By using the online tool for PDF editing by FormsPal, you can easily complete or change suntrust bank statement pdf right here and now. We are dedicated to making sure you have the best possible experience with our tool by constantly introducing new functions and upgrades. Our tool is now even more useful thanks to the most recent updates! So now, working with PDF documents is easier and faster than before. It merely requires several simple steps:

Step 1: First, access the pdf tool by clicking the "Get Form Button" above on this webpage.

Step 2: This editor lets you work with almost all PDF forms in a range of ways. Change it by writing your own text, adjust what's originally in the document, and add a signature - all at your convenience!

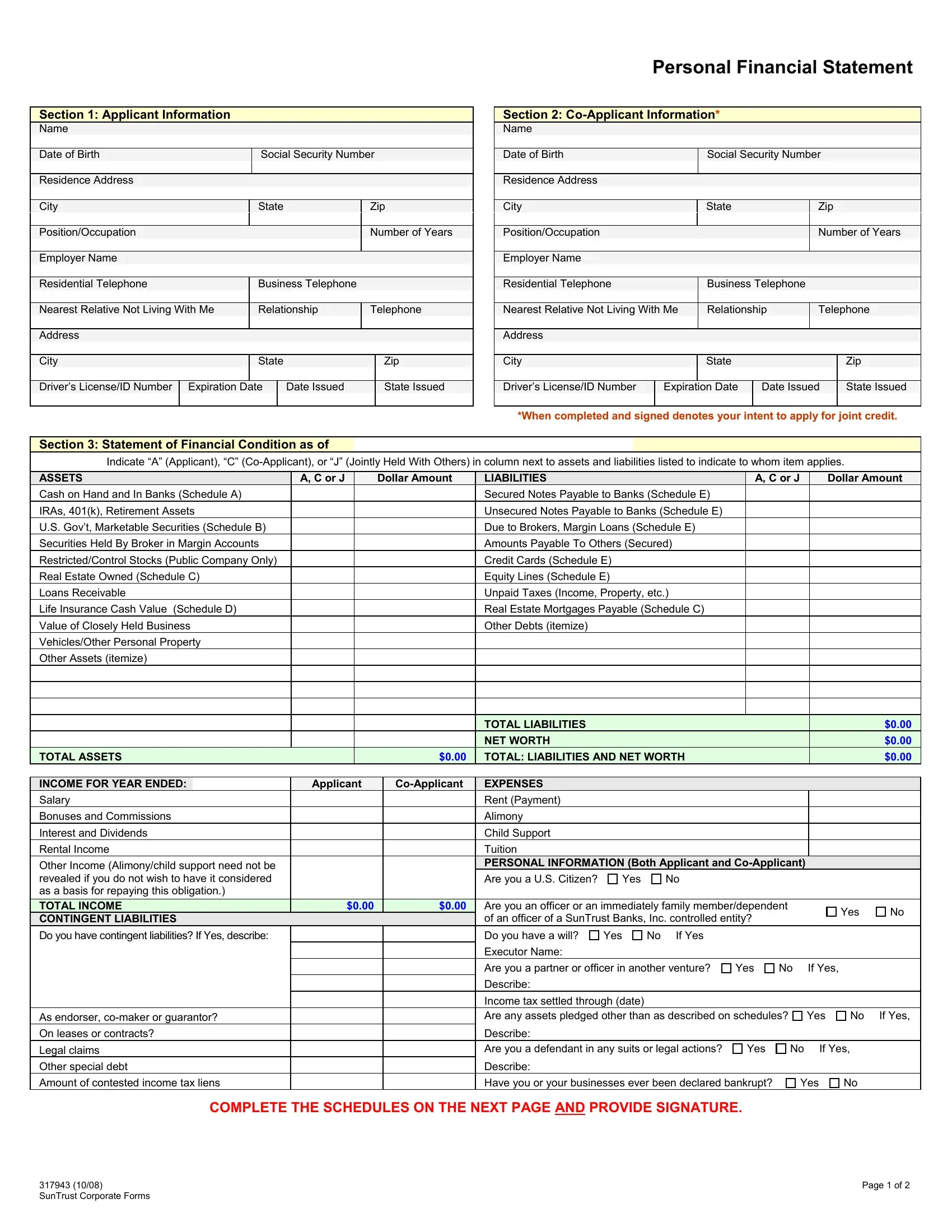

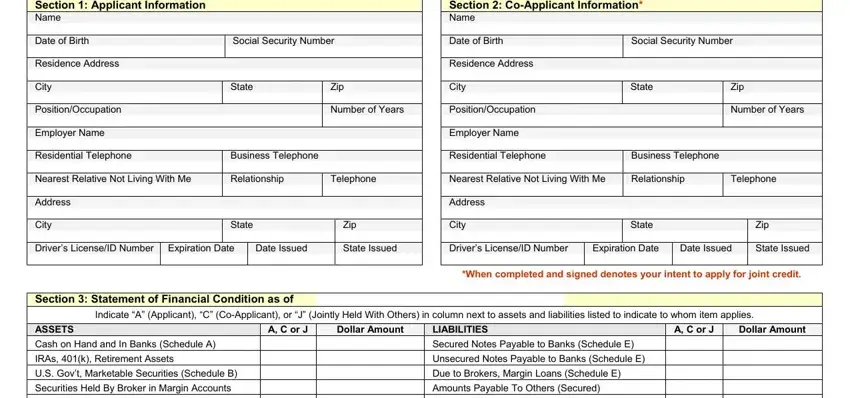

When it comes to blank fields of this specific document, this is what you should know:

1. To start with, once filling out the suntrust bank statement pdf, start in the form section that has the subsequent blanks:

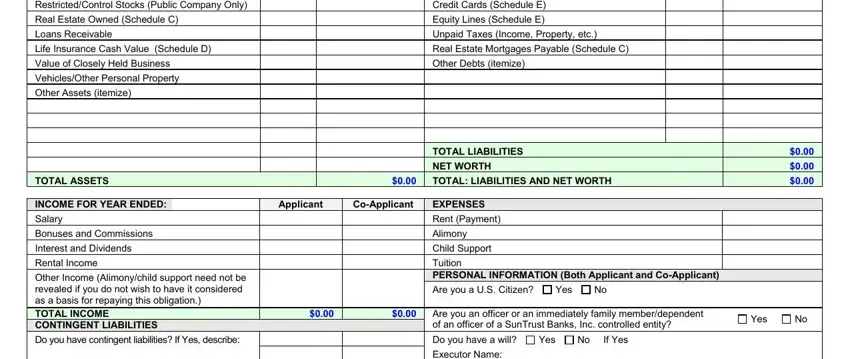

2. Soon after performing the previous part, go on to the next stage and enter all required details in these blanks - RestrictedControl Stocks Public, Real Estate Owned Schedule C, Loans Receivable, Life Insurance Cash Value Schedule, Value of Closely Held Business, VehiclesOther Personal Property, Other Assets itemize, TOTAL ASSETS INCOME FOR YEAR ENDED, Salary, Bonuses and Commissions, Interest and Dividends, Rental Income, Other Income Alimonychild support, Do you have contingent liabilities, and Applicant.

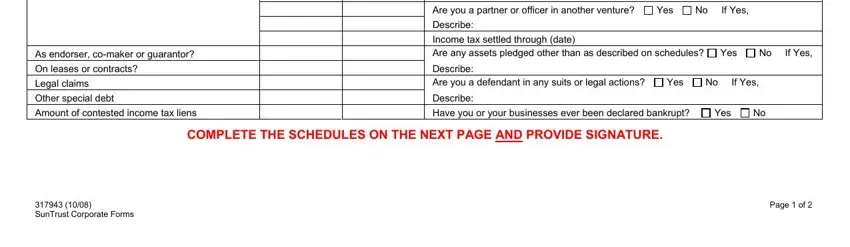

3. This next section will be focused on As endorser comaker or guarantor, On leases or contracts, Legal claims, Other special debt, Amount of contested income tax, Executor Name, Are you a partner or officer in, Yes, No If Yes, Describe, Income tax settled through date, Yes, No If Yes, Describe Are you a defendant in, and Yes - fill in all of these blanks.

People generally make some errors while filling in Describe Are you a defendant in in this section. Be sure to reread what you type in here.

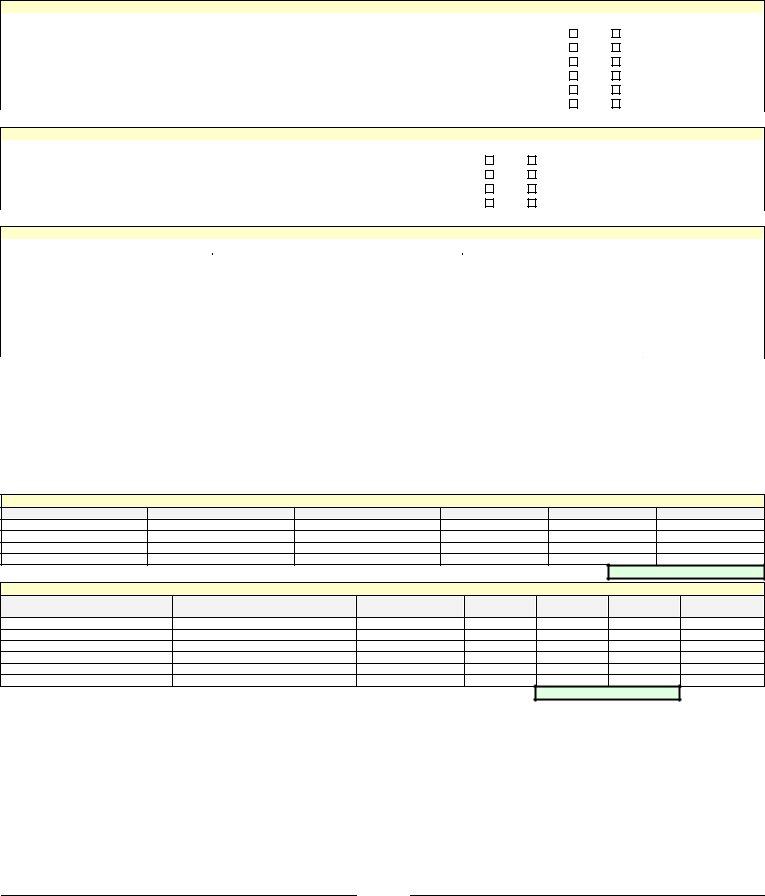

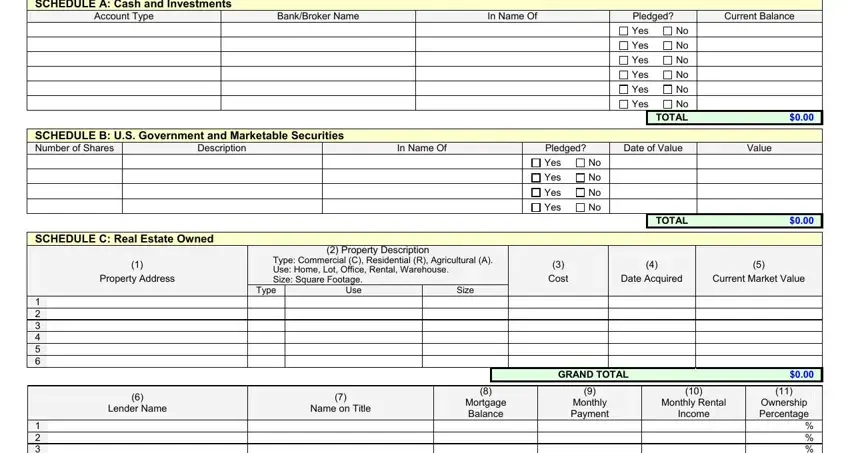

4. Completing SCHEDULE A Cash and Investments, Account Type, BankBroker Name, In Name Of, Pledged, Current Balance, Yes, Yes, Yes, Yes, Yes, Yes, No TOTAL, SCHEDULE B US Government and, and Description is crucial in the fourth step - don't forget to take your time and take a close look at every single empty field!

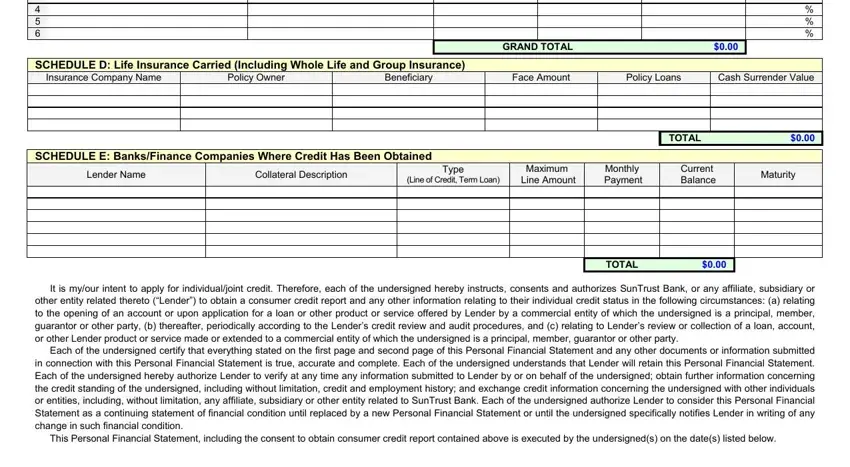

5. The pdf needs to be concluded by filling in this segment. Below you can find a comprehensive listing of fields that have to be completed with accurate details for your document usage to be accomplished: GRAND TOTAL, Ownership Percentage, SCHEDULE D Life Insurance Carried, Insurance Company Name, Policy Owner, Beneficiary, Face Amount, Policy Loans, TOTAL, Cash Surrender Value, SCHEDULE E BanksFinance Companies, Lender Name, Collateral Description, Type, and Line of Credit Term Loan.

Step 3: Before moving on, make certain that all form fields were filled in the right way. Once you think it's all good, click on “Done." Sign up with us right now and instantly get suntrust bank statement pdf, prepared for download. Every single change you make is conveniently kept , meaning you can change the file later on when required. When using FormsPal, you can easily fill out documents without needing to get worried about personal information incidents or records getting distributed. Our protected software helps to ensure that your private details are kept safe.