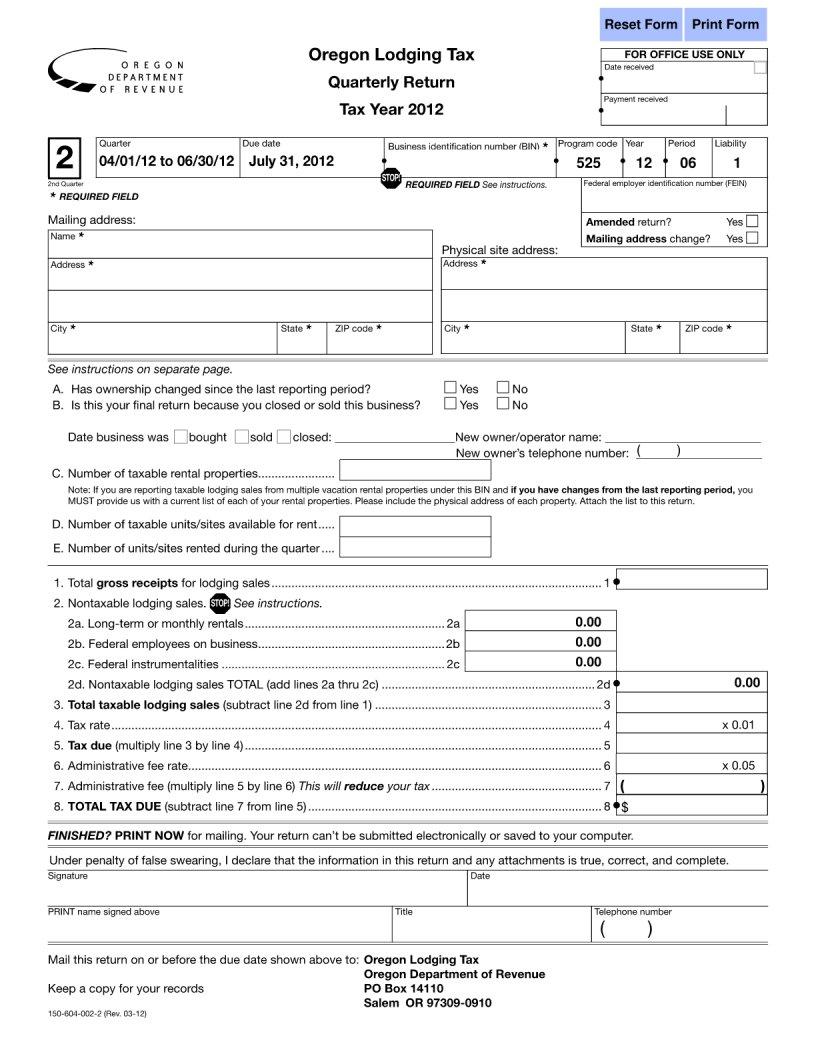

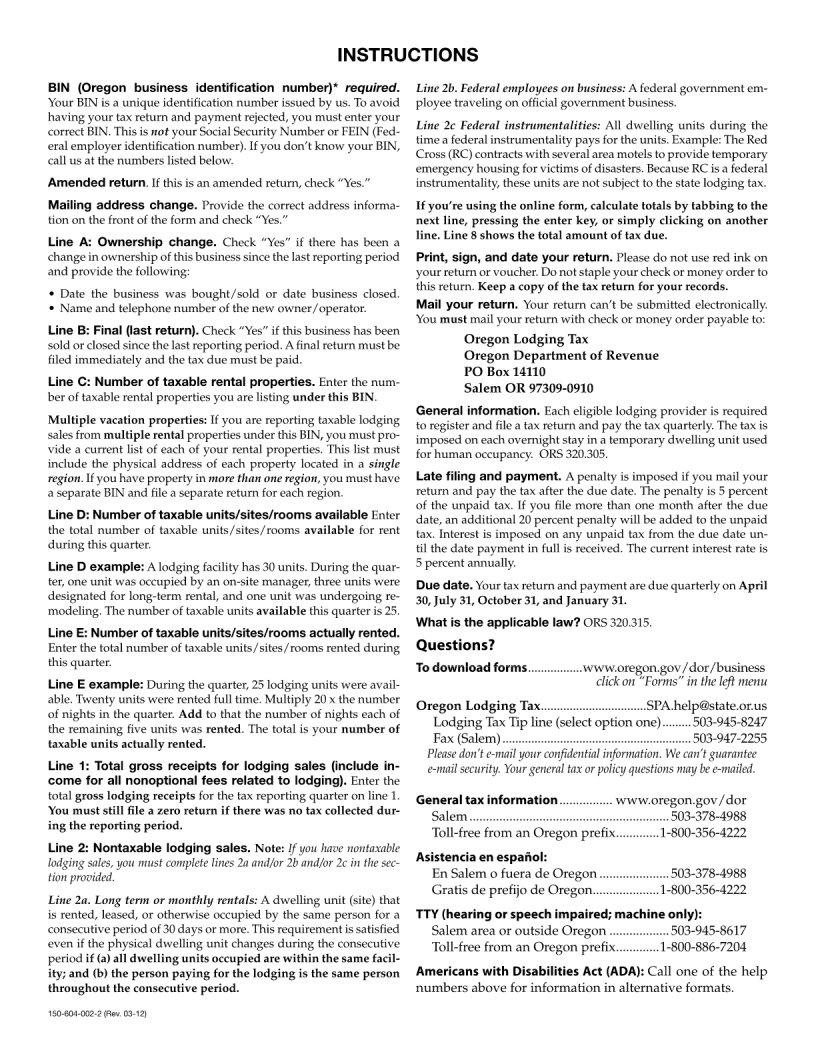

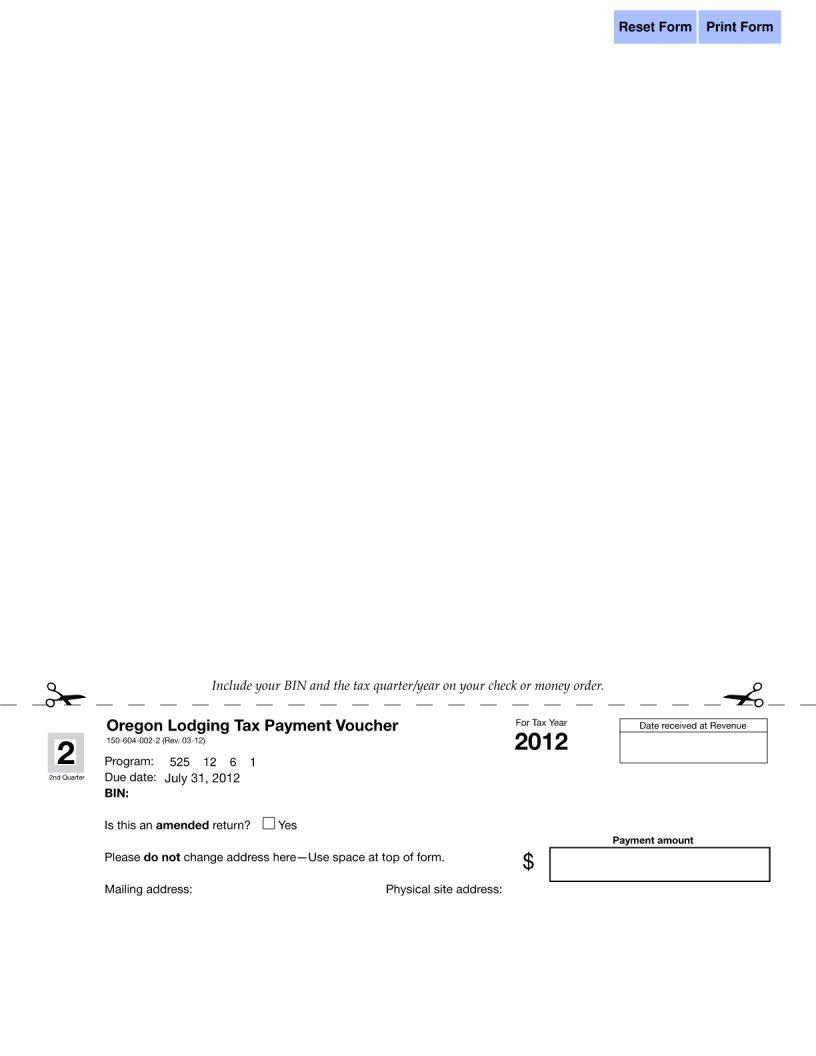

In the picturesque state of Oregon, both tourists and business travelers alike find a wide array of lodging options to suit their needs. From cozy bed and breakfasts nestled in scenic coastal towns to luxurious hotels in the bustling heart of Portland, the accommodations are as diverse as the state’s landscapes. However, one commonality shared among these lodging choices is the State of Oregon Lodging Tax form, a vital piece of documentation that helps ensure the tourism sector remains a thriving part of the state’s economy. This form is not only important for lodging operators who are required to collect and remit taxes from their guests but also plays a crucial role in maintaining the infrastructure that makes Oregon such an attractive destination. The tax collected contributes to local projects, tourism promotion, and the overall enhancement of visitor experiences. Understanding the nuances of the State of Oregon Lodging Tax form, including who needs to file it, the rates applied, and the deadlines for submission, is essential for lodging providers to comply with state laws, avoid penalties, and support Oregon's continuous efforts to be a welcoming destination for all visitors.

| Question | Answer |

|---|---|

| Form Name | State Of Oregon Lodging Tax Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | oregon state lodging tax forms 2016, oregon lodging tax online, oregon state lodging tax form 2019, state lodging tax form |