It won't be difficult to complete ga t of correction taking advantage of our PDF editor. This is how you can easily simply make your form.

Step 1: Hit the orange button "Get Form Here" on the following page.

Step 2: Now, you're on the file editing page. You can add content, edit current data, highlight certain words or phrases, place crosses or checks, insert images, sign the file, erase needless fields, etc.

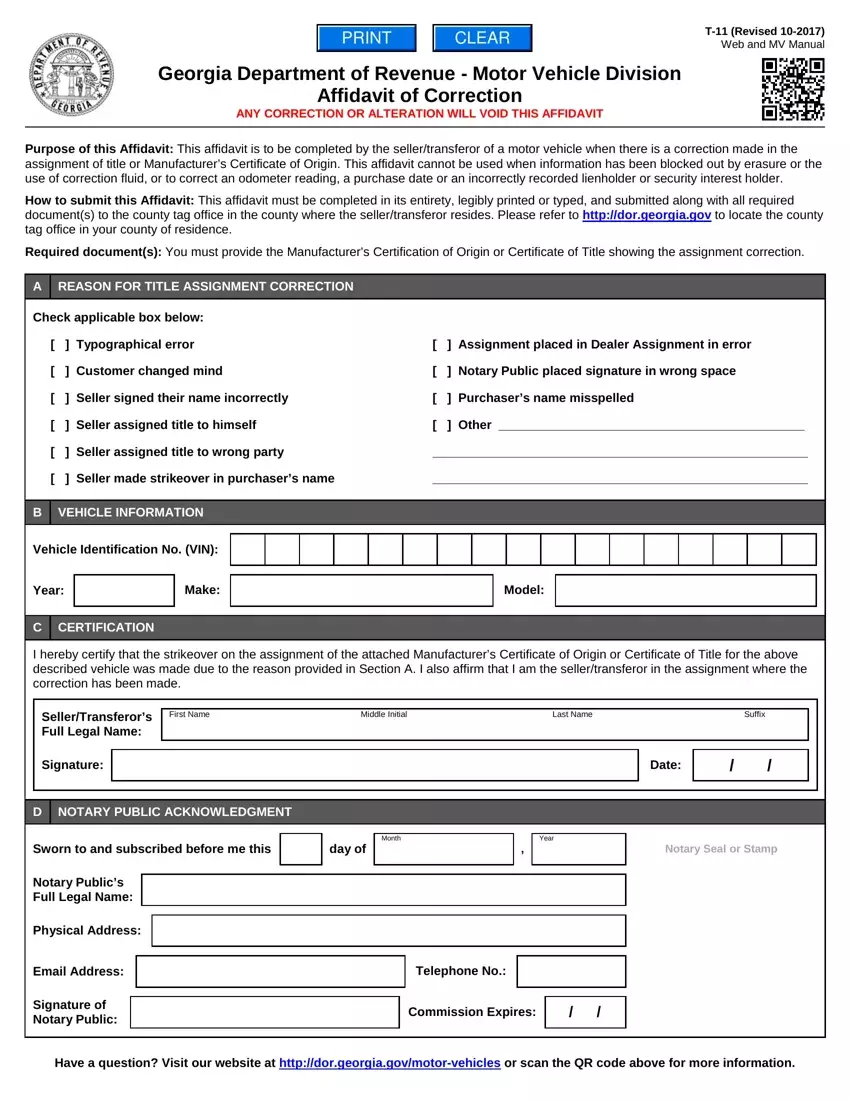

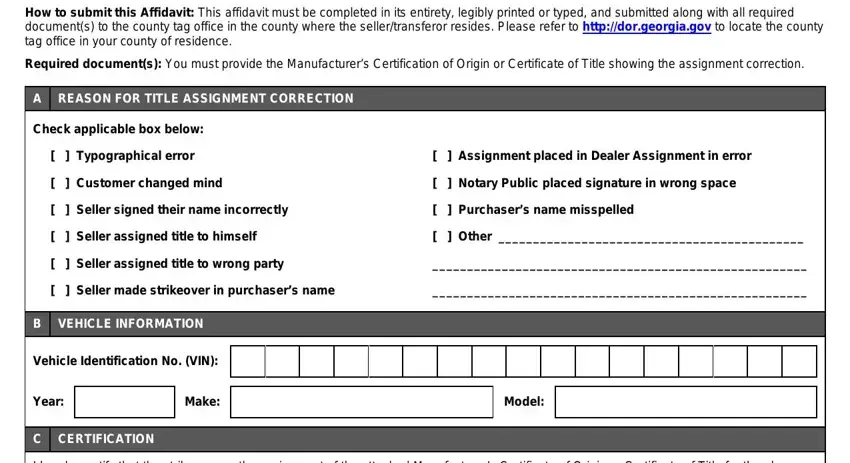

For every single segment, add the content required by the application.

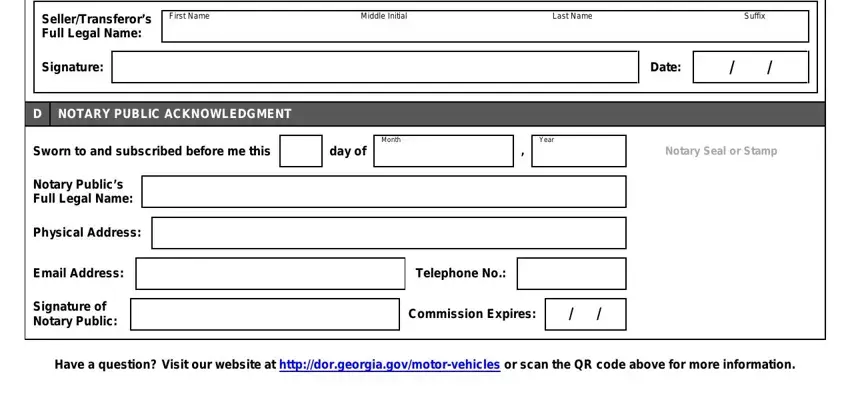

You have to write the information inside the part SellerTransferors Full Legal Name, Signature, First Name, Middle Initial, Last Name, Suffix, Date, D NOTARY PUBLIC ACKNOWLEDGMENT, Sworn to and subscribed before me, day of, Month, Year, Notary Seal or Stamp, Notary Publics Full Legal Name, and Physical Address.

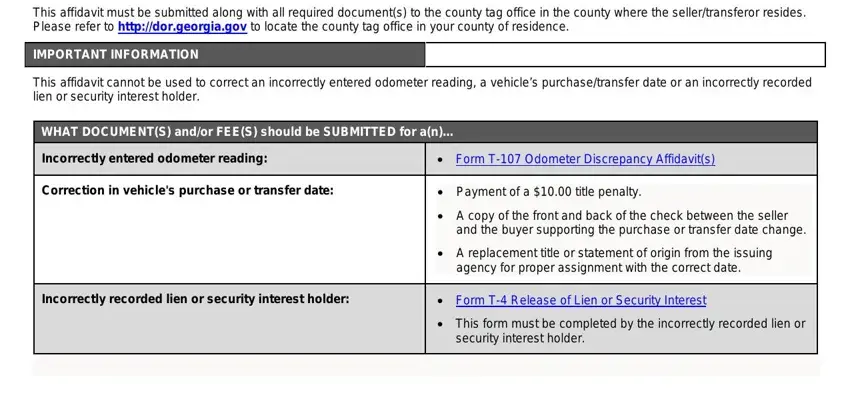

It's essential to emphasize the relevant particulars within the This affidavit must be submitted, IMPORTANT INFORMATION, This affidavit cannot be used to, WHAT DOCUMENTS andor FEES should, Incorrectly entered odometer, Form T Odometer Discrepancy, Correction in vehicles purchase or, Payment of a title penalty, A copy of the front and back of, and the buyer supporting the, A replacement title or statement, Incorrectly recorded lien or, Form T Release of Lien or, This form must be completed by, and security interest holder box.

When it comes to space Have a question Visit our website, specify the rights and responsibilities.

Step 3: When you choose the Done button, your finished document can be easily transferred to any of your gadgets or to electronic mail stated by you.

Step 4: You can generate duplicates of your document tostay clear of different potential problems. Don't worry, we don't distribute or track your details.