Any time you wish to fill out t2201 form, it's not necessary to download any sort of applications - just try our PDF tool. In order to make our editor better and more convenient to utilize, we constantly work on new features, with our users' suggestions in mind. With some simple steps, you can start your PDF journey:

Step 1: Click on the orange "Get Form" button above. It's going to open up our pdf editor so you can begin completing your form.

Step 2: Using our handy PDF editor, you'll be able to accomplish more than just complete blank fields. Edit away and make your forms seem faultless with customized textual content added in, or adjust the original input to perfection - all comes along with the capability to add just about any images and sign the file off.

Pay attention when completing this pdf. Ensure that every field is filled in accurately.

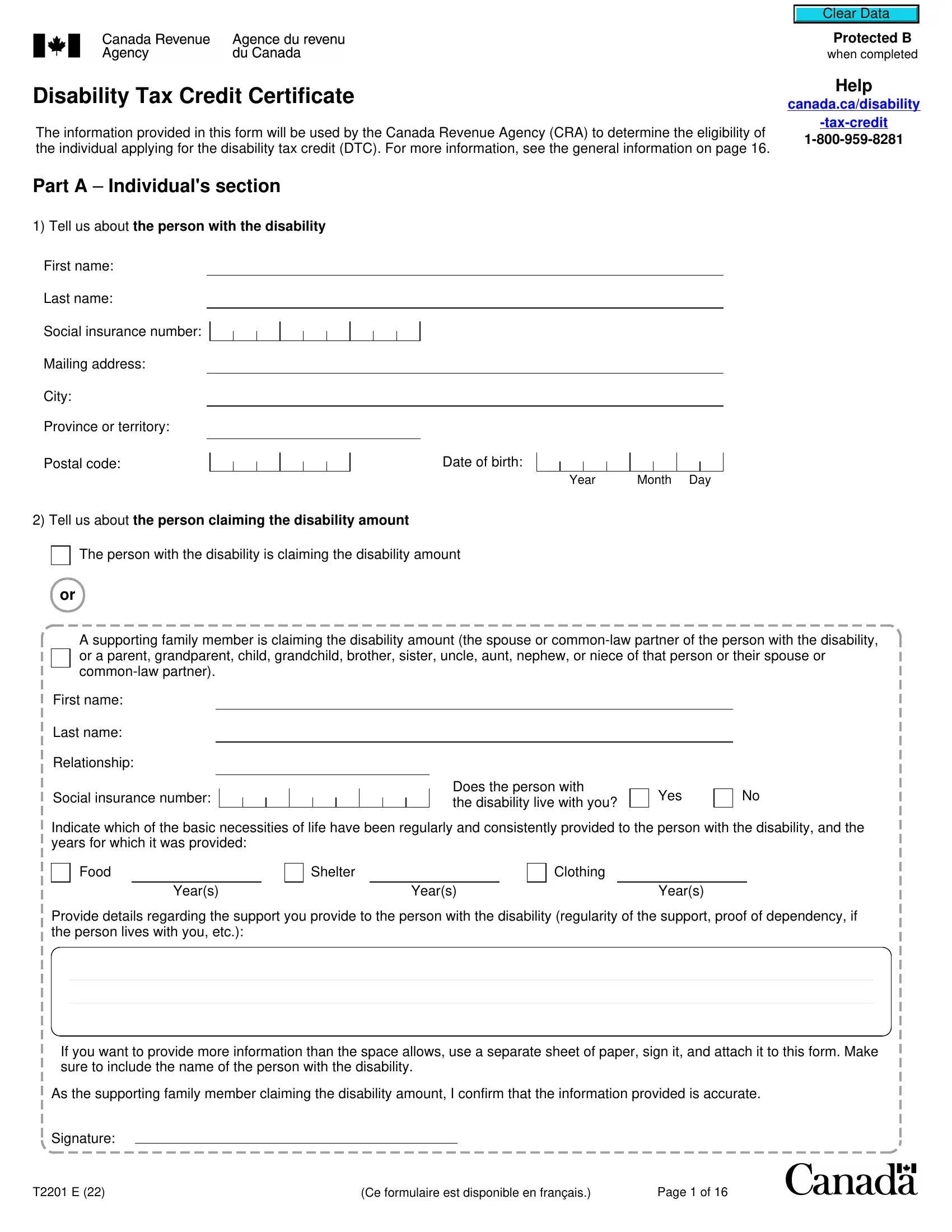

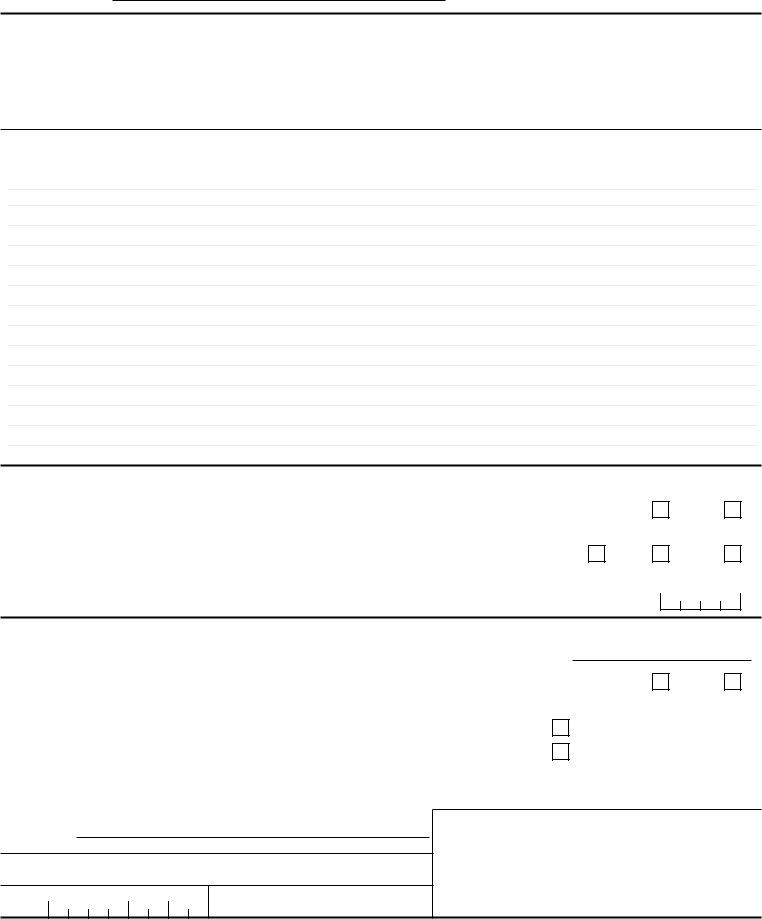

1. The t2201 form necessitates specific details to be entered. Make certain the next blanks are complete:

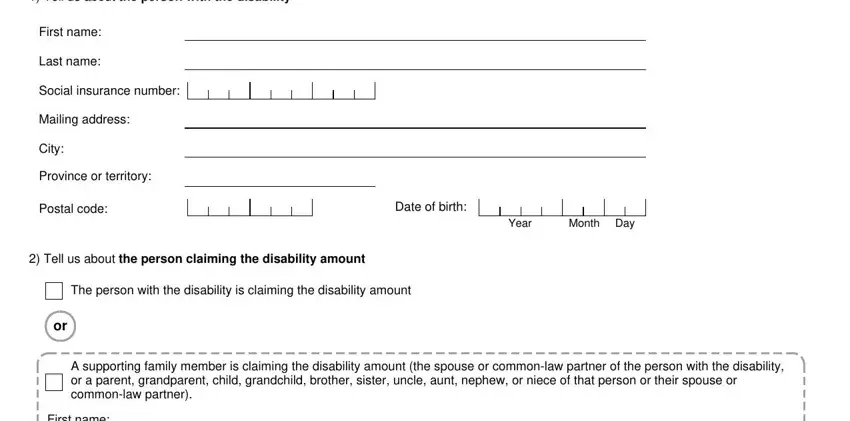

2. When the last segment is completed, you're ready to put in the required specifics in First name, Last name, Relationship, Social insurance number, Does the person with the, Yes, Indicate which of the basic, Food, Shelter, Clothing, Years, Years, Years, Provide details regarding the, and If you want to provide more so you can move on further.

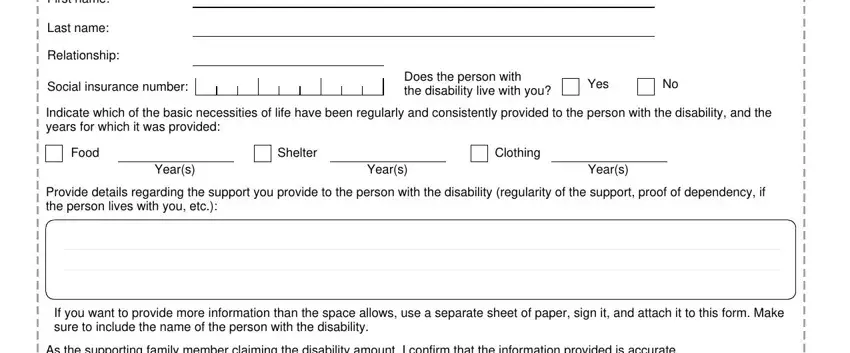

3. This next segment will be focused on Yes, If eligibility for the disability, Yes adjust my previous tax returns, No do not adjust my previous tax, Individuals authorization, As the person with the disability, I certify that the above, I give permission for my medical, determine my eligibility, I authorize the CRA to adjust my, Signature, Telephone number, and Date - fill in all these fields.

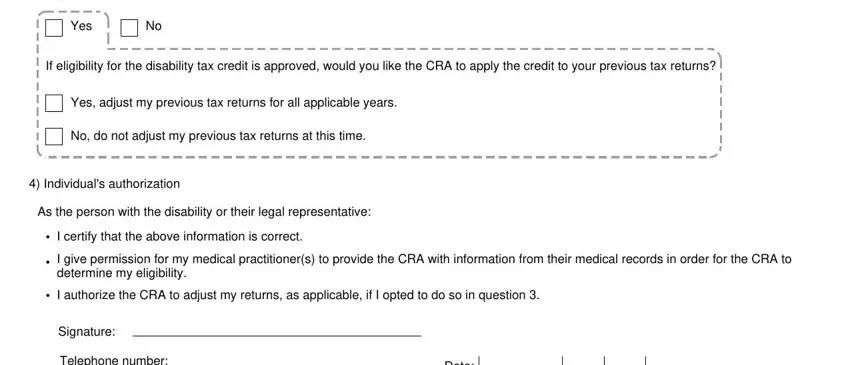

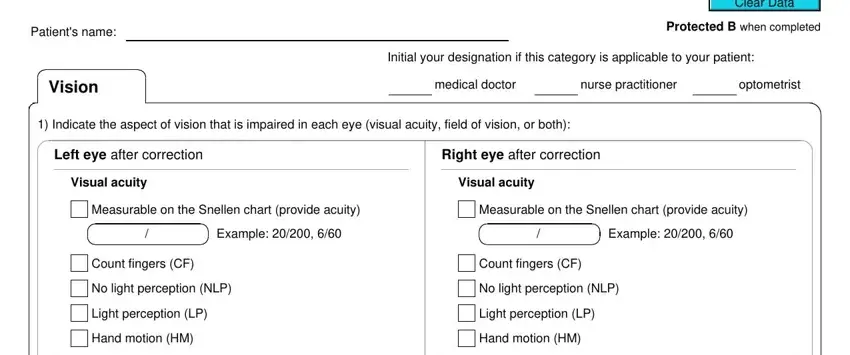

4. You're ready to fill in the next portion! Here you will get all of these Patients name, Vision, Clear Data, Protected B when completed, Initial your designation if this, medical doctor, nurse practitioner, optometrist, Indicate the aspect of vision, Left eye after correction, Visual acuity, Right eye after correction, Visual acuity, Measurable on the Snellen chart, and Measurable on the Snellen chart fields to fill in.

Always be extremely mindful while filling out Vision and Clear Data, because this is where most users make errors.

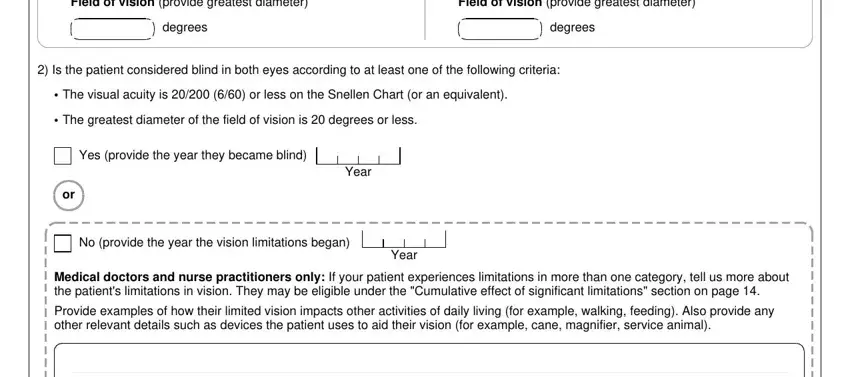

5. The document has to be finished with this particular area. Below you'll find a full listing of form fields that need to be filled in with appropriate information in order for your document submission to be complete: Field of vision provide greatest, Field of vision provide greatest, degrees, degrees, Is the patient considered blind, The visual acuity is or less on, The greatest diameter of the, Yes provide the year they became, Year, No provide the year the vision, Year, Medical doctors and nurse, and Provide examples of how their.

Step 3: As soon as you have reread the details in the document, press "Done" to conclude your document creation. Get your t2201 form as soon as you register here for a 7-day free trial. Immediately access the pdf form from your personal cabinet, together with any modifications and changes conveniently saved! We do not share or sell any details that you provide whenever dealing with documents at our website.