Working with PDF files online is quite easy with our PDF editor. Anyone can fill in social security form ssa 721 here and try out many other functions available. To make our editor better and more convenient to use, we continuously design new features, with our users' suggestions in mind. Here's what you'd want to do to get going:

Step 1: Access the PDF in our tool by hitting the "Get Form Button" in the top area of this page.

Step 2: This tool will give you the opportunity to modify nearly all PDF documents in various ways. Modify it by writing your own text, adjust what is originally in the PDF, and put in a signature - all close at hand!

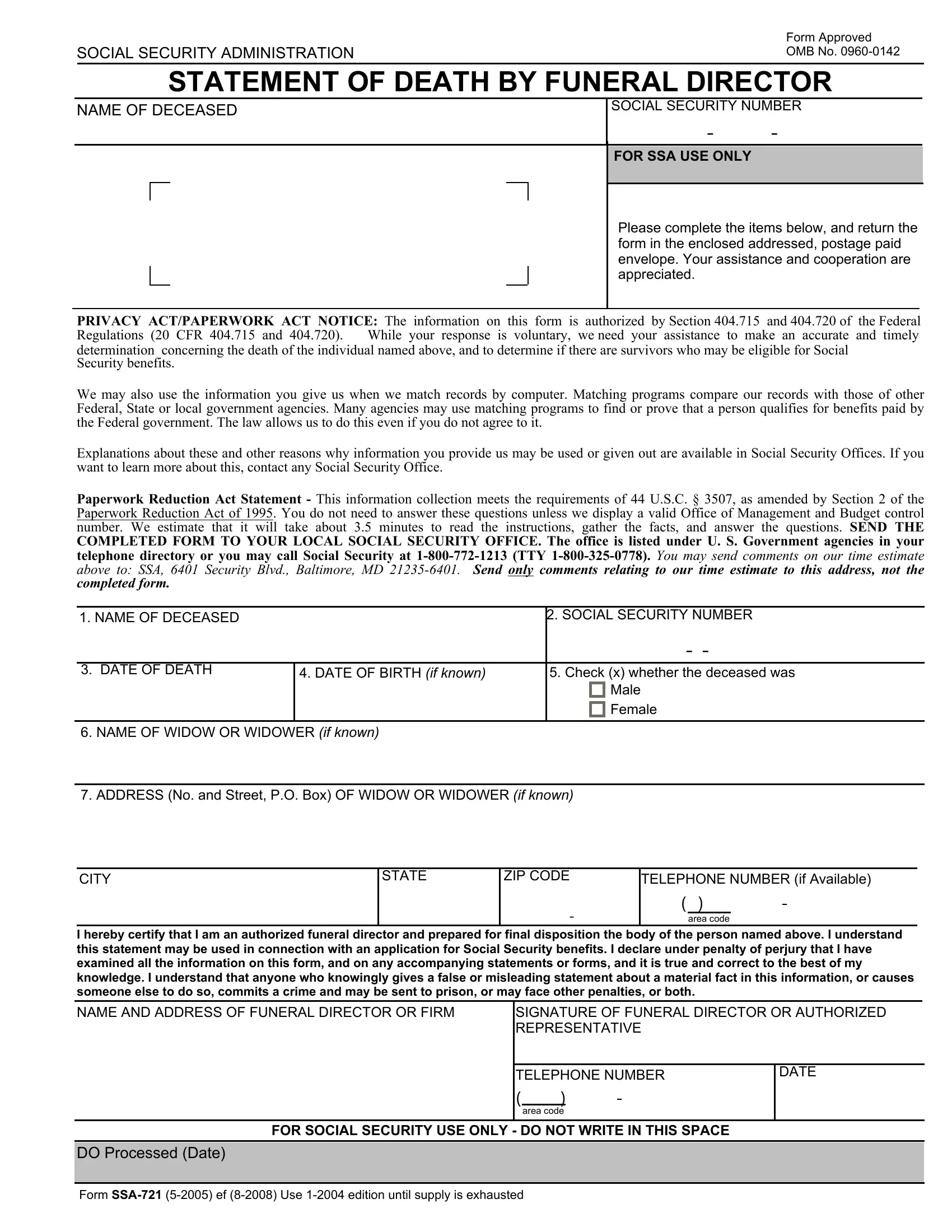

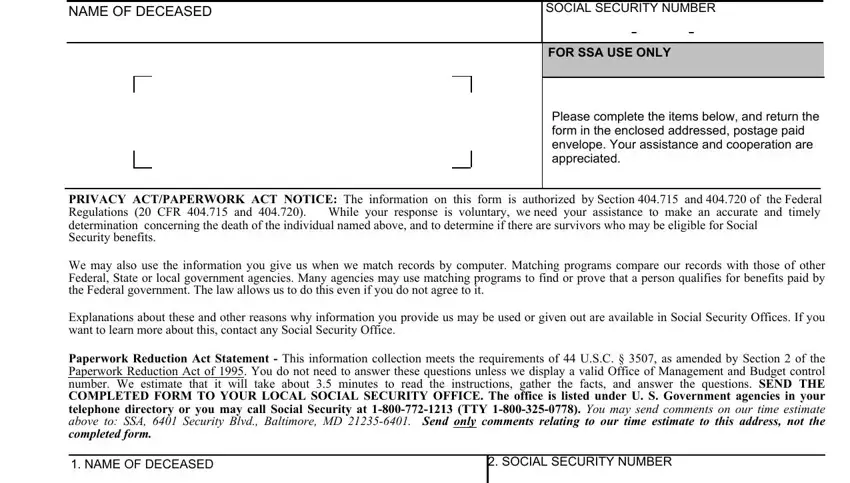

For you to complete this form, make sure you provide the right information in each and every blank:

1. The social security form ssa 721 usually requires particular information to be inserted. Ensure that the following blanks are filled out:

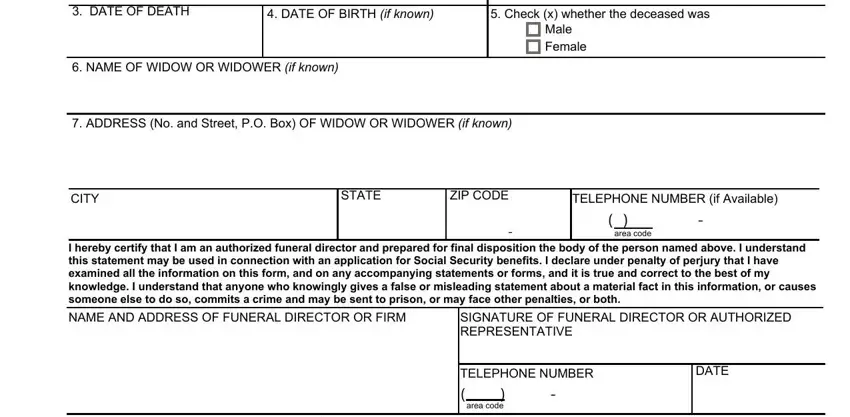

2. The subsequent stage would be to submit these fields: DATE OF DEATH, DATE OF BIRTH if known, Check x whether the deceased was, Male, Female, NAME OF WIDOW OR WIDOWER if known, ADDRESS No and Street PO Box OF, CITY, STATE, ZIP CODE, TELEPHONE NUMBER if Available, I hereby certify that I am an, NAME AND ADDRESS OF FUNERAL, SIGNATURE OF FUNERAL DIRECTOR OR, and area code.

3. Completing DO Processed Date, FOR SOCIAL SECURITY USE ONLY DO, and Form SSA ef Use edition until is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be extremely attentive while filling in DO Processed Date and FOR SOCIAL SECURITY USE ONLY DO, since this is the section in which many people make some mistakes.

Step 3: Reread what you've typed into the blank fields and then hit the "Done" button. Grab the social security form ssa 721 the instant you sign up for a free trial. Conveniently use the pdf file inside your personal account page, together with any modifications and adjustments being all kept! FormsPal guarantees your information privacy with a secure system that in no way records or distributes any sensitive information involved in the process. Feel safe knowing your documents are kept confidential every time you work with our service!