

|

|

|

|

Dates |

OTHER ITEMS (enter any other expenses incurred wholly, exclusively and |

£ Total |

|

necessarily in the course of work duties) |

|

|

|

|

|

|

|

|

TOTAL |

|

USE OF A PRIVATE VEHICLE

Tax relief is provided on trips carried out for business purposes. The allowance is dependent on vehicle type and the miles covered. The rate changes after the first 10,000 miles covered in a tax year.

Vehicle Type |

Rate for first 10,000 miles |

Rate for mileage over 10,000 miles |

Car or Van |

45 pence |

25 pence |

Motorbike |

24 pence |

24 pence |

Bicycle |

20 pence |

20 pence |

Dates

Destination and reason for journey

Vehicle Type

No. of miles

CONFIRMATION

By signing this form you confirm that the information you have provided is correct to the best of your knowledge and that on the days indicated you incurred an expense on Travel and/or Subsistence (a meal; food and drink) in the performance of the duties of the employment.

SIGNATURE:DATE:

PLEASE COMPLETE SECTIONS OVERLEAF. DOWNLOAD MORE COPIES OF THIS FORM FROM WWW.SHIPSHAPEPAY.COM

V10