It is possible to fill out stement of credit denial termination or change form without difficulty using our online editor for PDFs. The editor is consistently updated by us, receiving new functions and turning out to be better. All it requires is several basic steps:

Step 1: Click on the orange "Get Form" button above. It is going to open our pdf editor so you can begin filling in your form.

Step 2: As soon as you access the editor, you will get the form prepared to be filled in. Aside from filling out different blanks, you may as well perform many other actions with the form, that is putting on custom text, modifying the initial text, adding images, placing your signature to the PDF, and much more.

Concentrate when completing this document. Make certain each blank field is done correctly.

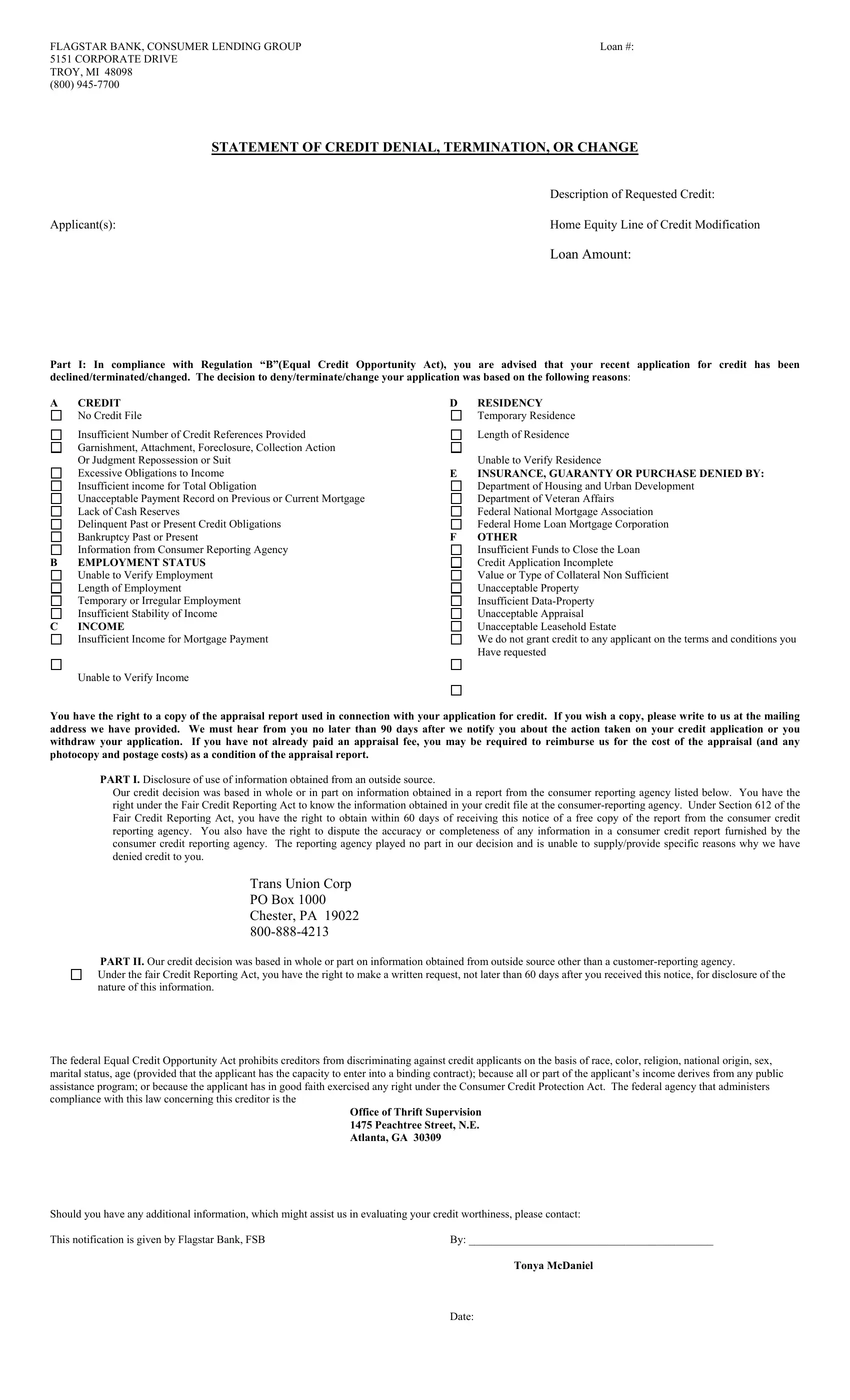

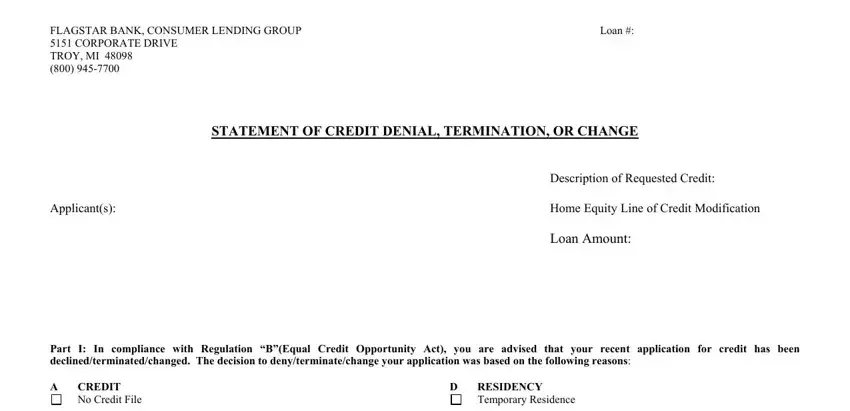

1. The stement of credit denial termination or change form needs certain details to be typed in. Ensure the subsequent blank fields are completed:

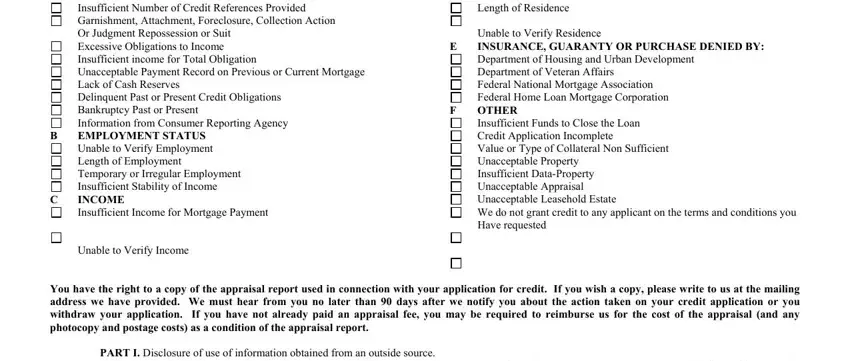

2. Soon after finishing this section, go to the next part and complete the necessary particulars in these fields - Length of Residence, Unable to Verify Residence, Department of Housing and Urban, OTHER Insufficient Funds to Close, Credit Application Incomplete, Insufficient DataProperty, Have requested, Insufficient Number of Credit, Garnishment Attachment Foreclosure, Insufficient income for Total, Or Judgment Repossession or Suit, Information from Consumer, Unable to Verify Employment Length, Insufficient Stability of Income, and Unable to Verify Income.

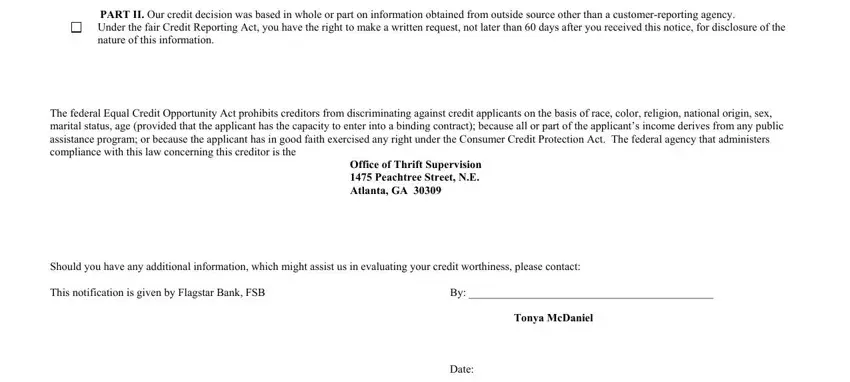

3. This next step is related to PART II Our credit decision was, Under the fair Credit Reporting, nature of this information, The federal Equal Credit, Office of Thrift Supervision, Tonya McDaniel, and Date - complete these blank fields.

Always be extremely attentive while completing PART II Our credit decision was and Under the fair Credit Reporting, as this is where many people make errors.

Step 3: Prior to finishing this form, double-check that blanks were filled out properly. Once you’re satisfied with it, press “Done." Right after starting afree trial account at FormsPal, you'll be able to download stement of credit denial termination or change form or email it right away. The form will also be accessible through your personal account menu with your every edit. FormsPal guarantees your information privacy with a protected system that in no way records or distributes any type of personal data provided. Be assured knowing your paperwork are kept safe any time you use our editor!