The State of South Carolina Department of Revenue mandates that individuals expecting to owe $1000 or more in taxes file a declaration of estimated tax, Form SC1040ES, which is a critical process for taxpayers in the state. This form aids in the calculation and payment of taxes on income not subject to regular withholding, across specified dates within the fiscal year. Most taxpayers will find themselves submitting payments on April 15, June 16, September 15, and January 15; however, certain circumstances, such as changes in income during the year, may alter these dates. Various sections within the form address who must file, when and how payments should be made, and the specific conditions under which one might file jointly or need to amend their declaration. Notably, the form also outlines penalties for underpayment or late payments, while providing exceptions that could prevent such penalties. Furthermore, detailed instructions accompany the form to ensure taxpayers accurately report and remit their estimated taxes, including the use of payment-vouchers to facilitate these payments. This comprehensive document serves not just as a means to collect estimated taxes but as a guide to help taxpayers navigate through the process, ensuring they meet their tax obligations efficiently and accurately.

| Question | Answer |

|---|---|

| Form Name | South Carolina Form 1040Es |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | sc1040es south carolina form 1040es |

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE www.sctax.org

INSTRUCTIONS AND FORMS FOR

2003

DECLARATION OF ESTIMATED TAX

FOR INDIVIDUALS

File and Pay

FORM SC1040ES

STATE OF SOUTH CAROLINA

INDIVIDUAL DECLARATION OF ESTIMATED TAX

INSTRUCTION AND WORKSHEET

The enclosed declaration

A WHO MUST FILE A DECLARATION

Every individual must file a declaration of estimated tax for 2003 if the expected total amount of tax owed when the income tax return is filed will be $1000.00 or more. This includes all individuals residing in the state, also nonresidents and

Exceptions for filing a declaration are:

(1)Farmers and Commercial Fishermen whose gross income from farming or fishing for 2002 or 2003 is at least

(2)Any Individual who was a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(3)Any Individual who was not a resident of South Carolina throughout the preceding taxable year, had no South Carolina tax liability for the prior year, and whose prior year tax return was (or would have been, had the individual been required to file) for a full 12 months;

(4)Any nonresident taxpayer doing business in South Carolina on a contract basis when the contract exceeds ten thousand dollars ($10,000) and the tax is withheld at the rate of two percent (2%) from each contract payment.

NOTE: You may be able to avoid making estimated tax payments by asking your employer to withhold more state tax from your earnings, if applicable. To increase your state withholding, file a new withholding exemption certificate. Civil service retirees may contact the US Office of Personnel Management at

B WHEN TO FILE YOUR ESTIMATED TAX

(2) Fiscal Year taxpayers must file their declaration of estimated tax vouchers on the 15th day of the 4th, 6th, and 9th months of the fiscal year and the first month of the following fiscal year.

C PAYMENT OF ESTIMATED TAX

Pay your estimated tax in equal amounts on the required filing dates attached to the corresponding voucher; however, you may pay all of your estimated tax on April 15, when the first installment is due. Instead of making your last payment of estimated tax on January 15 (Voucher Number 4), you may file your completed income tax return by January 31 and pay in full the balance of all income tax owed. If there is any overpayment shown on the income tax return filed, the overpayment may be transferred to your estimated tax account for the next year. The amount to be transferred must be entered on the income tax return. The declaration voucher does not have to be attached to the return for the transfer to be made.

D JOINT VS. SINGLE DECLARATION

A husband and wife who are living together may file a joint declaration; however, there are exceptions that require a single or separate declaration. These exceptions are: (1) married taxpayers with different taxable years and (2) married taxpayers who wish to retain their own identity by using different last names.

NOTE: Married taxpayers who file joint SC1040ES vouchers but file separately (or vice versa) when filing Form SC1040 may not receive proper credit for their estimated payments thus generating a deficiency or other notice. Should this occur, contact with the South Carolina Department of Revenue will be required to clarify the matter.

E AMENDED DECLARATION

Your declaration must be amended if you find that the estimated tax is substantially increased or decreased as a result of (1) a change in income, (2) a change in exemptions or (3) a change in the income tax withholding. The amended declaration should be filed on or before the next filing date that is June 16, September 15, or January 15. A special form for amending your declaration will not be needed. Therefore you must use the regular declaration voucher for the filing period.

F PENALTY FOR FAILURE TO FILE AND PAY ESTIMATED TAX

You may be charged a penalty for not paying enough estimated tax, or for not making the payments on time in the required amount. The penalty does not apply if each required payment is timely and the total tax paid is at least 90% of the total tax due. No penalty will be due for underpayments attributable to personal service income earned in another state on which income tax withholding due to the other state was withheld. Most taxpayers filing a declaration may also avoid penalty by paying 100% of the tax shown to be due on the return filed for the preceding taxable year. You must have filed a South Carolina return for the preceding tax year and it must have been for a full

G HOW TO USE THE

The preprinted

(1)If you do not have a preprinted

(2)Enter the amount shown on line 11 of the worksheet on the Amount of Payment line. If no payment amount is due, no payment voucher needs to be filed.

(3)Tear off at the perforation.

(4)Attach your check or money order, made payable to the South Carolina Department of Revenue, to the

Mail the

Cut Here

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

1 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

ENTER PAYMENT AMOUNT |

|

|

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

INSTRUCTIONS TO FOLLOW WHEN AMENDING YOUR DECLARATION

1.Use the Estimated Tax Worksheet on the reverse side as your guide to determine the Amended tax due using the corrected amounts of income, deductions and exemptions from your federal information.

2.Fill out the Amended Declaration Schedule below to determine the amount to be paid.

3.Refer to the

4.Tear off

|

2003 AMENDED DECLARATION SCHEDULE |

||

|

(Use if the estimated tax changes after you file your declaration.) |

||

|

|

|

|

1. |

Amended estimated tax enter here |

|

|

2. |

Less (A) Amount of 2002 overpayment elected for credit to 2003 |

|

|

|

(B) Estimated tax payments to date |

|

|

|

(C) Total of lines 2(A) and (B) |

|

|

3. |

. . . . . . . . . . . .Unpaid balance (subtract line 2(C) from line 1) |

|

|

4. |

Amount to be paid (line 3 divided by number of remaining filing dates) Enter here and on |

|

|

|

Payment |

|

|

|

|

|

|

2003 Tax Computation Schedule for South Carolina Residents and Nonresidents

TAX COMPUTATION SCHEDULE |

|

|

|

Example of computation for Tax Computation Schedule |

||

|

|

|

|

|

||

If the amount on line 3 of worksheet is: |

Compute the tax as follows: |

|

|

South Carolina income subject to tax on line 3 of worksheet is $15,240. |

||

|

|

|

|

|

||

|

BUT NOT |

|

|

|

The tax is calculated as follows: |

|

|

|

|

|

|

|

|

OVER |

|

|

$15,240.00 income from line 3, of worksheet |

|||

$0 |

$2,460 |

2.5% Times the amount $ |

0 |

|

||

|

X .07 percent from tax computation schedule |

|||||

2,460 |

4,920 |

3% Times the amount less $ |

12 |

|

||

|

1,066.80 |

|

||||

4,920 |

7,380 |

4% Times the amount less $ |

62 |

|

||

|

||||||

7,380 |

9,840 |

5% Times the amount less $ 135 |

|

|||

|

|

|

||||

|

$ 709.08 rounded to $710.00 |

|||||

9,840 |

12,300 |

6% Times the amount less $ 234 |

|

|||

|

|

|

||||

12,300+ |

or more |

7% Times the amount less $ 357 |

|

$710.00 is the amount of tax to be entered on line 4 of worksheet |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 2 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

STATE OF SOUTH CAROLINA |

2003 |

DEPARTMENT OF REVENUE |

INDIVIDUAL DECLARATION OF ESTIMATED TAX

SC1040ES

(Rev. 8/20/02)

3080

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

Payment Voucher Number |

3 |

||

|

|

|||

Your Social Security Number |

Spouse's Social Security Number (if joint) |

Calendar year |

||

|

|

|||

|

|

|

|

|

Name and Address (include spouse's name if joint) |

|

|

|

|

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

|

|

STATE OF SOUTH CAROLINA |

2003 |

SC1040ES |

||

|

|

DEPARTMENT OF REVENUE |

(Rev. 8/20/02) |

|||

|

INDIVIDUAL DECLARATION OF ESTIMATED TAX |

|

|

3080 |

|

|

|

|

|

|

|

|

|

Mail to: SC Department of Revenue, Estimated Tax, Columbia SC |

|

Payment Voucher Number 4 |

||||

|

|

|

|

|||

Your Social Security Number |

|

Spouse's Social Security Number (if joint) |

|

Calendar year |

||

|

|

|

|

|||

|

|

|

|

|

|

|

Name and Address (include spouse's name if joint)

ENTER PAYMENT AMOUNT

.

Office Use Only

Return this form with check or money order payable to: The SC Department of Revenue |

Write your Social Security Number(s) on your payment. |

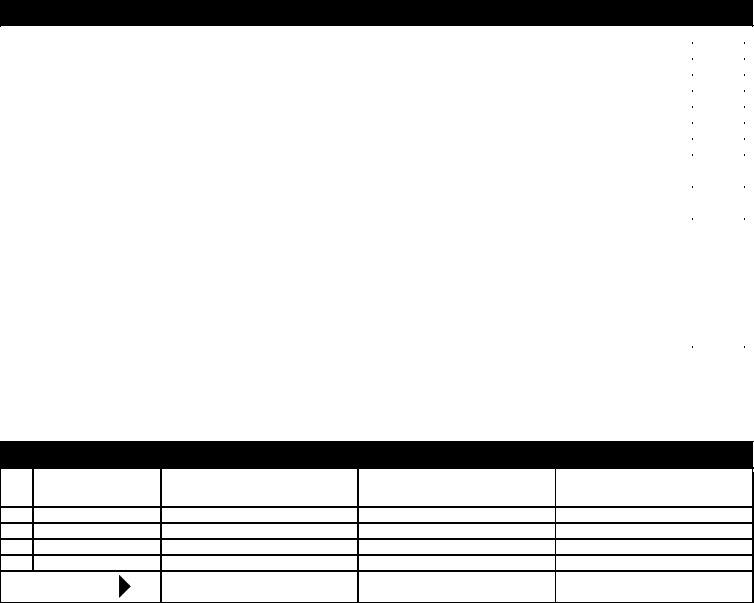

WORKSHEET AND RECORD

OF ESTIMATED TAX PAYMENT

HOW TO COMPUTE YOUR ESTIMATED TAX (Nonresident - see special instructions below.)

Below is your Estimated Tax Worksheet with the tax computation schedule for computing estimated tax. Use your 2002 income tax return as a guide for figuring the estimated tax. See instruction F for penalties.

2003 ESTIMATED TAX WORKSHEET

1. |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Enter amount of your federal taxable income from the 2003 Federal 1040ES, line 5 |

1. |

$ |

|

|

||

|

|

||||||

2. |

Allowable State Adjustments (plus or minus) . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

2. |

$ |

|

|

|

|

|

|

|||||

3. |

This is your South Carolina taxable income . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

3. |

$ |

|

|

|

|

|

|

|||||

4. |

Tax (Figure the tax on line 3 by using the Tax Computation Schedule in these instructions.) |

4. |

$ |

|

|

||

|

|

||||||

5. |

Enter any additional tax (SC4972) . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

5. |

$ |

|

|

|

|

|

|

|

||||

6. |

Add lines 4 and 5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

6. |

$ |

|

|

|

|

|

|

|

||||

7. |

Credits (Child and Dependent Care credit, Tax credit to other states, Two Wage Earner credit, Water Resources, etc) . . . . |

7. |

$ |

|

|

||

|

|

||||||

8. |

Subtract line 7 from line 6 |

. . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

8. |

$ |

|

|

|

|

|

|

||||

9. |

State income tax withheld and estimated to be withheld (including income tax withholding on pension, annuities, etc.) |

|

|

|

|

||

|

during the entire year 2003 |

9. |

$ |

|

|

||

|

|

|

|||||

10. |

Balance estimated Tax (Subtract line 9 from line 8.) If $1000.00 or more, complete and file the |

|

|

|

|||

|

your payment; if less, no payment is required at this time |

10. |

$ |

|

|

||

|

|

|

|||||

|

Caution: You are required to prepay at least 90% of your tax liability each year. If you prepay less than 90% of your |

|

|

|

|

||

|

actual tax liability, you may be subject to a penalty. See Section F of the instructions for penalty information. |

|

|

|

|

||

|

If you are unsure of your estimate, you may want to pay more than 90% of the amount you have estimated. |

|

|

|

|

||

11. |

If the first payment you are required to file is: |

|

|

|

|

|

|

|

Due April 15, 2003, enter 1/4 |

} |

of line 10 (less any 2002 |

|

|

|

|

|

Due June 16, 2003, enter 1/2 |

overpayment applied to 2003 |

|

|

|

|

|

|

Due September 15, 2003,enter 3/4 |

estimated tax). Enter here and |

|

|

|

|

|

|

Due January 15, 2004,enter amount |

on your |

11. $ |

|

|

||

|

|

|

|||||

|

|

|

|

|

|

|

|

RECORD OF ESTIMATED TAX PAYMENT

|

|

|

(C) 2002 |

(D) TOTAL PAID |

NO. |

(A) DATE |

(B) AMOUNT |

OVERPAYMENT |

AND CREDITED |

|

|

|

CREDIT APPLIED |

ADD (B) and (C) |

1.

2.

3.

4.

TOTAL . . . . . . . .

NONRESIDENT - SPECIAL INSTRUCTIONS

Use the 2002 Form SC1040 and Schedule NR as a basis for determining the modified South Carolina taxable income subject to an estimated tax. Enter the modified South Carolina taxable income on line 3 of the above worksheet. Determine the amount of tax using the 2003 tax computation schedule. Enter the tax on line 4 of above worksheet. Complete lines 5 through 11 of above worksheet as instructed.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.