Are you looking for an efficient and secure way to fill out a South Carolina ABL form? If so, you've come to the right place. In this blog post, we will explore the ways that you can make sure your ABL form is filled out correctly, quickly, and safely — saving you both time and money in the long run. You'll also find helpful tips on how to ensure accuracy when completing your forms as well as information about how filing electronically compares to other traditional methods. With just a few simple steps and some attention to detail, filling out a South Carolina ABL form doesn't have to be stressful or overwhelming anymore!

| Question | Answer |

|---|---|

| Form Name | South Carolina Abl Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | Fillable Online SC4506 - South Carolina Department of ... |

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 7/1/21) 4449

If you are a South Carolina corporation, Limited Liability Corporation (LLC), Limited Liability Partnership (LLP), or a Partnership, your entity must be registered with the South Carolina Secretary of State (SCSOS) for 30 days prior to applying. If you are a Sole Proprietor, you must be a resident of South Carolina for 30 days prior to applying.

Submit all of the following documents that apply:

1.Completed application, signed, and dated.

2.Permit fees

3.Completed

4.Competed

5.Criminal record check (CRC) for all principals that is less than 90 days old.

•If the principal has lived in SC for two years or more, submit the CRC from SLED at www.sled.sc.gov.

•If the principal has lived in SC for less than two years, the statewide CRC must be submitted from the previous state of residency and from SLED at www.sled.sc.gov.

•If the principal is not a SC resident, the statewide CRC must be submitted from the current state of residency.

•Attach a disposition for any charge that does not list the court charges determination.

6.LLC Operating Agreement, Partnership Agreement or

7.Brewer's Notice if applying as a brewery

8.Copy of Basic Permit issued by the Alcohol and Tobacco Tax and Trade Bureau (TTB)

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

44491017

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

APPLICATION FOR REGISTRATION OF

BEER AND WINE PRODUCER OR IMPORTER

(Rev.8/2/21)

4270

Mail to: SCDOR, ABL Section, PO Box 125, Columbia, SC

Email: ABL@dor.sc.gov

Permit Fee: $400 biennially

Expires: August 31 of even numbered years

File Number:

PRINT ALL INFORMATION

1. Legal entity name or sole proprietor |

|

|

|

|

|

5. Trade name (doing business as) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

6. Business phone number |

|

Principal's daytime phone number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. Physical location of business (no PO box) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

7. FEIN/SSN |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

8. Email |

|

|

|

|

|

|

|

|||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brewery |

|

|

|

Winery |

|||

|

|

|

|

|

|

|

|

|

|

|

|

9. Check one: |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

ZIP |

|

|

|

Beer producer/importer |

|

Wine producer/importer |

||||||||||

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Mailing address |

|

|

|

|

|

|

|

|

10. Does the applicant own or have a financial interest in a beer or wine |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

wholesaler/distributor or retail business in South Carolina? |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

||

|

Designated agent or compliance agent |

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, explain: |

|

|

|

|

|

|

|

||

|

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

ZIP |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. Type of ownership |

|

|

|

|

|

|

|

|

11. Does your TTB permit indicate that you are a wholesaler/distributor? |

|||||||||||||

|

|

Sole Proprietor |

Partnership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

LLC/LLP |

SC Corporation |

Date of Inc. |

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Foreign Corporation |

State of Inc. |

|

|

Date of Inc. |

|

|

|

|

|

If yes, submit a letter indicating you are the primary American source |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

or American producer. |

|

|

|

|

|

||||

|

|

Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DESIGNATED AGENT |

|

|

|

|

|

|

|

|||||||

You must designate a person to receive all notices from the SCDOR concerning your license and/or permit. These notices will be sent to the person at the mailing address shown in question 3. It is your responsibility to keep the SCDOR advised of any change regarding this person or your mailing address as the law will presume you received all notices sent to the address you have given us.

Name of designated agent or compliance agent |

Compliance agency name, if applicable |

Applications take at least six to eight weeks to process. If the application is denied by the SCDOR, this process will be delayed.

Beer, wine, and liquor are governed by SC Code of Laws Title 61, Chapters 2, 4, and 6; Title 12 Chapters 21 and 33; Title 20 Chapter 7, and Title 33 Chapter 42. Regulations are found in Chapter 7 of the Code of Regulations. Read the full code sections at dor.sc.gov/policy.

I certify that this business meets the legal requirements under South Carolina law for the license and/or permit type for which this application is being filed. I understand that a misstatement or concealment of fact in an application is sufficient grounds for the revocation of the license and/or permit. Under penalties of perjury, I declare that I have read and understood this form and the information I have provided is true, correct, and complete.

Principal's Signature |

Date |

42701011

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

APPLICATION FOR BEER/WINE

BRAND REGISTRATION

(Rev. 10/15/21) 4286

Mail to: SCDOR, ABL Section, PO Box 125, Columbia, SC |

|

|

|

|

|||||||

Email: ABL@dor.sc.gov |

|

|

|

|

|

|

|

|

|

||

Alcohol Beverage License Number |

|

|

|

|

Registered producer/importer name |

|

|

||||

|

|

|

|

||||||||

Contact Person |

|

|

|

|

Phone |

|

|||||

Address |

|

|

|

|

|

|

|

|

|

||

|

|

|

Street |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

ZIP |

||

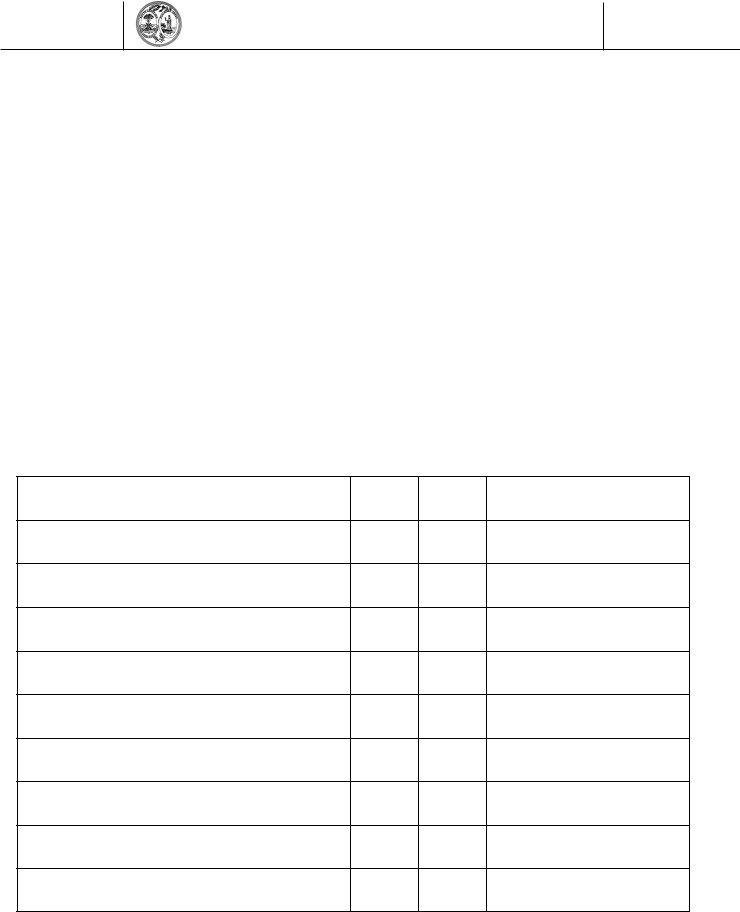

INSTRUCTIONS:

•List all label(s) and/or brand(s) you intend to ship and the wholesaler(s)/distributor(s) you ship to. If you need additional space, submit additional copies of the

•Attach a copy of the Certificate of Label Approval (COLA) from the Tax and Trade Bureau (TTB) for each label and/or brand listed. If the alcohol content is less than 7%, attach a copy of the label or brand.

•Provide a copy of the label and formula approval from TTB for flavored malt beverages without a Certificate of Label Approval (COLA).

•You may only ship to the licensed South Carolina wholesaler(s)/distributor(s) listed.

•Provide a Letter of Authority from the product owner giving you authority to register their product.

•Beer must contain less than 14% alcohol by weight.

•Wine must not contain more than 21% alcohol by volume.

Brand Name (list full brand name)

Proof

Size

Wholesaler(s)/Distributor(s)

42861021

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

APPLICANT AND PRINCIPAL CONSENT AND WAIVER

(Rev. 7/1/21) 4422

What you need to know

•The SCDOR cannot issue a license and/or permit to anyone that owes delinquent taxes, penalties, or interest.

•If an entity who is not an individual applies for a license and/or permit, all principals of the entity must also apply. See SC Code Sections

•To apply, you must allow information about your South Carolina taxes to be shared with any party. The information that may be shared includes, but is not limited to, information about delinquent taxes, penalties and interest, outstanding liabilities, or information concerning failure to file returns.

•You are waiving your rights under SC Code Sections

•SCDOR has the right to share information with other principals or applicants to process the application or any renewal.

Complete an

Legal entity name or sole proprietor |

|

FEIN/SSN |

||||||||||

Name |

|

|

|

|

|

|

|

|

|

|||

Home Address (No PO Box) |

|

|

|

|

|

|

|

|

|

|||

City |

State |

|

|

|

Zip |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Month/Date/Year of SC Residency |

|

|

|

|

Date of Birth |

|

|

|||||

SSN |

|

|

|

FEIN |

Select one: |

Owner |

Corporate Officer |

||

|

|

Nonprofit Officer |

Fiduciary |

|

Percent of Ownership

Partner |

Member (LLC) |

Manager (LLC) |

Publicly traded agent

Employee/Manager

Have you as an individual, or as an organization in which you were a principal, had any license to sell beer, wine, or alcoholic liquors revoked or suspended in this state or any other state?

Yes No

Have you been convicted of a crime in South Carolina or any other state?

Yes |

|

No If yes, you must attach an explanation. |

I understand that a misstatement or concealment of fact in an application is sufficient grounds for the revocation of the license and/or permit. Under penalties of perjury, I declare that I have read and understood this form and the information I have provided herein is true, correct, and complete.

Signature of applicant |

Printed Name |

Date |

Telephone number from 8 am to 5pm |

Social Security Privacy Act Disclosure

It is mandatory that you provide your Social Security Number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i) permits a state to use an individual's Social Security Number as means of identification in administration of any tax. SC Regulation

44221026