Should you would like to fill out nevada combined sales form, you don't have to install any software - simply make use of our PDF tool. The editor is continually upgraded by our staff, getting additional functions and growing to be more convenient. Getting underway is effortless! All that you should do is adhere to the following easy steps directly below:

Step 1: Press the "Get Form" button in the top section of this webpage to access our tool.

Step 2: With our advanced PDF file editor, you can actually accomplish more than just complete blank form fields. Try all the functions and make your forms appear high-quality with customized textual content put in, or tweak the file's original content to perfection - all that comes with the capability to insert your personal pictures and sign it off.

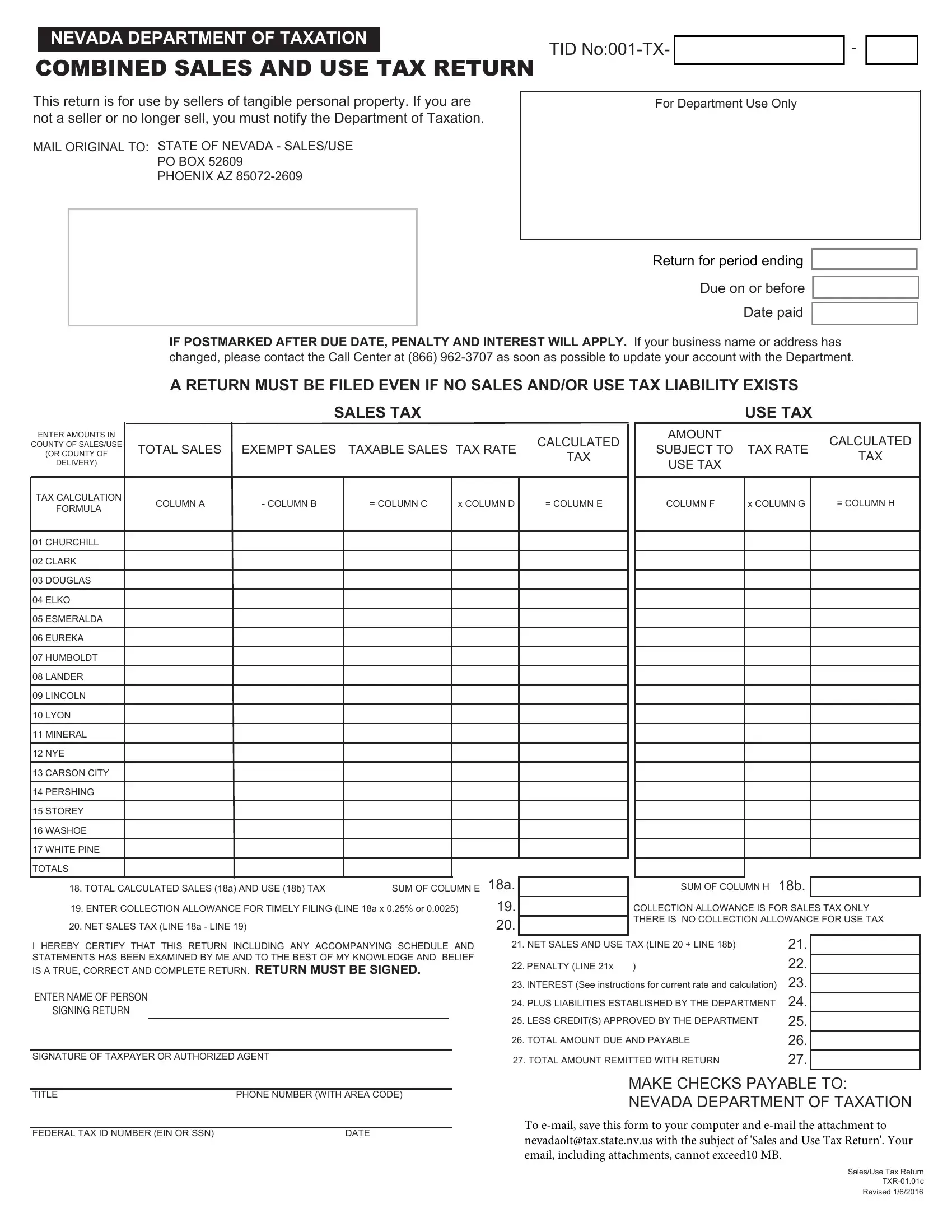

This PDF form will require specific info to be filled in, thus you should definitely take some time to fill in precisely what is expected:

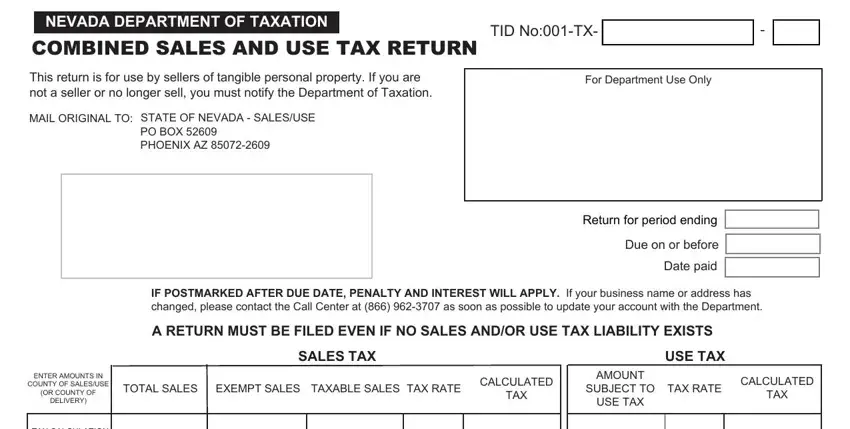

1. The nevada combined sales form requires specific details to be inserted. Make sure the next fields are completed:

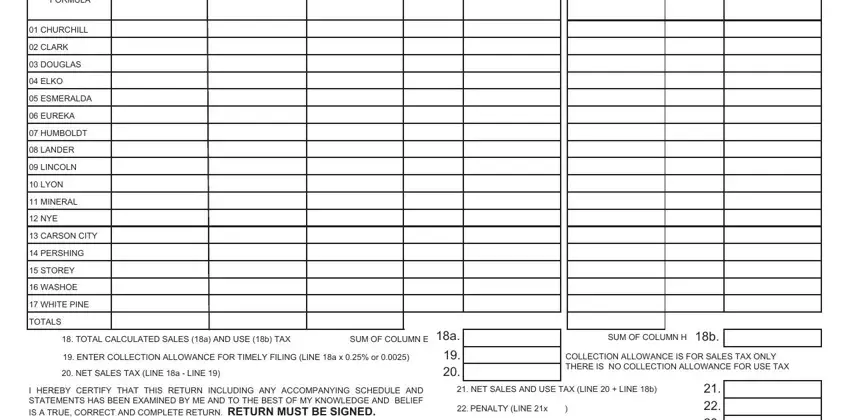

2. Your next stage would be to complete the next few blanks: COLUMN A, COLUMN B, COLUMN C, x COLUMN D, COLUMN E, COLUMN F, x COLUMN G, COLUMN H, FORMULA, CHURCHILL, CLARK, DOUGLAS, ELKO, ESMERALDA, and EUREKA.

People frequently make mistakes while completing CLARK in this area. Be sure you read twice what you type in here.

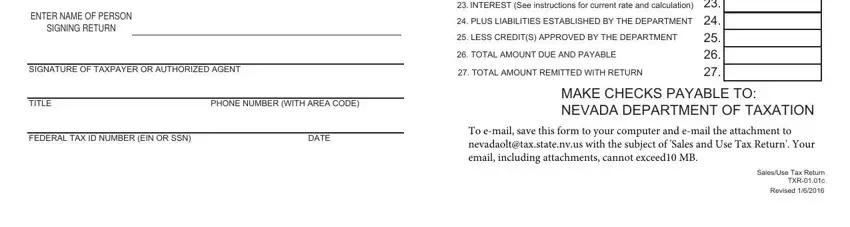

3. The following part should be relatively simple, ENTER NAME OF PERSON, SIGNING RETURN, SIGNATURE OF TAXPAYER OR, TITLE, PHONE NUMBER WITH AREA CODE, FEDERAL TAX ID NUMBER EIN OR SSN, DATE, PENALTY LINE x INTEREST See, LESS CREDITS APPROVED BY THE, TOTAL AMOUNT DUE AND PAYABLE, TOTAL AMOUNT REMITTED WITH RETURN, MAKE CHECKS PAYABLE TO NEVADA, To email save this form to your, and SalesUse Tax Return TXRc Revised - these empty fields is required to be completed here.

Step 3: Check that your details are accurate and then just click "Done" to complete the project. Acquire the nevada combined sales form the instant you subscribe to a 7-day free trial. Conveniently use the pdf file from your FormsPal cabinet, along with any edits and changes being automatically saved! FormsPal is dedicated to the privacy of all our users; we make sure that all personal information coming through our system is confidential.