Through the online PDF tool by FormsPal, it is possible to complete or change t1 general pdf here and now. Our tool is constantly evolving to give the best user experience achievable, and that's due to our resolve for constant improvement and listening closely to customer comments. Getting underway is effortless! All you need to do is adhere to the following basic steps below:

Step 1: Click on the "Get Form" button at the top of this webpage to open our PDF editor.

Step 2: Once you access the editor, there'll be the document all set to be filled out. Aside from filling out different fields, you could also perform several other things with the form, including putting on any textual content, changing the original textual content, adding graphics, putting your signature on the PDF, and much more.

This document requires specific information; in order to ensure correctness, please bear in mind the following steps:

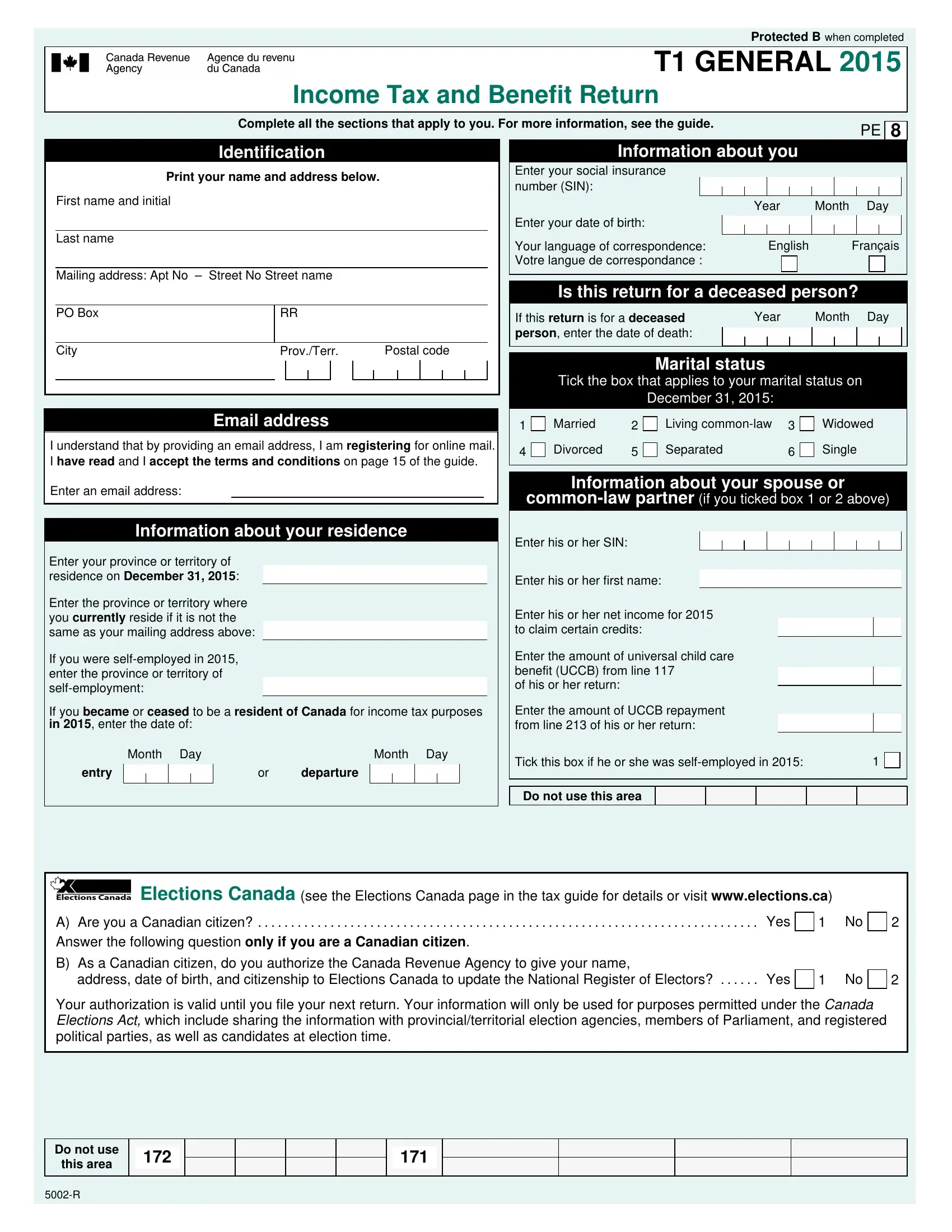

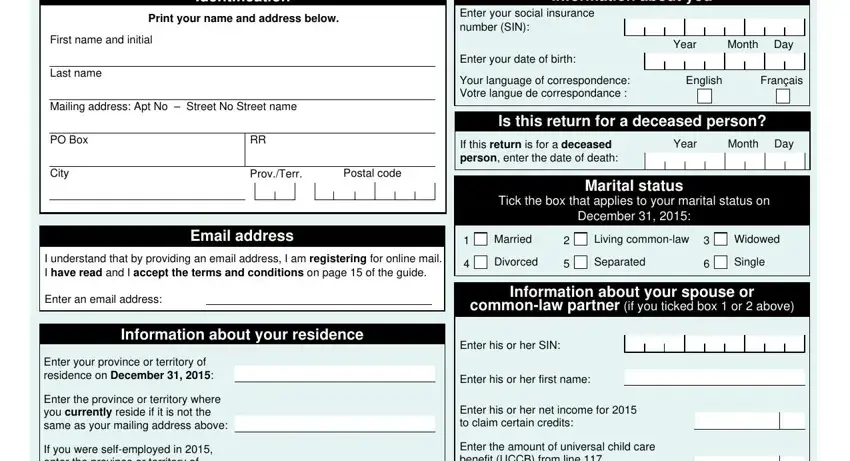

1. The t1 general pdf usually requires particular details to be typed in. Be sure that the next fields are complete:

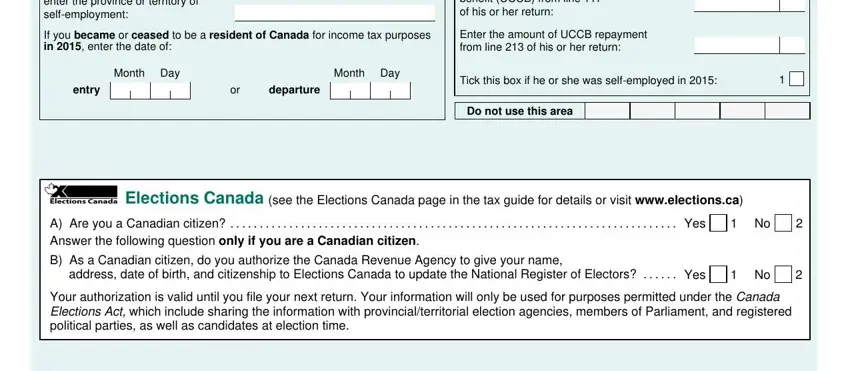

2. When the previous part is finished, you should include the essential details in If you were selfemployed in enter, Enter the amount of universal, If you became or ceased to be a, Enter the amount of UCCB repayment, Month Day, Month Day, entry, departure, Tick this box if he or she was, Do not use this area, Elections Canada see the Elections, A Are you a Canadian citizen, B As a Canadian citizen do you, address date of birth and, and Your authorization is valid until so you can move on to the third stage.

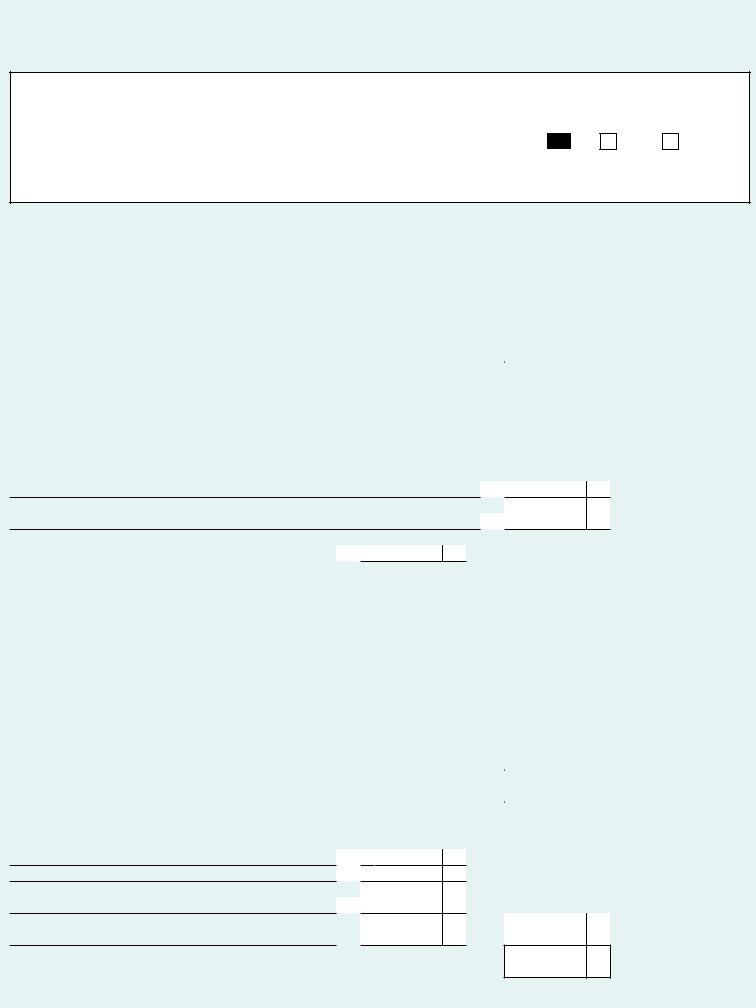

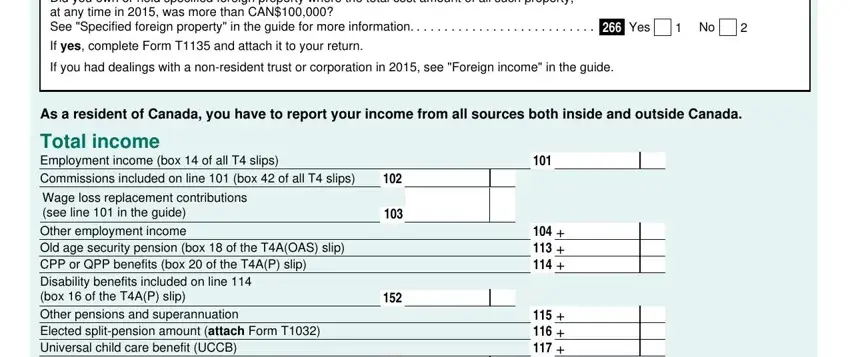

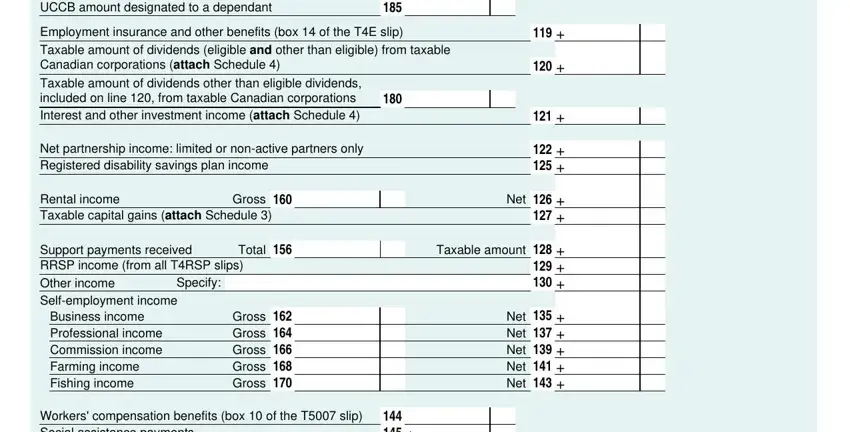

3. Throughout this stage, look at Did you own or hold specified, Yes, If yes complete Form T and attach, If you had dealings with a, As a resident of Canada you have, Total income Employment income box, and Wage loss replacement. All these should be completed with highest attention to detail.

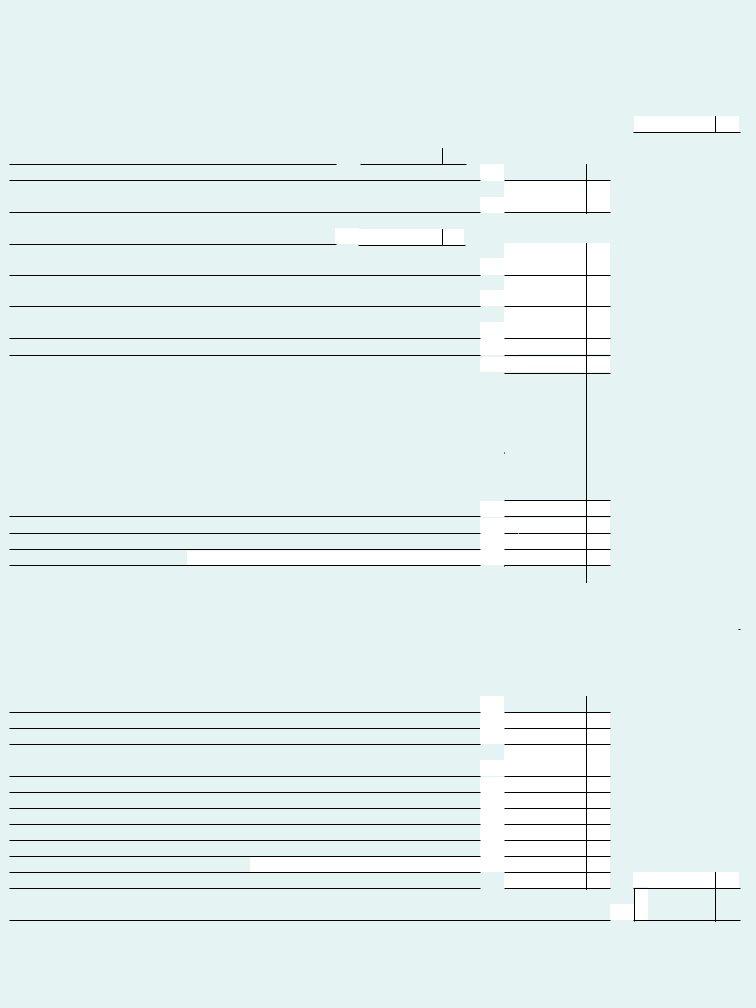

4. It is time to fill out this fourth portion! In this case you'll have all these Wage loss replacement, Employment insurance and other, Net partnership income limited or, Rental income Gross Taxable, Net, Support payments received RRSP, Specify, Total, Taxable amount, Business income Professional, Gross Gross Gross Gross Gross, Net Net Net Net Net, and Workers compensation benefits box empty form fields to fill in.

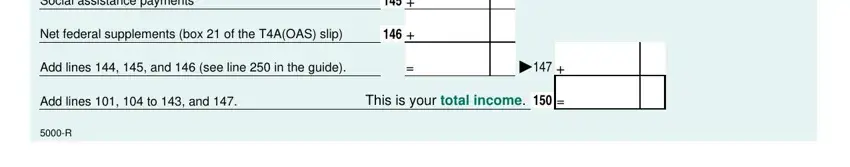

5. As a final point, the following last part is what you have to complete before closing the document. The blanks here include the following: Workers compensation benefits box, Net federal supplements box of, Add lines and see line in the, Add lines to and, and This is your total income.

Always be extremely careful when filling in Add lines to and and This is your total income, since this is where a lot of people make some mistakes.

Step 3: Prior to moving forward, make sure that blanks have been filled in the proper way. The moment you think it is all good, press “Done." Download your t1 general pdf after you register here for a 7-day free trial. Readily gain access to the document in your FormsPal cabinet, along with any edits and changes conveniently saved! When you use FormsPal, you're able to complete documents without stressing about information breaches or data entries being shared. Our secure system helps to ensure that your personal data is kept safely.