State Form 51623 can be filled out in no time. Just make use of FormsPal PDF editor to finish the job right away. Our editor is consistently evolving to deliver the best user experience attainable, and that is due to our commitment to constant enhancement and listening closely to feedback from users. Should you be seeking to get going, this is what it requires:

Step 1: Click the "Get Form" button at the top of this webpage to access our PDF editor.

Step 2: This tool helps you change most PDF forms in various ways. Modify it by adding your own text, adjust original content, and include a signature - all doable in minutes!

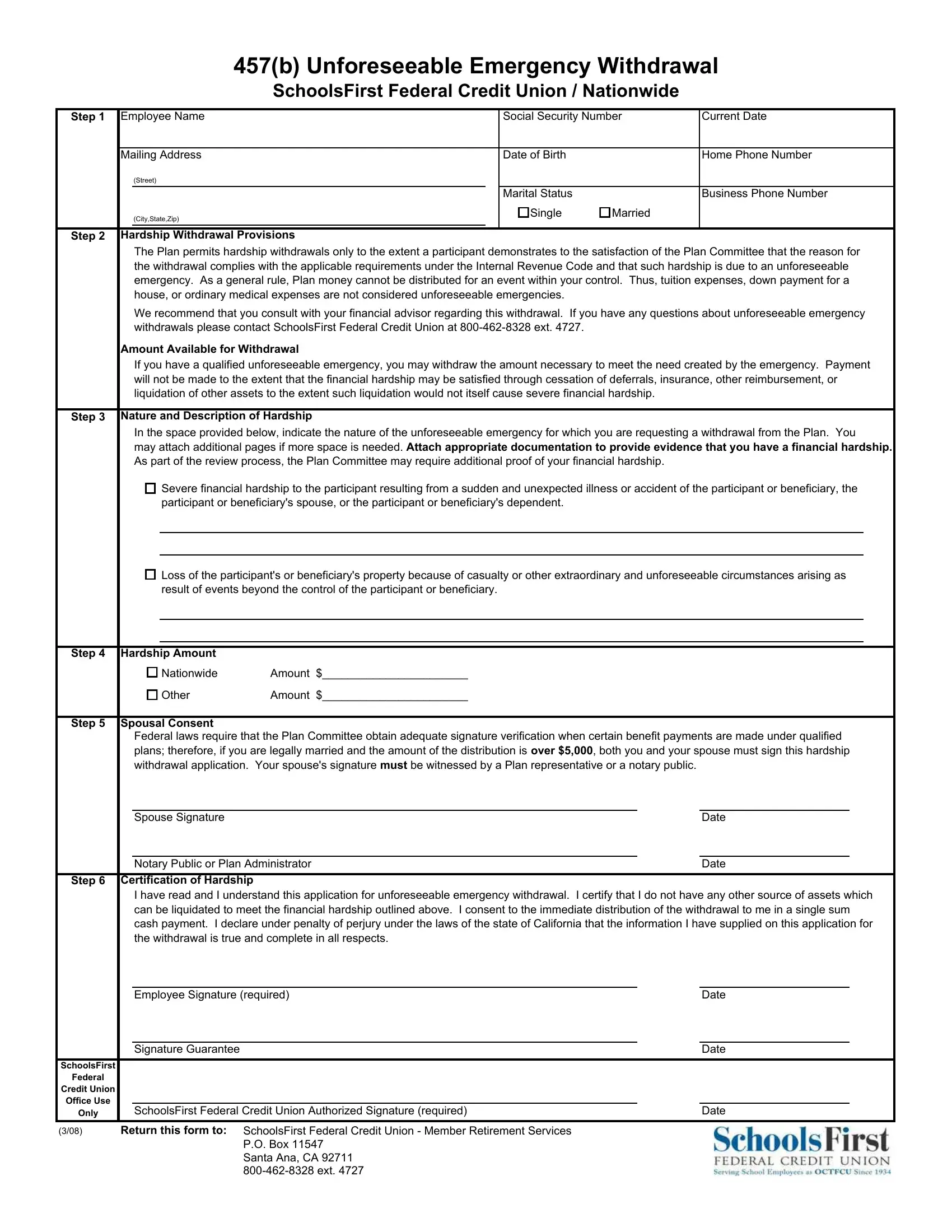

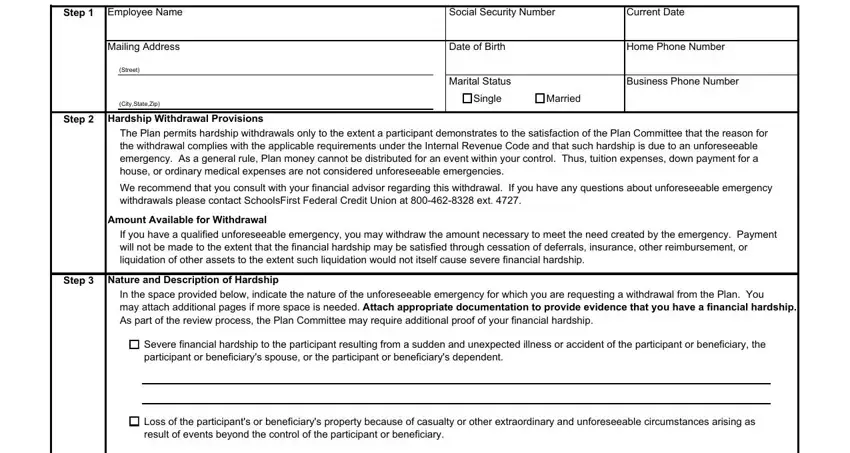

For you to finalize this PDF document, be certain to enter the right information in each and every blank field:

1. Whenever filling out the State Form 51623, be certain to incorporate all of the essential fields in its corresponding form section. It will help to hasten the work, enabling your details to be processed efficiently and correctly.

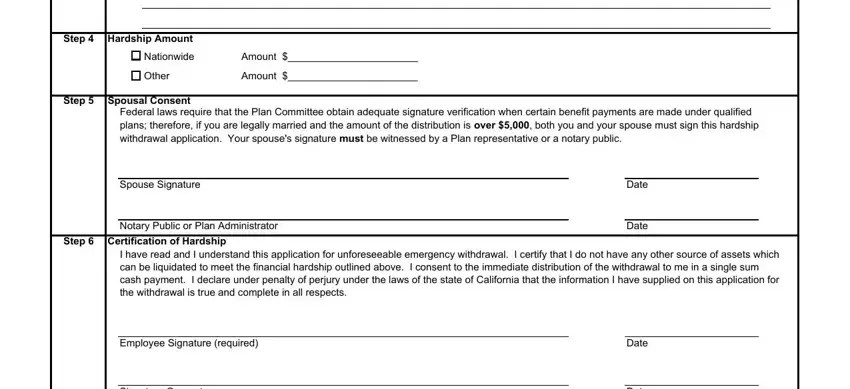

2. The third stage would be to submit all of the following fields: Step, Hardship Amount, Nationwide, Amount, Other, Amount, Step, Spousal Consent, Federal laws require that the Plan, Spouse Signature, Notary Public or Plan Administrator, Step Certification of Hardship, Date, Date, and I have read and I understand this.

As for Notary Public or Plan Administrator and Federal laws require that the Plan, be sure that you don't make any mistakes in this current part. These are the key ones in the file.

Step 3: Once you've looked once more at the details in the file's blanks, press "Done" to finalize your FormsPal process. Right after starting a7-day free trial account with us, you'll be able to download State Form 51623 or send it through email promptly. The document will also be readily available in your personal account menu with your modifications. FormsPal is committed to the privacy of all our users; we always make sure that all personal information entered into our editor stays protected.