Our PDF editor that you're going to work with was made by our top level programmers. You can fill in the pa workers insurance form form instantly and conveniently applying our application. Simply adhere to this particular procedure to start out.

Step 1: Select the button "Get Form Here" on the following site and hit it.

Step 2: The file editing page is right now open. You can include information or edit current information.

Type in the content required by the system to fill in the form.

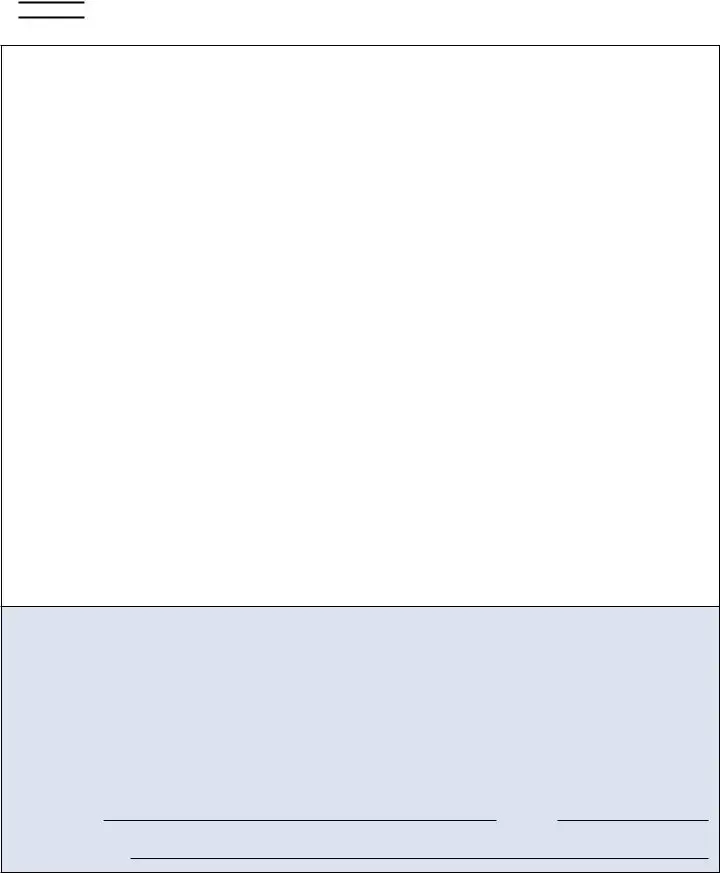

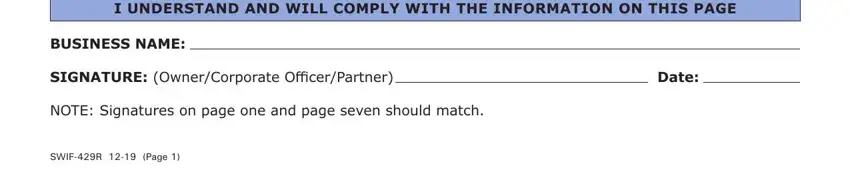

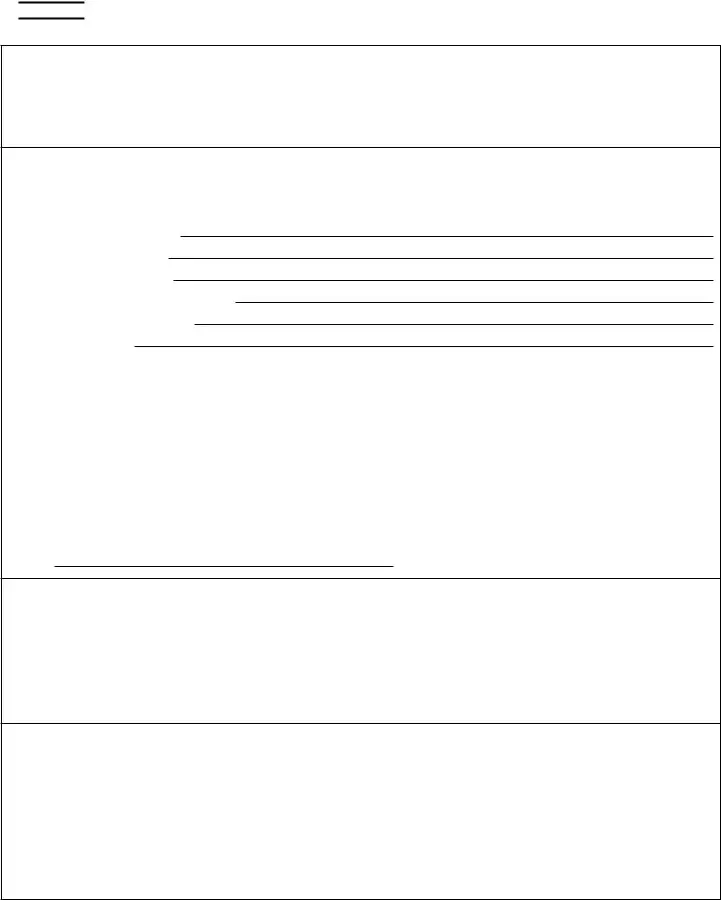

Fill out the I UNDERSTAND AND WILL COMPLY WITH, BUSINESS NAME, SIGNATURE OwnerCorporate, NOTE Signatures on page one and, and SWIFR Page fields with any information that may be demanded by the application.

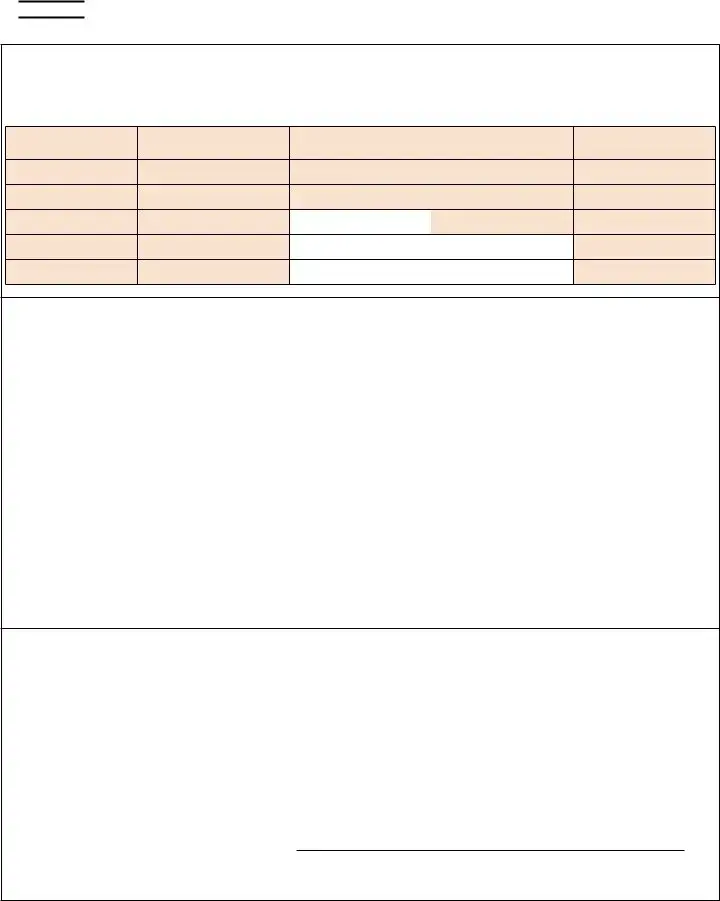

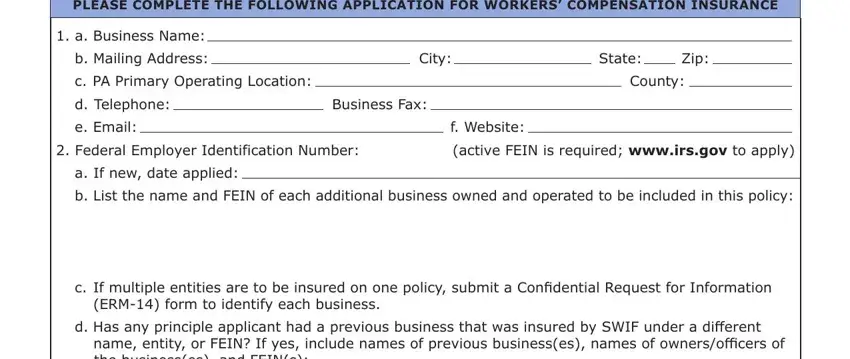

Note the necessary data while you're on the PLEASE COMPLETE THE FOLLOWING, a Business Name, b Mailing Address, c PA Primary Operating Location, City, State, Zip, County, d Telephone, e Email, Business Fax, f Website, Federal Employer Identification, active FEIN is required wwwirsgov, and a If new date applied segment.

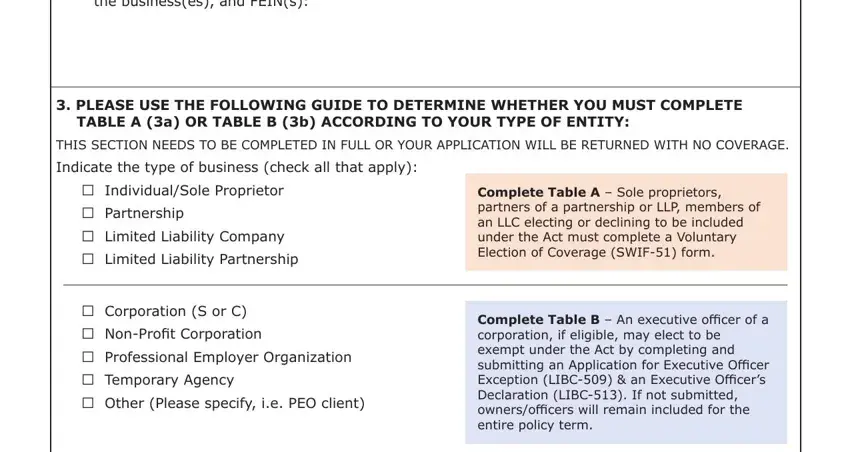

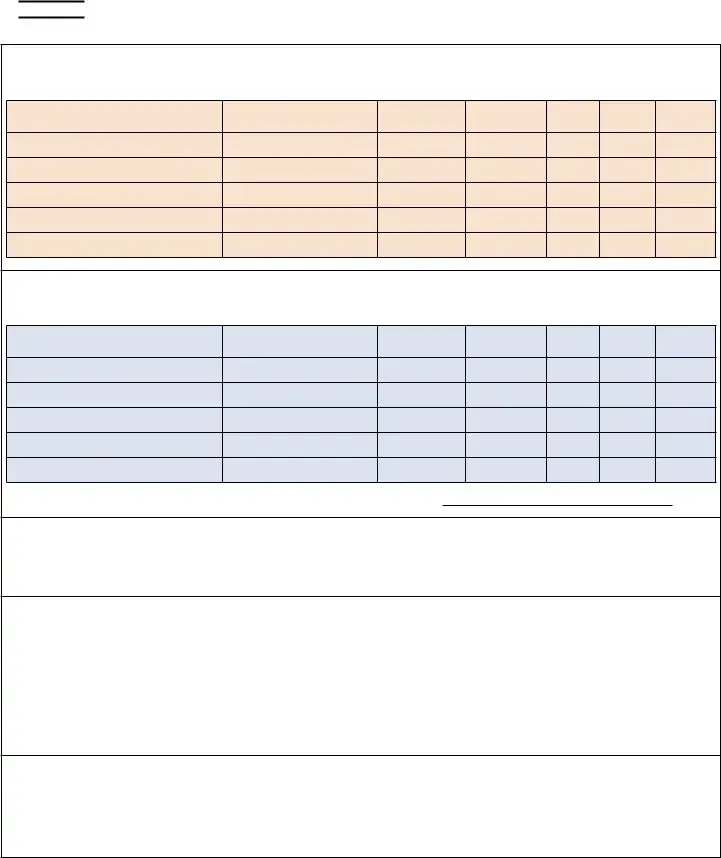

Make sure you describe the rights and obligations of the parties inside the name entity or FEIN If yes include, PLEASE USE THE FOLLOWING GUIDE TO, TABLE A a OR TABLE B b ACCORDING, THIS SECTION NEEDS TO BE COMPLETED, Indicate the type of business, IndividualSole Proprietor, Partnership, Limited Liability Company, Limited Liability Partnership, Corporation S or C, NonProfit Corporation, Professional Employer Organization, Temporary Agency, Other Please specify ie PEO client, and Complete Table A Sole proprietors space.

End up by checking all these sections and filling them in accordingly: NOTE ALL INCOMPLETE APPLICATIONS, and SWIFR Page.

Step 3: Choose the "Done" button. Next, it is possible to export your PDF file - upload it to your device or send it through email.

Step 4: Make sure to stay clear of possible future challenges by generating as much as 2 copies of your form.

$500K/$500K/$500K

$500K/$500K/$500K