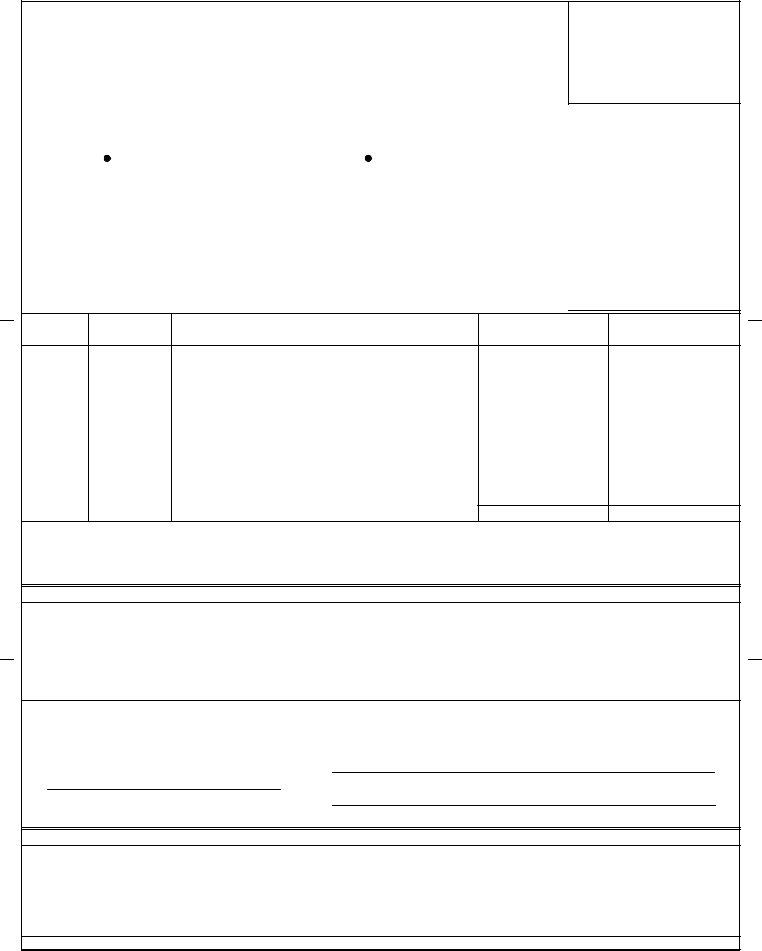

The Standard Form 1080, titled "Voucher for Transfers Between Appropriations and/or Funds," plays a crucial role in the management of financial transactions within the Department of the Treasury. Effective since its revision in April 1982, this form facilitates the meticulous documentation and authorization of funds moving between various departments, establishments, bureaus, or offices. Key elements of the form include detailed sections for the recording of financial transfers, such as voucher number, schedule number, bill number, and the specifics of the transaction like the date of delivery, type of article or service, quantity, unit price, and total cost. Additionally, it stipulates necessary accountability and verification steps through certificates by offices receiving and charged for the funds, ultimately ensuring that each fund transfer adheres to proper accounting classifications and procedures. As a crucial document, it not only supports transparency and accountability but also ensures that appropriations and/or funds are accurately allocated and utilized within government operations. Embedded within the form's framework is the requirement for certification by authorized administrative or certifying officers, thus affirming the validity of the transactions recorded. This form underscores the government's commitment to meticulous financial management and the importance of adhering to established protocols for fund transfers.

| Question | Answer |

|---|---|

| Form Name | Standard Form 1080 |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 57 |

| Avg. time to fill out | 11 min 43 sec |

| Other names | sf1080 form, department of defense 1080 form, what is a 1080 form, sf 1080 form |

Standard Form 1080 |

|

VOUCHER NO. |

Revised April 1982 |

VOUCHER FOR TRANSFERS |

|

Department of the Treasury |

|

|

I TFRM |

BETWEEN APPROPRIATIONS AND/OR FUNDS |

SCHEDULE NO. |

|

|

|

|

|

|

|

|

|

Department, establishment, bureau, or office receiving funds |

BILL NO. |

|

|

|

PAID BY |

|

|

|

|

|

|

Department, establishment, bureau, or office charged |

|

|

|

|

|

|

|

|

ORDER NO.

DATE OF DELIVERY

ARTICLE OR SERVICES

QUAN-

TITY

UNIT PRICE |

AMOUNT |

|

COST |

PER |

DOLLARS AND CENTS |

|

|

|

TOTAL

Remittance in payment hereof should be sent to -

ACCOUNTING CLASSIFICATION - Office Receiving Funds

CERTIFICATE OF OFFICE CHARGED

I certify that the above articles were received and accepted or the services performed as stated and should be charged to the appropriation(s) and/or fund(s) as indicated below; or that the advance payment requested is approved and should be paid as indicated.

(Authorized administrative or certifying officer)

(Date)

(Title)

ACCOUNTING CLASSIFICATION - Office Charged

Paid by Check No.

NSN |

Designed using PerForm Pro software. |

Previous Editions Are Usable |