GENERAL INFORMATION

INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid; otherwise, the payment of the tax must be made directly to a Bureau of Motor Vehicles license branch.

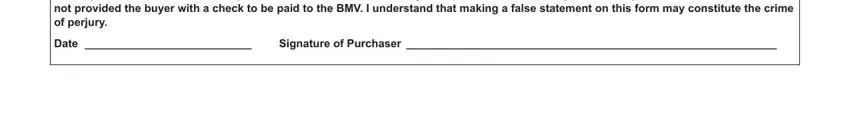

If NONE of the exemptions apply to the purchase, Form ST-108 must be completed by the dealer and the purchaser to indicate that the sales/use tax was collected by the dealer. The dealer is then required to submit the sales/use tax to the Department of Revenue.

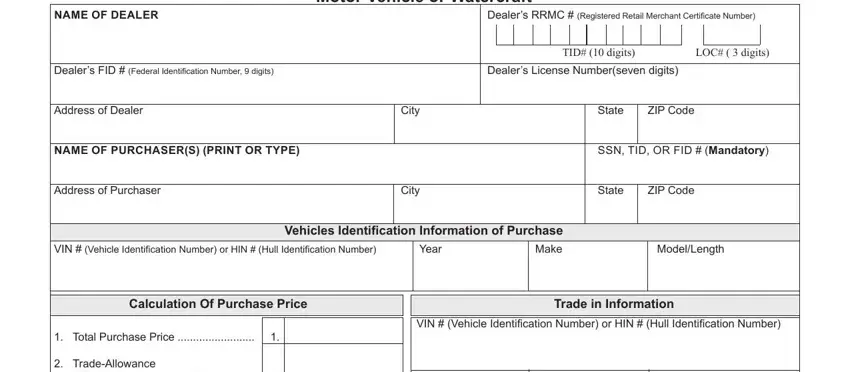

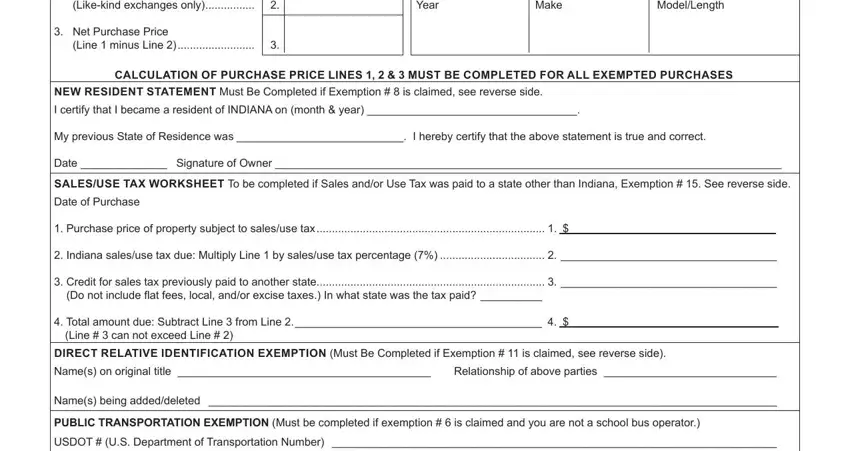

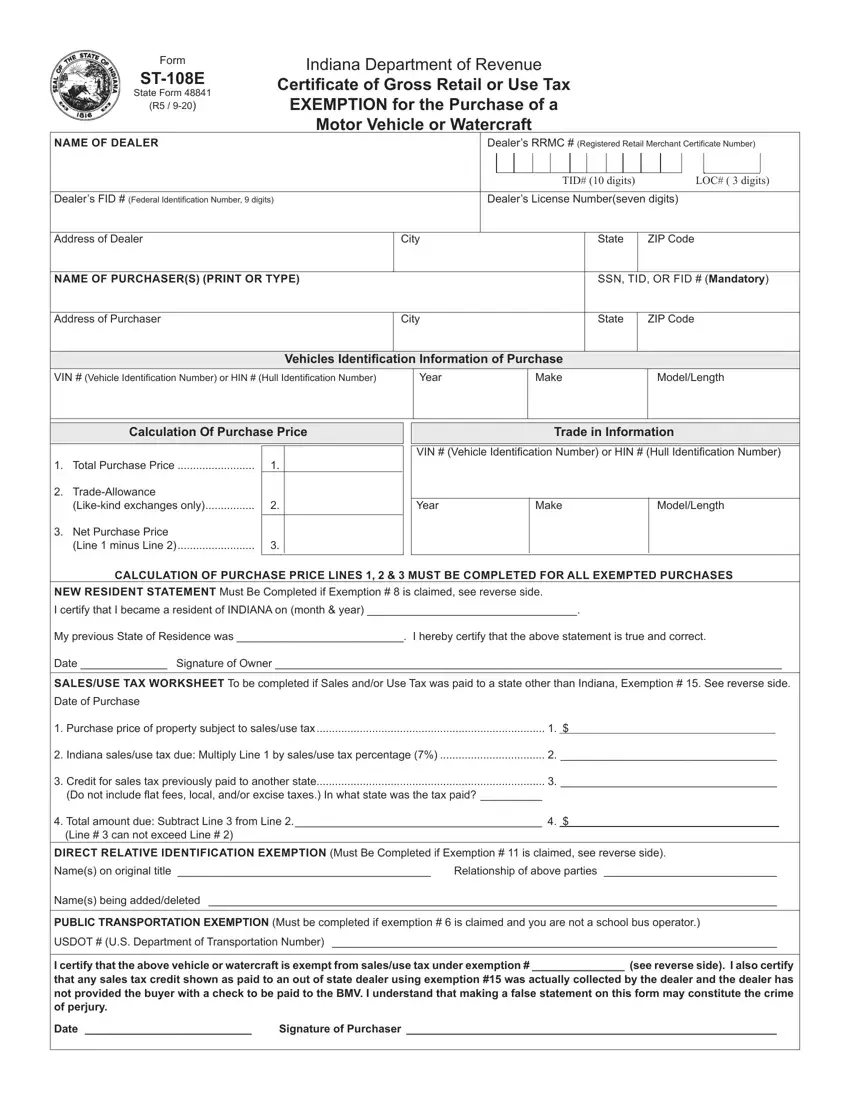

A purchaser’s ID# (SSN-Social Security #, TID - Indiana Taxpayer Identification #, FID - Federal Identification #) is mandatory to claim an exemption. Calculation of Purchase Price lines #1, #2 and #3 must be completed for all exempted purchases. The exemption claim is not valid without providing a required ID# and Purchase Price information. Exemptions available are:

1.Vehicles or watercraft purchased by Indiana or Federal governmental units or their instrumentalities.

2.Vehicles or watercraft purchased by nonprofit organizations operated exclusively for religious, charitable, or educational pur-

poses and using the vehicle for the purpose for which such organization is exempt. The applicant MUST indicate its 13 digit

Indiana TID and LOC number on the front of the form. The nonprofit name must be on the title to claim this exemption.

3.Issue title for the sole purpose of adding lien holder information. This exemption is not available to add, delete, or change the name on a title.

4.Trucks, not to be licensed for highway use, and to be directly used in direct production of manufacturing, mining, refining or harvesting of agricultural commodities. Ready-mix concrete trucks are exempt under this paragraph even though they are to be licensed for highway use. Vehicles registered with farm plates are not exempt.

5.Sales of motor vehicles or watercraft to Registered Retail Merchants acquiring the vehicles or watercraft to rent, or lease to others and whose ordinary course of business is to rent or lease vehicles or watercraft to others.

6.Vehicles or watercraft to be predominately used for hire in public transportation. (Hauling for hire.) Your USDOT number must be shown on the reverse side of this form. Predominate use is greater than 50%.

7.Vehicles or watercraft transferred from one individual to another with no consideration involved or received as outright gift or inheritance. Assumption of loan payments by the purchaser constitutes consideration and is therefore NOT exempt unless the transferred party was listed on the original security agreement. A copy of the original security agreement must be submitted with the title paperwork.

8.Vehicles previously purchased, titled and licensed in another State or Country by a bona fide resident of that State or Country, who subsequently has become an Indiana resident, are exempt from Indiana sales/use tax upon titling and registration of the vehicle in Indiana. Watercraft previously purchased, titled, or licensed in another state, by a bona fide resident of that state, who subsequently has become an Indiana resident, are exempt from sales/use tax upon titling or registration of the watercraft in Indiana. The New Resident Statement on the front of the form MUST be completed.

9.Vehicles or watercraft purchased to be immediately placed into inventory for resale. NonIndiana dealers must enter both their FID number and their state’s Dealer License Number on this form in lieu of the Indiana TID number if they are not registered with the Indiana Department of Revenue. Note: Motor vehicle dealers are only exempt from sales tax on new motor vehicles purchased for which they possess a manufacturer’s franchise to sell that particular vehicle. If a dealer does not possess a manufacturer’s franchise to sell the new vehicle purchased the dealer must pay sales tax and the resale exemption is invalid.

(I.C. 6-2.5-5-8)

10.Vehicles or watercraft, not to be licensed for use, which are eligible for a repossession title issued by the State of Indiana as a result of a bona fide credit transaction or salvage title resulting from an insurance settlement.

11.Transactions consisting of adding or deleting a spouse, child, grandparent, parent, or sibling of the owner of a motor vehicle only per 6-2.5-5-15.5. The Direct Relative Identification Statement on the front of the form MUST be completed.

12.Vehicles or watercraft won as a prize in a raffle or drawing which were previously titled by a qualified nonprofit organization. A valid Federal Miscellaneous Income Statement, Form 1099-MISC or an affidavit completed by the nonprofit organization must be submitted with the title paperwork in order for this exemption to be claimed. The affidavits must state the nonprofit organi- zation name and exemption number, the winner’s name, address and social security number and the fair market value of the vehicle awarded as the prize.

13.Redemption of repossessed vehicles or watercraft by the original owner.

14.Indiana Department of Revenue use only. This exemption may not be used unless authorized by the Department by calling (317) 232-3425, and selecting option 5 for Business Tax Compliance. A complete copy of each transaction claiming this exemption must be sent to DOR, Audit & Compliance Support.

15.Sales tax paid to a non-BMV licensed dealer. The seller may be either an Indiana seller or an out of state seller. This amount will be used as a nonrefundable credit against the amount of Indiana sales tax due.