Can the authorization stay effective longer than the 12-month period? Can the authorization end before or after the 12-month period ends?

The authorization can stay effective longer than the 12-month period, if you

•apply for SSI/SSP benefits before the State has the authorization form, or

•apply within the 12-month period the authorization is effective, or

•file a valid appeal of SSA’s determination on your initial claim.

The period of the authorization can end before the 12-month period ends, or end after the 12-month period ends when any of these actions take place:

•SSA makes the first SSI/SSP payment on your initial claim; or

•SSA makes a final determination on your claim; or

•the State and you agree to terminate this authorization.

The authorization period will end with the day of the month any of these actions take place.

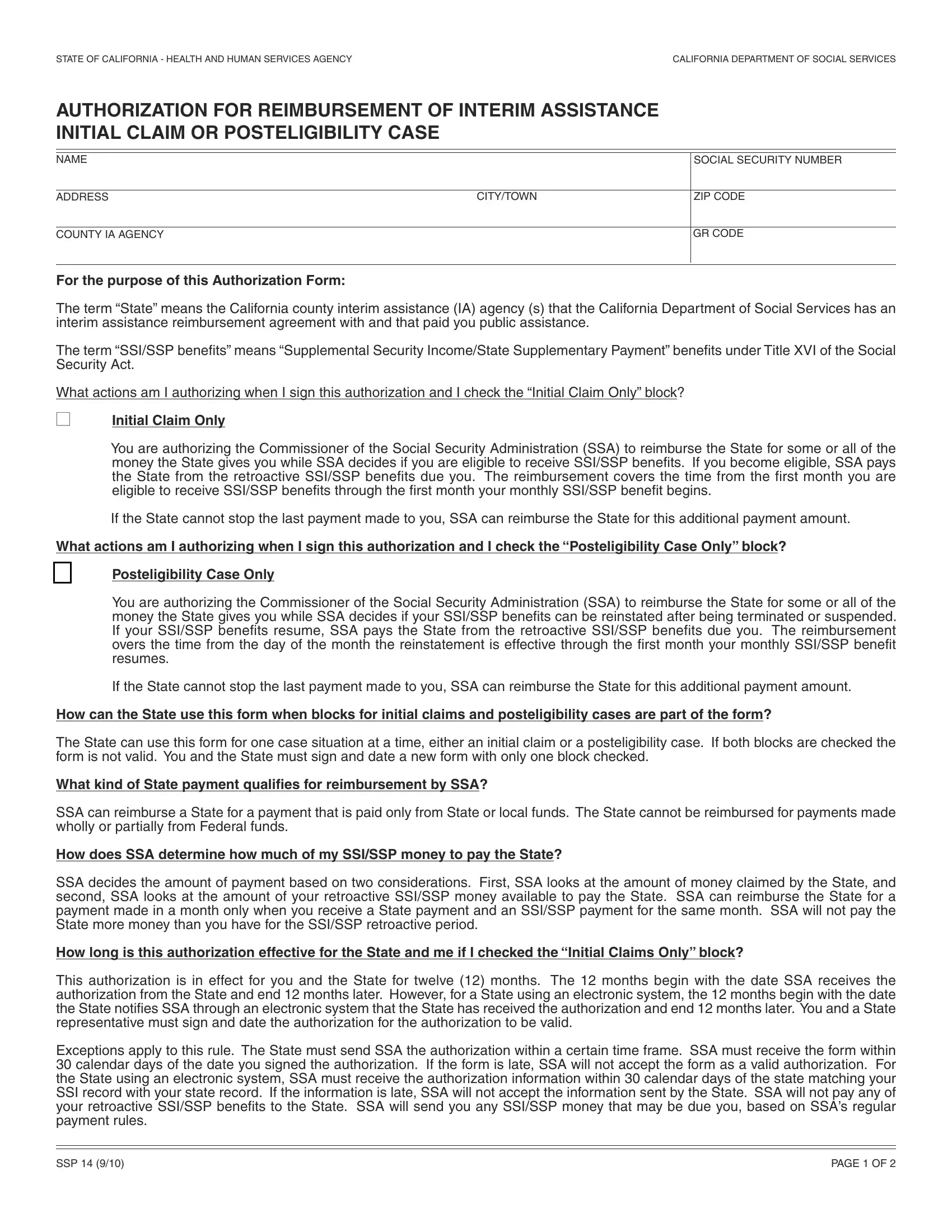

How long is this authorization effective for the State and me if I check the “Posteligibility Case Only” block?

This authorization is in effect for you and the State for twelve (12) months. The 12 months begin with the date SSA receives the authorization from the State and end 12 months later. However, for a State using an electronic system, the 12 months begin with the date the State notifies SSA through an electronic system that the State has received the authorization and end 12 months later. You and a State representative must sign and date the authorization for the authorization to be valid.

Exceptions apply to this rule. The State must send SSA the authorization within a certain time frame. SSA must receive the form within 30 calendar days of the date you signed the authorization. If the form is late, SSA will not accept the form as a valid authorization. For a State using an electronic system, SSA must receive the authorization information within 30 calendar days of the State matching your SSI record with your State record. If the information is late, SSA will not accept the information sent by the State. SSA will not pay any of your retroactive SSI/SSP benefits to the State. SSA will send you any SSI/SSP money that may be due you, based on SSA’s regular payment rules.

Can the authorization stay effective longer than the 12-month period? Can the authorization end before or after the 12-month period ends?

The authorization can stay in effect longer than the 12-month period if you file a valid appeal. You must file your appeal within the time frame SSA requires.

The period of the authorization can end before the 12-month period ends, or can end after the 12-month period ends when any of these actions take place:

•SSA makes the first SSI/SSP payment on your posteligibility case after a period of suspension or termination; or

•SSA makes a final determination on your appeal; or

•the State and you agree to terminate this authorization.

The authorization period will end with the day of the month any of these actions take place.

Can SSA use this authorization form to protect my filing date for SSI/SSP benefits?

SSA can use this form to protect your filing date if you checked the “Initial Claims Only” block. When you sign this form, you are saying that you have the intention of filing for SSI/SSP benefits if you have not already applied for benefits.

You have sixty (60) days from the date the State receives this form to file for SSI/SSP benefits. Your eligibility to receive SSI/SSP benefits can be as early as the date you sign this authorization if you file within the 60-day time period. If you file for SSI/SSP benefits after the 60-day time period, this form will not protect your filing date. Your filing date will be later than the date you sign this form.

How do I appeal the State’s decision if I do not agree with the decision?

You can disagree with a decision the State made during the reimbursement process. You will receive the State notice telling you how to appeal the decision. You cannot appeal to SSA if you disagree with any State decision.

Within 10 working days after the State receives the reimbursement money from SSA, the State must send you a notice. The notice will tell you three things: (1) the amount of the payments the State paid you; (2) that SSA will send you a letter explaining how SSA will pay the remaining SSI/SSP money (if any) due you, and (3) about your right to a hearing with the State, including how to request the State hearing.