printable social security retirement application can be completed online with ease. Just open FormsPal PDF editing tool to do the job promptly. Our tool is constantly developing to deliver the very best user experience possible, and that is because of our resolve for continual improvement and listening closely to customer opinions. In case you are seeking to begin, this is what you will need to do:

Step 1: Click on the "Get Form" button in the top area of this webpage to get into our PDF editor.

Step 2: With our advanced PDF file editor, it's possible to do more than just fill in forms. Try each of the functions and make your forms appear great with customized textual content added in, or modify the original content to excellence - all that backed up by the capability to insert just about any images and sign it off.

It will be easy to finish the pdf with this practical guide! Here's what you should do:

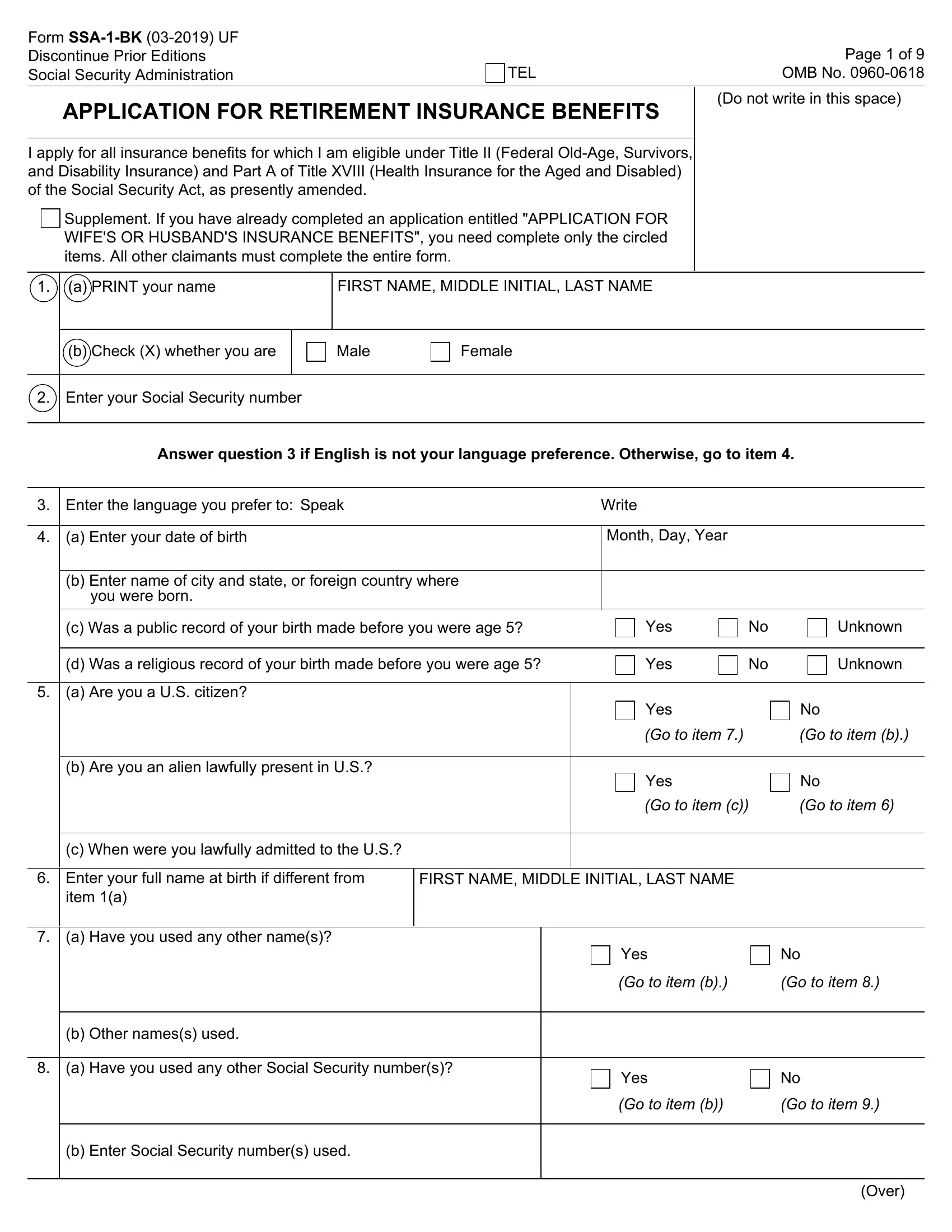

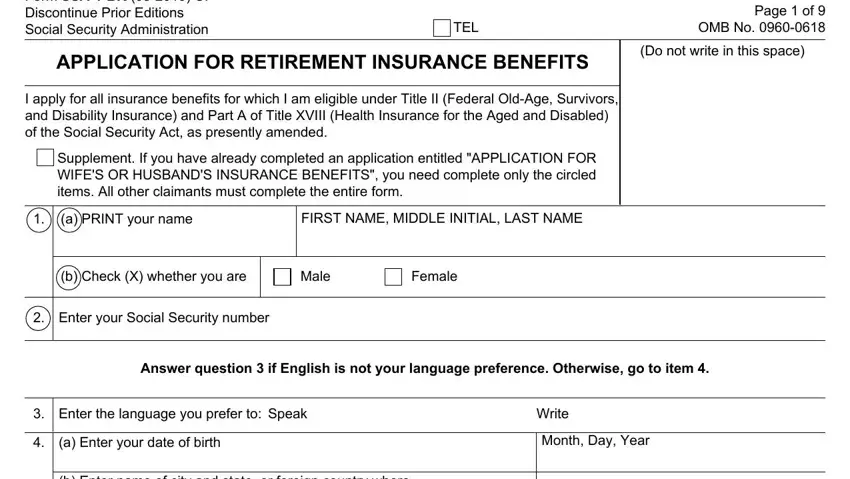

1. The printable social security retirement application necessitates specific details to be typed in. Be sure the following blanks are finalized:

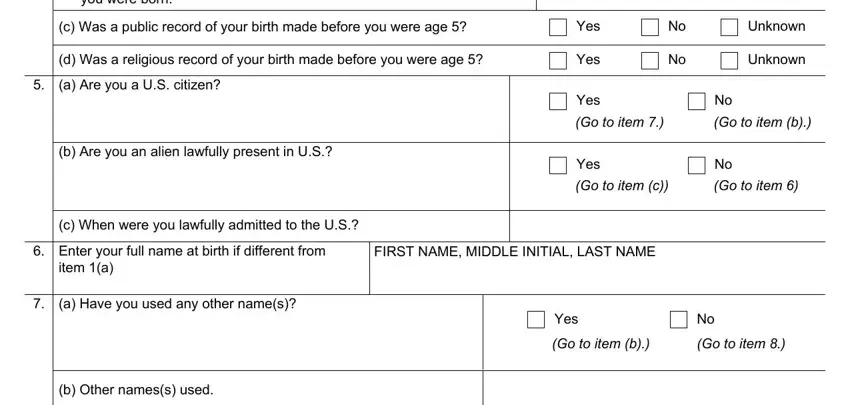

2. The third part would be to complete these particular blank fields: you were born, c Was a public record of your, d Was a religious record of your, a Are you a US citizen, Yes, Yes, Yes, Unknown, Unknown, Go to item, Go to item b, Yes, Go to item c, Go to item, and b Are you an alien lawfully.

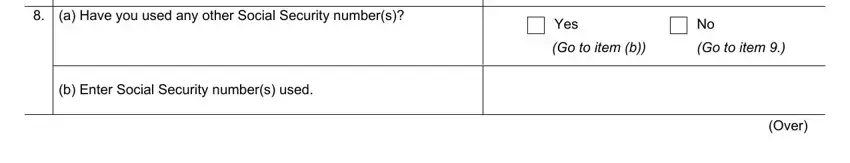

3. Completing a Have you used any other Social, b Enter Social Security numbers, Yes, Go to item b, Go to item, and Over is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

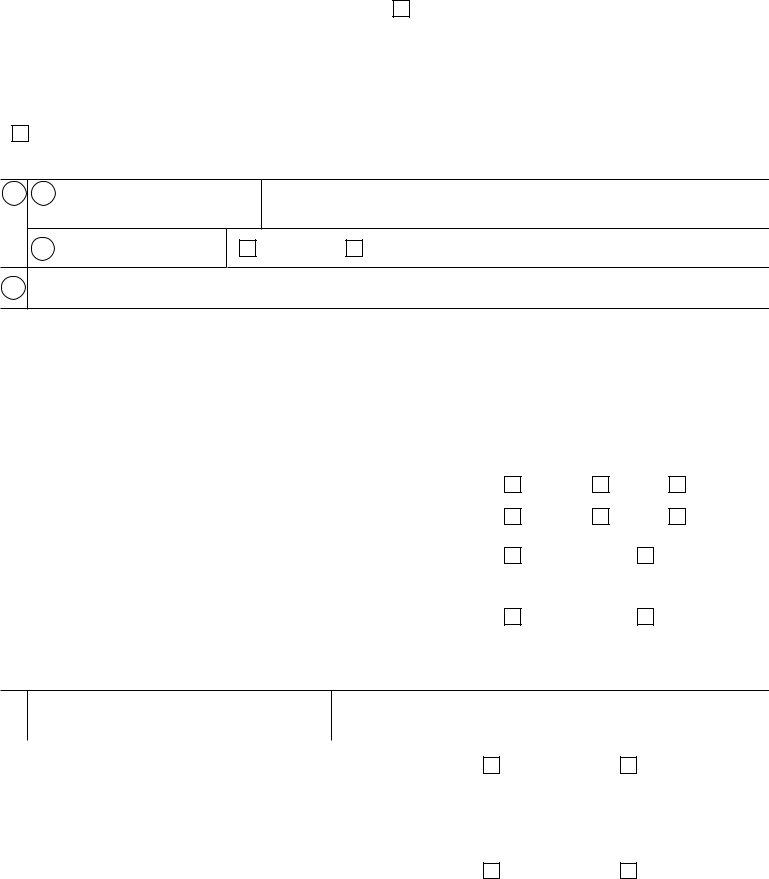

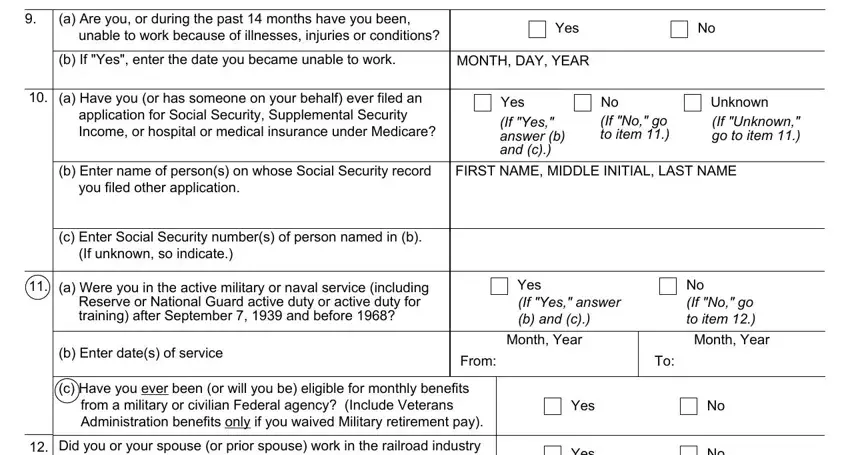

4. Your next subsection will require your input in the following areas: a Are you or during the past, unable to work because of, Yes, b If Yes enter the date you became, MONTH DAY YEAR, a Have you or has someone on your, application for Social Security, Yes, If Yes answer b and c, No If No go to item, Unknown If Unknown go to item, b Enter name of persons on whose, FIRST NAME MIDDLE INITIAL LAST NAME, you filed other application, and c Enter Social Security numbers of. Make sure that you fill in all of the required information to go forward.

As for No If No go to item and you filed other application, make sure that you take another look in this section. Both of these are certainly the most important fields in the page.

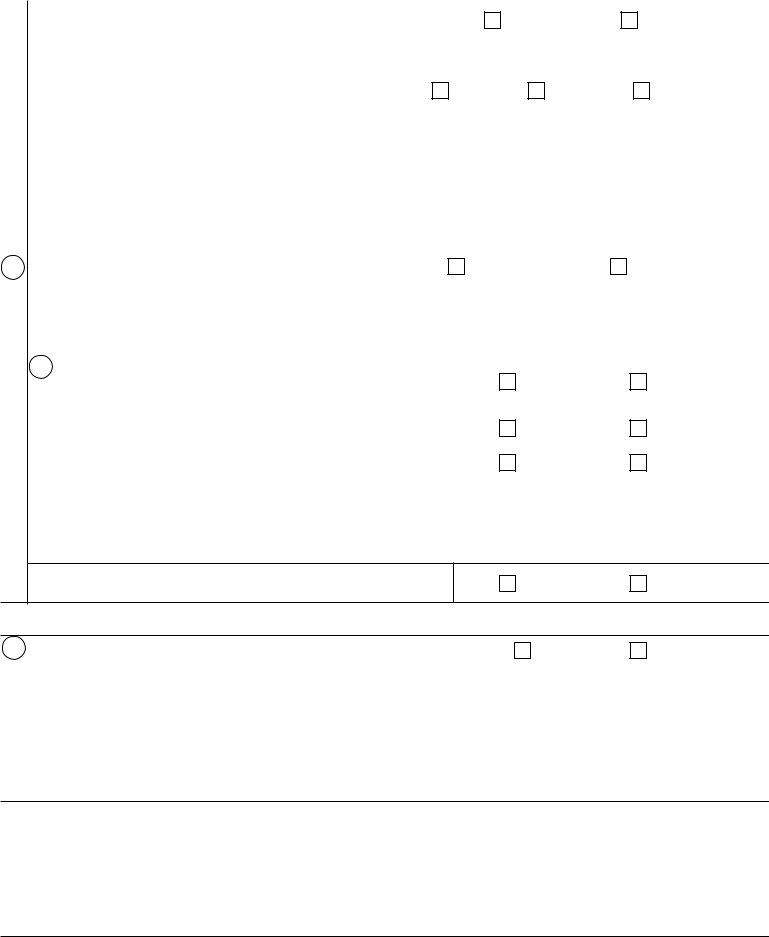

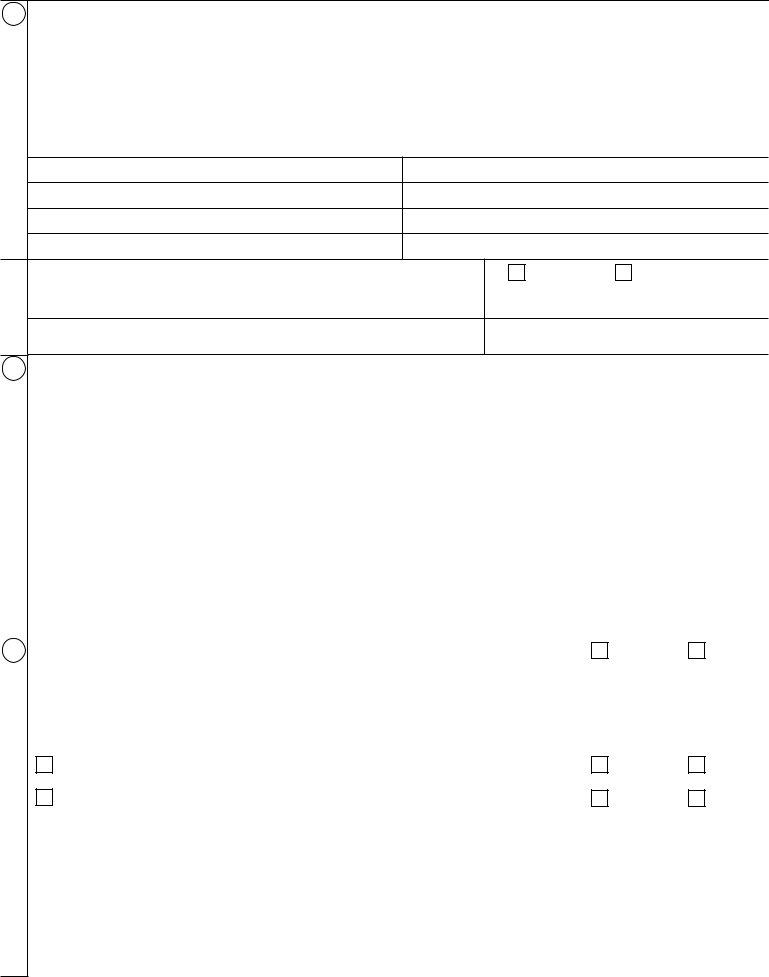

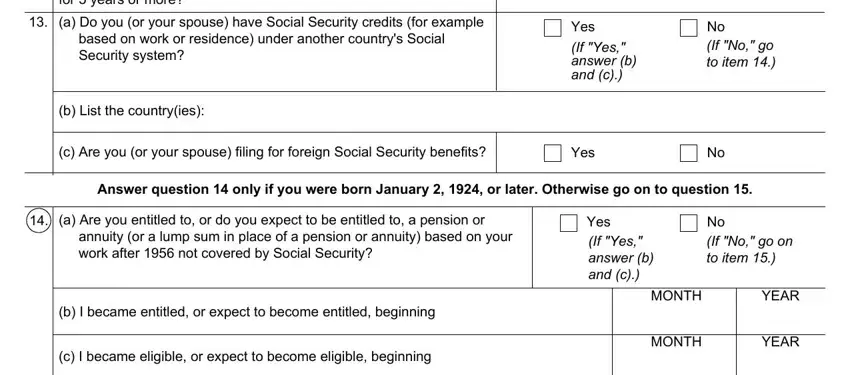

5. To wrap up your document, this last section incorporates a number of extra blanks. Entering Did you or your spouse or prior, a Do you or your spouse have, based on work or residence under, b List the countryies, Yes, If Yes answer b and c, No If No go to item, c Are you or your spouse filing, Yes, Answer question only if you were, a Are you entitled to or do you, annuity or a lump sum in place of, b I became entitled or expect to, c I became eligible or expect to, and Yes If Yes answer b and c should conclude everything and you'll be done in a short time!

Step 3: Proofread what you have entered into the blank fields and press the "Done" button. Get the printable social security retirement application as soon as you subscribe to a 7-day free trial. Easily use the pdf in your FormsPal account, with any modifications and adjustments being all preserved! At FormsPal.com, we do our utmost to be sure that all of your information is stored protected.