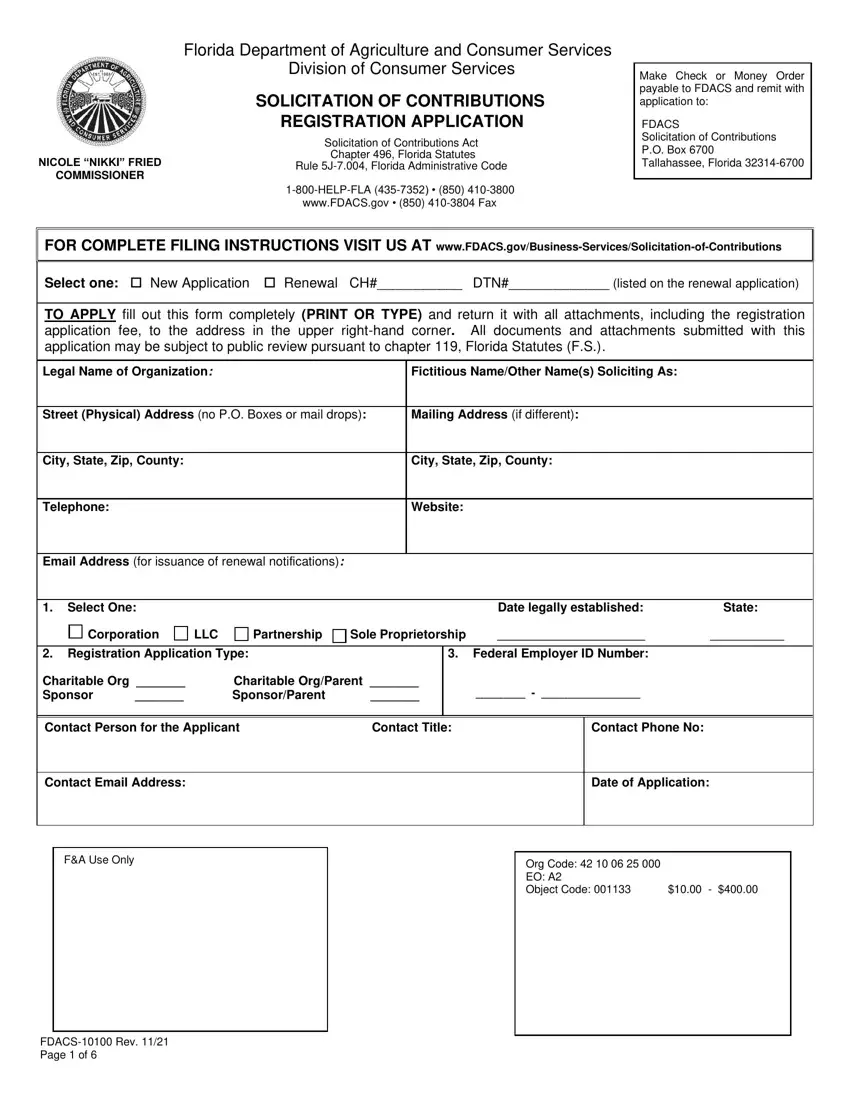

Florida Department of Agriculture and Consumer Services

Division of Consumer Services

SOLICITATION OF CONTRIBUTIONS

REGISTRATION APPLICATION

Solicitation of Contributions Act

Chapter 496, Florida Statutes

NICOLE “NIKKI” FRIEDRule 5J-7.004, Florida Administrative Code

COMMISSIONER

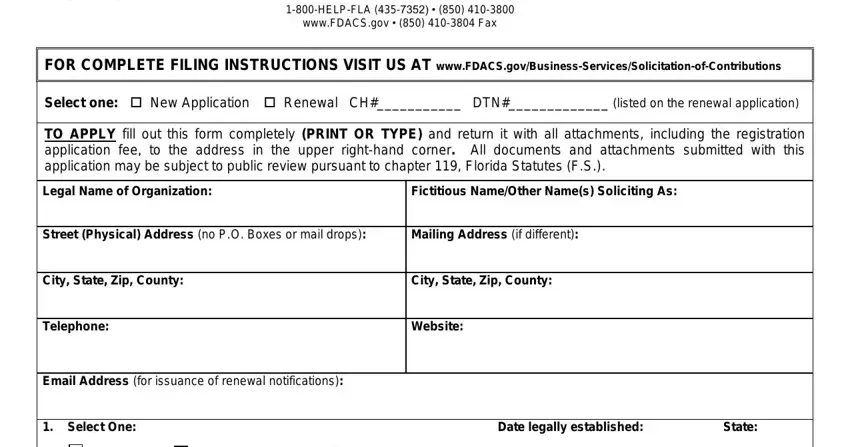

1-800-HELP-FLA (435-7352) • (850) 410-3800 www.FDACS.gov • (850) 410-3804 Fax

Make Check or Money Order payable to FDACS and remit with application to:

FDACS

Solicitation of Contributions

P.O. Box 6700

Tallahassee, Florida 32314-6700

FOR COMPLETE FILING INSTRUCTIONS VISIT US AT www.FDACS.gov/Business-Services/Solicitation-of-Contributions

Select one: New Application Renewal CH#___________ DTN#_____________ (listed on the renewal application)

TO APPLY fill out this form completely (PRINT OR TYPE) and return it with all attachments, including the registration application fee, to the address in the upper right-hand corner. All documents and attachments submitted with this application may be subject to public review pursuant to chapter 119, Florida Statutes (F.S.).

Legal Name of Organization:

Fictitious Name/Other Name(s) Soliciting As:

Street (Physical) Address (no P.O. Boxes or mail drops):

Mailing Address (if different):

City, State, Zip, County:

City, State, Zip, County:

Email Address (for issuance of renewal notifications):

1. |

Select One: |

|

|

|

|

Date legally established: |

State: |

|

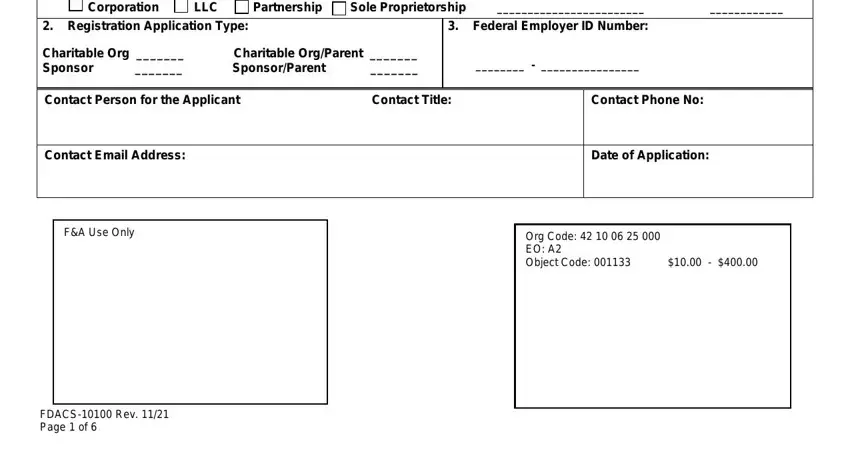

Corporation |

LLC |

Partnership |

Sole Proprietorship |

________________________ |

____________ |

|

|

|

|

|

|

2. |

Registration Application Type: |

|

3. |

Federal Employer ID Number: |

|

Charitable Org _______ |

|

Charitable Org/Parent _______ |

|

________ - ________________ |

|

Sponsor |

_______ |

|

Sponsor/Parent |

_______ |

|

|

|

|

|

|

|

|

|

|

|

Contact Person for the Applicant |

Contact Title: |

Org Code: 42 10 06 25 000 |

|

EO: A2 |

|

Object Code: 001133 |

$10.00 - $400.00 |

FDACS-10100 Rev. 11/21 Page 1 of 6

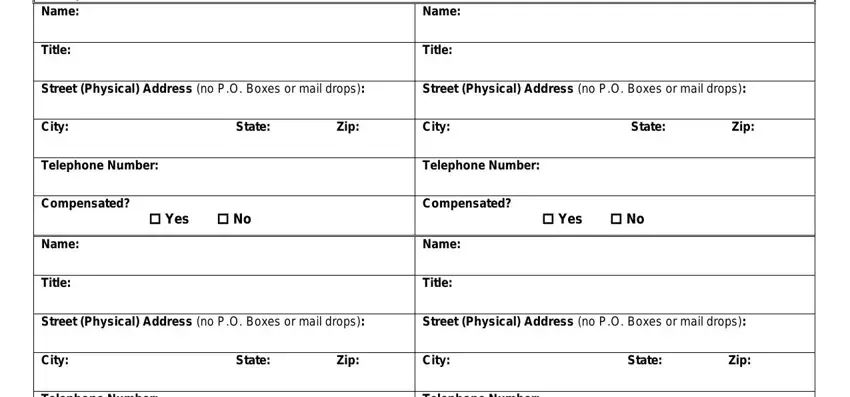

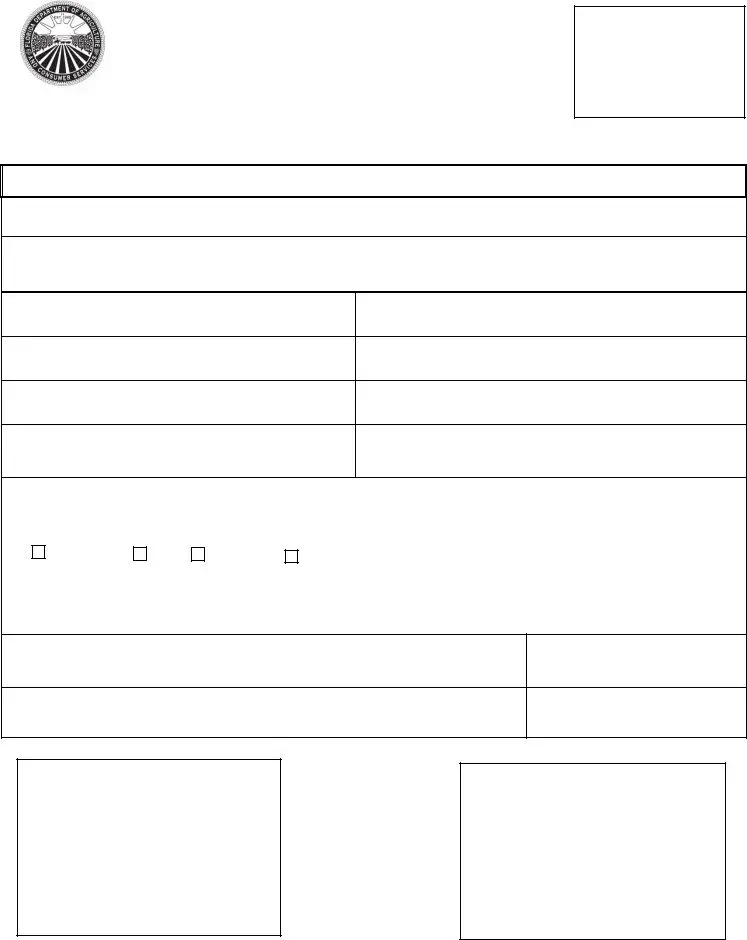

4.List all officers, directors, trustees, and principal salaried executive personnel: Exemptions from public records apply to certain individuals. For a complete list of exemptions, see chapter 119, F.S. If you qualify for one of these exemptions, please list the organization’s address and phone number in lieu of home address and phone number. (Attach additional sheets as necessary using the same format.)

Name: |

|

|

Name: |

|

|

|

|

|

|

|

|

Title: |

|

|

Title: |

|

|

|

|

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

|

|

Telephone Number: |

|

|

|

|

|

|

|

|

Compensated? |

|

|

Compensated? |

|

|

Yes |

No |

|

Yes |

No |

|

Name: |

|

|

Name: |

|

|

|

|

|

|

|

|

Title: |

|

|

Title: |

|

|

|

|

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

|

|

Telephone Number: |

|

|

|

|

|

|

|

|

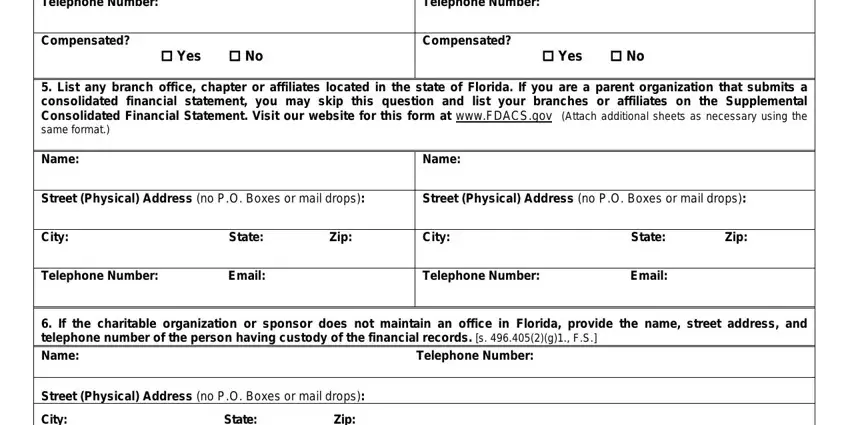

Compensated? |

|

|

Compensated? |

|

|

Yes |

No |

|

Yes |

No |

|

5. List any branch office, chapter or affiliates located in the state of Florida. If you are a parent organization that submits a consolidated financial statement, you may skip this question and list your branches or affiliates on the Supplemental

Consolidated Financial Statement. Visit our website for this form at www.FDACS.gov |

(Attach additional sheets as necessary using the |

same format.) |

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

Name: |

|

|

|

|

Street (Physical) Address (no P.O. Boxes or mail drops): |

Street (Physical) Address (no P.O. Boxes or mail drops): |

|

|

|

|

|

|

City: |

State: |

Zip: |

City: |

State: |

Zip: |

|

|

|

|

|

|

Telephone Number: |

Email: |

|

Telephone Number: |

Email: |

|

|

|

|

|

|

|

6. If the charitable organization or sponsor does not maintain an office in Florida, provide the name, street address, and telephone number of the person having custody of the financial records. [s. 496.405(2)(g)1., F.S.]

Name: |

|

Telephone Number: |

|

|

|

|

Street (Physical) Address (no P.O. Boxes or mail drops): |

|

City: |

State: |

Zip: |

|

|

|

|

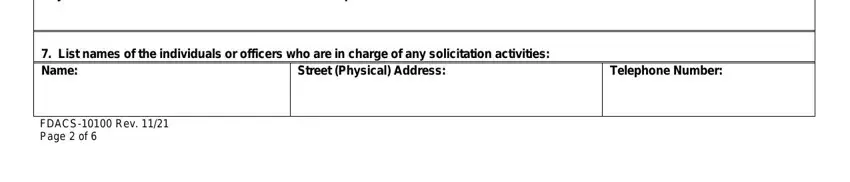

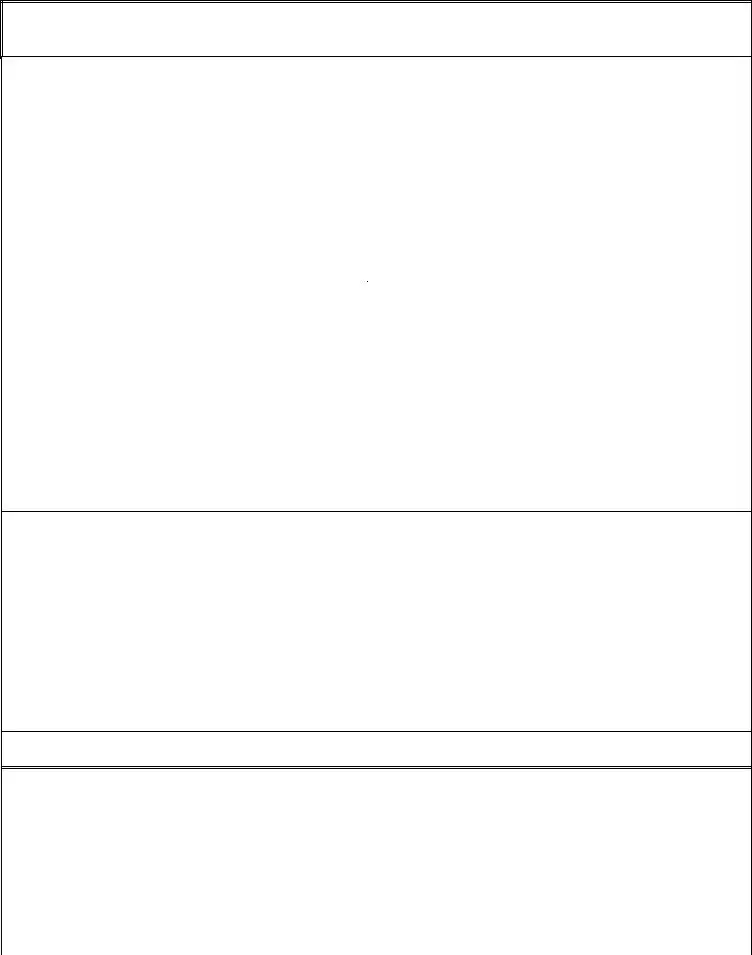

7. List names of the individuals or officers who are in charge of any solicitation activities: |

|

Name: |

|

Street (Physical) Address: |

Telephone Number: |

|

|

|

|

FDACS-10100 Rev. 11/21 Page 2 of 6

(insert number)

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

8. List the name, address, and telephone number(s) of any person(s) responsible for the custody and final distribution of contributions:

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

Name: |

Street (Physical) Address: |

Telephone Number: |

|

|

|

9.Month/day fiscal year ends: [s. 496.405(2)(g)3. F.S.] Month___________ Day_________

10.Has your organization been granted tax exempt status by the Internal Revenue Service? [s. 496.405(2)(f), F.S.]

|

Yes |

501(c) ____________ |

If yes, you must attach a copy of the tax exemption determination letter from the IRS. |

|

No

Pending (a copy of such determination must be filed with the department within 30 days after receipt)

Revoked

11.Charitable purpose for which the charitable organization or sponsor is organized? (Briefly and concisely explain the purpose for which your organization was created, i.e., the organization’s mission. It is best to summarize this information in your own words. Please attach additional pages if necessary.) [s. 496.405(2)(b), F.S.]

12.What is the purpose for which the contributions to be solicited will be used? (Briefly and concisely explain how contributions will be used to further your organization’s mission. Please attach additional pages if necessary. Do not reference 990 or include an attachment.) [s. 496.405(2)(b), F.S.]

13.List major program activities: (Briefly and concisely list the main activities in which your organization participates. Please attach additional pages if necessary.) [s. 496.405(2)(g)4, F.S.]

14.Does the charitable organization or sponsor employ a professional solicitor or professional fundraising consultant?

Yes |

No |

If yes, attach a copy of the current contract, and provide the following information for each. |

|

|

|

(Attach additional sheets as necessary using the same format.) |

|

|

Name: |

|

|

Telephone Number: |

Florida Registration Number (FC/SS): |

|

|

|

|

|

Street (Physical) Address: |

City: |

State/Zip: |

|

|

|

|

|

Indicate Contract Type: |

Contract Begin Date: Month/Day/Year |

Contract End Date: Month/Day/Year |

|

Solicitor |

Consultant |

|

|

|

FDACS-10100 Rev. 11/21 Page 3 of 6

15.Does charitable organization or sponsor utilize a commercial co-venturer?

|

Yes No |

If yes, attach a copy of the current contract, and provide the following information for each. |

|

|

(Attach additional sheets as necessary using the same format.) |

Street (Physical) Address:

NOTE: Any change to the responses provided to Questions 16-21 must be reported to the department within 10 days after the change occurs using the Solicitation of Contributions Material Change Form, FDACS-10118, Rev. 11/21 as incorporated in rule 5J-7.004(5), F.A.C. This form can be found online at www.FDACS.gov

16.Is applicant authorized by any other state to solicit contributions? [s. 496.405(2)(d)1., F.S.]

Yes No

17.Has the charitable organization/sponsor entered into an assurance of voluntary compliance (AVC) or agreement similar to that set forth in s. 496.420, F.S., in any jurisdiction? [s. 496.405(2)(d)4., F.S.]

Yes |

|

No |

If yes, attach a copy of the agreement. |

|

18.Has the charitable organization/sponsor or any of its officers, directors, trustees, or employees, regardless of adjudication, been convicted of, or found guilty of, or pled guilty or nolo contendere to, or been incarcerated within the last 10 years as a result of having previously been convicted of, or found guilty of, or pled guilty or nolo contendere to, any felony within the last 10 years?

[s. 496.405(2)(d)5., F.S.]

Yes No |

If yes, you must provide a copy of the court disposition and submit an explanation of the charge for review. |

19.Has the charitable organization/sponsor or any of its officers, directors, trustees, or employees, regardless of adjudication, been convicted of, or found guilty of, or pled guilty or nolo contendere to, or been incarcerated within the last 10 years as a result of having previously been convicted of, or found guilty of, or pled guilty or nolo contendere to, any crime involving fraud, theft, larceny, embezzlement, fraudulent conversion, misappropriation of property, or any crime enumerated in this chapter or resulting from acts committed while involved in the solicitation of contributions within the last 10 years? [s. 496.405(2)(d)6., F.S.]

Yes No |

If yes, you must provide a copy of the court disposition and submit an explanation of the charge for review. |

20.Has the charitable organization/sponsor or any of its officers, directors, trustees, or principal salaried executive personnel been enjoined in any jurisdiction from soliciting contributions or been found to have engaged in unlawful practices in the solicitation of contributions or administration of charitable assets or been enjoined from violating any law relating to a charitable solicitation? [s. 496.405(2)(d)2.,7., F.S.]

Yes No |

If yes, attach the name of such person, the date of the injunction, and the court issuing the injunction. |

21.Has the charitable organization/sponsor had its registration or authority denied, suspended, or revoked by any governmental agency? [s. 496.405(2)(d)3., F.S.]

|

Yes |

|

No |

If yes, attach the governmental agency action documents and an explanatory statement including the reason(s) for |

|

each denial, suspension, or revocation. |

|

|

|

|

22.Select the financial statement you are filing for the immediately preceding fiscal year ending _____/_____/_______: Please Note: We do not accept 990-PF or 990-N postcard in lieu of one of the below financial statements.

Please attach one of the following:

990 and all schedules |

990-EZ and Schedule O |

Budget (newly formed organizations only) |

FDACS-10122 Solicitation of Contributions Annual Financial Reporting Form, 11/21 (available online at www.FDACS.gov)

180 Day Extension request for financial statement only. (Failure to file a financial statement within the 180 days will result in an automatic suspension of your registration.)

FDACS-10100 Rev. 11/21 Page 4 of 6

Please provide the financial Information (must match the information listed on the immediately preceding fiscal year financial statement):

Total Revenue: |

$ ________________________ |

Total Expenses: |

$ ________________________ |

Program Service Expenses: |

$ ________________________ |

Management & General Expenses: |

$ ________________________ |

Fundraising Expenses: |

$ ________________________ |

23.Charitable organizations or sponsors that receive at least $500,000 in annual contributions must have their financial statement reviewed or audited by an independent certified public accountant. If annual contributions are more than $1 million, then the financial statement must be audited by an independent certified public accountant. If submitting an IRS form 990 or 990 EZ and contributions are $500,000 or more, those IRS forms must be prepared by a certified public account or another professional who prepares such forms or schedules in their ordinary course of business.

Attached is a copy of signed CPA review or audit Yes No

24.Calculation of Registration Fee:

Amount of contributions received in the immediately preceding fiscal year: $___________________

“Contribution” means the promise, pledge, or grant of money or property, financial assistance, or any other thing of value in response to a solicitation. The term includes, in the case of a charitable organization or sponsor offering goods and services to the public, the difference between the direct cost of the goods and services to the charitable organization or sponsor and the price at which the charitable organization or sponsor or a person acting on behalf of the charitable organization or sponsor resells those goods or services to the public. The term does not include:

(a)Bona fide fees, dues, or assessments paid by members if membership is not conferred solely as consideration for making a contribution in response to a solicitation;

(b)Funds obtained by a charitable organization or sponsor pursuant to government grants or contracts;

(c)Funds obtained as an allocation from a United Way organization that is duly registered with the department; or

(d)Funds received from an organization duly registered with the department that is exempt from federal income taxation under s. 501(a) of the Internal Revenue Code and described in s. 501(c) of the Internal Revenue Code. [s. 496.404(5) F.S.]

$10 fee: Less than $5,000

$10 fee: Less than $25,000 and no compensated directors/employees, no professional solicitors/consultants or commercial co-venturers.

$75 fee: $5,000 or more, but less than $100,000

$125 fee: $100,000 or more, but less than $200,000

$200 fee: $200,000 or more, but less than $500,000

$300 fee: $500,000 or more, but less than $1,000,000

$350 fee: $1,000,000 or more, but less than $10,000,000

$400 fee: $10,000,000 or more

Calculated Registration Fee: |

$________________________ |

Calculation of Late Fee (Renewals Only): + |

$________________________ |

($25 per month or any portion of a month following expiration date)

Total Fee Amount Enclosed: |

$________________________ |

MAKE CHECK OR MONEY ORDER PAYABLE TO: FDACS

*Submit your completed application along with the above registration fee and your financials with all attachments to:

FDACS

Solicitation of Contributions

Post Office Box 6700

Tallahassee, FL 32314-6700

FDACS-10100 Rev. 11/21

Page 5 of 6

ONLY SPONSORS NEED TO ANSWER THE FOLLOWING QUESTIONS:

“Sponsor” means a group or person who is or holds herself or himself out to be soliciting contributions by the use of a name that implies that the group or person is in any way affiliated with or organized for the benefit of emergency service employees or law enforcement officers and the group or person is not a charitable organization. The term includes a chapter, branch, or affiliate that has its principal place of business outside the state if such chapter, branch, or affiliate solicits or holds itself out to be soliciting contributions in this state.

[s. 496.404(25), F.S.]

The organization must consist of members who are individuals of whom at least 10% or 100 members, whichever is less, are actively employed as law enforcement officers or emergency service employees by an agency of the United States, this state, a municipality, or a political subdivision of this state, and who personally sign written membership agreements with the organization and pay an annual membership of not less than $10 a member.

a.Total number of sponsor’s members:

b.Total number of members actively employed as law enforcement or emergency service employees:

c.Percentage of total net contributions (defined as the total amount of all contributions raised in Florida minus the total cost of expenses incurred in raising contributions solicited), which are disbursed in the state on behalf of its members in furtherance of its stated purpose

CERTIFICATION

I certify the following:

The organization has adopted a policy regarding conflict of interest transactions, and I certify that all directors, officers, and trustees of the charitable organization are in compliance with the adopted policy.

The information furnished in this application and all supplemental forms, reports, documents and attachments are true and correct to the best of my knowledge. [s. 496.405(2) F.S.]

__________________________________________________ |

____________________________________________ |

Printed Name |

Date |

__________________________________________________ |

____________________________________________ |

Signature |

Title |

__________________________________________________ |

____________________________________________ |

Telephone Number |

Email Address |

FDACS-10100 Rev. 11/21

Page 6 of 6