Working with PDF files online is always surprisingly easy using our PDF editor. You can fill in 540nr here painlessly. Our editor is constantly evolving to provide the very best user experience attainable, and that's due to our dedication to continual enhancement and listening closely to user comments. All it requires is a few basic steps:

Step 1: Access the PDF in our tool by clicking the "Get Form Button" at the top of this page.

Step 2: This editor will give you the ability to change your PDF in a range of ways. Transform it by adding customized text, correct existing content, and include a signature - all at your fingertips!

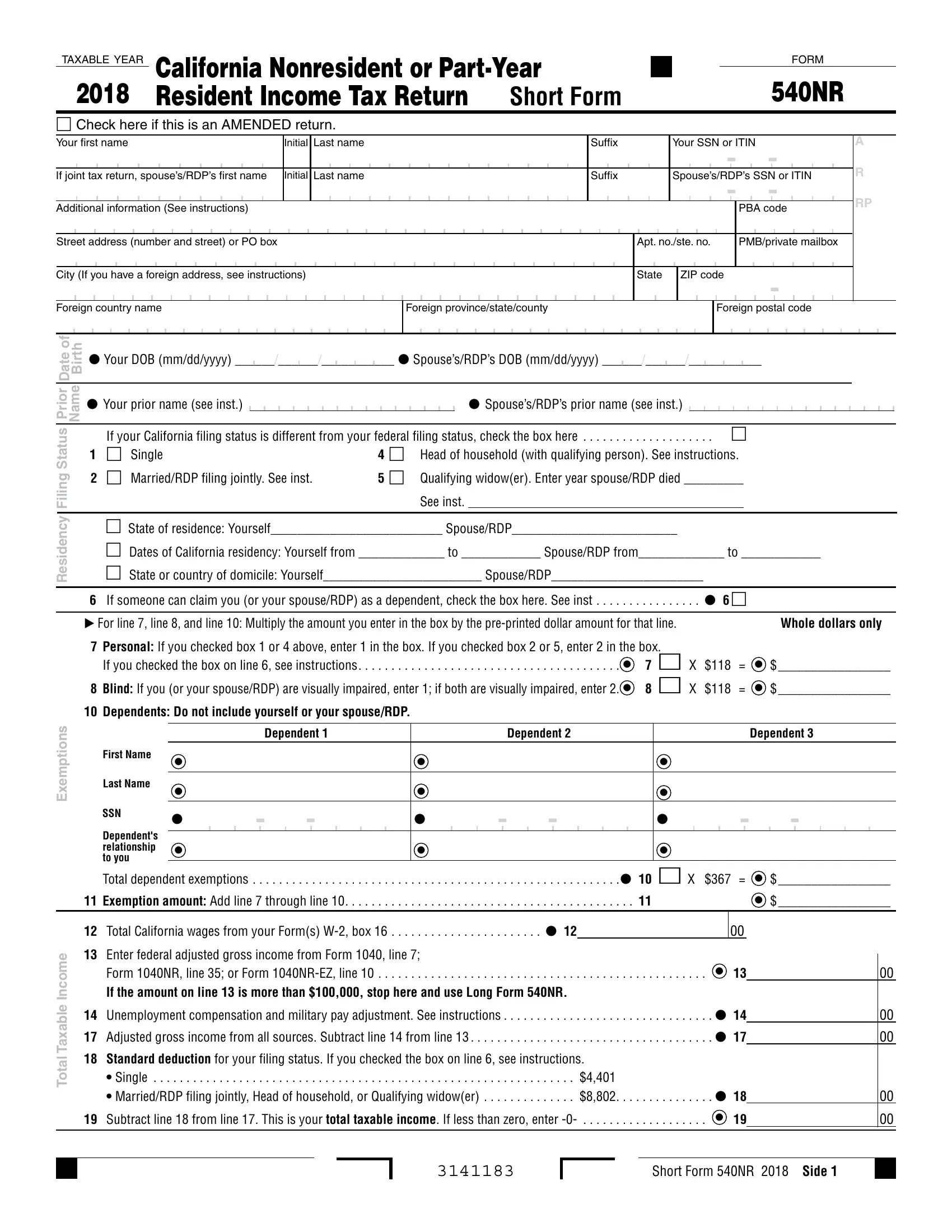

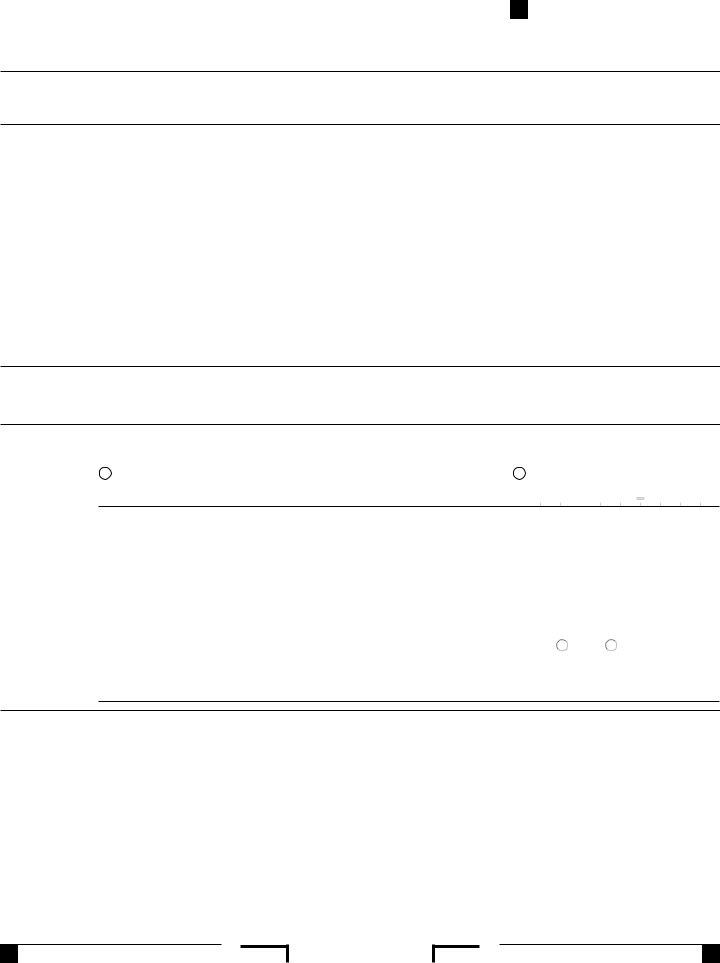

As a way to complete this document, make sure that you provide the necessary information in each and every blank field:

1. It is important to fill out the 540nr correctly, thus be attentive when filling in the segments including all of these fields:

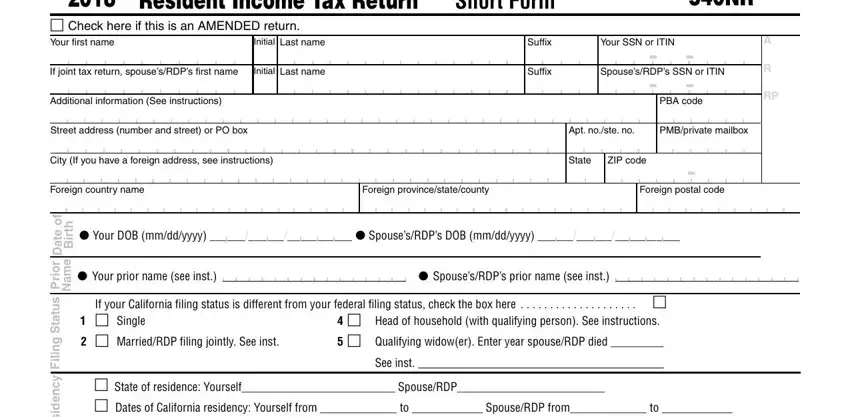

2. The third step is to complete these particular blanks: State of residence Yourself, If someone can claim you or your, For line line and line Multiply, Whole dollars only, Personal If you checked box or, If you checked the box on line, Dependent, Dependent, Dependent, y c n e d s e R, s n o i t p m e x E, First Name, Last Name, SSN, and Dependents relationship to you.

Always be really careful while completing Dependent and y c n e d s e R, as this is the section in which a lot of people make a few mistakes.

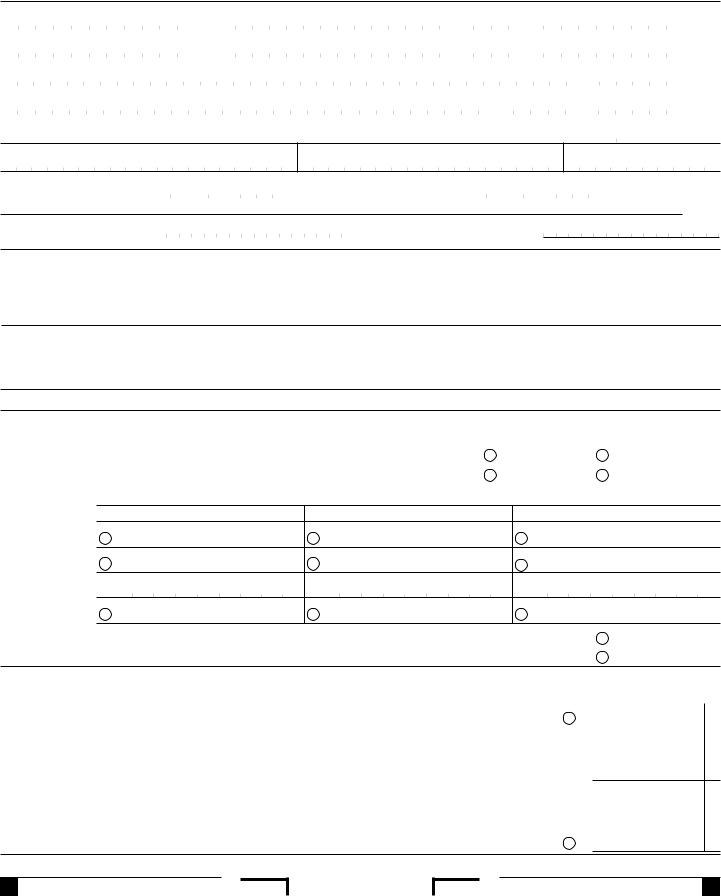

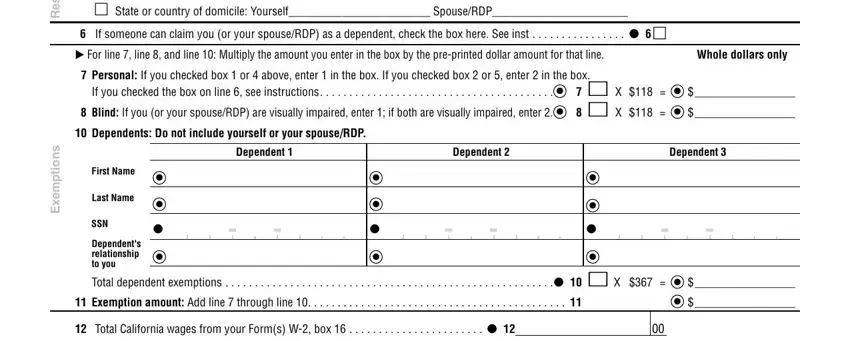

3. Your next stage will be simple - fill out all the empty fields in e m o c n, e b a x a T, a t o T, Form NR line or Form NREZ line, Enter federal adjusted gross, and Short Form NR Side to complete the current step.

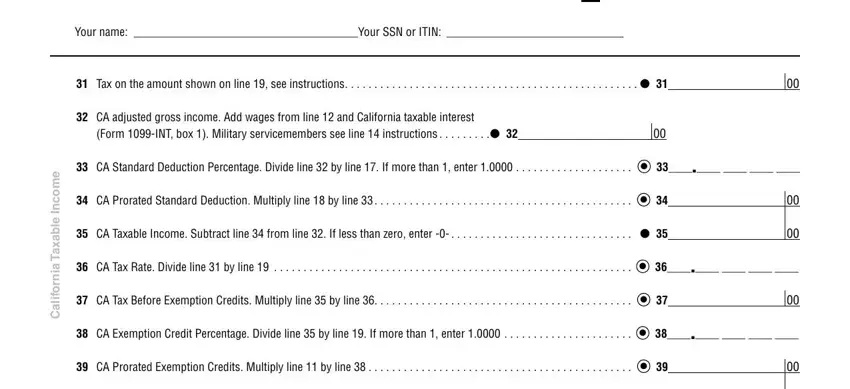

4. Filling in Your name Your SSN or ITIN, Tax on the amount shown on line, CA adjusted gross income Add, Form INT box Military, CA Standard Deduction Percentage, CA Prorated Standard Deduction, CA Taxable Income Subtract line, CA Tax Rate Divide line by line, CA Tax Before Exemption Credits, CA Exemption Credit Percentage, CA Prorated Exemption Credits, e m o c n, e b a x a T a n r o f i l, and a C is vital in this section - you'll want to take your time and take a close look at every blank area!

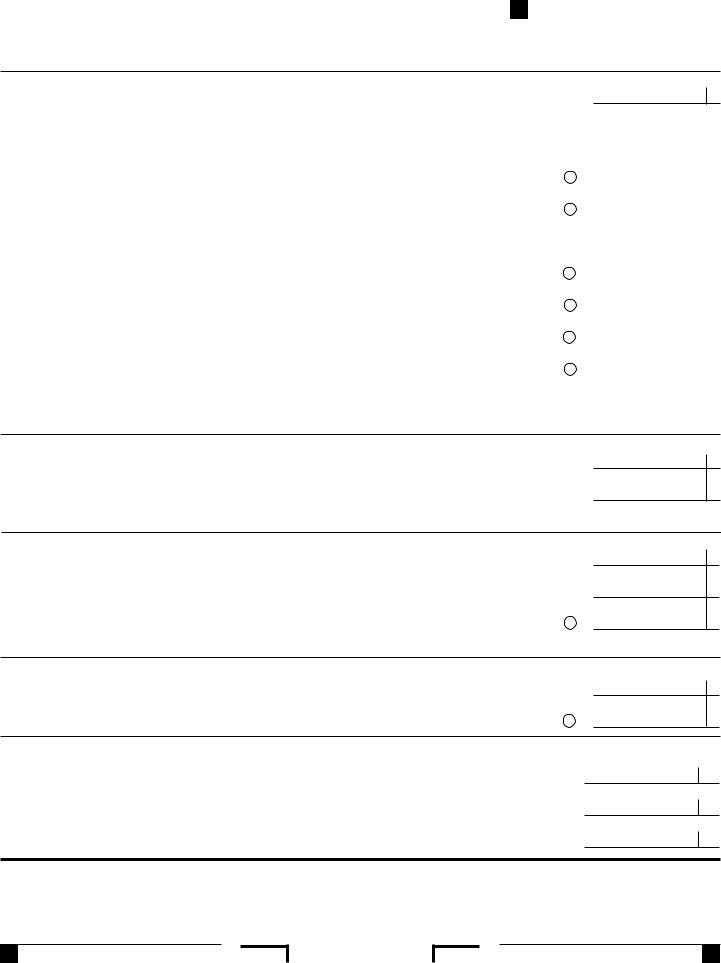

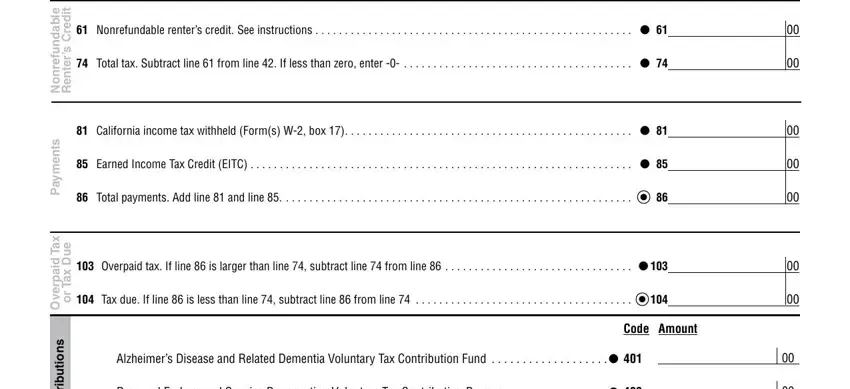

5. The form must be finished by filling out this area. Here you have a comprehensive set of blanks that need to be completed with appropriate details in order for your form submission to be faultless: Nonrefundable renters credit See, Total tax Subtract line from, e b a d n u f e r n o N, t i d e r C s r e t n e R, California income tax withheld, Earned Income Tax Credit EITC, Total payments Add line and line, s t n e m y a P, x a T d a p r e v O, e u D x a T r o, Overpaid tax If line is larger, Tax due If line is less than, s n o i t u b i r t n o C, Alzheimers Disease and Related, and Rare and Endangered Species.

Step 3: Before moving forward, make sure that blanks were filled in right. Once you’re satisfied with it, click “Done." After starting afree trial account with us, you will be able to download 540nr or send it through email right away. The file will also be easily accessible via your personal account menu with your modifications. FormsPal ensures your information confidentiality by having a secure system that never saves or shares any sort of private data involved. Rest assured knowing your documents are kept protected whenever you use our tools!