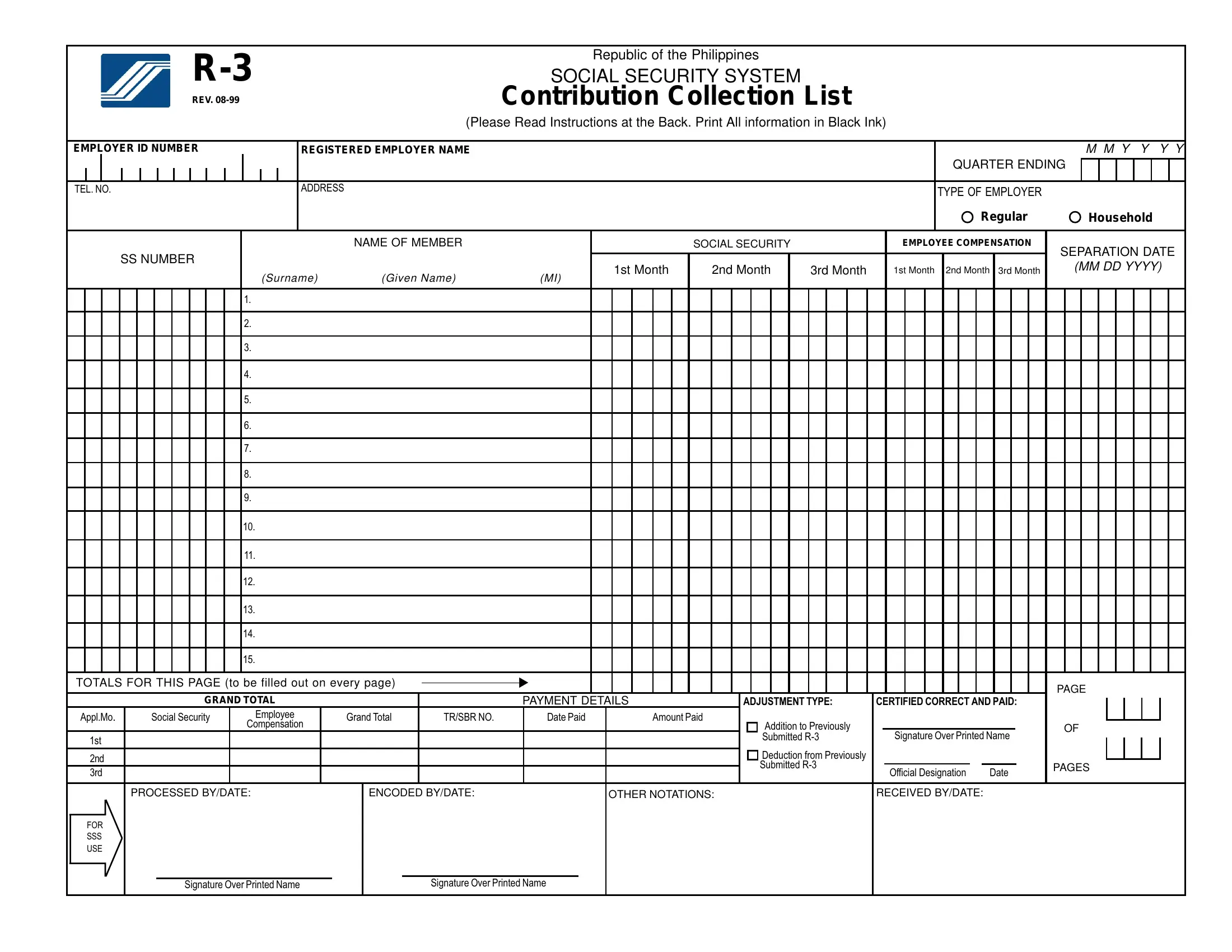

R-3 |

Republic of the Philippines |

SOCIAL SECURITY SYSTEM |

REV. 08-99 |

Contribution Collection List |

(Please Read Instructions at the Back. Print All information in Black Ink)

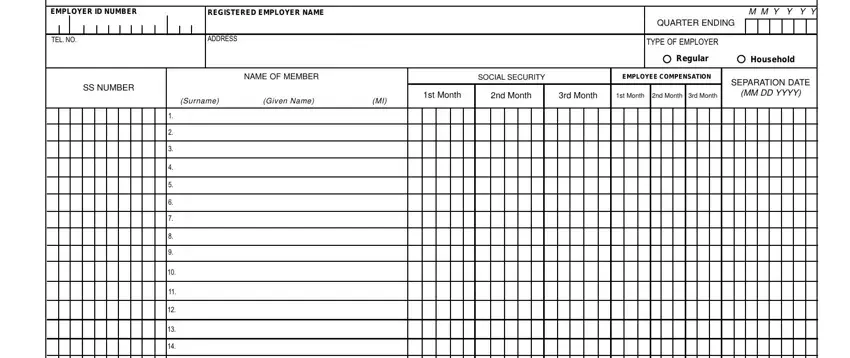

EMPLOYER ID NUMBER |

|

|

|

|

|

REGISTERED EMPLOYER NAME |

|

|

|

|

|

|

|

M M Y Y Y Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

QUARTER ENDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TEL. NO. |

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

TYPE OF EMPLOYER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regular |

|

Household |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF MEMBER |

|

|

SOCIAL SECURITY |

|

EMPLOYEE COMPENSATION |

SEPARATION DATE |

|

|

SS NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Month |

2nd Month |

3rd Month |

|

|

(MM DD YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Month 2nd Month 3rd Month |

|

|

|

|

|

|

|

|

|

|

|

(Surname) |

(Given Name) |

(MI) |

|

|

|

|

|

|

|

|

|

|

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

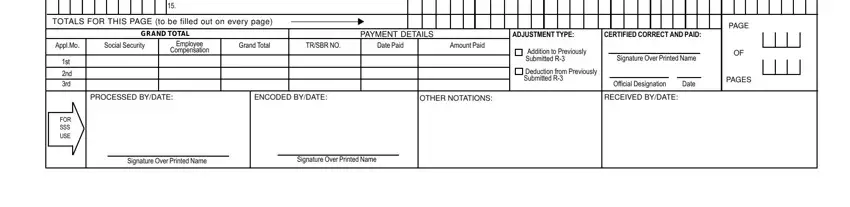

TOTALS FOR THIS PAGE (to be filled out on every page) |

|

K |

|

|

|

PAGE |

|

GRAND TOTAL |

|

|

|

|

|

|

|

|

|

PAYMENT DETAILS |

ADJUSTMENT TYPE: |

CERTIFIED CORRECT AND PAID: |

|

Appl.Mo. |

Social Security |

Employee |

Grand Total |

TR/SBR NO. |

Date Paid |

Amount Paid |

|

|

|

|

|

Compensation |

|

|

|

Addition to Previously |

Signature Over Printed Name |

OF |

1st |

|

|

|

|

|

Submitted R-3 |

|

|

|

|

|

|

|

|

|

|

2nd |

|

|

|

|

|

Deduction from Previously |

|

|

|

|

|

|

|

|

Submitted R-3 |

|

|

PAGES |

3rd |

|

|

|

|

|

Official Designation |

Date |

|

|

|

|

|

|

|

|

PROCESSED BY/DATE: |

ENCODED BY/DATE: |

OTHER NOTATIONS: |

RECEIVED BY/DATE: |

|

|

FOR |

|

|

|

|

|

|

|

|

|

SSS |

|

|

|

|

|

|

|

|

|

USE |

|

|

|

|

|

|

|

|

|

|

Signature Over Printed Name |

|

Signature Over Printed Name |

|

|

|

|

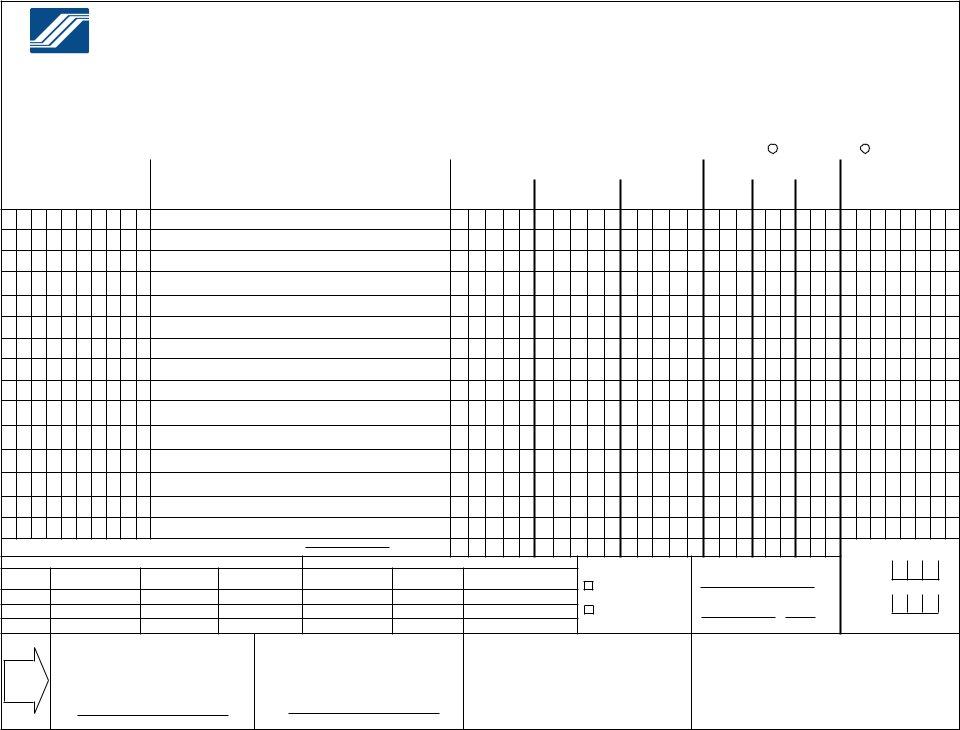

INSTRUCTIONS / REMINDER

1.IF SUBMITTING A REGULAR OR ADJUSTMENT R-3,

1.1Fill out in two (2) copies and indicate the type of employer by shading the applicable circle.

1.2Write the month and year of the applicable quarter ending March, June, September and December on the space provided.

1.3Check applicable box of adjustment.

2.Do not skip any line when filling out the form. Write “Nothing Follows” in the line immediately after the last employee.

3.Write the correct 10-digit SS number of your employees to ensure that all contributions paid will be credited to them.

4.Write family names as they are pronounced. For instance, Juan DELA CRUZ, Jose DELOS SANTOS, Pedro DE GUIA should be written as DELA CRUZ, Juan; DELOS SANTOS, Jose; DE GUIA, Pedro. Also, suffixes such as Jr., Sr., II, III should be written after the family name. For example, Lucio San Juan Jr. and Efren De Guzman III should be written as San Juan Jr., Lucio and De Guzman III, Efren, respectively.

5.Write the month, day and year of separation of your employee, if applicable.

6.The monthly Social Security (SS) and Employee Compensation (EC) contributions for an employee are based on his total actual remuneration for such month. Actual remunerations include the mandated cost of living allowances as well as the cash value of any remuneration paid in any medium other than cash, except that part of the remuneration in excess of the maximum contribution base. In filling out the SS and EC contributions, follow the sample below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security |

|

|

|

|

|

|

Employee Compensation |

Separation Date |

|

|

|

|

|

|

|

|

|

|

Name of Member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SS Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3rd Month |

|

(MM DD YYYY) |

|

|

|

(Surname) |

(Given name) |

(MI) |

|

1st Month |

2nd Month |

|

|

3rd Month |

|

1st Month |

|

2nd Month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

3 |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

7 |

1. San Juan Jr., |

Lucio |

A. |

|

|

9 |

2 |

4 |

|

|

9 |

2 |

4 |

|

|

|

|

|

|

|

1 |

0 |

|

|

1 |

0 |

|

|

|

0 |

2 |

2 |

8 |

1 |

9 |

9 |

9 |

0 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

0 |

1 |

2. De Guzman III, |

Efren |

B. |

|

|

1 |

2 |

6 |

|

|

1 |

2 |

6 |

|

|

1 |

2 |

6 |

|

|

1 |

0 |

|

|

1 |

0 |

|

1 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SS AND EC |

|

|

|

|

DATE OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTRIBUTIONS |

|

|

|

SEPARATION |

|

|

|

|

|

|

|

|

|

|

|

7.Fill out the Grand Total and Payment Details of the last page of the R-3 only.

8.Submit the original and duplicate copies of the accomplished form together with the corresponding extra copies of Form R-5s and SBRs to the NEAREST SSS OR POSTAL SERVICES OFFICE within the first (10) days of the month after the applicable quarter. The duplicate copy of this form is given back to the employer.

9.If SUBMITTING THROUGH THE POSTAL SERVICES OFFICE, mail this form with the R-5s and SBRs and prominently mark the envelope with “SSS Form R-3” addressed to the nearest SSS Office.

10.IF SUBMITTING A PRE-PRINTED R-3, effect all the necessary correction/adjustment in the form (2 copies).

Note: The amounts contained herein were based on the last R-3 posted & must be corrected corresponding to the actual income of the employees for the period.

11.Employers who fail to comply with the above requirements shall be subject to the provision of Section 28 (e) of the SSS law, as amended which states that “Whoever fails or refuses to comply with the provision of this Act or with the rules and regulations promulgated by the Commission, shall be punished by a fine of not less than Five thousand pesos (P5,000) nor more than Twenty thousand pesos (P20,000), or imprisonment for not less than six (6) years and one (1) day nor more than twelve (12) years or both, at the discretion of the court.”